April 2nd, 2024 | 07:10 CEST

Glencore, Almonty Industries, Albemarle - Commodities on the verge of a rebound

The first quarter of the stock market year 2024 is already history, and despite many disruptive factors, it has turned out better than many expected. Germany's leading index, the DAX, achieved growth of almost 11% and reached a new all-time high. The precious metal gold also reached the highest level in its history at USD 2,233 per ounce at the end of the quarter. In contrast, important commodities needed for the climate and energy transition are lagging. After months of bottoming out, copper, tungsten and lithium offer attractive entry opportunities at the current levels.

time to read: 3 minutes

|

Author:

Stefan Feulner

ISIN:

GLENCORE PLC DL -_01 | JE00B4T3BW64 , ALMONTY INDUSTRIES INC. | CA0203981034 , ALBEMARLE CORP. DL-_01 | US0126531013

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

Stefan Feulner

The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

He is passionate about analyzing a wide variety of business models and investigating new trends.

Tag cloud

Shares cloud

Glencore - Focus on Copper business

After a record year in 2022, due to the sharp rise in commodity prices, the commodity trading and mining group's profit fell significantly in 2023. Adjusted EBITDA declined by around 50% to USD 17.1 billion. Net profit amounted to USD 4.3 billion, 75% below the previous year's figure. Although the macroeconomic environment will remain challenging in the current year, according to Glencore CEO Gary Nagle, demand should recover, particularly in the western hemisphere, due to the expected interest rate cuts.

The Swiss see significant growth opportunities, primarily in the copper business. Global demand for the red metal is showing a considerable increase, while the available supply is simultaneously decreasing. This is exacerbated by the fact that competitors are reducing their copper production and some mines have ceased operations.

Due to rising demand and falling supply, the Company's CEO forecasts an inevitable rise in copper prices. Glencore plans to benefit from this development by investing substantially in copper production. Of the planned annual investments of around USD 5.7 billion by the year 2026, around half will be invested in the copper business.

