July 3rd, 2023 | 07:45 CEST

Forget the heating law - 100% turnaround opportunity possible with Deutsche Bank, Volkswagen, BYD and Cardiol Therapeutics

When the major indices perform, some stocks unfortunately fall by the wayside. This can be due to a lack of attractiveness or the impact of megatrends such as Artificial Intelligence or Digitalization. Deutsche Bank is well on track for 2023, Volkswagen's low valuation is bound to attract attention at some point, and biotech company Cardiol Therapeutics is poised for a big jump. We take a closer look.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

DEUTSCHE BANK AG NA O.N. | DE0005140008 , VOLKSWAGEN AG VZO O.N. | DE0007664039 , BYD CO. LTD H YC 1 | CNE100000296 , CARDIOL THERAPEUTICS | CA14161Y2006

Table of contents:

"[...] As a company dedicated to developing treatments for rare heart diseases, we see this as an opportune moment to contribute to the fight against heart disease and make meaningful strides in improving heart health worldwide. [...]" David Elsley, CEO, Cardiol Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Deutsche Bank - Well on the way, yet unpopular

The share price remains rock solid below EUR 10, but those who look at Deutsche Bank's figures will be pleasantly surprised. After years of restructuring, Germany's top institution has turned the corner. Earnings are rising strongly because, with the turnaround in interest rates, the lending business is now working again. Recently, investment banking has also started to move, and the high prices on the markets are helping to increase margins in asset management.

Positive signals are now also coming from the US. There, the DBK-US subsidiary mastered the latest stress test with flying colors. According to the latest results, the major transatlantic banks demonstrate their ability to cope well with an economic crisis in an emergency. In the darkest negative scenario of the US Federal Reserve, which assumes a severe economic slump, all 23 institutions tested were able to maintain an average capital ratio of 10.1%; the requirement was at least 4.5%. Given the turmoil among US regional banks in the spring, which led to the collapse of some institutions, the regular stress check was a particular focus of attention this time. The US subsidiary of Deutsche Bank, which had failed the test several times before, came out with a strengthened capital ratio of 17.4%. This cushion should protect it from adversity.

Unfortunately, there are still problems with Postbank's technical integration in Germany. The lengthy migration process is putting Postbank accounts into offline mode, customers are currently finding it difficult to use their funds, especially at weekends, and even cash withdrawals are not working consistently. Not a good report card for a Group that has been transforming itself into the modern era for 10 years now. Despite constantly setting new DAX records, DBK shares fell back to EUR 9.60 after an interim high of EUR 12.40. There are currently 23 studies on the Refinitiv Eikon platform. They calculate an average 12-month price target of EUR 12.67, so the turnaround in the share price should soon get off the ground.

