May 24th, 2024 | 07:15 CEST

Energy transition with the battery revolution! BASF, Altech Advanced Materials, Siemens Energy and BYD

And once again, Nvidia! The NASDAQ continues to set the pace. In addition to good figures from the corporate sector, hopes of an imminent interest rate cut are currently providing a boost. This should happen as early as June. Despite persistent inflation figures, the financial community believes that the Fed should prevent or at least mitigate the impending downturn in the US economy by making loans cheaper. This is grist to the mill of the long-term bulls in the tech sector. As a result, the NDX reached a new all-time high and only just missed the next thousand mark at 18,996 points. Commodities, especially battery metals, are now also bullish. This is shifting the focus of potential alternative technologies for the lithium-ion standard. Which stocks in this sector are attracting attention?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

BASF SE NA O.N. | DE000BASF111 , ALTECH ADV.MAT. NA O.N. | DE000A31C3Y4 , SIEMENS ENERGY AG NA O.N. | DE000ENER6Y0 , BYD CO. LTD H YC 1 | CNE100000296

Table of contents:

"[...] The collaboration with CVMR offers two primary advantages for Power Nickel: We can cover a larger portion of the value chain in the future, and despite the extensive cooperation with all its positive outcomes, we have remained significantly independent. [...]" Terry Lynch, CEO, Power Nickel

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BASF - Germany is no longer the first choice location

*Germany has no longer had access to cheap gas for 2 years. Given that this situation is unlikely to change in the foreseeable future, the world's largest chemical company, BASF, has now had to make initial adjustments at its main plant in Ludwigshafen. A restructuring is planned, which will also involve the sale of entire plants. This primarily affects production sites for ammonia, methanol and melamine, which can no longer be operated profitably in the current European market environment. "One cannot imagine this plant suddenly scaling back, closing down in part, instead of expanding. It has always expanded*," said Fritz Hofmann, former BASF works council member in Ludwigshafen.

BASF remains an important supplier in the global process industry, but the production of the substances no longer necessarily has to take place in Germany. According to the chemical company, it made a profit everywhere last year, except in Germany. The Board of Executive Directors complains that there are too high energy costs, too much bureaucracy, and too much over-regulation. As a result, BASF is cutting costs and reducing jobs in Germany. At the same time, the Company is investing massively in China, with around EUR 10 billion going into the construction of a new mega-plant for basic chemicals in Zhanjiang alone. BASF is also one of the largest battery material producers in the world. Therefore, proximity to Asia, the hub of e-mobility, makes perfect sense.

