July 25th, 2022 | 11:45 CEST

What is the future of copper? This chart concerns everyone! Nordex, Alpha Copper, Mercedes-Benz

The copper price is relevant for all investors. Why? It indicates how inflation is developing and hints at where the economy might be headed in the coming months. But is the industrial metal once again living up to its reputation as "Dr Copper", i.e. as an economic indicator that is more reliable than many an economist? We explain the situation surrounding copper, derive a possible scenario for the coming months from this and then take a look at the three shares of Nordex, Alpha Copper and Mercedes-Benz. Let's go!

time to read: 5 minutes

|

Author:

Nico Popp

ISIN:

NORDEX SE O.N. | DE000A0D6554 , MERCEDES-BENZ GROUP AG | DE0007100000 , ALPHA COPPER CORP | CA02074D1087

Table of contents:

"[...] We have a clear strategy for neutralizing sovereign risk in Papua New Guinea. [...]" Matthew Salthouse, CEO, Kainantu Resources

Author

Nico Popp

At home in Southern Germany, the passionate stock exchange expert has been accompanying the capital markets for about twenty years. With a soft spot for smaller companies, he is constantly on the lookout for exciting investment stories.

Tag cloud

Shares cloud

First positive signals around the Ukraine war and inflation

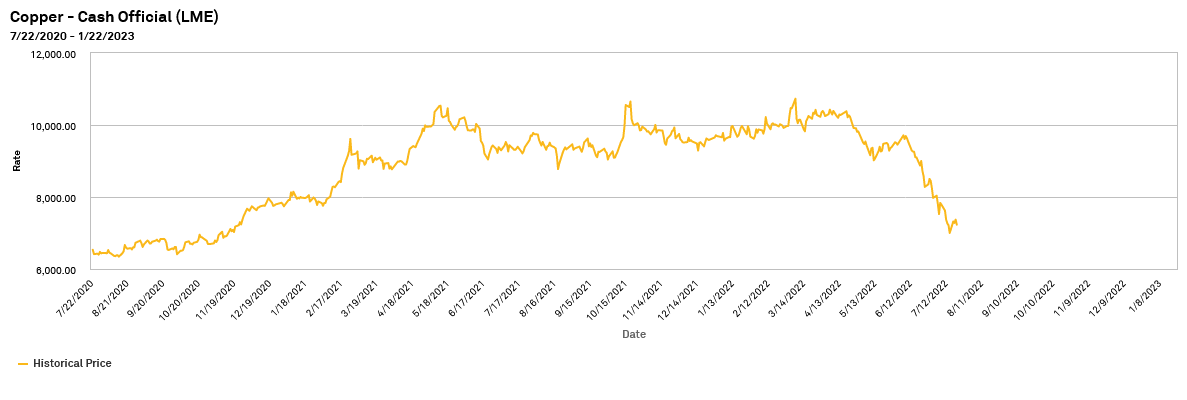

When copper was trading above USD 10,700 on the London Metal Exchange in March, the market was in a state of confusion. The war in Ukraine had just shaken the world, and it was already foreseeable that the situation in Ukraine could be the death blow for the economy. Nevertheless, copper reached a new high. A lot has happened since then. Copper plunged below USD 7,500 per ton, and the word recession is on everyone's lips. But is the situation that much worse today than it was in March?

While the world was thinking of all escalation options around the war in Ukraine in March, the situation has calmed down slightly since then. Russia and Ukraine have even reached an agreement on wheat exports. Gas is also flowing again in Nord Stream 1. At the same time, the major central banks have firmly taken up the fight against inflation. The US could soon dare to take the next step by 75 basis points, and the ECB has at least managed to raise interest rates by 50 basis points instead of the 25 it had announced. This determination is well received by many observers with a long-term horizon. Although there are once again critical voices against the ECB, the central bank was in a dilemma anyway - the choice between inflation and recession has to be weighed up. Cheating is not an option.

