December 8th, 2023 | 07:20 CET

Which stocks are leading the fight against cancer and chronic diseases? Defence Therapeutics, Merck and BioNTech

The pharmaceutical industry is facing complex developments in the fight against cancer, with Defence Therapeutics making significant progress with the successful FDA filing for its drug for the targeted treatment of tumors. The growing market opportunities in oncology until 2032 underline the potential of this breakthrough. In contrast, Merck KGaA is experiencing a severe setback with an 11% share price decline following the failure of evobrutinib for the relief of MS in late-stage clinical trials. According to analysts, this also impacts the Company's valuation. Despite promising cancer-fighting approaches, BioNTech faces uncertainties due to a reduced revenue forecast for 2023 and an 'Underweight' rating from JP Morgan. Despite these challenges, the sector remains dynamic. Find out which shares could be worthwhile in the long term here.

time to read: 5 minutes

|

Author:

Juliane Zielonka

ISIN:

DEFENCE THERAPEUTICS INC | CA24463V1013 , MERCK KGAA O.N. | DE0006599905 , BIONTECH SE SPON. ADRS 1 | US09075V1026

Table of contents:

"[...] Defence will continue to develop its Antibody Drug Conjugates "ADC" and its radiopharmaceuticals programs, which are currently two of the hottest products in demand in the pharma industries where significant consolidations and take-overs occurred. [...]" Sébastien Plouffe, CEO, Founder and Director, Defence Therapeutics Inc.

Author

Juliane Zielonka

Born in Bielefeld, she studied German, English and psychology. The emergence of the Internet in the early '90s led her from university to training in graphic design and marketing communications. After years of agency work in corporate branding, she switched to publishing and learned her editorial craft at Hubert Burda Media.

Tag cloud

Shares cloud

Defence Therapeutics achieves milestone: FDA application for cancer therapy signals a breakthrough in the treatment of solid tumors

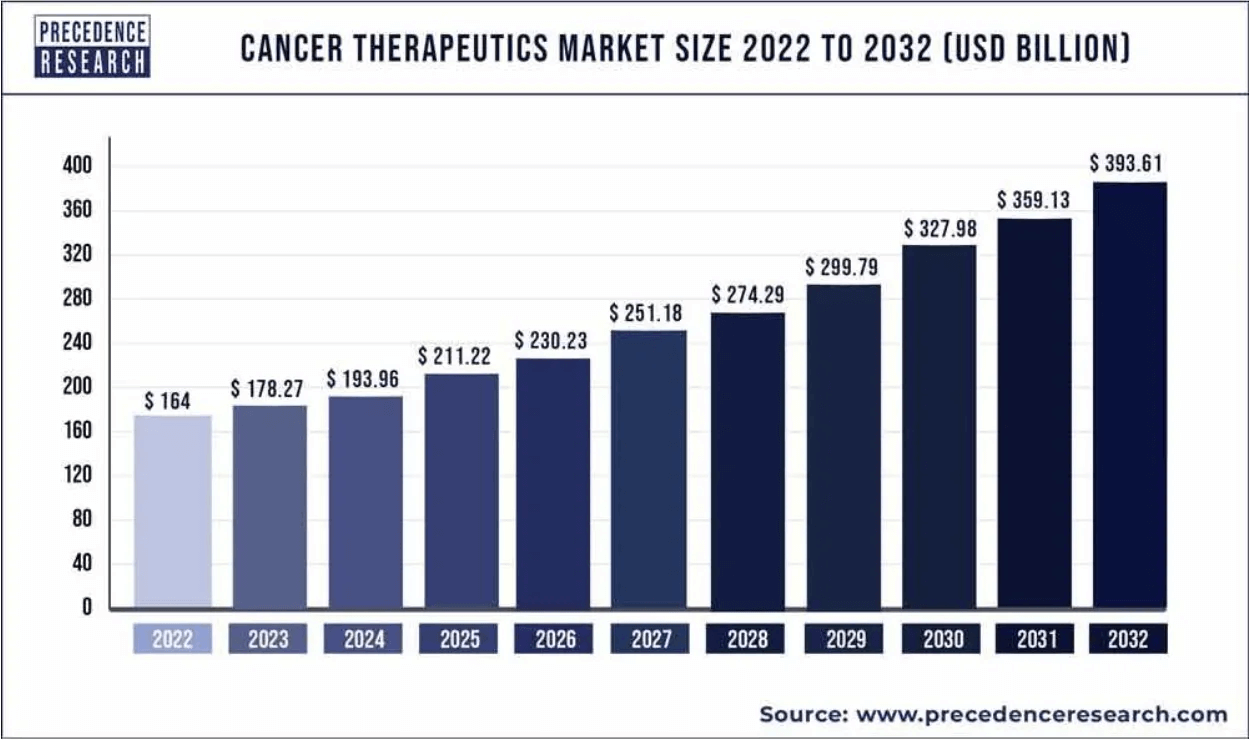

The market for cancer therapies is growing rapidly: it is expected to reach a whopping USD 393.61 billion by 2032, up from USD 164 billion in 2022. With an estimated annual growth rate of 9.20% between 2023 and 2032, this reflects the increasing demand for effective cancer treatments.

One of the reasons for the increase in cancer diagnoses is lifestyle. Since the mid-20th century, numerous unhealthy changes have affected diet, lifestyle, obesity, the environment and our microbiomes. These are tiny bacteria in the gut that are responsible for our well-being. These changes now appear to become entrenched earlier in life and could make people more susceptible to cancer at a younger age, according to a 'Nature' study.

