May 21st, 2024 | 07:30 CEST

Blackout ahead! Artificial intelligence becomes a power problem: Plug Power, Nel ASA and Carbon Done Right Developments

OpenAI has unveiled a new version of ChatGPT that communicates more humanely than any AI before it. Google is also rebuilding its search engine and will answer queries with AI-generated summaries in the future. According to experts, the boom in such tools could soon lead to network overload or even a blackout. This is because AI applications consume an enormous amount of power in data centers. The energy consumption of an AI-generated question differs from a normal search engine entry by up to a factor of 10. This puts the energy transition at risk, as full electrification will require more and more electricity for electric vehicles, heat pumps and electricity-based industrial solutions, which politicians want to come from renewable energy sources. However, the International Energy Agency predicts that the electricity demand will increase by 80 to 150% by 2050. The stock market evaluates energy companies according to their return potential without any ideological bias. Where are the opportunities for investors?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

PLUG POWER INC. DL-_01 | US72919P2020 , NEL ASA NK-_20 | NO0010081235 , CARBON DONE RIGHT DEVELOPMENTS INC | CA14109M1023

Table of contents:

"[...] In Canada, there is $1.75 of debt for every dollar of disposable income - and that was true even before the pandemic. [...]" Karim Nanji, CEO, Marble Financial

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Plug Power and Nel ASA - Pulling the plug

It was a very dark day for the recently popular hydrogen stocks. While there was still a sense of euphoria at the beginning of the week, this was already forgotten by the end of the week. This was due to the generous investment guarantee of USD 1.66 billion for the ailing H2 expert Plug Power. This amount was granted by the US Department of Energy (DOE) for the accelerated construction of 6 megawatt H2 factories in various states. With this conditional commitment, the electrolyser stack manufacturer has reached a significant milestone, demonstrating the DOE's intention to fund future Plug Power projects.

However, the emphasis should be on "conditional". Before any funds can flow, the Company must meet a series of technical, legal, environmental, and financial conditions. It took 48 hours for the stock market to catch on to the fact that this is only a guarantee for the time being and that no money has flowed on the investment side yet. The industry is still dependent on private investment, which is rare because green hydrogen is not economically competitive. Therefore, it must be subsidized by the state to have a chance on the market as an alternative energy source.

