September 11th, 2023 | 07:30 CEST

The next steps towards cannabis THC legalization are underway! Canopy, Tilray and BioNTech are taking the lead, and Cantourage Group is experiencing dynamic growth

Cannabis has been decriminalized in some countries but legalized in only a few states. In the US, cannabis is fully legalized in states such as California but outright banned in others such as Texas. While medical use is slowly catching on, the use as an intoxicant and cultivation for personal use remains controversial. Stronger momentum could be sparked by the US Department of Health and Human Services (HHS). The authorities are open to a downgrading of the degree of danger in the categorization of the US Drug Enforcement Administration (DEA). We are talking about two steps from Schedule I to Schedule III, which no longer puts THC on a par with common drugs such as heroin, ecstasy or LSD but classifies them as substances with comparatively little psychological dependence. That would be a revolutionary step. Which stocks can benefit?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

CANOPY GROWTH | CA1380351009 , TILRAY INC. CL.2 DL-_0001 | US88688T1007 , BIONTECH SE SPON. ADRS 1 | US09075V1026 , CANTOURAGE GROUP SE | DE000A3DSV01

Table of contents:

"[...] Defence will continue to develop its Antibody Drug Conjugates "ADC" and its radiopharmaceuticals programs, which are currently two of the hottest products in demand in the pharma industries where significant consolidations and take-overs occurred. [...]" Sébastien Plouffe, CEO, Founder and Director, Defence Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Canopy and Tilray - The authorities set the pace

