July 29th, 2025 | 07:05 CEST

Trump tariffs settled? What are the triggers now? Palantir, naoo AG, TeamViewer, and D-Wave

With the US-EU agreement on tariffs, markets opened positively yesterday but quickly slipped into negative territory. The reason: the agreement is widely viewed as a "loss-making deal" for the EU. While tariffs of over 20% were averted, 15% still remain. In return, NATO must purchase substantial US military equipment, while US vehicle exports to the EU remain tariff-free. Donald Trump could not have negotiated better himself - a diplomatic failure for Brussels. The decision will have a significant impact on the EU's automotive sector, luxury and consumer goods industries, and technology sector. For example, European wine will cost US consumers about 30% more, factoring in currency losses, which is devastating for European winemakers. All in all, this deal is considered a major setback for free trade, with serious inflationary consequences and declining consumer demand. Investors should reposition themselves, as late summer looks stormy from this perspective alone.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

PALANTIR TECHNOLOGIES INC | US69608A1088 , NAOO AG | CH1323306329 , TEAMVIEWER AG INH O.N. | DE000A2YN900 , D-WAVE QUANTUM INC | US26740W1099

Table of contents:

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Palantir Technologies and D-Wave Quantum – Higher, faster, and even more expensive

In April, Palantir Technologies shares were still trading at around EUR 65, but then began a rally of over 100% to nearly EUR 140. The market capitalization of the popular big data defense stock has now reached EUR 320 billion, with a price-to-sales ratio of just under 100. This is historically rare, but has become a daily reality on the Nasdaq. Next week, on August 4, the specialist in highly sensitive data analysis will release its Q2 figures. If the forecasts are not exceeded by at least 20%, a correction in the share price seems inevitable. After all, even the long-term revenue forecast of USD 7.5 billion for 2027 hardly justifies the current market value. But perhaps Palantir bulls know something the rest of us don't!

Another example of overvaluation is provided by D-Wave Quantum, a leading expert in quantum computing. The stock has gained around 1,800% since August 2024, rising from USD 1.12 to over USD 20, and is now worth USD 6 billion. Revenue estimates for the Burnaby-based Canadian company are expected to soar from USD 24 million in 2025 to USD 180 million by 2029. Even then, this revenue would still be billed at a factor of 33. It should be noted that no profits are expected for the entire period. Most likely, investors are betting on a massive merger deal with one of the "MAG7" tech giants. D-Wave is also set to release its Q2 figures on August 7 - Very exciting!

