June 11th, 2024 | 06:45 CEST

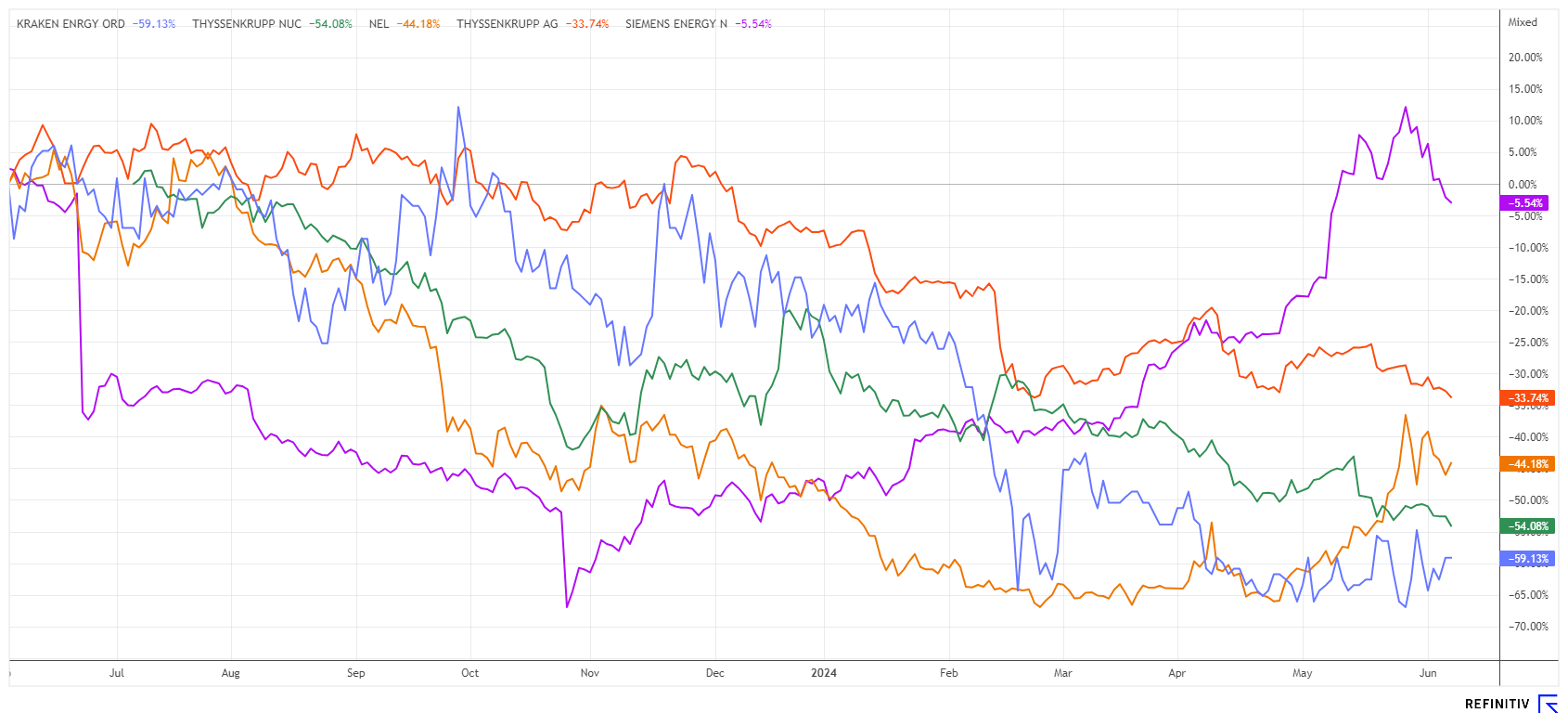

After the European elections: Is it all happening now? Nel ASA, Kraken Energy, Siemens Energy, ThyssenKrupp and Nucera in focus

Europe has voted, and the Green parties have suffered historic losses! Now, the energy debate is coming to the fore again. While Germany is focusing entirely on green energy in the future, other countries have long since turned the challenges of the time into action. Nuclear energy remains a "zero-zero solution", making France, the Czech Republic and Poland the biggest climate protection exporters in the EU. This is because many new state-of-the-art reactors are being built here. The electricity market is huge, as Germany alone will have to shut down its gas and coal-fired power plants over the next few years due to the CO2 reduction commitments from the Paris Agreement. This threatens to create a supply gap that can only be filled with alternative energies, nuclear power, or hydrogen. What should investors focus on now?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

THYSSENKRUPP NUCERA AG & CO KGAA | DE000NCA0001 , THYSSENKRUPP AG O.N. | DE0007500001 , KRAKEN ENERGY CORP | CA50075X1024 , NEL ASA NK-_20 | NO0010081235 , SIEMENS ENERGY AG NA O.N. | DE000ENER6Y0

Table of contents:

"[...] When we acquire something, we want to make sure that the acquisition fits with our strategy and has the potential to be successful for our shareholders. [...]" John Jeffrey, CEO, Saturn Oil & Gas Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Nel ASA - IPO of the filling station subsidiary ahead

