November 12th, 2024 | 07:30 CET

Trump is back! Buy commodities; hydrogen is on the sidelines! Siemens Energy, Globex Mining, Nel and Plug Power

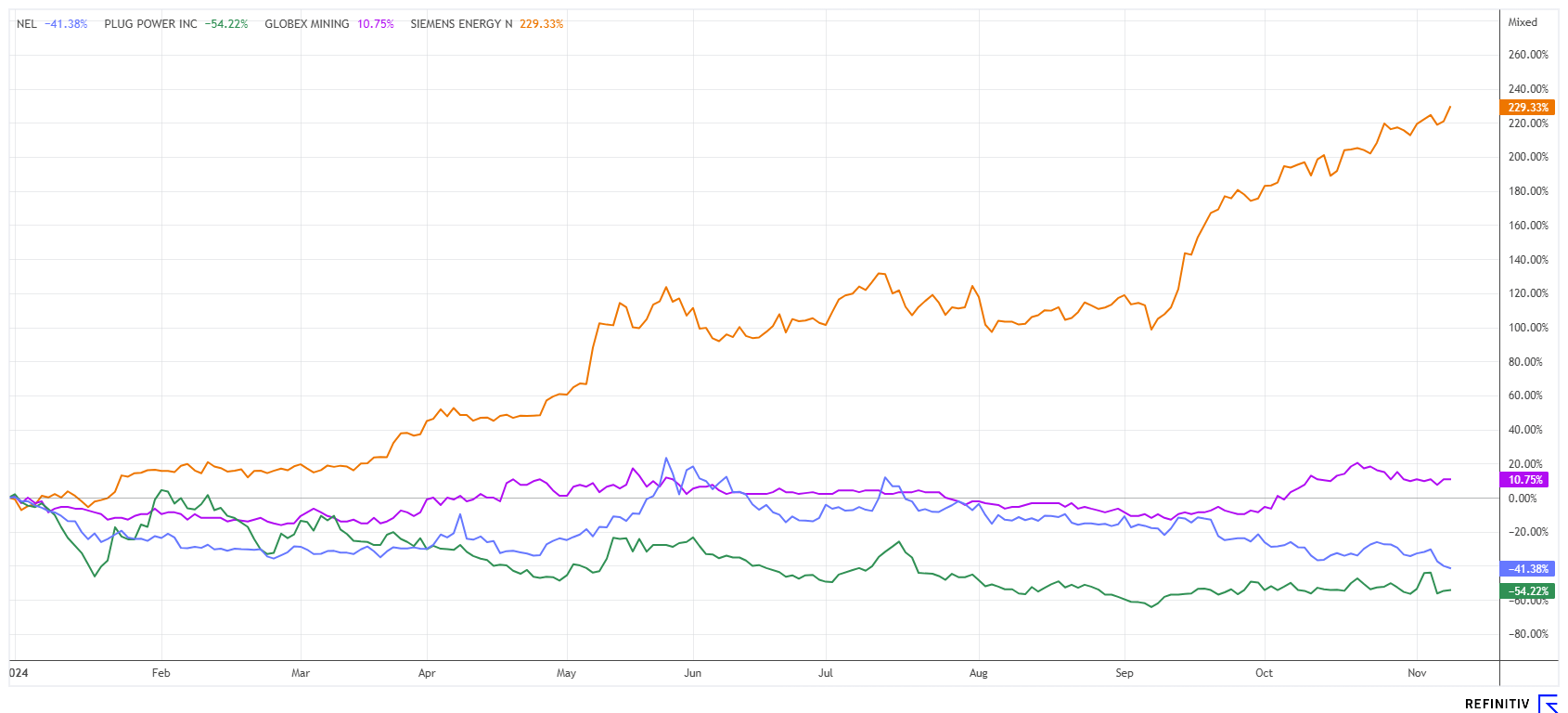

With Trump's election victory and the resignation of the coalition government, the European Union's "NetZero" strategy by 2050 could be undermined. New governments now recognize that persistently high energy prices lead to significant job losses in industry. Large corporations are turning their backs on Germany in particular, where energy costs are sometimes ten times higher than in other countries around the world. America is once again taking a unique path. According to Trump, energy prices should be halved, signaling clear support for expanding fossil fuels and a strong stance against costly hydrogen solutions. However, the strengthened industrial policy should also drive up the consumption of raw materials, positioning Globex Mining in a good position and sidelining Nel ASA and Plug Power. What should investors look out for now?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

SIEMENS ENERGY AG NA O.N. | DE000ENER6Y0 , GLOBEX MINING ENTPRS INC. | CA3799005093 , NEL ASA NK-_20 | NO0010081235 , PLUG POWER INC. DL-_01 | US72919P2020

Table of contents:

"[...] We will trigger indirect creation of 1,665 new jobs nationwide, while directly employing 300 staff - 270 operational and 30 administrative. [...]" Dennis Karp, Executive Chairman, Manuka Resources Limited

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Nel ASA and Plug Power – Further sidelined by Trump

