March 28th, 2025 | 07:00 CET

Tariffs and Markets – Where investors should strike now with Power Metallic Mines, Steyr, and Vonovia

The new US tariffs on cars and goods have become a reality this week, and the markets are reacting with uncertainty: Companies like Power Metallic Mines, Steyr Motors, and Vonovia are in focus – their share prices are responding differently. This moment offers opportunities for investors. The Canadian junior explorer Power Metallic Mines offers long-term investors an exciting field of copper, gold, and valuable battery metals. Steyr Motors shines as a stable growth stock with a EUR 200 million order backlog in the defense sector, despite a price scandal. Vonovia attracts those seeking stability with a 4.2% dividend yield. However, the real estate crisis continues to erode the Company's fundamentals. Market sentiment is tense. The tariffs are testing the resilience of these companies – how they react could set the tone for the coming weeks.

time to read: 5 minutes

|

Author:

Juliane Zielonka

ISIN:

POWER METALLIC MINES INC. | CA73929R1055 , STEYR MOTORS AG | AT0000A3FW25 , VONOVIA SE NA O.N. | DE000A1ML7J1

Table of contents:

"[...] We can make a big increase in value with little capital. [...]" David Mason, Managing Director, CEO, NewPeak Metals Ltd.

Author

Juliane Zielonka

Born in Bielefeld, she studied German, English and psychology. The emergence of the Internet in the early '90s led her from university to training in graphic design and marketing communications. After years of agency work in corporate branding, she switched to publishing and learned her editorial craft at Hubert Burda Media.

Tag cloud

Shares cloud

NISK project shines: Power Metallic stock on the rise despite tariffs?

The new US tariffs on cars and other goods are changing the stock markets. However, Power Metallic Mines Inc., a junior explorer focused on valuable and highly sought-after metals, remains resilient despite the fluctuations. As a mining company, Power Metallic aims to potentially develop the high-grade nickel-copper-PGM-gold-silver NISK project into the next polymetallic mine in Canada. This could open up great opportunities for investors with a long-term horizon. The flagship NISK project in Quebec is making remarkable progress in developing high-grade deposits of nickel, copper, cobalt, and platinum group metals (PGM), as demonstrated by the latest drilling results from March 25, 2025. The stock could come under short-term pressure from tariffs – a moment that strategic investors might seize.

