February 17th, 2025 | 06:25 CET

Things are heating up with Alibaba and Credissential, while Palantir and SAP ride the AI boom

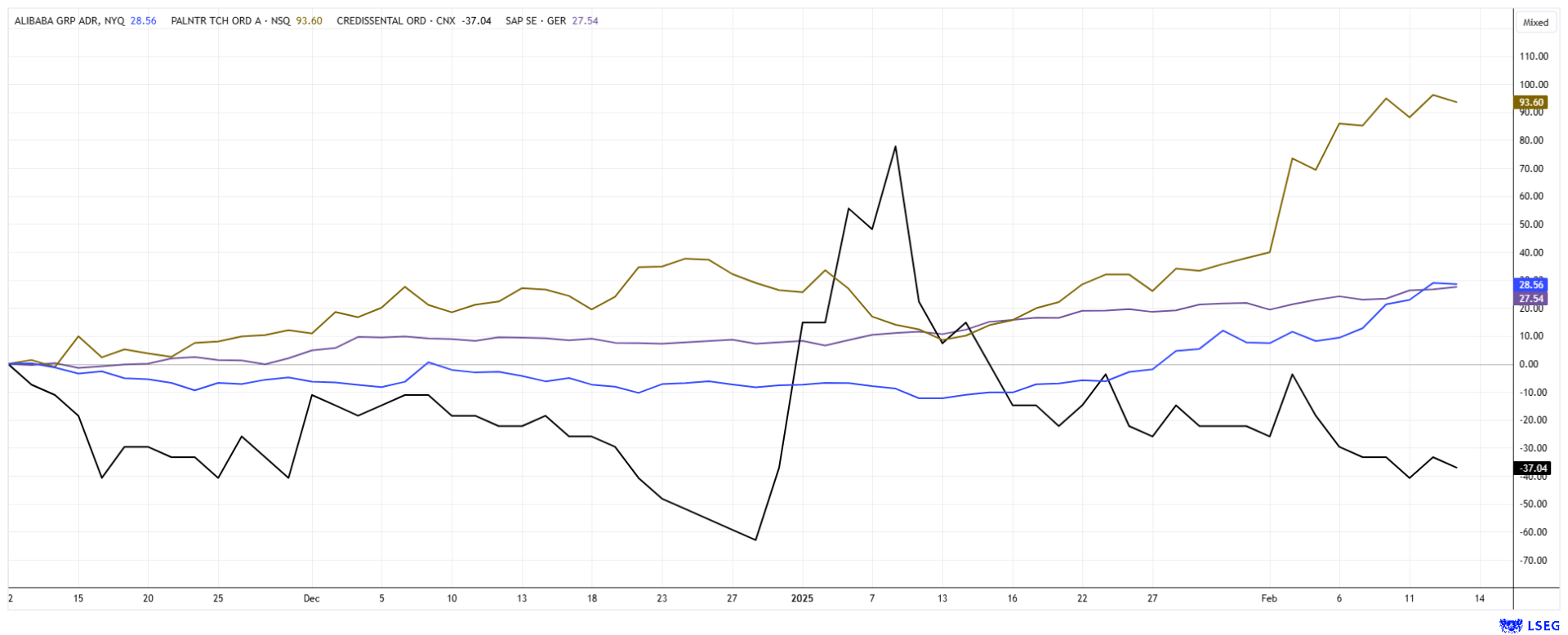

The stock market is picking up speed. In addition to the high-tech and AI fantasy, there are rumors of peace in Ukraine. European equities that are likely to play a role in any reconstruction are attracting a lot of attention. Cement maker Heidelberg Materials has been performing well for weeks, and Siemens is also gaining daily. Outside of geopolitical considerations, SAP remains the only German cloud of hope to be a long-running success. Is a correction possible here? It is difficult to imagine at the moment, so attention is turning to lagging stocks or stocks that have already fully exploited their momentum. For those paying close attention, divergences are visible!

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

ALIBABA GROUP HLDG LTD | KYG017191142 , CREDISSENTIAL INC | CA22535J1066 , PALANTIR TECHNOLOGIES INC | US69608A1088 , SAP SE O.N. | DE0007164600

Table of contents:

"[...] Having Investors like Robert Friedland and Rob McEwen come in with CVMR and Terra Capital really was terrific. [...]" Terry Lynch, CEO, Power Nickel Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Alibaba – Cooperation with Apple in the field of AI

The shares of the Alibaba Group, listed in Hong Kong, have been in strong demand for several days and recently reached a four-month high. The background to this is the announcement that Alibaba has entered into a strategic partnership with Apple to develop AI functions for iPhones in China. Apple is said to have evaluated several systems from other Chinese tech giants, including Baidu, Tencent, ByteDance, and DeepSeek, but chose Alibaba. The decisive factors in the choice are said to be Alibaba's extensive user data and deep technological expertise, which enable personalized services for Chinese users.

