September 18th, 2023 | 06:30 CEST

Unbelievable! Hands off AI, biotech in rebound! Bayer, Defence Therapeutics, Morphosys

The big fall decline is now over. It is always a difficult time, but the so-called "Triple Witching" went relatively smoothly this time. The European Central Bank (ECB), in its first interest rate meeting after the summer break, decided to raise key rates by another quarter point to 4.00%, up from the previous 3.75% in July. At the same time, it lowered its inflation forecast for 2025 and the outlook for economic growth in the Eurozone for the years 2023 to 2025. Economic risks are increasing, but inflation remains the determining factor for interest rates. Expectations that the US Federal Reserve (FED) will announce an interest rate pause at its next meeting on Wednesday have boosted confidence. Last week's big losers were the recently favoured AI stocks Nvidia, Microsoft and C3.ai. However, the biotech sector has recently started to climb again. Where are the opportunities for investors?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

BAYER AG NA O.N. | DE000BAY0017 , DEFENCE THERAPEUTICS INC | CA24463V1013 , MORPHOSYS AG O.N. | DE0006632003

Table of contents:

"[...] In Canada, there is $1.75 of debt for every dollar of disposable income - and that was true even before the pandemic. [...]" Karim Nanji, CEO, Marble Financial

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Morphosys - This is a bang for the buck

The Munich-based biotech company Morphosys had to endure a long dry spell. In December 2022, the stock dropped to as low as EUR 11.82. Many hedge funds were betting against the share, with the short ratio peaking at almost 15%. The reasons at that time were the sluggish sales of the cancer drug Monjuvi, a botched study in the field of Alzheimer's with partner Roche, and the resignation of CFO Sung Lee.

An analysis house that argued very skeptically at that time and rated the title Morphosys as "Sell" was Goldman Sachs. The price target of EUR 12.50 also appeared very quickly on the price list. Last week, the same investment house now expects significantly better prospects and raised the rating from "Sell" to "Neutral". The change in the price target is dramatic: It is now EUR 33.50 after EUR 12.50, i.e. an increase of almost 200%. The background to this drastic change of opinion is that the analysts have become significantly more confident about the drug Pelabresib. The active ingredient for the treatment of blood cancer is currently in the Phase III clinical trial and, in the opinion of the analysts, has great potential. Though the results are not expected until the fourth quarter, they will likely have speculative relevance for the Morphosys share price even before then.

