June 5th, 2025 | 16:10 CEST

Urgent: NATO approves largest rearmament program since the Cold War - Almonty, Hensoldt, Rheinmetall

The news is a bombshell: In light of an acute threat from Russia, NATO is opening the money floodgates. The most extensive rearmament since 1990 not only provides for a massive increase in conventional military capabilities, but also reveals the dependence of modern armed forces on critical raw materials – especially tungsten. The decision was made during a meeting of NATO defense ministers in Brussels and has far-reaching consequences. For investors, but also for all of us.

time to read: 3 minutes

|

Author:

Nico Popp

ISIN:

ALMONTY INDUSTRIES INC. | CA0203981034 , HENSOLDT AG INH O.N. | DE000HAG0005 , RHEINMETALL AG | DE0007030009

Table of contents:

"[...] While tungsten has always played an important role in the chip industry, it is now being added to batteries for e-cars. [...]" Lewis Black, CEO, Almonty Industries

Author

Nico Popp

At home in Southern Germany, the passionate stock exchange expert has been accompanying the capital markets for about twenty years. With a soft spot for smaller companies, he is constantly on the lookout for exciting investment stories.

Tag cloud

Shares cloud

EUR 200 billion in additional spending for Germany – Every year!

The latest NATO decision stipulates that NATO countries must specifically eliminate weaknesses in the areas of long-range weapons, integrated air and missile defense, and highly mobile ground forces. Earlier in the day, German Defense Minister Boris Pistorius had already announced that Germany would have to recruit an additional 60,000 soldiers by 2030 in order to meet NATO requirements. Decision-makers in Europe are now also repeatedly mentioning the military spending target of 5% of economic output, which was first brought into play by the US. This target is considered very ambitious and extremely costly – for Germany alone, a 5% target would mean spending over EUR 200 billion. Year after year. With these decisions, the 1980s could return for German citizens. At that time, deterrence toward the East was considered one of the country's most important national goals. German industry benefited from this.

German arms manufacturers in demand – But there is only one solution for the tungsten bottleneck

The outlook for companies such as Rheinmetall and Hensoldt also looks bright in the coming years. German arms manufacturers stand for quality and engineering excellence – which is also a potential export model. However, raw materials are needed to manufacture important goods for the military. Tungsten is the most important metal for the defense industry. It is used in missile tips as well as in armor-piercing ammunition and protective armor. It also has high-tech applications in the chip industry, battery technology, and aviation. Despite its diverse role, Western economies have allowed China to have a virtual monopoly on tungsten and its refinement for decades – according to the US Geological Survey, the country accounted for 82.7% of global tungsten production in 2023.** Other major suppliers include Russia and North Korea – neither of which are potential partners for NATO.

Almonty Industries supplies tungsten from secure regions

However, this situation, which poses a threat to NATO, will be resolved starting this summer. A key part of the solution is the emerging tungsten company Almonty Industries, which is bringing one of the world's largest tungsten projects into production in South Korea with Sangdong. Almonty recently signed a three-year supply contract for 1,200 tons of high-purity tungsten oxide per year with Tungsten Parts Wyoming, a company close to the US Department of Defense. That is enough to produce 400,000 armor-piercing shells. But there is further potential in Sangdong and Almonty's mine, already in production in Portugal. Production at Sangdong could be doubled through further investment after the ramp-up of the first production phase. In addition, molybdenum also lies dormant beneath the tungsten in Sangdong.

Over the past few years, Almonty Industries, whose anchor shareholders include the Austrian Plansee Group and which is financed by the German state-owned Kreditanstalt für Wiederaufbau (KfW) development bank, has focused entirely on Sangdong. The fact that the mine will go into production this summer presents a unique opportunity for investors: tungsten has never been in greater demand than after the historic NATO decision on June 5, 2025.

NATO is united again – Nasdaq listing raises Almonty's profile in the US

Recent events also show that Almonty's decision to focus on supply chains for the US defense industry was the right one. The NATO decision highlights that the United States and the countries of Europe will continue to be in the same boat in the future. Even though it looked like the US was turning its back on Europe for months, the latest decision has strengthened unity – the prospect of returns for each country's own defense industry is also likely to have brought the negotiating partners together.

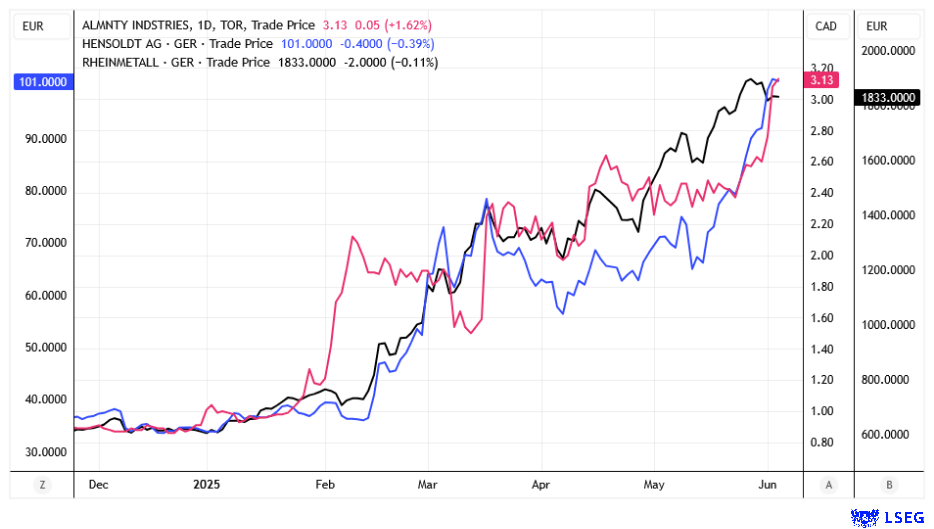

Almonty shares were still a small-cap just a few months ago. Today, the Company is approaching a billion-dollar valuation and is seen as a beacon of hope for the NATO defense alliance. Offtake agreements are already in place, and Almonty Industries' planned listing on the US Nasdaq stock exchange is expected to inject additional liquidity into the stock. So far, the stock has been visible almost exclusively to European and Canadian investors – but according to the Company, that is set to change soon. Almonty is already the winning stock of the year and has recently shown strong momentum. While the market has already anticipated much of what is in store for Rheinmetall and Hensoldt, Almonty shareholders are struggling to keep up with the revaluation. Today marks a turning point – for citizens of NATO countries and for everyone who holds Almonty Industries in their portfolio.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.