April 12th, 2023 | 10:20 CEST

TeamViewer with 100% rally: Now bet on HelloFresh, Infineon and Aspermont?

The TeamViewer share has put on an impressive rally in the past six months. Since October, the stock has gained almost 100% and is trading at over EUR 15. From JP Morgan's point of view, this is too much. The analysts expect little growth momentum and recommend the share with "Underweight". The target price is EUR 12. In contrast, the shares of Infineon, HelloFresh and Aspermont are recommended as buys. HelloFresh and Aspermont, in particular, did not participate in the tech rally of the past months and have catch-up potential. Experts even see more than 100% price potential.

time to read: 3 minutes

|

Author:

Fabian Lorenz

ISIN:

TEAMVIEWER AG INH O.N. | DE000A2YN900 , HELLOFRESH SE INH O.N. | DE000A161408 , INFINEON TECH.AG NA O.N. | DE0006231004 , ASPERMONT LTD | AU000000ASP3

Table of contents:

"[...] Having Investors like Robert Friedland and Rob McEwen come in with CVMR and Terra Capital really was terrific. [...]" Terry Lynch, CEO, Power Nickel Inc.

Author

Fabian Lorenz

For more than twenty years, the Cologne native has been intensively involved with the stock market, both professionally and privately. He is particularly passionate about national and international small and micro caps.

Tag cloud

Shares cloud

Aspermont: GBC Research sees significant upside potential

Leading in an attractive niche, strong growth, debt-free and high cash reserves - these are the characteristics of Aspermont Limited. Nevertheless, the Australian company's shares have lost around 50% of their value since October. This can only be explained by the general weakness of small-cap stocks. After all, Aspermont's operations are running smoothly. Therefore, GBC Research recommends buying the shares of the Australian global market leader for business-to-business (B2B) media for the commodities industry. The price target is EUR 0.08. Currently, the share is trading at EUR 0.011.

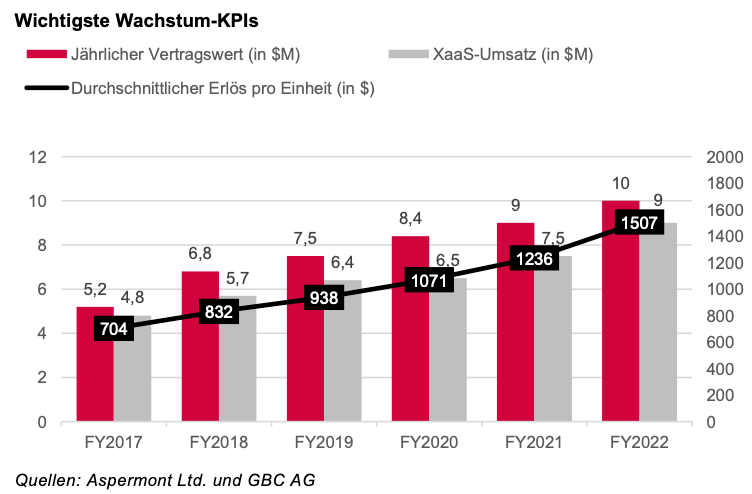

Aspermont offers subscription-based content services in the mining, energy, agriculture and technology sectors. The Company has steadily increased its revenues over the last 25 quarters and had another record year in 2022 in terms of revenue, gross profit, EBITDA and net cash. The analysts are particularly impressed by the transformation to the digital XaaS business. Recurring revenues now account for 75% of total revenues of AUD 18.7 million (2021: AUD 16.10 million). Aspermont is growing at double-digit rates across all XaaS KPIs. Notably, average revenue per subscriber rose 28% to a record AUD 1,538. Then, in the current year, net income is expected to post a significant surplus of EUR 1.13 million. In 2024, GBC expects Aspermont to grow to AUD 29.26 million in revenue and AUD 3.18 million in net profit. Currently, the Company is valued at AUD 41 million. The full GBC report is available for download here more-ir.de/d/26469.pdf.

HelloFresh: JP Morgan upgrades

HelloFresh's share price has also disappointed in recent months. However, in recent weeks it has recovered from its low for the year of below EUR 16, and yesterday it climbed by over 3% to over EUR 23. The trigger for the price jump was JP Morgan. The analysts of the US bank upgraded the HelloFresh share from "underweight" to "overweight". The valuation is now attractive again, and the expansion of the business model to include the delivery of ready-to-eat meals is correct. The demand in the cooking box business is manageable. Although there are cannibalization effects, the bottom line is that growth should regain momentum. Overall, the risk-reward ratio has improved. Therefore, the analysts raised their price target from EUR 18 to EUR 27.

Deutsche Bank sees considerably more upside potential. The analysts had renewed their buy recommendation for the HelloFresh share at the beginning of April. The analysts expect 2023 to be a "transition year". In the long term, the prospects are positive. The price target of the analysts is EUR 36.

Infineon: Over 30% price potential

The Infineon share has gained around 20% in the current year. And analysts see further upside potential. Warburg Research recently raised its price target for the German chip group from EUR 45 to EUR 48 and confirmed its buy recommendation. UBS also raised its price target from EUR 47 to EUR 49. The environment for semiconductors, for the automotive sector and industry, remains positive. Profitability is also high in a peer group comparison. The Infineon share is currently trading at around EUR 35.

Both analyst firms thus reacted positively to the increase in Infineon's forecast for the full year 2023 (fiscal year ending 30 September). According to this forecast, revenues are expected to be significantly higher than the previously expected EUR 15.5 billion. The demand for high-priced products, such as energy-saving systems made of several semiconductors, is encouraging. This would also allow higher margins to be achieved.

Infineon is doing well operationally and analysts see more than 30% upside potential. Despite the rally in big tech stocks, investors should not lose sight of small caps. Aspermont offers an attractive entry opportunity. The HelloFresh share is seen more positively again by analysts.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.