The share of Norwegian hydrogen pioneer Nel ASA has been the shooting star in recent weeks, more than doubling from EUR 0.37 in March to EUR 0.78. The reason: Nel is set to spin off its H2 refueling business. The new company will soon be listed under the name Cavendish Hydrogen. For shareholders, this means an increase in their portfolio, as the parent company will distribute the shares as a dividend in kind. For every 50 Nel shares, shareholders will receive one new H2 filling station share. In 2023, the former Fueling division achieved sales of just under EUR 30 million, but overall, the Nel division generated an operating loss of around EUR 21 million. The EU has set a legal requirement for a refuelling station network with a density of 200 km by 2030. This should allow the company to grow further. However, the Refinitiv Eikon platform experts are rather pessimistic about Nel ASA and expect a medium-term price target of NOK 5.70 - a full 22% below the current price.

ThyssenKrupp - Shareholders disappointed by Nucera spin-off

The new shareholders of the promisingly launched ThyssenKrupp Nucera probably expected more. About a year ago, the IPO took place with a starting price of EUR 20. With initial euphoria, the share price climbed to EUR 26, but yesterday, the price stood at EUR 10.60 - more than halved. Investors' hydrogen dreams have not yet come true for Europe, because Europe needs a large-scale energy supply. This cannot be achieved today with hydrogen as a niche product. And now the Company has been relegated from the SDAX due to insufficient liquidity. The parent company ThyssenKrupp still holds more than 50%, and the former cooperation partner De Nora still holds 25%. The shares are likely to remain in stable hands for the time being.

The parent company, ThyssenKrupp, is also in deep trouble. High debt, crazy pension burdens, and little dynamism in the traditional steel business. Now, another key manager is leaving. The Chief Technology Officer of the steel subsidiary, Arnd Köfler, will leave the Company for personal reasons on June 30. Köfler is responsible for implementing the plans for climate-friendly steel production, the most important project of Germany's largest steel group. Perhaps the Group management should consider merging the marine division with the Italian shipbuilder Fincantieri to create new opportunities. A solution for the marine subsidiary has been sought for years. In the current environment, this would create a promising European defense company. Investors are likely very critical of the Duisburg-based company's situation, and yesterday, the share price fell to a 4-year low of EUR 4.30.

Kraken Energy - Uranium from Nevada on the agenda

In the current arms race, a large number of strategic metals are needed. One of these is the very rare uranium. It is used in all nuclear power units and is in demand worldwide, not least because of hundreds of new reactors. Industry experts estimate that the uranium deficit will exceed 35% of actual demand from 2028. This brings new projects around the globe into focus. The uranium price had already reached a 5-year high of USD 106 in January and is currently consolidating at around USD 87.

The Canadian uranium explorer Kraken Energy, is focusing on its four properties in the US and has discovered strong radon anomalies on the Apex property in Nevada. The drilling permit on the property is nearing completion. Currently, all additional requested United States Forest Service (USFS) baseline surveys have been completed in anticipation of the upcoming operating plan to begin drilling adjacent to the historic Apex Mine. **The USFS is still reviewing final changes to the plan of operations, and drilling is expected to start as early as August 2024.

At the beginning of June, the Company announced a small capital increase at CAD 0.09. Around CAD 1 million will be raised to get the drilling projects underway. Investors reacted positively, immediately pushing the share price up by 40%. The rising forward price for uranium could prove to be a good catalyst for Kraken Energy.

Siemens Energy - Our technical analysis hit the bull's eye

We pointed out the problematic technical situation at Siemens Energy about two weeks ago. Now, the double top in the EUR 26 area has proven to be correct; the price reacted with a decent correction to EUR 22.80 and is currently recovering somewhat. This is due to the Munich-based company's announcement to spin off its Indian business and float it separately on the stock exchange. Analysts are divided: Bernstein expects considerable costs for Siemens, which could range between EUR 3 and 7 billion. The rating is "Underperform", with a target price of EUR 15. Barclays is somewhat more optimistic and estimates the costs to be only up to EUR 2.5 billion, voting "Equal-Weight" with a price target of EUR 18. The analysts at Deutsche Bank paint a more positive picture, assuming expenses of around EUR 1 billion. Consequently, they maintain their "Buy" recommendation and corresponding price target of EUR 27.

Will all this be enough for a further upgrade? Only 12 of 23 experts on the Refinitiv Eikon platform vote "Buy", with a weighted target price of EUR 23.90. There is little potential compared to the current price. The last mentioned stop at EUR 23.50 has already been reached. There is currently little visibility, so it is advisable to stand on the sidelines for a while.

The stock market is currently taking no prisoners! What does not deliver gets beaten up. On the other hand, stocks like Nvidia are seeing new highs every day. Current hydrogen technologies have yet to prove their economic viability, as production remains too costly. The next wave of uranium purchases will likely come soon when the announced European and Chinese nuclear power projects come online.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.