July 8th, 2025 | 07:00 CEST

Tungsten and molybdenum for the US military and Elon Musk: Why Almonty's NASDAQ listing could provide the next boost

Tungsten is harder than steel and only melts at 3,422 degrees - no wonder it is used in rockets, industrial robots, semiconductors, and many other high-tech applications. However, 84% of the world's critical metal comes from China, which poses a strategic risk to the West. Since the Chinese government imposed export restrictions, there has been significant upheaval. This is where Almonty Industries comes in. With mines in South Korea, Portugal, and Spain, the Company is building the largest independent tungsten pipeline outside China. For investors, Almonty is thus becoming a lever for raw material independence.

time to read: 4 minutes

|

Author:

Armin Schulz

ISIN:

ALMONTY INDUSTRIES INC. | CA0203987072

Table of contents:

"[...] While tungsten has always played an important role in the chip industry, it is now being added to batteries for e-cars. [...]" Lewis Black, CEO, Almonty Industries

Author

Armin Schulz

Born in Mönchengladbach, he studied business administration in the Netherlands. In the course of his studies he came into contact with the stock exchange for the first time. He has more than 25 years of experience in stock market business.

Tag cloud

Shares cloud

Current developments

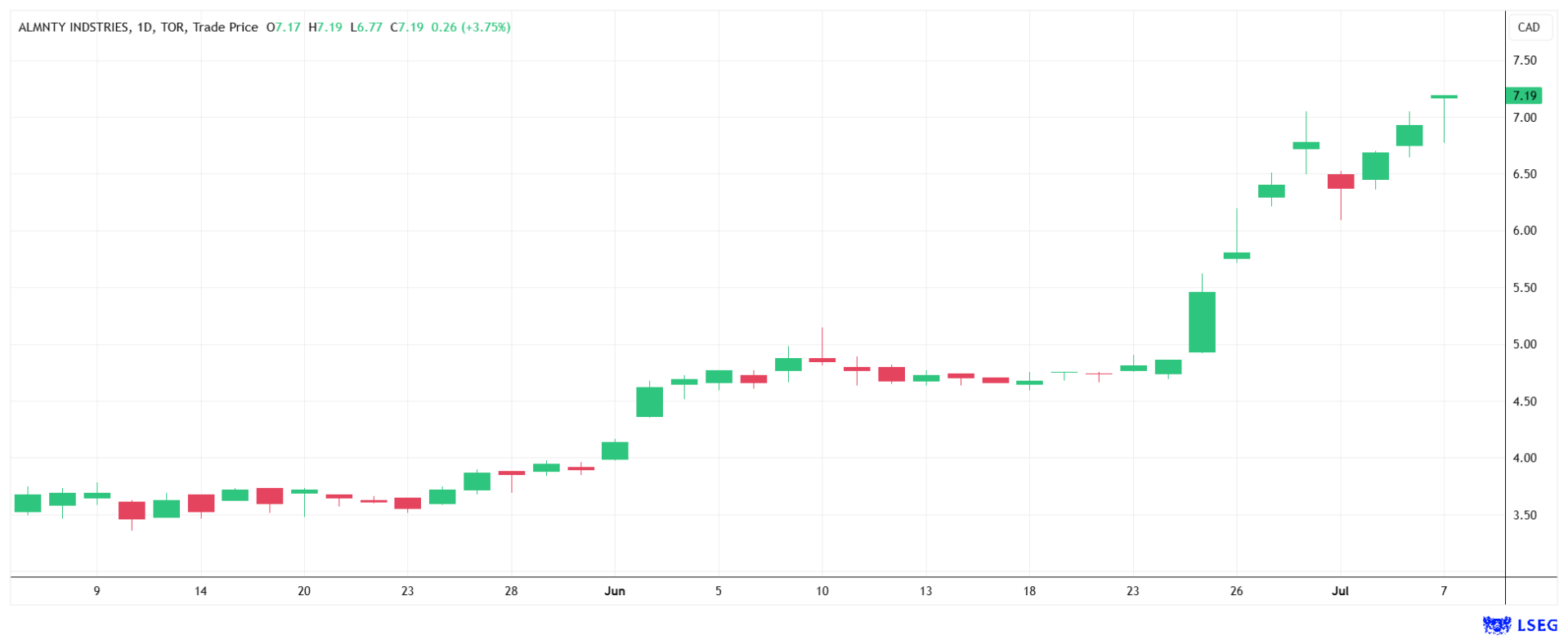

June 2025 marked the next milestone for the Company. Its inclusion in the S&P/TSX Global Mining Index catapulted Almonty into the circle of established mining giants. CEO Lewis Black commented: "This recognition underscores the continued execution of our strategy and Almonty's growing importance as a leading supplier of tungsten for the defense needs of the US and its allies."

