January 2nd, 2026 | 07:05 CET

Attention - fasten your seatbelts! 2026 could be a rocket launch for Novo Nordisk, Evotec, Bayer, and Vidac Pharma

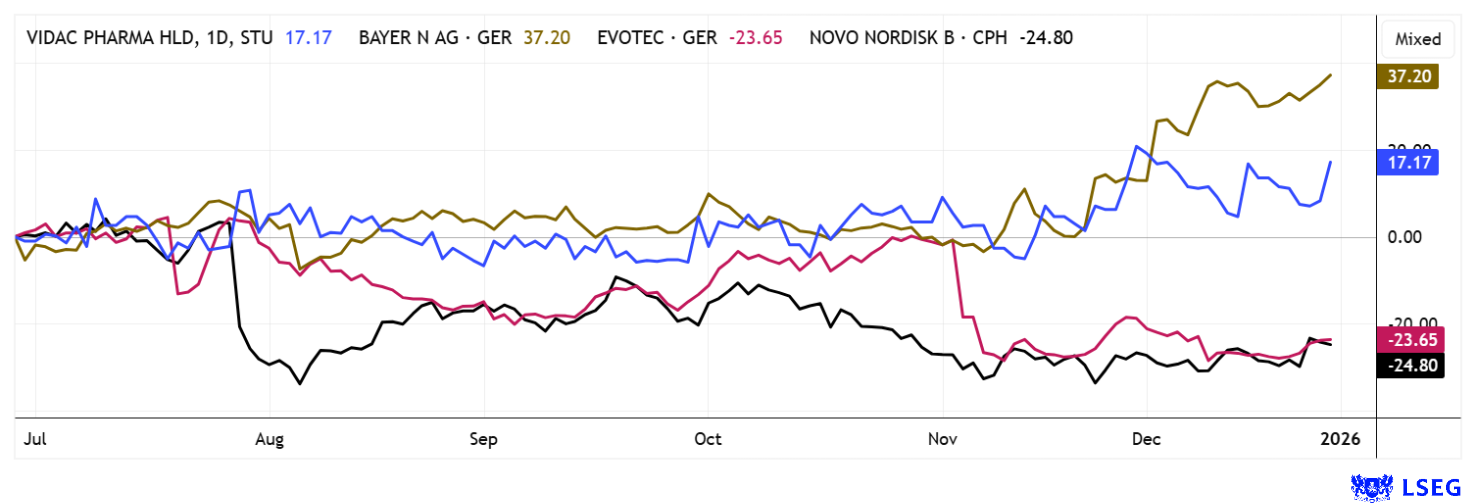

The stock market is starting the new year 2026 in a buoyant mood. The mining and commodities sector showed that it is not only possible to make money with tech stocks, with almost every stock doubling in value, and some even increasing tenfold. The coming year, however, could bring yet another shift in perspective. The biotech sector has been quiet for quite some time, but some of the protagonists in our selection are showing, in part, significant technical base formations. For risk-aware investors, it may be time to reshuffle more decisively and realign portfolios. Come in and find out!

time to read: 6 minutes

|

Author:

André Will-Laudien

ISIN:

NOVO NORDISK A/S | DK0062498333 , EVOTEC SE INH O.N. | DE0005664809 , BAYER AG NA O.N. | DE000BAY0017 , VIDAC PHARMA HOLDING PLC | GB00BM9XQ619

Table of contents:

"[...] Defence will continue to develop its Antibody Drug Conjugates "ADC" and its radiopharmaceuticals programs, which are currently two of the hottest products in demand in the pharma industries where significant consolidations and take-overs occurred. [...]" Sébastien Plouffe, CEO, Founder and Director, Defence Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Evotec – Another year of consolidation

Long hoped for, but still unrealized: following a weak 2025, Evotec remains in a challenging phase. The share price has lost around 35% of its value over the year, and the hoped-for recovery has yet to materialize. Market sentiment was further weighed down by the complete exit of a major shareholder, as the foundation associated with pharmaceutical group Novo Nordisk divested its entire 5% stake - a move widely perceived as a negative signal.

The new management team, however, is clearly prioritizing profitability over growth and has already begun selling off capital-intensive business areas. Most notably, the Just - Evotec Biologics site in Toulouse was sold to Sandoz, generating USD 350 million in cash. In addition, there are opportunities for further milestone payments and license fees of over USD 300 million in the coming years. Importantly, Evotec retains a perpetual license to the J.POD technology, preserving future revenue opportunities.

Analysts initially expect a slight decline in revenue of around 5% to approximately EUR 780 million in 2025 due to the new structure. According to the consensus, revenues are not expected to rise again to around EUR 833 million until 2026. Investors are placing their hopes primarily on a biosimilar portfolio with ten molecules. However, the stock market remains skeptical, as evidenced by the low year-end closing price of EUR 5.40. The sale of shares by Chief Scientific Officer Dr. Cord Dohrmann caused additional unrest, even though this transaction is not necessarily negative. Some analysts on the LSEG platform, however, see opportunities for an operational turnaround and are setting price targets of around EUR 8.89. This would mean a potential doubling of the share price. Overall, however, Evotec faces the test of whether its new strategy can sustainably reconcile growth and earnings. We are now putting Evotec back on the watch list, but any increases should only be speculative up to EUR 5.70 and with a consistent stop at EUR 5.05.