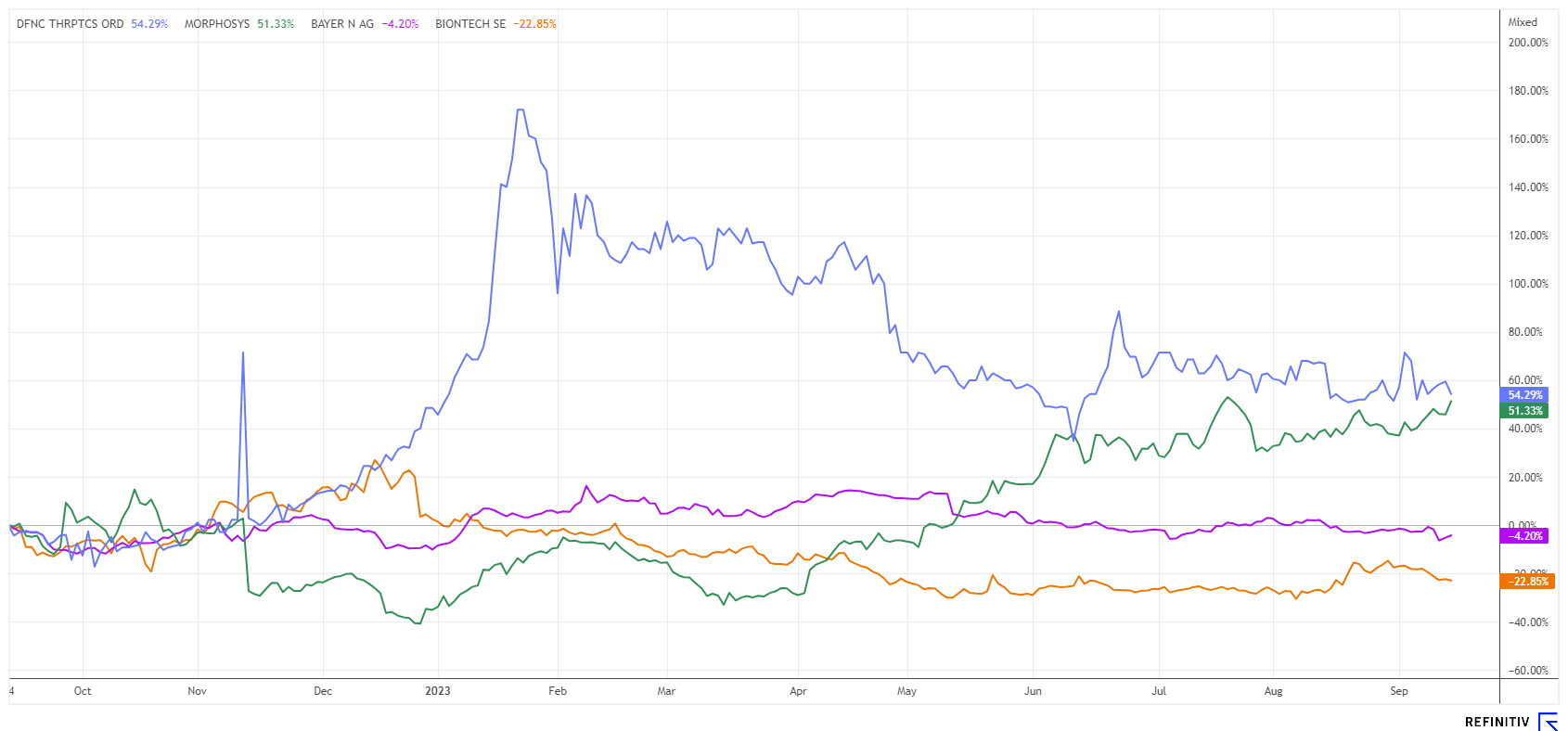

Last week, Morphosys already caused a stir with another piece of good news. The US Food and Drug Administration (FDA) granted fast-track status to the active substance tulmimetostat for the treatment of uterine cancer. On the Refinitiv Eikon platform, the upgrades are now piling up. The median target price recently increased from EUR 24.50 to EUR 28.75. **Since the beginning of the year, the share price has risen by 50% to EUR 30.30. This is likely not the end of the road, especially considering potential further short-covering.

Defence Therapeutics - Making strides towards cancer therapeutics

The Canadian biotech company Defence Therapeutics (DTC) is focusing on its Accum™ platform. Currently, the Company is broadening its research areas to include further innovative strategies for the treatment of various indications in the field of immuno-oncology. Regardless of whether antibodies, cell-based vaccines or small molecule therapeutics are used, the common denominator in all developed products is the Accum™ technology. It denotes a platform specifically designed to strategically enhance and amplify the efficacy of all existing biopharmaceuticals against cancer. A wide range of products are being considered, including antibody-drug conjugates (ADCs), protein- or cellular-based vaccines, and the development of small chemotypes for cancer treatment.

The original primary use of ADCs was to fight breast cancer. Defence has researched that modifying these ADCs via bioconjugation can improve the efficacy of commercially available ADCs by a factor of twenty to one hundred. The Company is actively developing two new ADCs using its proprietary monoclonal antibodies for targeted use on two tumor-specific cell surface proteins and payloads. The partnership launched in 2023 with Orano, a French global nuclear company, could lead to the development of the next generation of radioimmunoconjugates, enabling first-in-class ADC therapies using the intracellular Accum™ technology. Progress is also being made in the field of vaccines.

Defence has already developed and tested a dual-action vaccine targeted against cervical cancer. This protein-based vaccine uses a single protein rather than the usual mix of viral capsid proteins. Defence has demonstrated in preclinical models that the vaccine synergizes with various immune checkpoint inhibitors, resulting in survival rates between 70% and 100%. Following completion of all ongoing GLP studies, Defence is working either independently or with a partner to manufacture the vaccine to initiate a Phase I clinical trial against head and neck tumours next year.

Defence Therapeutics is on the verge of significant turning points. With its large pipeline, it is extremely well positioned for cancer prevention and improving the efficacy of all biopharmaceuticals to fight cancer. The stock is trading very liquid, sometimes with over 20,000 shares in Germany. **With a market capitalization of EUR 70 million, it is close to the required NASDAQ listing hurdle of USD 100 million. The next few months are bound to be very exciting.

Bayer - Slow growth and high debt

The share of Bayer AG is completely out of step because although the DAX 40 index is reaching new highs, the stock is down an even 7% from the beginning of the year. More and more analysts are warning against exaggerated growth expectations as the Company has taken on significant debt since the acquisition of Monsanto. With rising interest rates, refinancing is no longer as easy as it was 5 years ago. Expiring bonds could see interest expenses double upon renewal.

JPMorgan had already expressed skepticism last week. The responsible analyst, Vosser, considers the consensus values to be too high. He consequently cut his price target from EUR 55 to EUR 47 with an unchanged rating of "Neutral". Most recently, the rating agency Fitch downgraded the outlook for Bayer from "stable" to "negative", while the "BBB+" rating remained unchanged at investment grade. The experts see operational risks and possible price pressure in the core areas of pharmaceuticals and crop science, and the glyphosate litigation is not yet off the table. Due to declining free cash flows, the Group is able to repay less, thus increasing its net debt ratio. Less cash also reduces the scope for investments and M&A transactions. Especially in the Pharma division, top products like Xarelto and Eylea are gradually losing their patent protection, allowing competitors to enter the market.

Despite all the temporary burdens, Bayer is a solid standard stock with a dividend yield of just under 5% and a book value of around EUR 39. **From the top price of around EUR 62, the stock has meanwhile corrected 20%. And with a 2023 P/E ratio of 7.8, Bayer shares are by no means too expensive.

**The stock market is currently very volatile. The biotech sector is taking it up a notch due to the high beta value. Bayer is somewhat stuck in the curve, but Morphosys and Defence Therapeutics have been dynamic recently. Broad diversification reduces portfolio risks.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.