September 8th, 2025 | 07:00 CEST

Trillion-dollar market for tokenized securities: Stock market newcomer Finexity, Deutsche Börse, Coinbase

Blockchain offers transparency and efficiency—it is no surprise that digital assets are considered the next evolutionary stage of capital markets. Studies predict a market volume in the double-digit trillions by 2030. Boston Consulting, for example, is talking about a market volume of USD 16 trillion by 2030. The race for market share includes the major stock exchange operators as well as savings banks and fintechs. Finexity, a pioneer in digital assets, has now gone public - a company that has significantly shaped developments in recent years and is well-positioned for the future. We shed light on the prospects for Finexity and explain how far along competitors like Deutsche Börse and Coinbase already are.

time to read: 3 minutes

|

Author:

Nico Popp

ISIN:

FINEXITY AG | DE000A40ET88 , DEUTSCHE BOERSE NA O.N. | DE0005810055 , Coinbase | US19260Q1076

Table of contents:

"[...] We have built one of the largest land packages of any non-producer in the belt at over 440 sq.km and have made more than 25 gold discoveries on the property to date with 5 of these discoveries totaling about 1.1 million ounces of gold resources. [...]" Jared Scharf, CEO, Desert Gold Ventures Inc.

Author

Nico Popp

At home in Southern Germany, the passionate stock exchange expert has been accompanying the capital markets for about twenty years. With a soft spot for smaller companies, he is constantly on the lookout for exciting investment stories.

Tag cloud

Shares cloud

Finexity: Many years of experience with digital assets and regulation

Since last week, shares in Hamburg-based Finexity AG have been listed on the Munich m:access SME segment. The Company has been involved in tokenization for many years and has thus developed a deep understanding of the requirements of customers, partners and regulators. In the early years, the Company brokered investments for private customers, but since 2022, it has been working increasingly as a white label partner for banks and asset managers. Today, Finexity cooperates with savings banks and credit unions as affiliated trading partners. More than 50 issuers use the platform, more than 250 tokenized securities are listed, and more than 14,000 investors are registered.

