May 16th, 2024 | 07:00 CEST

Attention: Here we go! Hydrogen and uranium on the rise: Plug Power, Nel ASA, Kraken Energy and Siemens Energy in focus

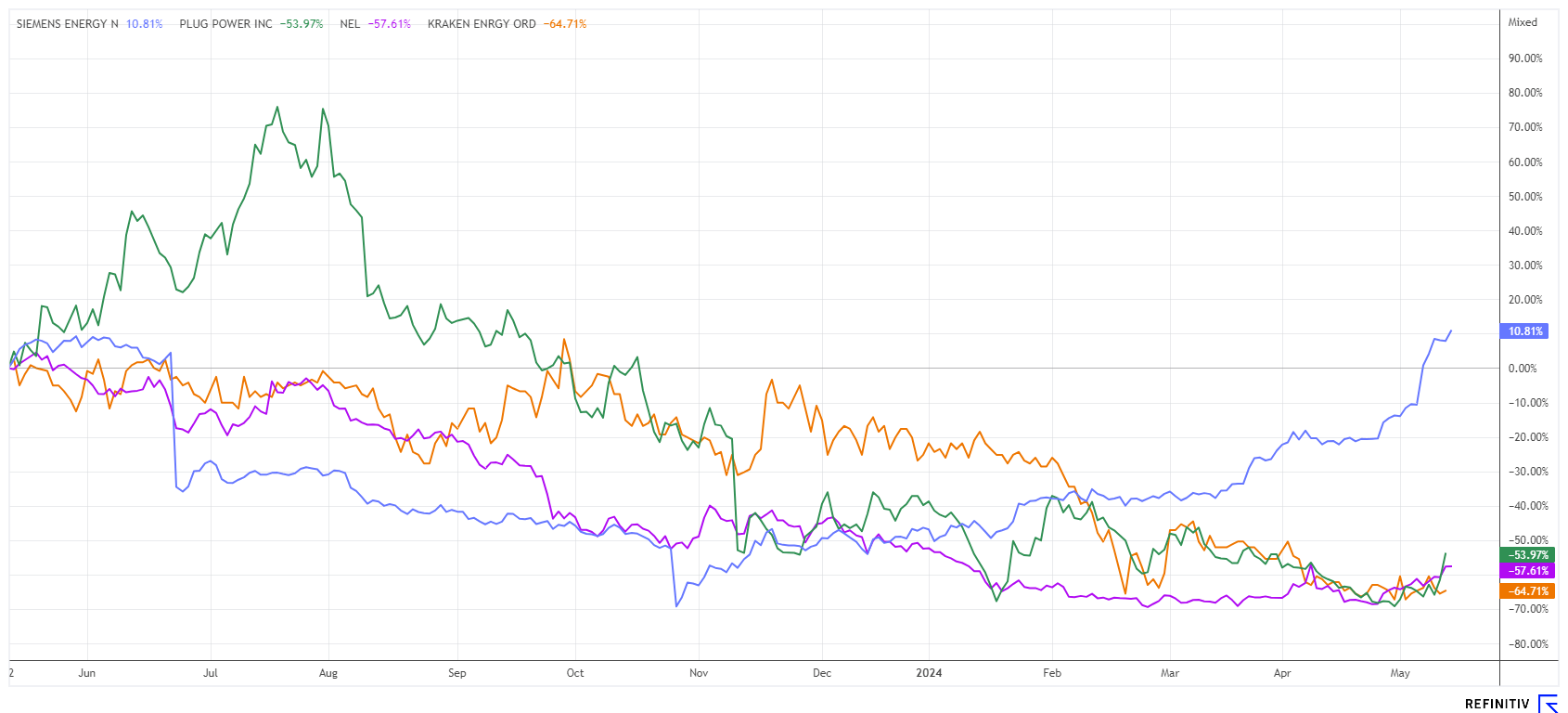

It has finally happened! After months of sell-offs in hydrogen shares, there was a sigh of relief across the sector the day before yesterday. The reason: industry leader Plug Power received a government guarantee of USD 1.66 billion as backing for the construction of six-megawatt sites nationwide to create an initial hydrogen infrastructure. The Department of Energy (DOE) is thus demonstrating that the US is serious about investing in alternative energies. The decision boosted the entire energy sector, with uranium also continuing its recent upward trend. Where do the opportunities lie for investors?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

PLUG POWER INC. DL-_01 | US72919P2020 , NEL ASA NK-_20 | NO0010081235 , KRAKEN ENERGY CORP | CA50075X1024 , SIEMENS ENERGY AG NA O.N. | DE000ENER6Y0