For companies like Defence Therapeutics, this translates to growing market opportunities. The young biotech company specializes in the research and development of active substances for the treatment of cancer and infectious diseases. The difference from the big players lies in the Company's agility. Thanks to their platform Accum™ technology, which can be used in cancer treatment, they are at the forefront of technology. Accum™ can deliver drugs exclusively to the infected parts of affected cells at a rate ten times higher than current solutions.

Defence Therapeutics has achieved a significant breakthrough in the field of immuno-oncology. In early November 2023, the Company successfully submitted an Investigational New Drug (IND) application to the US Food and Drug Administration (FDA). The aim is to obtain approval for AccuTOX®, an injectable anti-cancer molecule, to treat solid cancer tumors.

The procedure for tumor treatment is already established among interventional radiologists. This means it is already accepted on the market and does not need to be made accessible to doctors through additional, complex educational measures. The therapy works as follows: The AccuTOX® molecule disrupts the inner membranes of the degenerated cells, influences their movement, triggers genetic effects and ensures that the cells die in a way that activates the patient's own immune system.

Tests on animals with various types of cancer have shown impressive results, demonstrating survival rates of 70 to 100% in solid T-cell lymphoma, melanoma and breast cancer. Defence Therapeutics plans to partner with the renowned US cancer clinic City of Hope to conduct testing on AccuTOX® for melanomas and other tumors.

Setback for MS drug in late-stage trial - Merck KGaA shares fall 11%

Merck KGaA shares fell by 11% at the start of trading on the Frankfurt Stock Exchange. This came after the pharmaceutical company announced that its experimental drug for multiple sclerosis (MS), evobrutinib, had failed to meet its primary objective in late-stage clinical trials. Late-stage clinical trials are mainly aimed at demonstrating the efficacy, safety and cost-effectiveness of a product. These correspond to phases 2b and 3, the so-called confirmatory studies, often compared with the therapeutic "gold standard", if available.

According to the Company, evobrutinib did not reduce the annualized relapse rate in patients with relapsing-remitting multiple sclerosis (RMS) in the Phase III trial compared to Sanofi's Aubagio. Multiple sclerosis (MS) is an inflammatory disease of the central nervous system that causes various neurological symptoms by affecting the insulating layer around nerve fibres. Relapsing-remitting multiple sclerosis shows sudden symptoms that last for a few days to weeks and typically resolve completely. The relapses recur on average every one to three years. Around 2.8 million people worldwide live with multiple sclerosis (35.9 per 100,000 inhabitants).

JP Morgan states that the failure of evobrutinib could potentially lead to a 1% decline in group sales in 2025, with a possible increase to 3% by 2028-2030. The broker estimates that this could mean a 2% decline in group EBITDA (previously), rising to 8-9% by 2028-2030 unless there are offsetting cost savings. In addition, JP Morgan expects that Merck KGaA could make a provision for the completion of the trials with the Q4 results, which would reduce Group EBITDA (previously) for 2023 by around 2% to around EUR 5.8 billion. HSBC reacted to the news by downgrading Merck's rating to "Hold" from "Buy" and lowering the price target by 8% to EUR 170.

Despite winning in patent dispute, are the prosperous years over for BioNTech?

A whole army of molecules in the fight against cancer is slumbering in the pipeline of BioNTech. The Company is working on many fronts. On the one hand, it has downgraded its sales forecast for 2023 by 20% from EUR 5 billion to EUR 4 billion.

On the other hand, it has won a legal dispute against the pharmaceutical company Moderna. The European Patent Office has declared an mRNA patent invalid, which Moderna claimed in a legal dispute alleging patent infringement by BioNTech and its partner Pfizer. This paves the way at the legal level once the studies on the individual molecules have been successfully completed.

However, JP Morgan considers the share to be "Underweight". Their analyst Jessica Fye has lowered her price target for BioNTech from USD 106 to USD 99 per share. She reasons that the declining estimates for the Company's COVID-19 vaccine business have hurt the stock, and the ongoing uncertainty will continue to have a negative impact. Investors should rebalance their portfolios if they have not already done so.

Defence Therapeutics has reached a new milestone by successfully submitting an FDA application for AccuTOX®. Given the growing market for cancer therapies until 2032, promising market opportunities are opening up for Defence Therapeutics. The positive results of the studies to date lay the foundation for the planned partnership with the renowned City of Hope Cancer Clinic. Merck KGaA, on the other hand, suffered a setback with the MS drug evobrutinib. The 11% drop in Merck KGaA's share price following the announcement of the failure in late-stage clinical trials reflects investor disappointment. Analysts speculate that this setback will also affect group sales and the overall company valuation. BioNTech faces challenges despite a recent patent win and promising molecules in its cancer-fighting pipeline. The Mainz-based company reduced its sales forecast for 2023 by 20% due to uncertainties in the COVID-19 vaccine business. The legal dispute won against Moderna is overshadowed by JP Morgan's classification of the BioNTech share as "Underweight". Defence Therapeutics, as an agile company, can score points with its FDA approval and is just as exciting an addition to the portfolio as BioNTech. With a well-stocked pipeline, BioNTech from Mainz is set to launch several initiatives in the fight against cancer in the coming years. Plenty of time for Merck KGaA to recover from the setback.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.