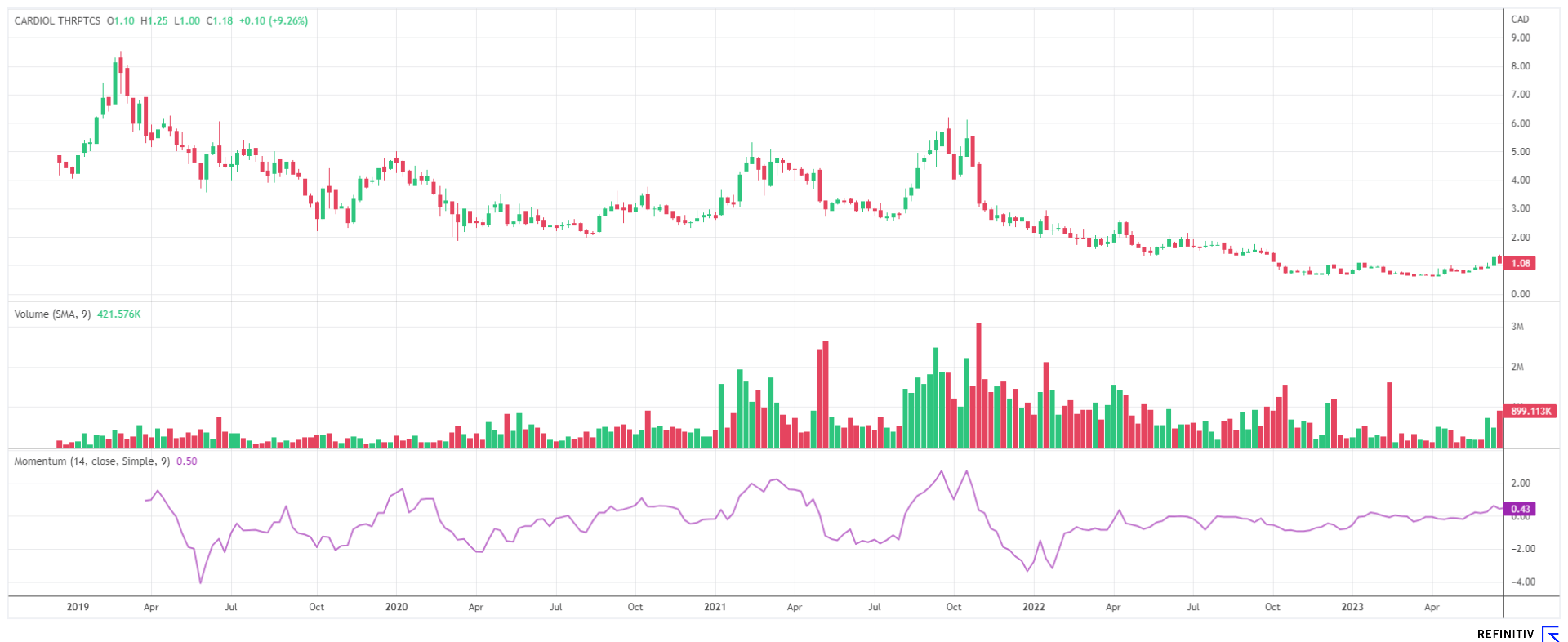

Cardiol Therapeutics - Focused on the heart

Cardiol Therapeutics Inc (CRDL) is a Canadian biotechnology company focused on the discovery and clinical development of innovative therapies for the treatment of cardiovascular disease. The Company's promising product candidate, CardiolRx (cannabidiol), is a pharmaceutically manufactured oral solution formulation designed specifically for use in heart disease. Cannabidiol is known to inhibit activation of the inflammasome signaling pathway, which is known to play an important role in inflammation and fibrosis associated with myocarditis, pericarditis and heart failure. In December, the Company initiated a Phase II pilot study for the treatment of recurrent pericarditis, an inflammatory heart disease with symptoms such as stabbing chest pain, shortness of breath and fatigue that limit physical activity and quality of life for those affected. In the US, the indication of heart failure is expected to increase by 33% in the next few years. Almost 10 million people in the US already suffer from this life limitation.

The CRDL share price made a 100% jump from CAD 0.67 to CAD 1.37 due to good research progress in the second quarter. On Friday, it was priced at CAD 1.18, with high trading volumes. "We believe we are dramatically undervalued," said David Elsley, CEO of Cardiol Therapeutics, in a recent interview with Manuel Koch. Indeed, with a market capitalization of only CAD 76.8 million, the stock is currently valued just above its cash position of about CAD 60 million. When brokers offer a capital increase, David Elsley smiles calmly because the Company is financed through 2025. Analysts at Leede, Jones & Gable and First Berlin see a weighted 12-month price target of around CAD 4.00. With more good news this year, the Canadians should become one of the top performers in the biotech sector.

Volkswagen versus BYD - The technical counterattack is underway

Two turnaround stocks from the automotive sector are currently attracting attention. On the radar, the largest Chinese manufacturer, "Build Your Dreams" (BYD), appears with a completed bottom formation at around EUR 25. The technology company had already reached a high of EUR 41.80 in July 2022, after which Warren Buffet also sold shares in the Company. The share price promptly stumbled and reached its preliminary low of EUR 20.65 in November 2022. Fundamentally, the Company continues to grow strongly at around 20% per annum and will achieve sales of more than CNY 1 trillion in 2026. According to studies on Refinitiv Eikon, the P/E ratio is expected to fall from around 30 to around 12. Of 32 analysts, 29 are positive, and the median 12-month price target is CNY 336 or EUR 42.50.

German competitor Volkswagen is growing nowhere near as strongly but is analytically valued at a 2023 P/E ratio of only 4.5. In China, the Company has a top position in vehicle sales, but in Europe, the business has been declining for years. In direct comparison to BYD, the market capitalization is about 25% lower at around EUR 70 billion. Meanwhile, VW's sales reach over EUR 300 billion, 4 times the level of its Far Eastern rival. It seems that international investors prefer the high dynamics of Asian manufacturers over "Made in Germany". Still, with a 2025 P/E ratio of 3.7 and a 7% dividend, the VW stock must eventually reappear on the buy list. The 33 analysts on the Refinitiv Eikon platform expect EUR 159 in 12 months - a potential premium of 30%. In the 3-year chart, the saucer formation would be completed at around EUR 175. Time to collect!

The stock market gives and takes. While AI-related papers are trading in the range of their multi-year highs, other sectors are currently neglected. However, there are opportunities in the automotive and biotech sectors that should be on one's radar.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.