January 4th, 2021 | 10:49 CET

Vale, Almonty Resources, Glencore: commodity stocks for 2021

Although the news is primarily dominated by the pandemic and the effects of the lockdown, the economy continues to turn. Many service providers are suffering from the pandemic, and the structural change it has triggered. The situation for producers is quite different: Manufacturers of electrical appliances and electric cars are sitting on full order books and looking to a rosy future. Mining companies are also feeling this optimism: since the pandemic's outbreak, commodity prices have been on the rise. Project financiers and major investors are not backing down or adopting a wait-and-see attitude, even in times of crisis. For private investors, this is a good sign - there is something to be gained in the commodities sector.

time to read: 3 minutes

|

Author:

Nico Popp

ISIN:

CA0203981034 , BRVALEACNOR0 , JE00B4T3BW64

Table of contents:

Author

Nico Popp

At home in Southern Germany, the passionate stock exchange expert has been accompanying the capital markets for about twenty years. With a soft spot for smaller companies, he is constantly on the lookout for exciting investment stories.

Tag cloud

Shares cloud

Vale is not a sure-fire winner

The share price of the Brazilian mining group Vale has moved upward in recent months. Although cash flow is declining and sales are also weakening, the group has managed to return to profitability. Vale did particularly well in the iron ore and nickel sectors. The latter raw material, in particular, is benefiting from the rising demand for electric motors. Vale wants to get as big a slice of the nickel production pie as possible.

Vale's example shows that raw material companies do not depend exclusively on extraction costs and market prices. After the group was held responsible by a Brazilian court for the Brumadinho dam burst at the beginning of 2019, claims worth billions still exist against the Company.

While Vale is demanding money for its part, such legal disputes are always poison for a share price. Although the stock gained about 25% on a one-year view, the accompanying circumstances weigh on the price. In addition to the legal dispute, Vale has a relatively low equity ratio compared with the rest of the industry, and it does not have the best cost structure. The share is, therefore, not a sure-fire winner. However, if the legal disputes disappear, this could be a catalyst for rising share prices.

Almonty Industries: Tungsten hope outside China

While Companies like Vale mine a wide range of raw materials and are thus prepared for all eventualities, Almonty Industries focuses exclusively on tungsten. In addition to two existing mines in Spain, Almonty is developing the largest tungsten mine outside China in South Korea, making it a significant player for the industrial metal. Tungsten is also benefiting from the electrification of mobility and is primarily used in charging stations. Already today, around 30% of demand comes from the automotive industry. Other sources of demand are the mining industry, the energy sector, aviation and the construction sector. According to the European Union and the US Congress, tungsten is one of the critical industrial metals whose stock should be secured for industrialized nations.

Almonty Industries’ planned tungsten mine in South Korea reinforces the country's ambition to further expand its influence around the production of processors, memory chips, LEDs or LCDs. The Sangdong mine is located around 190 kilometers southeast of Seoul and is scheduled to go into production in 2022. The mine boasts high tungsten content, a long production time and low costs. All regulatory approvals have been granted, and a potent financing partner has been found in the German KfW. The share price has risen by around 50% on a one-year horizon. From a technical chart point of view, the stock is in a consolidation formation that could be resolved upwards beyond rates of CAD 0.81.

Glencore: Bad boy with potential

When it comes to industrial metals, investors often think of the Glencore share. Since the former commodities trader merged with Xstrata in 2013, the new Company has been involved in the extraction of all kinds of raw materials. Glencore suffered a drop in sales in the first half of the fiscal year, primarily due to falling oil prices. As with Vale, Glencore is repeatedly facing accusations: In addition to environmental violations, corruption is also a recurring issue. In a world in which even commodity companies increasingly have to be measured against sustainability criteria, this is not good news in addition to the associated legal risks.

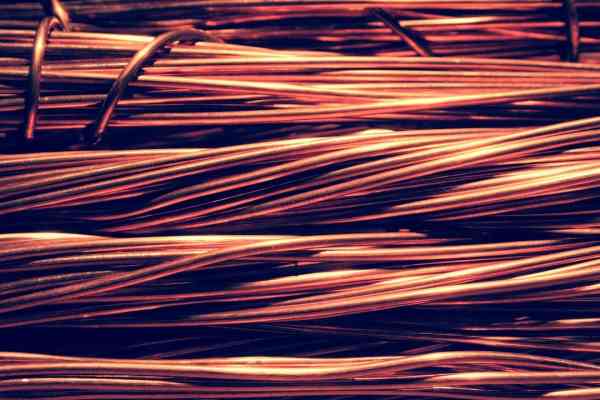

The share price fell sharply in the first half of 2020 but picked up even more sharply towards the end of the year. Over a twelve-month period, the share price did not show a great return, rising by just 2.6%. However, if one looks at the share price from a long-term perspective, Glencore may have exited its downward trend, which has been intact since mid-2018, to the upside. The share around copper, nickel, zinc, aluminum or even oil and coal and agricultural products, could develop potential in 2021. However, risks are not off the table.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may in the future hold shares or other financial instruments of the mentioned companies or will bet on rising or falling on rising or falling prices and therefore a conflict of interest may arise in the future. conflict of interest may arise in the future. The Relevant Persons reserve the shares or other financial instruments of the company at any time (hereinafter referred to as the company at any time (hereinafter referred to as a "Transaction"). "Transaction"). Transactions may under certain circumstances influence the respective price of the shares or other financial instruments of the of the Company.

Furthermore, Apaton Finance GmbH reserves the right to enter into future relationships with the company or with third parties in relation to reports on the company. with regard to reports on the company, which are published within the scope of the Apaton Finance GmbH as well as in the social media, on partner sites or in e-mails, on partner sites or in e-mails. The above references to existing conflicts of interest apply apply to all types and forms of publication used by Apaton Finance GmbH uses for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and etc. on news.financial. These contents serve information for readers and does not constitute a call to action or recommendations, neither explicitly nor implicitly. implicitly, they are to be understood as an assurance of possible price be understood. The contents do not replace individual professional investment advice and do not constitute an offer to sell the share(s) offer to sell the share(s) or other financial instrument(s) in question, nor is it an nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but rather financial analysis, but rather journalistic or advertising texts. Readers or users who make investment decisions or carry out transactions on the basis decisions or transactions on the basis of the information provided here act completely at their own risk. There is no contractual relationship between between Apaton Finance GmbH and its readers or the users of its offers. users of its offers, as our information only refers to the company and not to the company, but not to the investment decision of the reader or user. or user.

The acquisition of financial instruments entails high risks that can lead to the total loss of the capital invested. The information published by Apaton Finance GmbH and its authors are based on careful research on careful research, nevertheless no liability for financial losses financial losses or a content guarantee for topicality, correctness, adequacy and completeness of the contents offered here. contents offered here. Please also note our Terms of use.