Table of contents:

"[...] Why should a modular electrolyzer cost more than a motorcycle? [...]" Sebastian-Justus Schmidt, CEO and Founder, Enapter AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Nel ASA and Plug Power - Billion-dollar credit line puts an end to the blues in the short term

One rarely sees anything like this. The news of a state loan guarantee in the hydrogen sector the day before yesterday sent a jolt through a sold-out sector. While Plug Power gained up to 80% over the day, the Norwegian Nel ASA rose 20% in sympathy. After opening strong at USD 5.00, the industry leader Plug lost USD 1.55 over the course of the day and closed at USD 3.45. Yesterday was the moment of truth. With good inflation figures, it rose to USD 3.80, but then sentiment turned negative again.

No wonder, just two months ago, Plug Power raised almost USD 1 billion with an "emergency placement" to avoid imminent insolvency. One can almost assume that government guarantees were issued to save the reeling electrolyser manufacturers from going under. After all, there are still no private investors of industrial significance in sight. We are therefore predicting a flash in the pan and renewed sales across the sector.

The experts on the Refinitiv Eikon platform see a medium-term price target of USD 5.17 for Plug Power, but there are currently only 9 active recommendations from 29 studies. NOK 5.75 is expected for competitor Nel ASA, where yesterday's tops were NOK 6.37. In the evening, the share was already struggling with the NOK 6.00 mark again. The short "dead cat bounce" probably only amused traders.

Kraken Energy - Strong radon anomalies identified

Things are much quieter in the uranium sector at the moment. Uranium producers are thin on the ground worldwide, and they can hope for stable business for years to come due to the many reactor construction projects. Industry experts estimate that the uranium deficit will exceed 35% of actual demand from 2028 onwards, bringing new projects into focus. The price of uranium consolidated slightly on the futures markets in April to USD 82, but yesterday, it reached a high of just under USD 93.

Now, there is news from Canadian uranium explorer Kraken Energy, which began drilling in Utah in February. The Company operates a total of 4 properties in the US. Recent samples at the Apex property in Nevada indicate strong radon anomalies along the shoulder of high magnetic anomalies that correlate well with known high-grade, near-surface uranium mineralization. They are located at both the historic Apex and Lowboy mines.

"As we approach drilling at the historic Apex mine, our team continues to generate exciting new uranium targets along the currently outlined 17.5 km trend of mineralization on the Apex property," said CEO Matthew Schwab.* "We have recently delineated additional strong ground radon anomalies that indicate potential uranium mineralization at depth and are further supported by airborne geophysics*."

The historic Apex uranium mine was historically the largest in Nevada, producing approximately 106,000 pounds of U3O8 at an average grade of approximately 0.25% in the 1950s. So, the sails are set, and there should be further success stories over the course of the year. There are currently 54.4 million shares issued, which are actively traded in the CAD 0.10 to 0.13 range. If further ore discoveries are made, the share price should really take off. The high forward price of uranium also has a positive effect on the entire industry.

Siemens Energy - First quartered and then quadrupled again

Unbelievable! In October 2023, there were fears that the quality problems at the Spanish subsidiary Gamesa could cost Siemens Energy its head and neck. Even a state guarantee was necessary to continue processing the existing orders. The share price plummeted from over EUR 20 to around EUR 6. Yesterday, however, it climbed back up to the EUR 24 mark, as the Company headquarters in Munich had recently raised its forecasts.

Siemens is currently benefiting above all from a strong grid business, but the management is also more optimistic for other sectors such as gas turbines, industrial transformation and the crisis-ridden wind turbine manufacturer Gamesa. Sales growth of 10 to 12% is now expected in the current year, whereas the Group had previously forecast an increase in revenue of 3 to 7%. CEO Christian Bruch raised the lower range for the operating margin before special effects and now expects between -1 and +1%; experts had expected minus 2%. Although the struggling wind subsidiary Gamesa continued to post losses in Q2, these were not as high as analysts had expected. The bottom line was a net profit of EUR 108 million after a loss of EUR 189 million in the previous year.

Will all this be enough for another upgrade? Only 13 of 22 experts on the Refinitiv Eikon platform have a "Buy" rating, but the weighted target price of EUR 24.20 was already exceeded yesterday. For those sitting on lavish profits, consistently raise your stop to EUR 23.50 and remain invested. Nothing should go wrong on the chart at the upward breakout line.

What a hydrogen rebound! With the US Department of Energy's announcement, the trend has changed across the entire sector. Plug & Co are now back on the buy lists. Uranium has been on the rise for several months now. Here, one can still affordably jump on the bandwagon with Kraken Energy.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.