Trading venue to become growth driver – Low trading costs are a key advantage

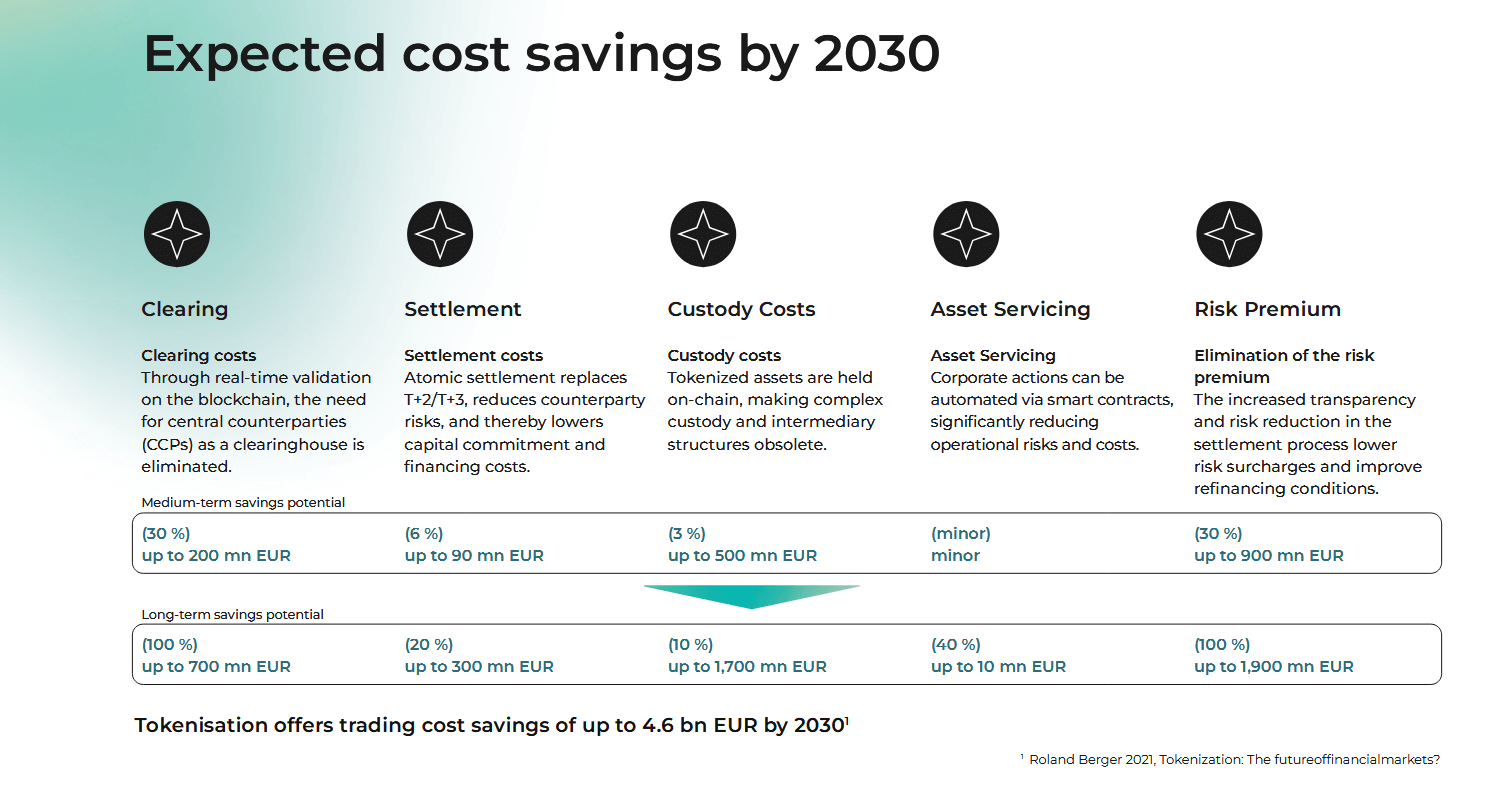

In the future, Finexity plans to leverage its market position to launch its own trading venue. Market participants will then be able to trade asset classes such as real estate, private equity, private debt, infrastructure, renewable energy, and even valuable tangible assets in a matter of seconds. While some limitations remain due to the still-developing market, Finexity already enables such trading today - a space traditionally reserved for institutional investors. The main advantages of tokenized securities lie in their transparency and significantly lower trading costs. A study by Roland Berger from 2021 estimates that the technology could save up to EUR 4.6 billion in trading costs by 2030. Although Finexity offers its clients support in the tokenization and placement of digital assets, the Company sees the greatest future growth potential in its trading venue. To this end, the Hamburg-based company is also considering secondary listings.

"*Private markets are among the fastest-growing segments of the global capital markets. Through the use of our scalable trading infrastructure, strategic partnerships, and our international presence, we are excellently positioned to *play a leading role in shaping this market," comments Finexity CEO Paul Hülsmann, who himself holds a 16% stake in the Company and points to the stable shareholder structure of around 50% from management and anchor shareholders.

IPO creates acquisition currency: Finexity plans targeted acquisitions

The move to the capital market is likely to bring the Company increased visibility and support its inorganic growth strategy. Finexity has already successfully made acquisitions in the past, including the Swiss company Crowdli and Germany's Effecta, a licensed liability umbrella that brings with it additional intermediaries and access to 70,000 affiliated customers. With its own shares now available as acquisition currency, such acquisitions could become even easier in the future. According to industry insiders in the digital asset market, regulation and market conditions have led to consolidation in recent years – many startups have either sought out their niche or disappeared from the market. Finexity therefore has little competition today.

Deutsche Börse and Coinbase: Everything is in flux when it comes to digital assets

Even big names such as Deutsche Börse are taking a slow approach to the future when it comes to digital assets, leaving innovation to portfolio companies such as 360X. In May, the startup became only the third company in Europe to receive a license under the EU DLT pilot regime. Such a license makes it possible to convert existing OTC trading venues into fully-fledged digital exchanges. Finexity has also already planned to apply for a license and wants to catch up with 360X before the end of this year.

The fact that the pie in the digital asset market is only gradually being distributed is also demonstrated by Coinbase. The crypto trading specialist only applied to the US Securities and Exchange Commission (SEC) this summer to be able to offer conventional stocks in tokenized form. Coinbase aims to broaden its base by moving into traditional securities. CEO Brian Armstrong said in this context that even a 3% market share in stock trading would mean a doubling of revenue for Coinbase. However, competition in stock trading is particularly fierce – it remains to be seen whether Coinbase, as a crypto exchange, can quickly gain market share here.

Finexity: Many years of experience and a strong market position justify price premiums

The market for digital assets is in flux and so large that different approaches can coexist. The agile Hamburg-based company Finexity appears to be well-positioned for this with its established partnerships with issuers, the financial sector, and investors. Its focus on asset classes that have been difficult to invest in, even for some professionals, also makes sense. Finexity is valued at just over EUR 50 million following its IPO. Given the significant growth potential of digital assets, Finexity's comprehensive expertise, and its long-standing management team, the starting position for the stock appears favorable: Finexity is an exciting small-cap with considerable return potential.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.