Alibaba's shares had already turned around in the chart about three months ago. After a sustained downward trend since 2020, the Chinese tech stock was able to break away from its lows in 2024 and is now rising almost daily. According to reports, Apple and Alibaba have already submitted their jointly developed AI features to the Chinese cyberspace regulator for approval. The services are scheduled to launch in April. Alibaba is growing organically at around 10% per year and has a 2025 P/E ratio of 9.3, according to the analyst platform LSEG. Compared to Apple or Amazon, it is a real bargain.

Please register in time for the next virtual International Investment Forum. Register here to secure your place.

Credissential Inc. – Who knows the data rules the world

Another player in the AI world is the Canadian company Credissential Inc. As part of its ongoing commitment to future-proofing its technology, the Company has successfully integrated a quantum encryption layer into its Antenna software, ensuring a high level of security for its users. The post-quantum integration addresses the potential cybersecurity risks posed by quantum computing and ensures that Antenna's infrastructure remains resistant to new decryption capabilities. Antenna, a secure payment and file transfer platform, now benefits from post-quantum cryptography, a forward-looking safeguard designed to mitigate the threats posed by quantum advancements. CEO Colin Frost believes that the rise of quantum computing presents both an opportunity and a challenge for global financial security. The company already uses artificial intelligence and will use blockchain technology in the future. The Credissential, Dealerflow and Antenna software platforms already offer innovative added value in the financial industry.

In mid-February, the next phase of the growth strategy was presented. The initiative focuses on building a robust financial technology ecosystem, including core solutions like DealerFlow and Antenna, designed to improve financial literacy, solve key financial challenges, and create scalable revenue opportunities across industries. Credissential's approach is to balance organic growth through continued product innovation and strategic financial technology acquisitions to further expand its technology offerings.

In the first step, the Company continues to invest in the development and improvement of its existing platforms. This includes the integration of AI-driven automation, quantum encryption protocols, and data analysis to provide services that are ahead of market trends. It is also actively seeking acquisitions that complement and further expand its core technology stack. AI, quantum, and blockchain technologies form the backbone of Credissential's solutions, providing data processing, automation, and security. These technologies enable the Company to provide scalable, data-driven services that offer personalization and improved efficiency, which are key to overcoming various financial challenges in today's business landscape. The prospects for the company's shareholders are extremely exciting, as billions of dollars are being invested in futuristic financial software platforms in the current environment. From this perspective, the services offered by Credissential form a modern product suite. The Credissential share is quoted under the symbol WHIP in Canada and on all German stock exchanges. The share price is currently in the CAD 0.08 to 0.10 range - the valuation is still very low for an AI software specialist.

Translated with DeepL.com (free version)

Palantir and SAP – Riding the wave of big data

The two blockbuster stocks, Palantir and SAP, continue to ride the AI and Big Data wave. In the last six months alone, the stocks have gained around 300% and 47%, respectively. Is this the end of the road? With a view to the LSEG analysis platform, we now see a 2025 price-to-sales ratio of 70 for Palantir, with a P/E ratio of around 220. Although there are 17 "Buy" recommendations, the price target over the next 12 months is set at USD 92. Yesterday, prices of around USD 119 were reached, so the experts may need to recalculate!

SAP has become the absolute DAX high-flyer. The Walldorf-based software giant announced a partnership with the US software company Databricks on Thursday. The aim is to improve artificial intelligence in companies through a new cloud for business data. Databricks CEO Ali Ghodsi praises it as "a perfect match". Comparing the approximately EUR 320 billion market capitalization for an estimated EUR 38 billion revenue for 2025, the P/S ratio stands at "only" 8.4, while the P/E ratio calculates to 46. At least 23 out of 34 analysts at LSEG are bullish on the Walldorf-based company, but the average 12-month price target of EUR 282 was already reached yesterday.

Those who continue to ride the AI wave will have to ride bigger waves in the medium term. The current one-way street is rare, but those with strong nerves can simply keep adjusting their stops consistently.

It continues at full speed! Donald Trump's obscure decisions are creating a strong differentiation among economic sectors. While armaments and high-tech continue their advance, other sectors are under pressure. Long positions should be hedged with trailing stops. In general, the rule remains: The trend is still your friend!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.