After 12 years of development work, the plant will start production in the second half of 2025. The plant is considered the "most advanced tungsten processing facility outside of China" – a technological advantage that enables significant cost savings. On July 4, the Company announced that an updated NI 43-101 study for the Sangdong Mine had been submitted. When fully ramped up, the production facility is expected to process approximately 640,000 tons of ore per year. Later, capacity could even increase to up to 1.2 million tons through expansion in Phase 2.

The share underwent a reverse stock split at a ratio of 3:2, which means that 3 old shares were combined into 2 new shares, and the value of the share increased. This secures the NASDAQ listing.

This listing will further increase the Company's visibility and give ETFs the opportunity to include the stock in their portfolios. For many Americans, stocks only become interesting when they are traded in the US.

The mines and their advantages

While Sangdong symbolizes the future, the Portuguese Panasqueira mine has been generating operating cash flow since 1896. It processes 700,000–800,000 tons of ore annually and, according to a visit report by Stockhouse, is one of the oldest continuously operated tungsten mines in the world.

In South Korea, Almonty is drawing on its experience in Europe to plan the plant accordingly. At USD 110–120 per metric ton unit (MTU), production costs in Sangdong are significantly lower than those of Chinese state-owned mines, which range from USD 205 to USD 245 per MTU. This cost advantage results from the high-grade ore and optimized processing. Both are key factors for future margins. In addition, the property also has large molybdenum deposits.

South Korea also scores highly in terms of taxation. As a "Foreign Investment Zone," Almonty pays no corporate income tax for three years, after which it pays only 12.5% instead of the standard 25%. Analysts expect revenue to jump in the coming quarters as Sangdong's ramp-up curve takes effect.

Strategic importance and geopolitical context

The facts speak for themselves: China has been curbing exports for months, while the US defense industry is desperately searching for alternatives. Almonty is supplying them and is now being courted by politicians. First, the Company's headquarters were relocated to the US. Then, the board of directors was gradually strengthened with the addition of high-ranking names. The first was retired General Gustave F. Perna, followed by the appointment of Alan Estevez, former Assistant Secretary for Security at the US Department of Commerce. Estevez is considered an expert in logistics and, like Perna, has contacts in the Pentagon. In addition, a strategic partnership was established with American Defense International, and Almonty was invited to join the Critical Metals Forum.

All these measures have had an effect. A letter from the US Congressional Committee to Almonty highlighted the importance of Sangdong. In addition, the committee expressed interest in further cooperation, particularly as a supplier to the US defense industry.

Contracts and market leverage

The strategic position translates into concrete contracts:

-

There has long been a purchase agreement with the Plansee Group, which stipulates a minimum price of USD 235 per MTU.

-

This year, a purchase agreement was signed with Tungsten Parts Wyoming and Metal Tech, stipulating a minimum monthly purchase of 40 tons of tungsten oxide. A fixed minimum price has also been agreed here. The oxide is intended explicitly for US defense projects.

-

100% of molybdenum production has been secured by SpaceX supplier SeAH M&S from South Korea. Here, the minimum price is USD 19 per pound.

At the same time, Almonty is pushing ahead with vertical integration. The Company plans to build its own tungsten smelter by 2027. In addition, a production facility for tungsten oxide is planned. This will enable the Company to bypass Chinese processing monopolies and increase its margins.

Outlook and analyst opinions

Analysts at GBC have recently raised Almonty's target price to CAD 5.50 (before the reverse split). Due to its exceptional position, Almonty has become a geopolitical infrastructure provider. The forecast was raised based on expected annual revenue growth of 45% and profit growth of 55.8% from 2026 onwards.

The demand base is growing rather than shrinking. The demand for tungsten for electric vehicle batteries is expected to grow by 300% by 2030 (source: British Geological Survey), while the US military budget is projected to increase by 12% in 2026. NATO has also provided tailwinds with an arms budget of 5% of gross domestic product.

The share is currently trading at CAD 7.19.

Almonty Industries is positioning itself as an indispensable tungsten supplier to the West – strategically, cost-efficiently, and politically desirable. With the state-of-the-art Sangdong mine (starting in H2 2025), the Company is not only building the largest independent pipeline outside China, but also leveraging clear competitive advantages:

-

Cost dominance: Production at USD 110–120/MTU and tax advantages.

-

Geopolitical relevance: US defense contracts, high-ranking board members, and inclusion in the S&P/TSX Global Mining Index underscore the Company's systemic importance.

-

Growth drivers: NASDAQ listing, vertical integration, long-term off-take agreements, and doubling of capacity by 2027.

With the boom in demand for tungsten and Western de-risking strategies, Almonty is more than just a mining operator. It is a geopolitical infrastructure provider with leverage.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.