July 2nd, 2025 | 07:00 CEST

From microcap to market leader: How to get in on the booming billion-dollar graphene market with Argo Living Soils

Graphene sounds like something out of a science fiction novel, but it is already being used today where it matters most: in our roads and buildings. This miracle material, which is 200 times stronger than steel and as conductive as copper, is revolutionizing concrete and asphalt. It makes infrastructure more durable, drastically reduces CO₂ emissions, and lowers construction costs. For investors, this creates a perfect storm of technological advancement and sustainability pressure. Those who get in early with the companies driving this change will position themselves at the forefront of a billion-dollar market.

time to read: 3 minutes

|

Author:

Armin Schulz

ISIN:

ARGO LIVING SOILS CORP | CA04018T3064

Table of contents:

Author

Armin Schulz

Born in Mönchengladbach, he studied business administration in the Netherlands. In the course of his studies he came into contact with the stock exchange for the first time. He has more than 25 years of experience in stock market business.

Tag cloud

Shares cloud

The starting point

The partnership between Argo Living Soils, soon to be Argo Graphene Solutions, and Graphene Leaders Canada (GLC) is a stroke of luck for the construction industry. While GLC brings its expertise in the production of liquid graphene nanoplatelets to the table, Argo complements this with practical industry know-how, led by CEO Scott Smale, whose 35 years of construction experience cover every detail of materials science. Their common goal is to develop a marketable additive that enhances the pressure resistance of concrete and asphalt by up to 30% and increases their flexibility by 80%, while reducing cement requirements by up to 50%.

The strategic approach is convincing. For just CAD 100,000, Argo is financing the first test phase through independent laboratories. If the promising preliminary studies are confirmed in August, the path to commercialization will be open. The timing is ideal, as North America's ready-mixed concrete market, valued at USD 250 billion, is growing at a rate of 4.5% annually. Argo is focusing precisely where the leverage is greatest: on mass-market products for infrastructure, not niche solutions.

Graphene could revolutionize numerous industries – from electronics to energy supply, medical technology, aviation, and many more. What makes this material so unique? Its electrical conductivity, combined with high stability, flexibility, and chemical resistance, makes it the all-rounder of the future. If commercialization in concrete and asphalt is successful, other products could also be optimized.

Concrete becomes a climate hero

Until now, cement production has been responsible for 8% of global CO2 emissions – each ton of cement produced emits around 650 kg of greenhouse gases. Graphene is radically changing this equation. It enables a 50% reduction in cement usage through optimized particle bonding. This saves up to 325 kg of CO2 per ton of concrete while simultaneously increasing durability and performance. The result is longer-lasting bridges, more stable high-rise buildings, and lower maintenance costs over the life cycle.

However, the advantages extend even further: Graphene makes concrete "smart". It detects microcracks at an early stage, is four times more resistant to water, and survives extreme freeze-thaw cycles without damage. These additional properties are worth their weight in gold, especially in parts of North America. Argo is now driving this innovation forward with an initial large order of 1,000 litres of high-purity graphene oxide for North American pilot projects, which represents a decisive step towards market penetration.

Asphalt: The silent growth engine

While concrete is in the spotlight, graphene is unfolding its full potential in the approximately USD 82 billion asphalt market. Roads gain up to 70% more stability under load, develop fewer ruts under heavy traffic, and last significantly longer thanks to improved temperature resistance. For municipalities, this means threefold benefits:

- Lower construction costs

- Longer maintenance intervals

- Fewer traffic disruptions

Pilot projects in Vancouver are already demonstrating how graphene-reinforced asphalt enables "smart roads" with integrated sensor technology for real-time monitoring.

A market in turbo growth mode

The figures speak for themselves. According to Precedence Research, the global graphene market is expected to grow at an annual rate of 31.7% to nearly USD 7 billion by 2034. In North America alone, revenues are projected to rise from USD 50 million in 2024 to USD 850 million by 2035.** Building materials are the key growth driver in this development.

Argo is ideally positioned in this ecosystem:

- The strategic name change to "Argo Graphene Solutions" underscores the focus.