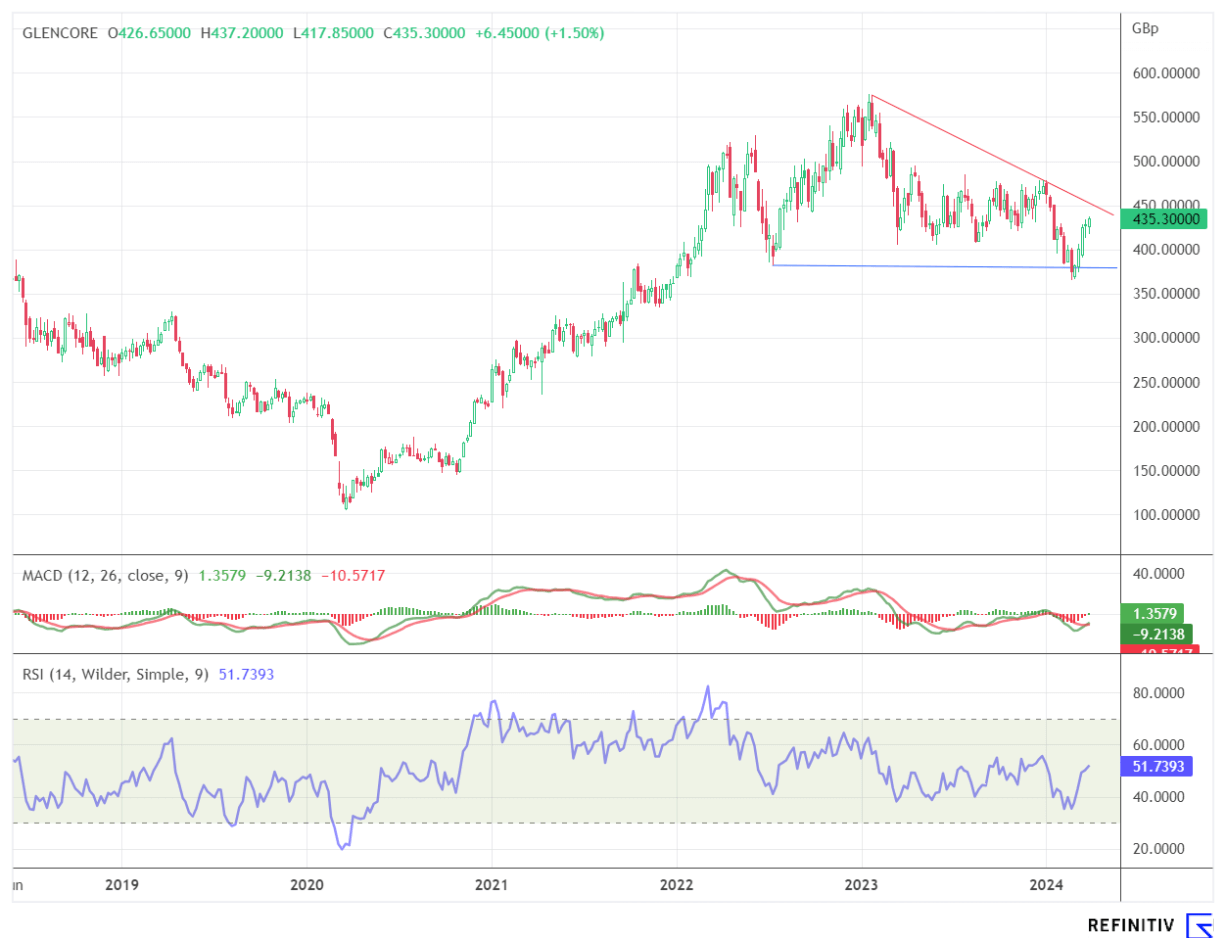

From a technical chart perspective, the Glencore share has formed a solid support level in the range of GBP 383.85 in recent weeks. If the downtrend established since January 2023 at GBP 450 is overcome, a fresh buy signal would be generated, potentially leading the share to last year's high at GBP 576.12.

Almonty Industries - Key player in the supply chain

The growing demand for tungsten, driven by developments in the battery, semiconductor and defense industries, highlights the strategic importance of Almonty Industries for the Western world. A recent visit by representatives of the US Department of Commerce to their Panasqueira mine in Portugal underscores this and emphasizes the need to become less dependent on Chinese supplies.

The Canadian company operates four tungsten properties in Spain, Portugal and South Korea. The expansion of the Panasqueira mine in Portugal to Level 4 aims to increase the EBITDA margin to over 30%, underlining the financial stability and profitability of the project. In addition, Almonty Industries is on the verge of commissioning the Sangdong mine in South Korea, the largest tungsten mine outside China, with an expected life of over 90 years. This mine already has a 15 year off-take agreement with the Plansee Group, which guarantees at least USD 580 million in revenue. In addition to tungsten, there is a significant molybdenum deposit on the Sangdong mine site, opening up further expansion opportunities, including the potential construction of a tungsten oxide plant to strengthen Almonty's position in the market.

Almonty shares have already gained almost 50% to CAD 0.62 in recent months. The analysts at Sphene Capital believe that the share price recovery is far from over and have issued a "Buy" rating with a target price of CAD 1.69.

Albemarle - Leader in the lithium sector

The lithium sector, which was unstoppable at the beginning of the decade due to the high demand for the energy transition, is also showing the first signs of life after a strong correction that lasted for months. This is due to the stabilization of the lithium carbonate price, which has been on a rollercoaster ride over the past three years. In August 2021, one ton of lithium carbonate was traded for around CNY 100,000 on the most important market, the Chinese spot market. The price then escalated and rose to CNY 597,500 by the fall of the following year before collapsing back to CNY 96,500 by the end of 2023.

