November 24th, 2022 | 11:12 CET

What the heat turnaround means for copper: Siemens Energy, Kodiak Copper, ThyssenKrupp

Investors looking for the latest trends often focus on metals such as rare earths, vanadium and lithium. But if you want to get the future into your portfolio, you don't have to rely on exotic elements; copper offers the best conditions. As the British Building Services Research and Information Association (BSRIA) has shown on behalf of the International Copper Association, the demand for copper alone for climate-related refurbishment will increase to 160,000t by 2035 from the current 40,000t. That represents an annual growth rate of around 10%. We highlight three companies around the trend.

time to read: 4 minutes

|

Author:

Nico Popp

ISIN:

SIEMENS ENERGY AG NA O.N. | DE000ENER6Y0 , KODIAK COPPER CORP. | CA50012K1066 , THYSSENKRUPP AG O.N. | DE0007500001

Table of contents:

"[...] We have a clear strategy for neutralizing sovereign risk in Papua New Guinea. [...]" Matthew Salthouse, CEO, Kainantu Resources

Author

Nico Popp

At home in Southern Germany, the passionate stock exchange expert has been accompanying the capital markets for about twenty years. With a soft spot for smaller companies, he is constantly on the lookout for exciting investment stories.

Tag cloud

Shares cloud

Siemens Energy: Giant heat pumps to make the difference

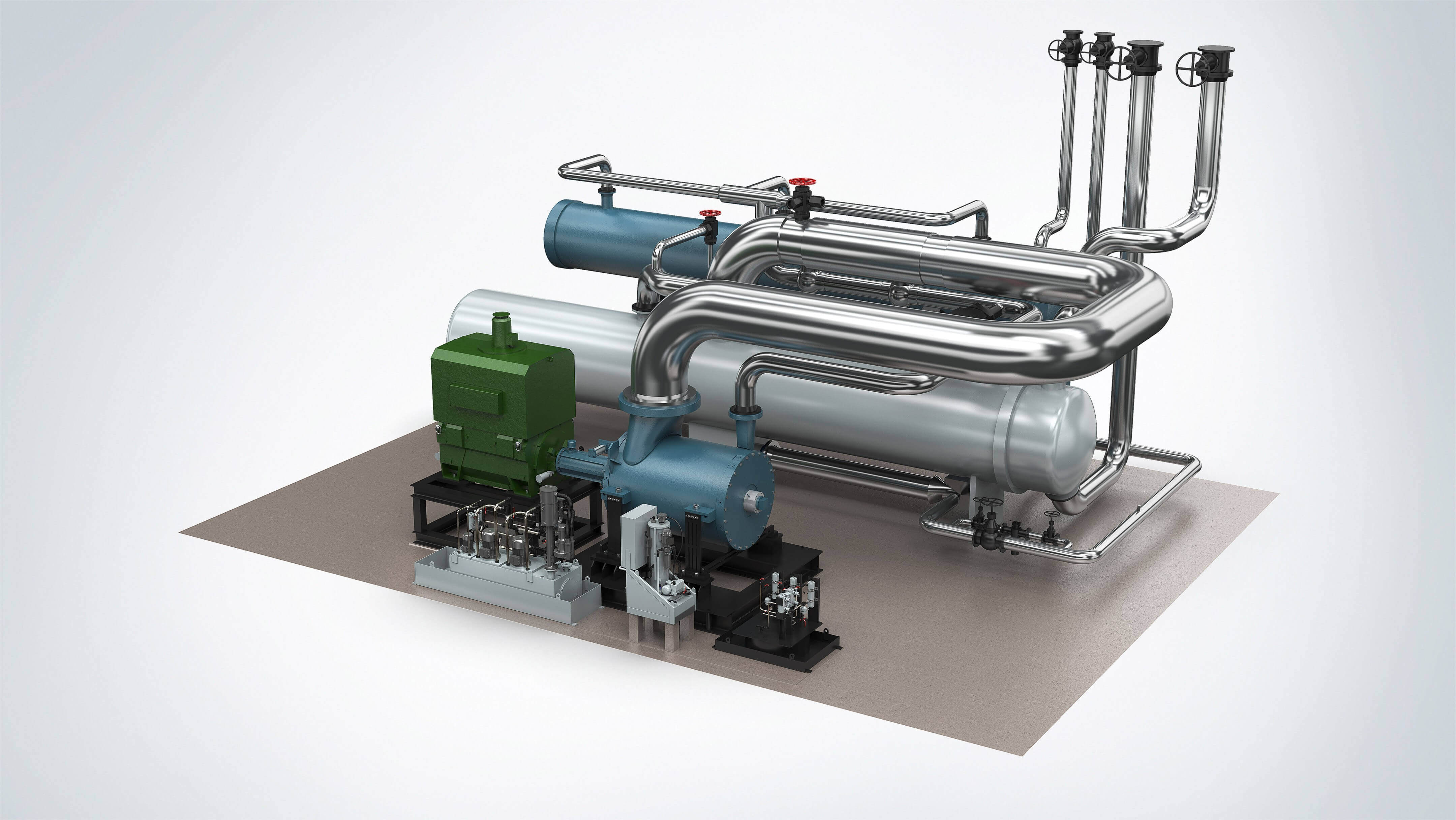

Of the 160,000t of copper needed for climate protection measures by 2035, a full 75,000t is accounted for by the power sector. Heat pumps, in turn, account for 35,000t of this share. In 2021, Siemens Energy signed a contract with Vattenfall for joint testing of a large-scale, high-temperature heat pump. It will be used to generate district heating. Specifically, the heat pump takes waste heat from a power plant that has been supplying energy to around 12,000 offices, 1,000 apartments and several cultural institutions at Potsdamer Platz in Berlin since 1997. The example shows: Heat pumps are suitable for more than just single-family homes. In the future, heat pumps could be used wherever waste heat is generated on a large scale.

However, as we have said, this is not so easy: Siemens Energy is currently struggling with high material costs and strained logistics. Although the order backlog is still significant, the Company is also in the midst of a transformation. The fact that the most important division is still called Gas and Power (share of sales around 64%) is significant. The Gamesa wind power division (around 35% sales share) has also recently made negative headlines. Most recently, a member of the supervisory board resigned. Siemens Energy had previously announced its intention to take over Gamesa completely. Despite the still smoldering problems, the share has picked up speed and is close to a resistance zone. If the stock jumps above the August high of EUR 16.50, a further 10% return is quickly possible. However, the medium-term potential is relatively non-existent.

Kodiak Copper: Copper secret tip with surprise potential