- Scalable supply chains enable rapid growth.

- Regulatory tailwinds from CO2 pricing and ESG requirements are accelerating adoption.

- The US subsidiary Argo Green Concrete Solutions Inc. secures access to the US market.

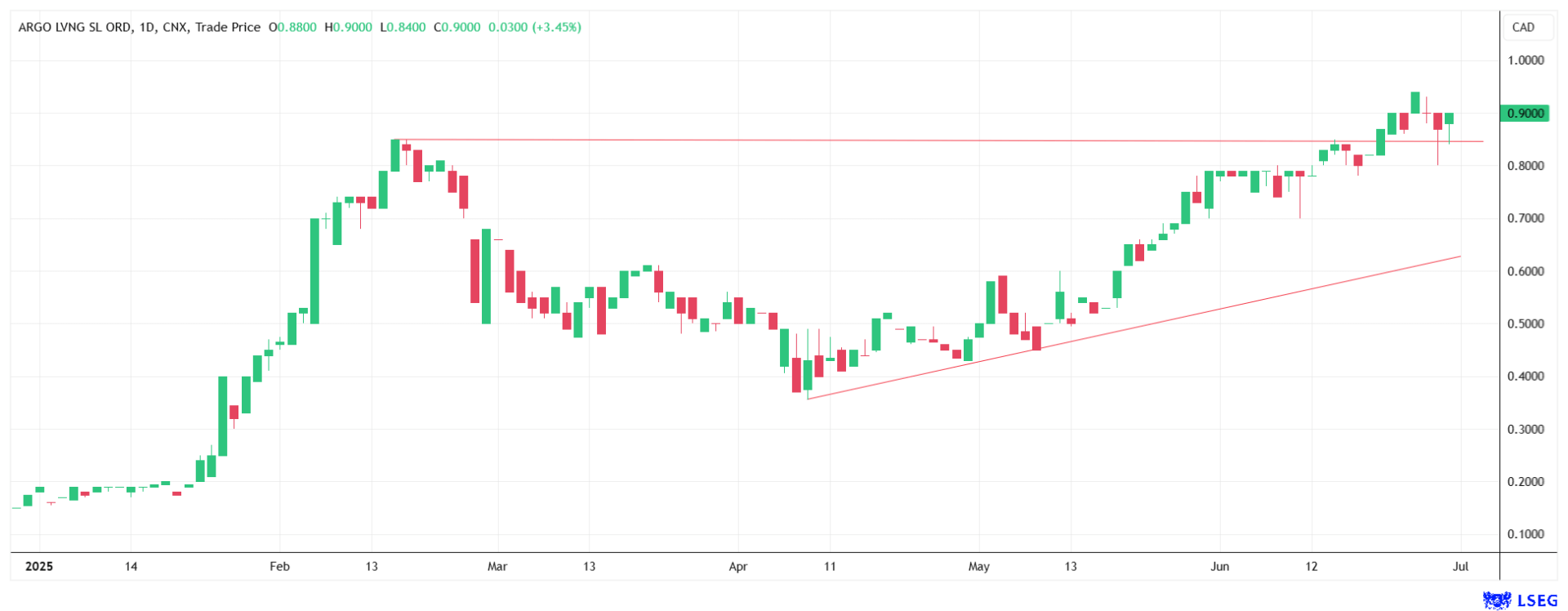

Funds and investors are looking for exactly such players - companies that deliver measurable environmental benefits while improving products in traditional sectors. With a current market capitalization of just CAD 16.6 million and a share price of CAD 0.90, Argo offers the asymmetric risk-reward profile of a technology innovator in a considerable market.

Graphene is transforming the construction industry from the ground up, and Argo Living Soils is driving this change. With its strategic partner GLC, focused leadership, and scalable solutions for concrete and asphalt, the Company is on the cusp of a massive wave of commercialization. The combination of CO2 reduction, increased durability, and regulatory tailwinds creates a unique investment theme. For forward-thinking investors, this is an opportunity not only to accompany the next step toward more sustainable infrastructure but also to position themselves early in order to benefit from it in the long term.**

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.