June 6th, 2023 | 07:45 CEST

Climate Crisis: Copper is the new oil! BYD, Orestone Mining, Ford, Nio - 100% acceleration in Greentech

At the beginning of May, analysts at Bank of America declared a new "super cycle" for basic and raw materials. What they mean by this is that a whole series of important materials will be in great short supply for years. The prime example is the red metal copper. The price of the industrial metal has almost doubled in the past 12 months. It is currently quoted at around USD 8,350 per tonne, not far from the historic high of USD 10,750. During the pandemic, the metal briefly fell to USD 4,500. Currently, however, forecasts are once again pointing upwards. Bank of America expects the price to more than double again to around USD 18,000 in the next three years. We take a look at some hot stocks.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

ORESTONE MINING CORP. | CA6861543032 , BYD CO. LTD H YC 1 | CNE100000296 , FORD MOTOR DL-_01 | US3453708600 , NIO INC.A S.ADR DL-_00025 | US62914V1061

Table of contents:

"[...] We knew the world was rapidly electrifying and urbanising and needing significant amounts of copper to do so. [...]" Nick Mather, CEO, SolGold PLC

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Orestone Mining - Copper is the new oil

Copper is in high demand in all electronic devices, buildings, and power-based infrastructure. The mediatization of humanity has seen demand for laptops, smartphones, routers and screens increase 3-fold in the last ten years, most recently due to the shift of work activities to the home office. Jim Currie, a commodities expert at the US investment bank Goldman Sachs, formulated his vision in an interview with Bloomberg TV: "Copper is the new oil." An advantage for the owners of copper resources.

Canadian explorer Orestone Mining (ORS) is sitting on a prospective deposit called Captain in northern British Columbia. The copper-gold project hosts a gold-bearing porphyry system over about 105 sq km. It is located in a good jurisdiction and includes several suitable porphyry targets already explored through geophysical surveys and drilling. The property is characterized by relatively flat terrain, moderate tree cover and an extensive network of logging and forest service roads which can be used for year-round exploration. In a recent reassessment, Orestone has demonstrated the presence of massive porphyry veins traced within thick intervals of gold-copper mineralized altered volcanic rocks in three drill holes. These strongly altered quartz-monzonite porphyry dykes range from 4 to 110 metres thick and grade up to 0.84 g/t gold and up to 0.17% copper. Aerial magnetic surveys are now continuing in the spring.

The share is still undiscovered, with prices around CAD 0.04. Therefore, the entire gold-copper project is only valued at just under CAD 2.3 million. The share price should swing upwards very quickly if the drilling results are good because new copper projects are highly sought after by the big mining companies.

BYD - The integrated Chinese all-rounder

Despite many doubters, the electric boom in China will continue in 2023. In this context, the Chinese "Build Your Dreams" (BYD) group can perform particularly well with its integrated business strategy. Last year, the BYD Group overtook its arch-rival Tesla as the world's largest producer of e-cars. In the current year, it has now also passed Volkswagen to become the market leader in China, the world's largest car market.

Although Norway is the leader in Europe with an electric new car rate of 80-90%, the important decisions for the industry are made in China. Nevertheless, with EU headquarters in the Netherlands, BYD has established a presence quite quickly in Norway, Germany and Poland. Italy, Spain and Portugal will follow in the next few months. Nevertheless, more cars are sold annually in China than in the EU and the USA combined. The pent-up demand in the increasingly affluent middle class is huge. In March, BYD was ahead of Volkswagen in the overall car market for the first time, according to data from the CPCA. German premium manufacturers, Mercedes and BMW did not even make it into the top 10, as other Chinese producers also scored with their models behind BYD.

