August 7th, 2025 | 07:10 CEST

The billion-dollar business! Arms and defense stocks in vogue – Volatus Aerospace, DroneShield, Leonardo, and Airbus

The European defense sector is set to experience significant growth over the next five years. Analysts anticipate average growth of 5 to 8% per annum. The European defense market is expected to grow from around EUR 125 billion to around EUR 170 billion by 2030. A key driver: EU funding is increasing massively, including through the Readiness 2030 program, which will provide up to EUR 800 billion in additional funding, including EUR 150 billion in low-interest loans for the joint procurement of drones, air defense systems, and artillery. In addition, NATO countries have committed to spending 5% of their GDP on defense by 2035, which will require additional investments of approximately EUR 320 billion per year. Which companies stand to benefit?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

VOLATUS AEROSPACE INC | CA92865M1023 , DRONESHIELD LTD | AU000000DRO2 , LEONARDO S.P.A. EO 4_40 | IT0003856405 , AIRBUS | NL0000235190

Table of contents:

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Volatus Aerospace – Billions in potential through smart air surveillance

Volatus Aerospace is a Canadian specialist in advanced airborne surveillance of critical infrastructure. Equipped with state-of-the-art sensor technology and AI-supported image analysis, the Company offers intelligent solutions across a range of industries, from pipeline monitoring and energy sectors to transportation and logistics. Using drones, aircraft, and helicopters, vast amounts of data are collected in ultra-HD, evaluated, and continuously analyzed as digital twins. This allows changes and risks to be identified at an early stage, significantly improving maintenance and safety. Volatus has already inspected over 1.7 million kilometers of pipelines and 40,000 supply stations in more than 16,000 transport flights. Expansion is progressing dynamically, with the US, Europe, and Africa becoming increasingly important in the future. The defense segment is growing particularly strongly, as the number of orders is rising rapidly thanks to AI and automated monitoring solutions.

But development is still in its infancy here! Yesterday, Volatus Aerospace announced a CAD 1 million order to supply tactical ISR drone systems to a NATO partner country. The lightweight drones are designed for short ranges and equipped with electro-optical and thermal imaging sensors for day and night operations in all weather conditions. Thanks to their compact design and rapid deployment, they are ideal for reconnaissance and situation assessment in dynamic operational environments. CEO Glen Lynch emphasized that the systems are field-proven, cost-efficient, and meet the increasing demands of modern combat operations. The order underscores Volatus' growing commitment to the defense sector and creates good scaling opportunities for the coming months.

The Canadians also announced a private placement of approximately 8.1 million shares at CAD 0.52 per share, generating gross proceeds of CAD 4.2 million. Each security unit is accompanied by half warrants, which entitle the holder to purchase additional shares at CAD 0.76 for a period of three years. The net proceeds will be used specifically for the defense business, the expansion of the drone fleet to meet strong demand in North America and internationally, and for general corporate purposes. With current defense orders including a NATO order worth CAD 1 million, a continued robust pipeline, and a clear focus on AI-enabled services, Volatus is well-positioned to take the next leap in growth and expand its leading role in intelligent air surveillance. Due to ongoing financing, the share will be available for purchase at between CAD 0.52 and CAD 0.60 in the coming days, but the share is set for a significant revaluation in the long term.

DroneShield – A little too much of a good thing

Australian defense specialist DroneShield is in the running for public contracts. The Company is a leading provider of anti-drone technology and recorded sensational revenue growth of 480% to AUD 38.8 million in Q2. The growth was driven by a massive global increase in defense spending in NATO and its partner countries. The group is benefiting massively from the increased demand for drone defense systems, which analysts say is a market with more than USD 10 billion in future potential.

DroneShield underscores its role as a global innovation leader with a unique portfolio of advanced solutions. From mobile to stationary and fully autonomous systems, the Company delivers AI-powered detection, radio frequency monitoring, and automated defense measures. The firm order backlog now stands at AUD 176.3 million, and the sales pipeline value is impressive at AUD 2.33 billion. In addition to the imminent market launch of new hardware and services, the Company is prioritizing its entry into civilian applications, the expansion of European production capacities, and accelerating growth in its software business and AI divisions.