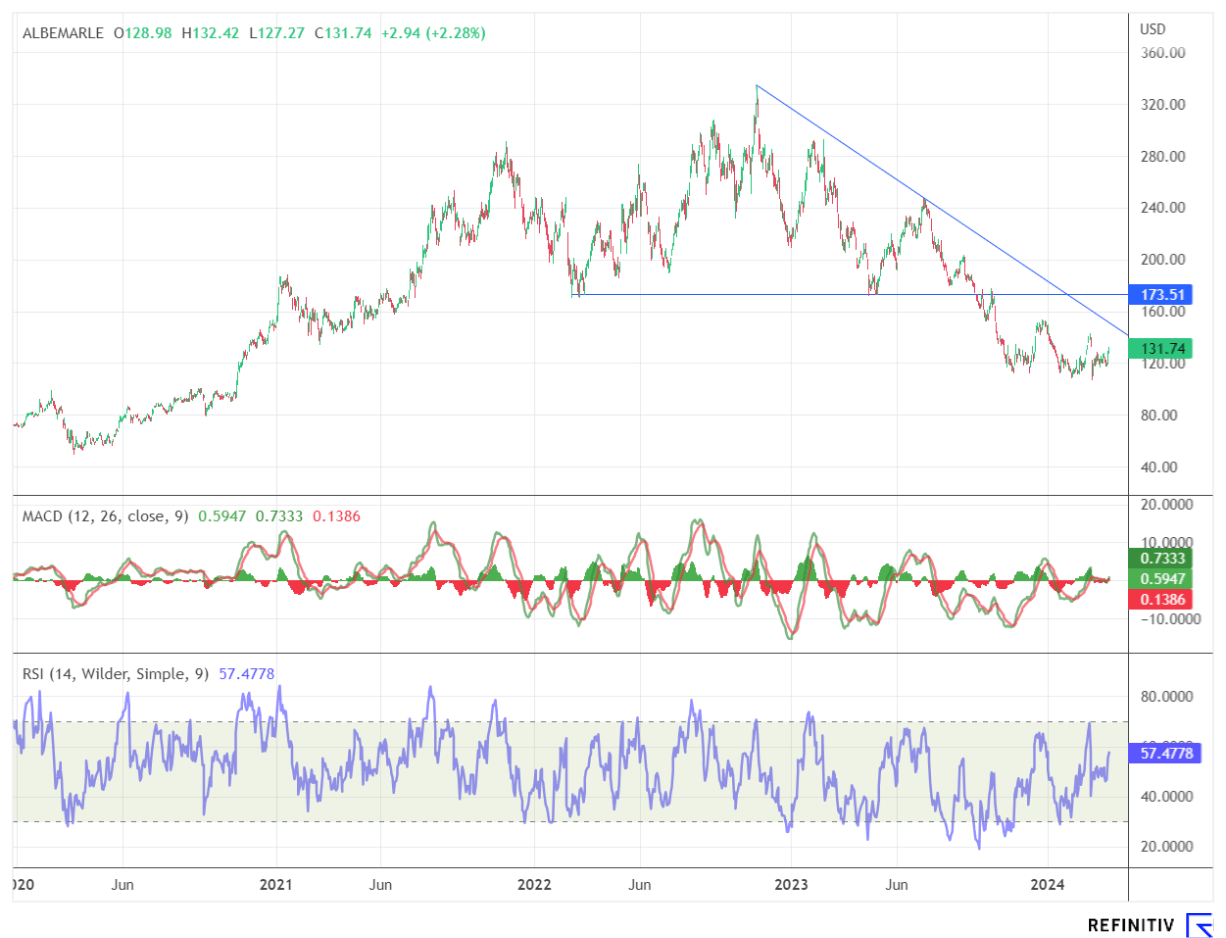

Since then, both the spot market and many lithium producers have been showing signs of bottoming out. The technical picture for one of the world's largest producers, Albemarle, could continue to brighten after a significant downward trend.

After forming a double bottom, the formation would be completed with the break of the downward trend that has been in place since November 2022, currently at USD 150.97, and a strong buy signal would be delivered. The first target would then be the horizontal resistance at USD 173.51.

After significant corrections and the formation of a sustainable bottom, several commodity companies are sending the first rebound signals. Lithium producer Albemarle and the world's largest commodities trader Glencore could break through their medium-term downtrend. Analysts believe that a price multiplication is imminent for Almonty Industries.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.