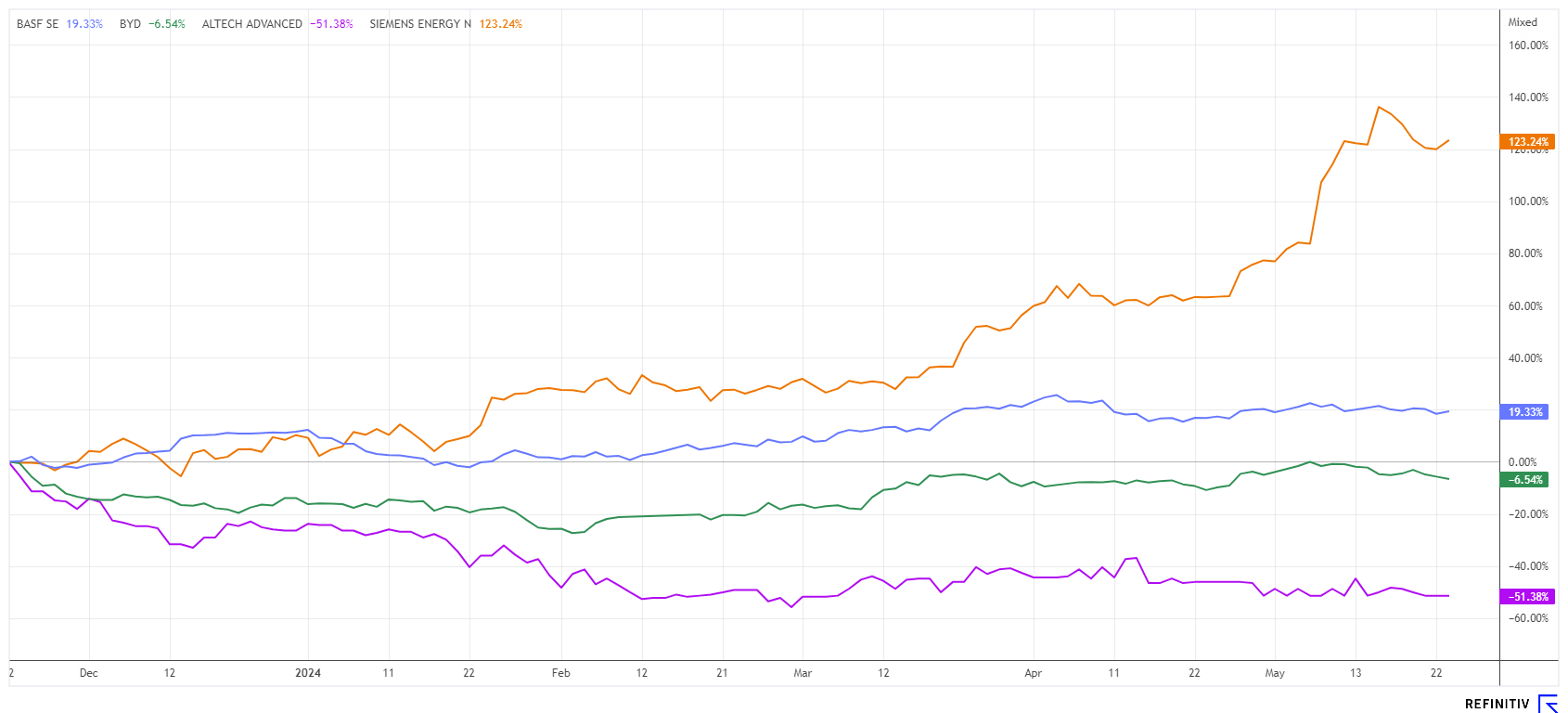

**BASF shares have performed very well so far in 2024, with an increase of over 19%, including a generous dividend payment. 13 out of 25 analysts on the Refinitiv Eikon platform continue to vote to "Buy" and have an average price expectation of EUR 54.70, around 12% above the current price.

BYD - A new version of the Blade Battery is on the way

BYD has performed poorly this year. Although the Company was able to outperform Tesla in the delivery of e-vehicles in the first quarter, the share price is not really getting back on its feet at the moment. In terms of technology, the Chinese remain at the forefront. A new version of the successful Blade Battery has just been unveiled. It weighs significantly less than its predecessor but can store more electricity due to its increased energy density. The further developed lithium iron phosphate battery (LFP) is due to be launched on the market this summer. The innovative battery technology is now also being sold to competitors such as Tesla, Toyota, Kia, Ford and Hyundai. On the Refinitiv Eikon platform, 33 out of 34 experts are still positive, with an average 12-month upside potential of 32%.

Altech Advanced Materials - The next generation up its sleeve

After several capital measures, the Altech Advanced Materials share price has recently calmed down. No wonder because after a positive feasibility study, the battery innovator from Germany is now looking for permits and subsidies at the Schwarze Pumpe site. In a few years, ultra-modern units should be rolling off the production line here, but substantial investments will have to be made before that. The joint venture project with Fraunhofer is called CERENERGY® and focuses on a new sodium chloride solid-state battery for intermediate energy storage in the grid.

In 2023, the battery cell was further improved, and a production design has already been developed, i.e., all raw material, machine, and system suppliers have been determined. The necessary approval procedures have been initiated, funding applications have been submitted and the Company is attending trade fairs to further raise its profile. CEO Uwe Ahrens is setting the bar high for the coming years because, in addition to the existing pilot plant for the new sodium-based CERENERGY® battery, the patented Silumina Anodes coating process is also to be launched on an industrial scale in the future.

The battery market is on the move; in addition to Asia, the next generations are also being developed in Germany. Anyone investing in Altech now is currently doing so at a very low market valuation of around EUR 41 million. Next week, on May 28 at 10:30 a.m., Altech will comment on current developments in a conference call. You can register here: mwb-Research - Conference call with Altech

Siemens Energy - This chart looks dangerous

Pay attention to the chart of Siemens Energy. With the rally of the last 7 months, the share price has quadrupled from EUR 6.40 to around EUR 25.80. Fundamentally, resolving the problems at the Spanish wind subsidiary Siemens Gamesa has finally allowed the Company to breathe a sigh of relief. To streamline the Company, the Munich-based company is now selling its Indian division, Siemens Gamesa Renewable Energy, for around USD 1 billion. Despite all the euphoria, the negative comments from analysts have been piling up recently. JP Morgan and Bernstein remain skeptical, with price targets of EUR 13 and EUR 15, respectively, while Goldman Sachs recently confirmed its target of EUR 32.70. From a technical standpoint, we would like to point out a double top from 2023 around the EUR 25 mark. If you set your safety stop at EUR 23.50, the ample profits will remain in the book or increase further in the event of an upward breakout.

Now that Berlin has canceled the environmental bonus for e-vehicles, the market can only continue to exist with good battery performance data compared to conventional technologies. BASF, BYD and Altech Advanced Materials have the right ideas in a highly dynamic market, so the long-term opportunities for investors should outweigh the risks. Siemens Energy is at risk of a correction after the considerable rise.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.