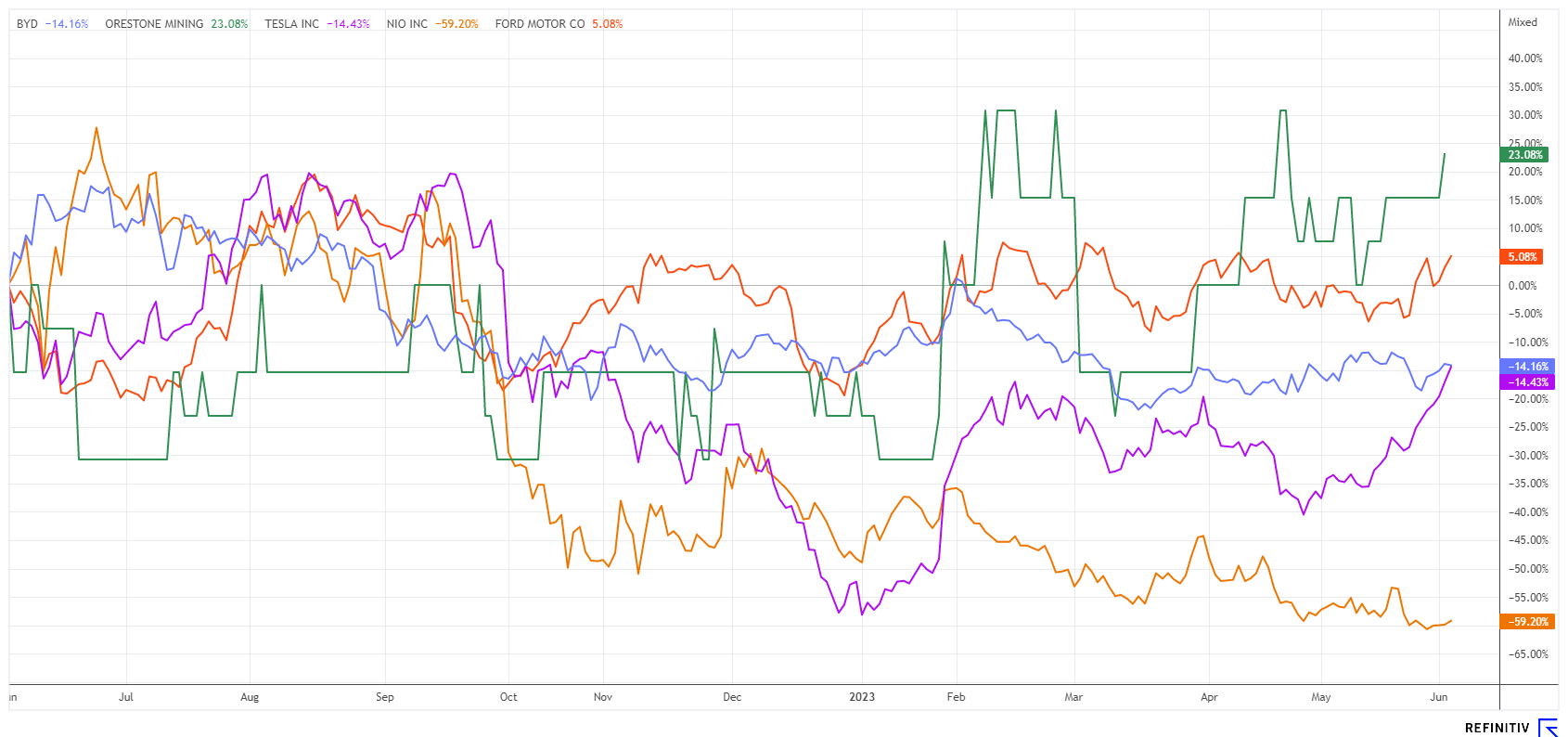

BYD managed growth of a proud 89% in sales in the entire first quarter, while German competitor VW suffered a 12 to 32% crash at its two partnerships, FAW and SAIC. Whether price reductions by foreigners in China will help is questionable, as BYD has significant cost advantages in production due to its control of supply chains. Although BYD's share price went into reverse gear in the first quarter, it has been rising since April, from EUR 23.50 to now EUR 29.50. The high was around EUR 41.80 in July 2022. Technically, the way to the upside is clear once the EUR 31 mark has been overcome.

Ford Motors and Nio - Falling by the wayside so far

E-mobility newcomers Ford and Nio provide a rather depressing view. Both corporations ventured into the technology late, which was punished via plummeting stock prices. Ford had relied too long on the success of its pick-up models in the US and completely slept through the international e-car boom. The share price peaked at around USD 25 at the beginning of 2022 and lost more than 60% in the same year.

Ford wanted to offer models as early as 2023 that would appeal to many people because of their low prices. The Company from Dearborn, Michigan, has now shattered this dream. Ford boss Jim Farley recently predicted: "Today, e-cars are primarily an alternative for those who can also afford a luxurious combustion engine. The prices are so high that petrol and diesel cars jump up one equipment class for the same money. That is not going to change any time soon!" The CEO believes that many manufacturers of electric cars will continue to face significantly higher costs than the combustion engine industry for years to come. Accordingly, prices are not expected to converge before 2030. For many manufacturers, this will only be the case with the second to third generation of e-cars. Ford's shares are down about 7% in a 12-month period, but that is still better than its competitors VW, BYD and Tesla.

In the current second round of the price war between carmakers, it is precisely manufacturers with a small market share that will lose out. In China, this concerns the start-ups Nio, XPeng and Li Auto. Consequently, the sales figures of Nio and XPeng were relatively poor. After the latest sales figures of Nio, which had to cope with a decline of 12.4% to 6,155 units in May compared to 2022, major brokerage houses downgraded their share price targets. Analysts at Jefferies lowered the price target for Nio shares from HKD 89.03 to now HKD 53.39, even below the traded level of HKD 58.45 earlier this week. Nio shares are already one of the big losers on a 12-month basis, down 60%. However, the still-young company wants to achieve its first operating profit already in 2025. According to Refinitiv Eikon's estimates, the price-sales ratio on a 2025 basis is about 1.5. However, if the group continues to shrink instead of grow, this could end badly for the Nio share.

The complete electrification of humanity will probably fail because of the availability of copper. However, politically green ideals will likely land the market in permanent oversupply in the next few years. As a result, car manufacturers will have to struggle with rising costs, while upcoming copper suppliers like Orestone Mining can celebrate when the real value comes to light.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.