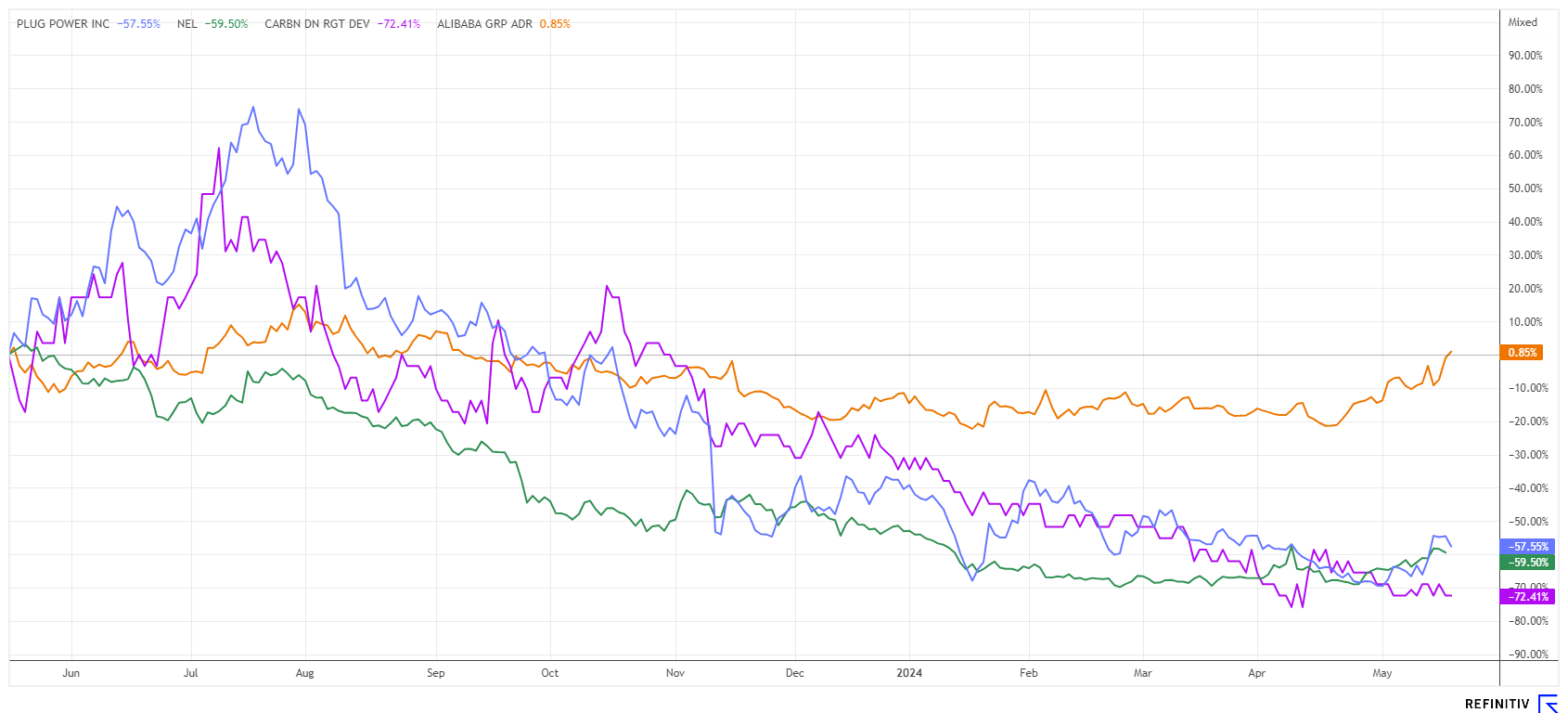

Our "flash in the pan" assessment from last Wednesday hit the mark perfectly. Plug Power has again lost over 40% from its high, while Nel ASA has been spared with a loss of 10%. The advice remains: Stay vigilant, as the sector correction will likely continue for a while longer.

Carbon Done Right Developments - Climate protection at your fingertips

Anyone engaged in climate change initiatives should focus on projects that offer a measurable improvement compared to the status quo because an existing climate impact can be measured in CO2 units. For the financial world, there are also tradable rights for such pollution in the form of carbon certificates. These certificates aim to provide an end-to-end assessment of CO2 emissions for the purpose of pricing and passing them on to the industry. There are still industrial sectors, such as mining, heavy industry, the defense industry, and the traditional energy industry, where the need for action has been building up for decades.

Nothing can be done quickly here because entire production processes must be adjusted to lower emissions, which takes years and consumes billions in investments. In addition, the new process landscapes also require the commitment of the management to implement them. Those who have not yet embraced this mindset or are operating within the legal deadlines will need to purchase "pollution rights" on the capital market. Where there are buyers, there are, of course, also producers. They generate suitable compensation programs through reforestation measures, with appropriate certification, and produce these tradable rights. Although the overall process balances out to zero, the measures do not further burden the planet.

The Canadian company Carbon Done Right Developments (formerly Klimat X) is committed to offsetting climate pollution. It offers CO2 polluters corresponding investment opportunities in environmental projects that focus on forest regeneration, mangrove protection and water conservation. In order to better address the market and also establish new blockchain-based business models, the Company has announced the prospect of a listing on AIM in addition to its Canadian listing. By using blockchain technology, each transaction is carefully recorded in a decentralized ledger so that the origin, ownership, and full transaction history of each certificate is verifiable and unalterable. Due to the delayed submission of the figures for 2023, a KLX share can currently be purchased cheaply between CAD 0.04 and 0.05. The stock is tradable in Frankfurt and on the TSX with a market capitalization at a low level of EUR 3 million.

Alibaba - This could be the starting signal

The shares of the online giant Alibaba have been consolidating for a long time. To increase its competitiveness in e-commerce, the Chinese trading company is increasingly relying on artificial intelligence. Users can now use an AI chatbot on the Company's platform to make personalized product recommendations. For example, flat-screen TVs from a well-known Japanese brand are suggested according to the user's specifications. This service is supported by a powerful AI language model developed from the Company's cloud-based data. The power of these tools is impressive.

There were figures again last week. Despite many technological innovations, Alibaba recently saw its market share decline from 80% in 2017 to 37% in 2023. In the last financial year (ending 30.03.24), revenue increased by 8% to around USD 130.4 billion, and net profit rose to USD 9.9 billion. Due to high write-downs on investments, profits fell by 96% in the last quarter, but sales continued to rise by 7%. Contrary to other industry trends, Alibaba achieved growth through price reductions. The cloud segment is expected to continue its double-digit growth in 2024. Internationally, investors are increasing their stakes in Chinese stocks while at the same time reducing their holdings in US tech companies. From a purely technical chart perspective, the 13% increase last week could signal the end of the internet giant's three-year slump.

Energy is becoming a rare commodity due to the increased use of artificial intelligence. In addition to traditional energy sources, hydrogen is slowly making its way, but the real wave of investment has not yet begun, and Plug Power and Nel ASA remain in focus. Carbon Done Right offers access to modern, blockchain-based exchanges for CO2 certificates and can actively shape a new growth segment.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.