Bayer – Analysts revise price targets upwards

Bayer is currently showing its stronger side again, with its share price up 91% over the year, putting it in second place behind Siemens Energy in the DAX. A key driver was the success of the Phase III "Oceanic-Stroke" study with the experimental anticoagulant asundexian, which achieved both its primary efficacy and safety endpoints. In patients after non-cardioembolic strokes or high-risk TIAs, the substance reduced the risk of another stroke. Bayer is now planning global discussions with authorities and will present the study data at a scientific congress. One question remains in the glyphosate case: How much remaining compensation can be expected here? The Trump administration has surprisingly come out in favor of limiting the pending lawsuits, which could potentially save billions in compensation. Bayer had previously spent around EUR 8.53 billion to settle the lawsuits and set aside an additional EUR 1.2 billion. A favorable ruling by the Supreme Court could significantly reduce legal uncertainty and make future lawsuits more difficult.

After years of pessimism, the average 12-month price target of analysts on the LSEG platform has gradually increased from EUR 26.50 to EUR 33.70. 10 out of 21 experts are now voting to buy again. In contrast, six months ago, the picture was much more discouraging. If the technical breakthrough at EUR 35 to 37 is now also achieved, the EUR 45 mark is technically within reach. If the experts are correct in their expected earnings per share of EUR 4.75 in 2026, the stock is currently trading at a P/E ratio of 7.8. Long-term funds in the pharmaceutical sector show room for growth up to 15.5, which means the price could easily double again. No one would have predicted that!

Vidac Pharma – Now you can go all in

Vidac Pharma is continuously expanding its position as an innovative developer of metabolic cancer therapies and placing tumor metabolism at the center of therapeutic strategies. The Company recently received a comprehensive patent from the US Patent and Trademark Office for a new class of HK2-targeting agents, which are designed to act on tumors highly dependent on the enzyme hexokinase-2. By reversing the so-called Warburg effect, these compounds aim to return cancer cells to a near-normal metabolic state while making them more susceptible to immune attack. The current platform forms the scientific basis for the drug candidates VDA-1275 and VDA-1102 (Tuvatexib), which are being further developed in clinical trials. Most recently, the European Medicines Agency gave the green light for the Phase 2B clinical trial with Tuvatexib against rapidly progressing precursors of skin cancer, a key milestone for the Company. Vidac is working closely with CentroDerm, under Prof. Thomas Dirschka, to implement the trials efficiently.

With a market capitalization of around EUR 28 million, Vidac remains extremely undervalued compared to its peers on the NASDAQ. If clinical development is successful, the stock could become an attractive takeover candidate. The combination of first-in-class technologies, a differentiated pipeline, and a strong patent portfolio clearly positions Vidac as an innovative oncology company with high growth and return potential. The research firm Sphene Capital recently confirmed its "Buy" recommendation for the oncology pioneer's stock with a price target of EUR 4.20 over a 36-month horizon. Sphene points to the blockbuster potential inherent in the current drug developments. Founder and CEO Dr. Max Herzberg struck again at the end of the year and significantly increased his shareholding. If that is not a good sign for 2026, what is? Keep an eye on the chart: at EUR 0.58, the share price is on the verge of a significant breakout above EUR 0.60! Vidac is one of our biotech favorites for 2026 – very exciting!

Novo Nordisk – If that is not bottoming out, what is?

Down 50% – is that enough now? In recent months, Novo Nordisk has gone through one of the most difficult correction phases in its recent history. Although it has not yet been technically confirmed that the four-part downward movement has ended, the recent high trading volumes indicate a possible capitulation by sellers.

New study data on the weight-loss drug Amycretin, which helped type 2 diabetics lose up to 14.5% of their body weight within 36 weeks, provided a tailwind. Both a weekly injection and an oral version of the active ingredient were tested in comparison with a placebo. At the same time, increasing competition is driving down prices, especially in China, where Wegovy is expected to be offered at a significantly lower price from 2026. This is in line with the global strategy of focusing more on self-payers and tapping into new volume markets. At the same time, pressure is mounting as the patent on the active ingredient semaglutide expires in China in 2026. The latest approval of an oral version of Wegovy in the US, which is set to hit the market in January, was also well received. This gives Novo Nordisk an important edge over competitors such as Eli Lilly and could revitalize its own growth story. 15 of 28 analysts on the LSEG platform continue to see attractive upside potential of around 20% over the next 12 months. Perhaps the Danish pharmaceutical titan will return to the returns stage sooner than expected! The 10% jump at the end of the year is exciting! Accumulate between EUR 40 and EUR 45 in the long term!

Looking ahead to the new trading year 2026, investors are expected to take a closer look at the biotech sector. After all, no one has been able to make a killing here in the last 3 years. In the well-paid tech sector, there are increasing signs of a consolidation of the lavish valuations, especially as fund managers no longer urgently need the stocks after reporting them in their annual investment list to embellish their results. Vidac Pharma and Bayer are showing technical strength, while Evotec and Novo Nordisk are still somewhat speculative but not uninteresting at their low levels.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.