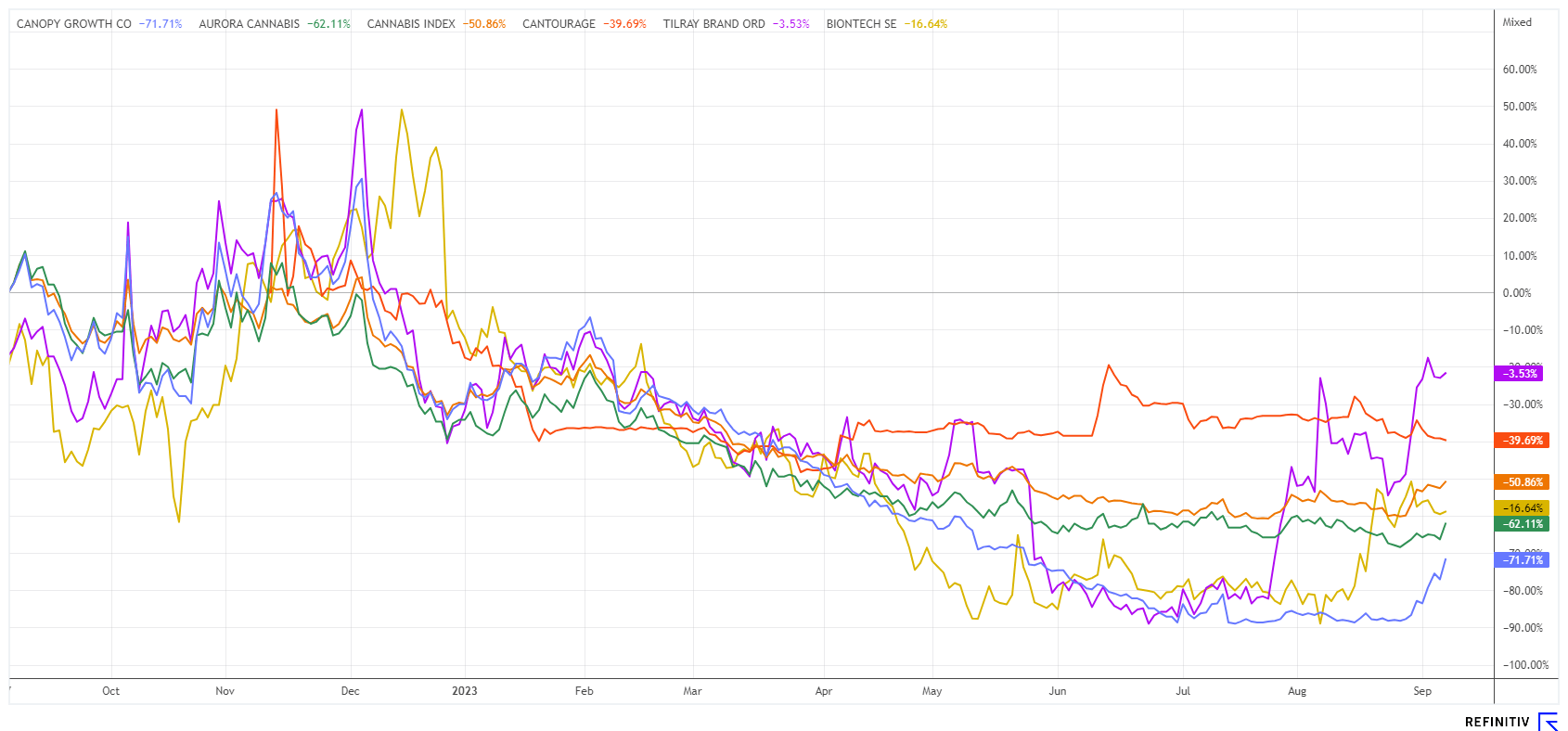

Turned on its heels and headed dynamically upward. This is how Canopy, Tilray and Aurora can be summed up. The North American cannabis protagonists have seen gains between 30% and 100% in recent weeks, and the multi-month slump seems to be fading. The reason lies in the regulation on the US federal level, where there appears to be some initial movement. The Drug Enforcement Agency (DEA) has recently confirmed that it has received a letter requesting a downgrade of cannabis to Schedule III. However, the agency has not yet said whether it will follow the Department of Health and Human Services recommendation. Cannabis is currently still in the highest category of narcotics and is treated the same as substances such as heroin or ecstasy.

If possession and small-scale consumption were decriminalized, the industry could finally breathe a sigh of relief, and the enormous investments made in recent years would ultimately pay off after all. While the 13 analysts on Refinitiv Eikon are still skeptical about Canopy Growth and Tilray, with price targets of CAD 0.72 and CAD 2.42, respectively, the assessment for Aurora Cannabis looks a bit better at CAD 0.92. Despite the rally, the shares could still run further in the short term after minor pullbacks. In the long term, only regulatory changes are likely to bring about a revaluation of the entire sector.

Cantourage Group SE - Well positioned and at the forefront

The picture is quite different for Cantourage Group SE, which has been listed in Germany since November 2022. This is because there are already advanced discussions in this country about how recreational use can be permitted alongside the already established medical use. A current bill could come into force as early as the beginning of 2024. From then on, adults in Germany would be allowed to smoke a joint legally and even carry smaller amounts for personal consumption, according to the draft of the traffic light coalition. The planting of up to 3 hemp plants would then also be permitted. In addition, cannabis is to be removed from the Narcotics Act, where it is currently listed alongside heroin and other drugs as a prohibited substance and subject to corresponding penal provisions. CSU-governed Bavaria has so far still strictly refused to legalize it.

The Berlin-based company Cantourage already sees itself as a leading European company for producing and distributing medicinal preparations and drugs based on cannabis. The Company is also well prepared for the new legislative proposals. The Group covers an extensive range of hemp products and, in addition to inexpensive preparations, also has cannabis flowers on offer that are perceived as being of particularly high quality. The linchpin is the cultivation technique which results in special flowers with a unique effect profile. Demand for such variants is diverse, leading to double-digit sales growth from quarter to quarter. Due to worldwide overproduction, the Company does not cultivate itself, but imports via strong partners. In Germany, the energy input for lighting, cooling and drying would simply be too high. Competition from the so-called "club rules" is not yet seen because smaller manufacturers cannot produce competitively.

The launch of the Company's telemedicine platform for medical cannabis is also promising. Under the name Telecan, patients with chronic conditions can get advice on the possibilities of cannabis therapy. According to Cantourage, only a few people in Germany currently know that treatment with cannabis flowers or extracts is available for sleep and anxiety disorders, chronic pain or epilepsy via a doctor's prescription. Here, too, the market should be able to accelerate further. The share price has recently consolidated. At just under EUR 10, the Company is currently valued at EUR 112 million. Balanced result on an EBITDA basis expected for the current year. Highly interesting!

BioNTech - Technical signals call for entry

A small sector swing to biopharma offers just as much fantasy for the coming months. Because, since September, the adapted Corona vaccine for the current variants of the COVID-19 virus can be ordered from BioNTech. The Company, together with its partner Pfizer, was a real success story among the vaccine producers of 2021/22, with the Mainz-based company accumulating a total of EUR 20 billion in surplus at the time - a solid basis to develop the favored cancer research forward.

However, after a sell-off of more than 80%, the BioNTech chart has been stabilizing above the EUR 105 mark for several weeks. With a current price of EUR 112, the stock is only a razor-thin distance from the 200-day line at around EUR 117. Analytically, the former stock market darling trades at a 2023 P/E ratio of 21.5, with a market capitalization of EUR 26.5 billion, just above cash on hand. If a new Corona wave spreads in the fall, one should quickly jump on the bandwagon because there are hardly any more competing players in this sector. Watch out for momentum above EUR 117.

The cannabis sector is currently in its third spring. After the well-known bulls in 2018 and 2021, the big stocks now seem to have found their bottom. Germany's Cantourage Group may already be well positioned in Europe for the upcoming regulatory changes. BioNTech is also worth another look.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.