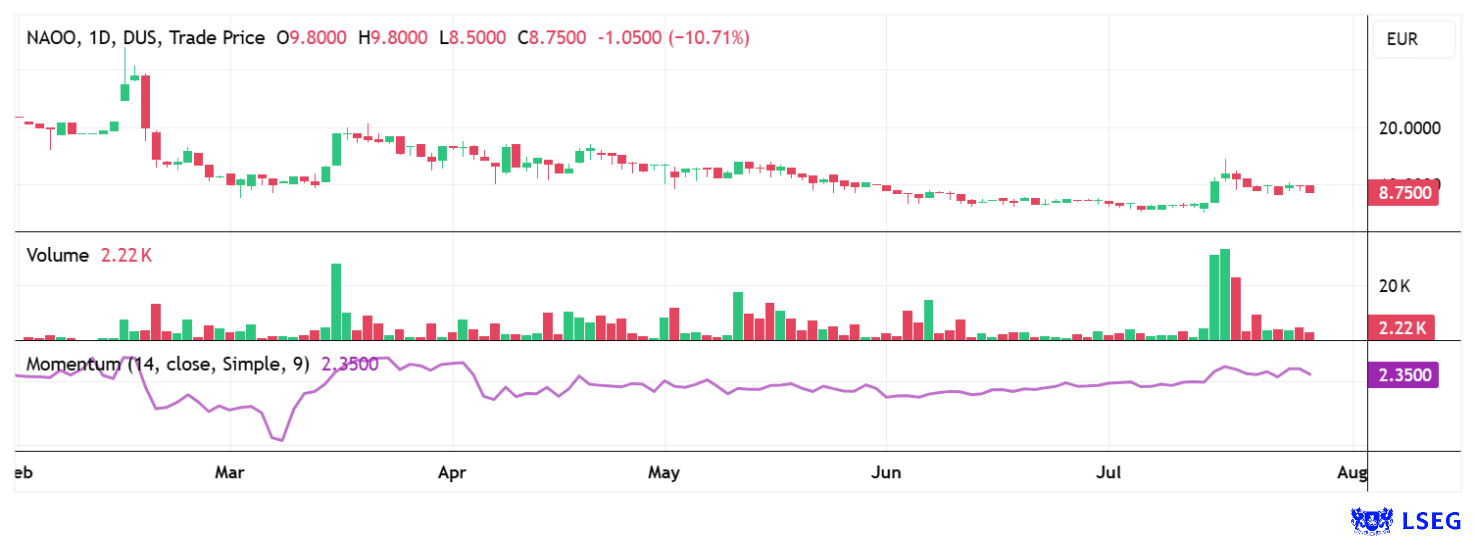

naoo AG – Kingfluencers brings momentum to the balance sheet

Overvaluation is not an issue at Swiss company naoo AG – quite the contrary: with the integration of renowned influencer agency Kingfluencers, it has taken a decisive step toward scaling its platform business. The strategic acquisition not only secures the Company direct access to an established customer base and a broad network of social media creators, but also expands its expertise in content production, campaign management, and data-driven influencer marketing. Kingfluencers has its own AI-powered campaign engine that analyzes and optimizes advertising impact in real time. In addition, the agency brings strong B2B partnerships with leading brands in the consumer goods, fashion, and technology sectors, which will serve as a lever for future platform conversions on naoo. The Swiss company's positioning as a holistic provider in the booming digital communications and advertising market is thus taking shape.

For the 2025 financial year, naoo anticipates revenues of around CHF 10 million, largely driven by Kingfluencers' strong market position. Analysts at GBC view the recent upturn in order intake as confirmation of a positive trend, with developments indicating dynamic business growth. In their initial assessment, they expect a 12- to 24-month price target of EUR 28.48 and confirm this with a "Buy" rating. Particularly noteworthy: Kingfluencers' operating result (EBIT), adjusted for one-time integration costs, is expected to be positive already in the current year.

naoo AG is increasingly evolving from a platform operator to an integrated social media ecosystem. For investors with an eye on digital marketing and social commerce, this presents a highly exciting investment opportunity with long-term potential. With further innovative ideas, the Swiss company could follow a similar path to that already successfully trodden by other US social media models. Collect under EUR 10!

TeamViewer – Is it time to get involved again?

Staying in IT, TeamViewer is worth a look. The Company will report its Q2 results today, with analysts' consensus estimates predicting a profit of EUR 0.322 per share. For the year as a whole, the figure is expected to be EUR 1.04. This would mean that the interaction software specialist from Göppingen would only be valued at a 2025 P/E ratio of 9.1. Revenue is expected to rise from EUR 671 million in 2024 to EUR 770 million in the current year, an increase of almost 15%. The chart is currently shaking us awake, as prices around EUR 9.40 have not been seen for a long time; in April, the stock was still at EUR 13.30. Despite a solid Q1 2025 with revenue growth of 7% to approximately EUR 190 million and an EBIT margin of 43%, investors reacted negatively. The reason: earnings per share were below expectations, despite revenue exceeding the consensus. While the enterprise business grew strongly by 21%, the SMB segment stagnated at only 2%. Rising cancellation rates and a lack of upselling potential weighed particularly heavily on sentiment. It will be very interesting to hear what CEO Oliver Steil and his management team have to say about the outlook at today's press conference.

The DAX 40 index reached an intraday high of 24,563 points early yesterday morning, as recorded by IG Markets. From that point on, the index declined steadily throughout the day. By 4 pm, it had fallen well below the 24,000-point mark. This means that the index has failed to reach new highs for the third consecutive time. Investors should therefore strictly adjust their hedges and stop limits in the current environment. In contrast, naoo AG appears to be moving independently of the broader market. GBC calculates a fair value of EUR 28.48, suggesting a clear opportunity to triple your investment from current levels!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.