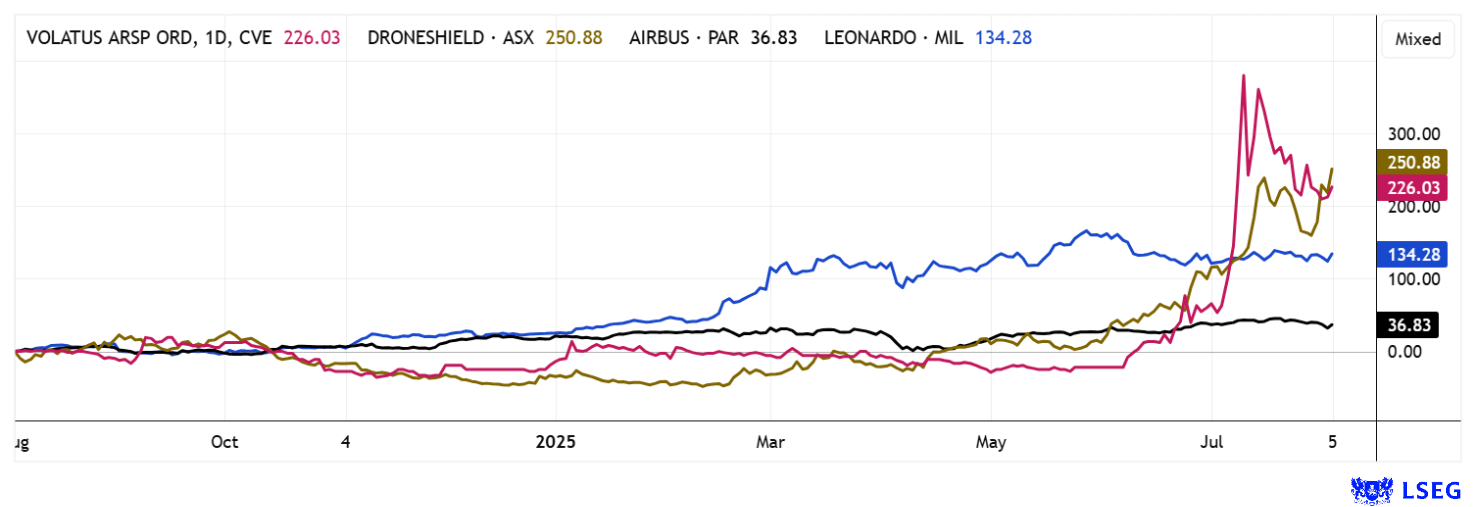

CEO Oleg Vornik emphasizes: "We are not competing with other providers, but with the technologies of entire countries." By 2028, DroneShield aims to grow its pipeline to AUD 5 billion, further expand its global market leadership in AI and defense systems, and become the first port of call for security innovations. The share price has quintupled since January and has now reached a market capitalization of just under EUR 2 billion. With revenues of around AUD 200 million, the stock is trading at a fabulous P/S ratio of 28. Long speculators should keep a close eye on their stops.

Airbus and Leonardo – This is what European winners look like

Airbus and Italy's Leonardo are also getting a slice of the EU defense investment pie. In the first quarter of 2025, Airbus increased its revenue to EUR 13.5 billion, representing an increase of 6%. The Defense & Space division performed particularly well, growing by 23% to EUR 2.6 billion. The helicopter division, which generates around half of its revenue from military orders, also grew by 10% to EUR 1.6 billion. The order book is robust, and new civil-military business is in full swing. For the full year, Airbus expects continued revenue and earnings growth, driven by further increases in European defense budgets. Analysts on the LSEG platform expect an average 12-month target price of EUR 197, which is still 10% higher than yesterday's closing price of around EUR 176.

Leonardo has also recorded strong revenue and order growth since the beginning of the year. In the first quarter of 2025, it again confirmed significant growth in revenue and order intake; the current order backlog stands at a very high EUR 44.2 billion, securing revenues for the coming years. For the full year 2024, Leonardo reported revenue of EUR 17.8 billion, driven in particular by EU-driven defense projects and diversification into high-tech areas such as drones and cybersecurity. Management expects additional revenue of EUR 4 to 6 billion in 2025 due to additional EU defense spending. Analysts on the LSEG platform have likely not yet adjusted their revenue estimates correctly and estimate revenue at just under EUR 19 billion for 2025. The consensus target price is EUR 54.50, but the annual high of May 29 already marked EUR 56.50. Eleven out of 16 experts are voting "Buy" – well then!

The stock markets continue to thrive on price gains in the high-tech and defense sectors. In the current environment, no one can imagine that these stocks could fall again. Therefore, "the trend is your friend" – especially with strong technical charts such as Volatus Aerospace, DroneShield, and Leonardo.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.