One company that could contribute to the energy transition is the Canadian copper company, Kodiak Copper. The Company operates its MPD project in southern British Columbia and is drilling up to 25,000 meters this year. Increasingly, the goal is to discover new zones of mineralization. "Our interpretation from the beginning has been that MPD is a large copper-gold porphyry system with multiple centers. Following our initial discovery of a high-grade porphyry center in the Gate Zone, we are now pursuing the same systematic exploration approach in additional target areas to make additional high-grade discoveries and take the project to the next level. With a solid financial position and a fully funded exploration program, we are well positioned to move MPD forward and realize for our shareholders the potential of a porphyry copper system that we believe is very large in size," CEO Claudia Tornquist commented on the developments in the fall.

In total, the MPD project covers 147 sq km and is not far from existing mines around copper and gold. A drill hole that revealed grades of 0.49% copper and 0.29 g/t gold over a distance of 535 meters is considered a direct hit. This is another reason why Kodiak Copper is regarded as a hot candidate for the future within the mining community. Currently, the stock may be suffering from general recession fears, but the market should soon put the recession behind it and look ahead. Because Kodiak Copper is fully funded and offers one of the most desirable commodities of the coming decades in a safe mining region, the stock is a candidate for any watch list. Since the Company has other irons in the fire with Mohave (copper, molybdenum, silver), the stock is currently worth considering, especially for anticyclical investors. The past has shown that Kodiak Copper can always experience dynamic upward movements. Due to the low liquidity of the share, trend followers usually have a hard time jumping on the bandwagon. It therefore makes sense to have a foot in the door with Kodiak.

ThyssenKrupp: Lots of hope, little return

A foot in the door is also what industrial companies like ThyssenKrupp would like to have in the basic materials market. The producer of crude steel is still suffering from shortages of raw materials and energy costs. But unlike many of its competitors, ThyssenKrupp has already developed several promising business areas. It is well positioned in hydrogen production through electrolysis plants and plans to float this business separately on the stock market. ThyssenKrupp is also benefiting from a special boom in the construction of submarines and surface vessels - regrettable as this is due to the war in Ukraine.

However, there is virtually no sign of this boom on the stock market. ThyssenKrupp's stock is trading at a long-term low - the value has halved in the space of a year. That puts the former pride of the Ruhr region in the same league as Kodiak Copper, but the latter is a growth stock with no cash flows but great potential at the bottom. While ThyssenKrupp and Siemens Energy have to transform their operating business during the course of the energy transition, Kodiak Copper can already achieve success with "business as usual". Anyone who thinks speculatively and has an eye on the coming copper deficit should take a very close look at the Kodiak share.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.