After Trump's election in the US, the two hydrogen companies Nel ASA and Plug Power are no longer on investors' buy lists. Both stocks lost between 10 and 15% last week. It is currently unclear when calm will return to the stocks, as sentiment is at rock bottom. On October 16, the Norwegians opened their books and presented their results for the third quarter of 2024. A loss per share of NOK 0.07 was reported, which was well above analysts' estimates of minus NOK 0.057 per share but still above the minus NOK 0.14 from the same period last year. Revenues rose slightly from NOK 303 to 366 million, while NOK 407 million was expected. The US bank Morgan Stanley reacted quickly and lowered its rating from "Equal-weight" to "Underweight". The target price was slashed from NOK 9.0 to 3.5. This revaluation shows the great uncertainties regarding the growth opportunities for hydrogen specialists, especially in the US market.

There, the 10 times larger competitor Plug Power is suffering a similar fate. Investors are already trembling in the run-up to the quarterly figures expected after today's trading. In the last 10 days, the price has fallen again accordingly to around USD 2.00, but recently, it rose to around USD 2.40 on high turnover. The capital increase via the market, which has been ongoing since the summer, was increased again by USD 375 million to almost USD 1 billion. Plug Power still appears to have empty coffers. Investors are likely eager to hear the outlook from its flamboyant CEO, Andy Marsh. High volatility and a sour mood across the entire sector do not suggest a quick investment. For safety reasons, stay in observation mode!

Globex Mining – Ideally positioned in the commodities sector

In the context of the global shortage of metals and the search for secure sources of supply, the properties of Globex Mining are coming into focus. Located primarily in Quebec, the Company has all the advantages in the international race for favored locations: energy, good infrastructure, a mining-friendly jurisdiction, and good contacts with the indigenous owners of the land. Currently, CEO Jack Stoch is overseeing his 252 projects and 106 royalty contracts, providing a solid foundation for the future. Additionally, Globex holds readily liquidatable shares and cash of around CAD 25 million. The company is entirely debt-free.

This year, the price of the Canadian explorer and asset manager had already risen by more than 30% to CAD 1.15, and in recent days, news has been increasing again. Partner Cerrado Gold Inc. reported that the funds from the sale of its Monte Do Carmo project in Brazil will be used in part to complete a feasibility study for the "Mont Sorcier" iron ore project, in which both Chibougamau Independent Mines and Globex Mining Enterprises own between 1 and 2% gross metal royalties. Globex also holds 11 million shares of Electric Royalties, which will collect a 1% royalty on vanadium production from the property. Cerrado holds a 100% interest in the Mont Sorcier iron ore and vanadium project, which has the potential to produce a high-quality iron ore concentrate over a long mine life with low operating costs and capital intensity.

Reports of this kind keep coming in, and the intrinsic value of Globex Mining is increasing noticeably as a result. Nevertheless, at CAD 1.03, Globex's shares are anything but expensive. With 56,294 million shares issued, the market value of all properties, after deducting cash reserves and liquid shares, is less than EUR 20 million. This value should soon see a strong rebound.

Siemens Energy – All-time highs ahead of the annual results

Siemens Energy's stock has seen a roaring development. The energy group has gained over 300% in the current year - the reason is that Europe, in particular, is looking for a constant renewal of its energy infrastructure. With gas turbines and extensive knowledge in the construction of power lines and networks, the Munich-based company is involved in almost all international tenders. Analysts at Deutsche Bank have closely examined their forecast for Siemens Energy and are raising the target price in the base scenario from EUR 38 to EUR 43. Investors, however, are excited about the best-case scenario: here, the experts even believe the value could jump to EUR 70. This is a prospect that makes one sit up and take notice because, in addition to the almost endless AI potential, the Frankfurt analysts believe in a multi-year boom in the energy sector due to the EU's "NetZero" efforts.

Tomorrow's reporting day, when Siemens Energy will present its results for the fourth quarter and the full fiscal year 2023/24, ending September 30, 2024, will be exciting. Many bank analysts expect positive momentum, particularly from strong business in gas turbines and transmission technology. However, a question mark remains over the wind power subsidiary Gamesa, which has been struggling with operational difficulties for months now and has repeatedly slowed the positive momentum of the share. The consensus view is that annual sales for 2024 will be EUR 34.48 billion, with the free cash flow expected to rise again to over EUR 700 million. With further sales increases of around 10% in 2025/26, the P/E ratio should then also fall to a tolerable 19.5. On the Refinitiv Eikon platform, only 8 out of 18 analysts remain positive, and the average price target is set at EUR 36.40, around 10% below the current price. Caution at the platform edge! Cautious investors might want to consider selling before the earnings report.

The US has voted. This sets the course for many shareholders, because stocks from the defense, industry, and security sectors are in demand again. Since the new president is not supportive of climate change, this will likely have a negative impact on international capital allocations in the "green tech" sector. However, the demand for raw materials is expected to remain high, making Globex Mining shares a top choice.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.