Why things are different this time

The central banks' decisive interest rate moves, coupled with the price losses on the commodity markets, could help to bring inflation back to a normal level in the medium term. Although the textbook says that higher interest rates dampen economic activity and are "poison" in the face of an impending recession, the current situation is different. While faced with supply problems and general shortages, two behaviours currently prevail in the economy: The first is to secure goods as soon as they are available, freely following the motto "it is better to have than to need." The second is to wait and see, given the fragile situation. Financing conditions are the least of the problems in both scenarios. In addition, interest rates are still very low in historical terms.

Instead, the central banks' clear stance coupled with falling commodity prices could at least dispel the specter of inflation, removing a major factor of uncertainty for the economy. Last week, purchasing managers' indices were released in Germany and France. They each slipped into recessionary territory below 50 points for the industrial component. Only France's service sector remains in slightly positive territory. Helaba's experts see a combination of "geopolitical uncertainty, gas crisis, high price increases, skills shortages, supply bottlenecks and rising interest rates" as the reason. Or in short: the situation is diffuse and has a significant psychological component.

Copper: More psychology than facts

John Meyer of SP Angel also believes that market psychology could play a significant role. The expert sees some hedge funds betting on lower copper prices. These would price in a recession scenario and take lockdowns in China as an opportunity to take further short positions. Fundamentally, however, the copper supply remains limited, and the demand, especially from the renewable energy sector, remains high, also because of climate change. The rise in copper prices immediately after the outbreak of the war also suggests that the fundamental situation, i.e. the interplay of supply and demand, is somewhat positive for copper.

Even if important economies slip into a technical recession, which only becomes apparent in retrospect and can hardly be more than a statistical phenomenon given the extent of the distortions in the economy, copper will remain in demand. Above all, the unique economic situation surrounding the electrification of the economy and the requirements in the wake of climate change should support the industrial metal again in the long term. John Meyer also assumes that copper can reach the level of USD 10,000 per ton again.

Nordex or Mercedes-Benz: Investors with a chicken-and-egg problem

As the market finds it difficult to cope with various risk factors, some of which have conflicting effects, and collective psychology prefers unambiguous scenarios, the market is currently playing out a recession scenario using copper, other commodities and also important stock indices as examples. Although this cannot be dismissed altogether, the situation is more complex. Even the first successes in the fight against inflation could make economic players and consumers more confident again. As the future is traded on the stock exchange, investors should not write off copper. At the latest, when the market starts to focus on other factors instead of the recession, copper should rise again after the significant slump.

There are various options for investors to position themselves around copper. Since the expansion of renewable energies largely drives the demand for copper, investors could get the idea of taking a closer look at stocks such as Nordex. However, this is where investors confuse cause and effect. When copper rises, so do the costs for wind turbine manufacturers. Since Nordex already had a problem with its margin in the past, caution is called for here - despite all comeback fantasies. Copper is also primarily a cost factor for classic industrial stocks like Mercedes-Benz. Although a rising copper price should correlate again with a friendly-trending economy in the medium term, these are not causal relationships.

Alpha Copper: Stock matches market phase

Those who think logically should instead position themselves with companies in the copper industry. Industry experts, such as John Meyer, also advise taking a very close look here: Inflation would hit producers with high production costs particularly hard. Therefore, a better option for investors is exploration companies, such as Alpha Copper. Exploration companies do important preliminary work by searching for and identifying raw material deposits. However, if they are adequately financed, they tend to be little affected by the current economic turmoil. Alpha Copper has two copper projects in Canada that are among the most promising in the country. The Indata project covers 3,189 hectares and is located in the immediate vicinity of other promising discoveries, such as Kwanika and Stardust. Both projects are only about 15 km from Indata. The Okeover project, with a total area of 3,950 hectares, is also considered prospective. It has been explored in the past - i.e. at much lower copper prices.

With a market capitalization of only EUR 9 million, Alpha Copper offers speculative-oriented and experienced investors a good opportunity to profit from the comeback of the copper price in a complex overall situation. As exploration projects on the stock market offer considerable leverage on the development of commodity prices, the respective shares are also suitable for small positions. The lower liquidity also suggests an anti-cyclical entry. The current environment around copper seems suitable for this: The industrial metal is trading at a low, and sentiment is very poor. At the same time, copper remains in demand precisely because of future challenges. In the long term, the copper path should lead back upwards.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.