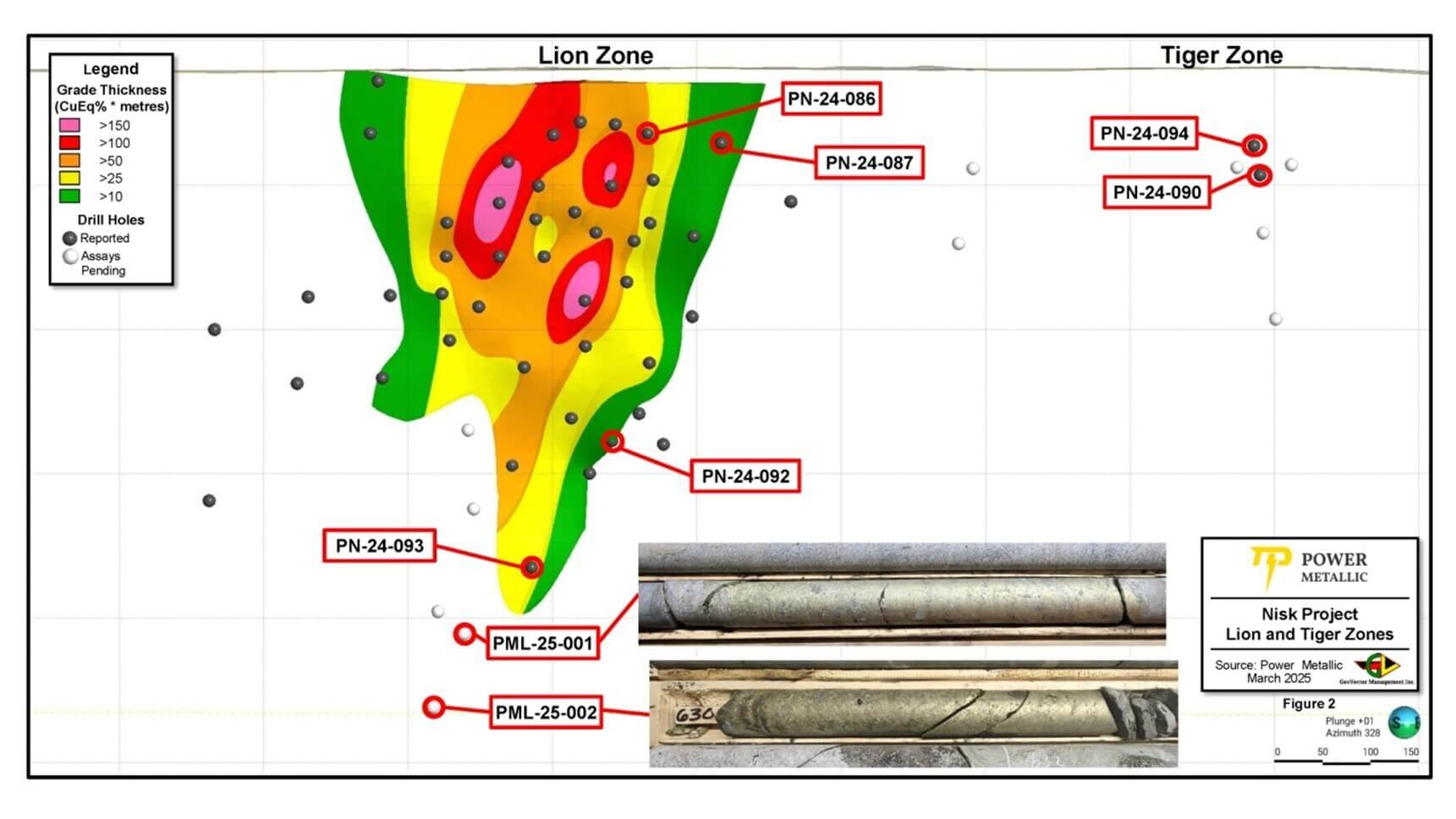

The latest drilling at the Lion Zone, hole PN-24-093, returned the deepest measured mineralization to date, confirming the potential for a "polymetallic supergiant". **High-grade finds, including 1.55 m of 65.09 g/t palladium in hole PN-24-086, underscore the quality of the deposit. The Tiger Zone, 700 m to the northeast, is also showing the first Ni-Cu massive sulfides, indicating an expandable system. Thanks to its location next to a main road, a Hydro-Québec station with low-cost green electricity, and generous tax incentives, NISK remains a cost-effective project with low risk. Analysts see great potential for long-term growth here, supported by the energy transition.

US tariffs could increase export pressure as demand from the US auto industry could fluctuate. However, Power Metallic does not rely solely on this market – global demand for precious metals such as gold, battery metals for electric vehicles, and copper for renewable energies remains strong. According to experts, short-term price setbacks could provide an ideal buying opportunity, as the Company is well-positioned for the future with its flat deposits and CO₂-neutral approaches. The combination of high-grade finds and geopolitical uncertainties makes the stock exciting.

Steyr focuses on acquisitions – Prospects despite market manipulation suspicions

The Austrian special motor manufacturer Steyr plans to accelerate its growth through acquisitions, as CEO Julian Cassutti explained earlier this week. With an order backlog of EUR 200 million and a 40% increase in sales for 2025, Steyr offers stability. However, a share price scandal is causing displeasure: After reaching a high of over EUR 400 in March, the share price plummeted to below EUR 90. This could attract the attention of BaFin.

In 2024, Steyr reported an adjusted EBIT of EUR 10.1 million (previous year: EUR 3.6 million) on revenues of EUR 41.7 million. Revenues increased by 9.2% compared to the previous year. From the IPO in October 2024 at EUR 14, the share price shot up to EUR 240 but fell sharply after Mutares' announcement that it would lift the lock-up period early. A community of affected shareholders has raised suspicions of market manipulation: On March 18, 2025, the share price reached EUR 400, fell to EUR 230 by the time of the ad hoc announcement at 5:06 PM, and is now at EUR 62 – a decline that raises questions about insider trading. Mutares remains the main shareholder with 71%.

Despite tariffs, Steyr remains robust: Over 70% of sales come from the defense sector, for example for Leopard 2 tanks. "We are not feeling any direct effects from tariffs," emphasizes Cassutti. With an EBIT margin of over 20% and planned acquisitions, Steyr offers prospects. The share could be a stable growth stock – once the price confusion is cleared up.

CEO Rolf Buch sees Vonovia strengthened: Growth course with 4.2% dividend yield

Vonovia, Germany's largest residential real estate company, sees itself on the road to recovery, as CEO Rolf Buch emphasized on Monday of this week. With an adjusted EBITDA of EUR 2.63 billion (+1.6%) and a rent of EUR 8.01 per square meter (+3.5%) for 2024, that sounds like stability. However, the real estate crisis continues to erode the Company's assets.

"We are emerging from the crisis earlier than many others. And we are emerging from it stronger than we entered it. We have focused on our core business over the last three years and generated around EUR 11 billion in additional cash. We have done our homework. No other company owns more rental apartments than we do. Now is the time for us to fully exploit our potential and lead the market with new prospects," says Rolf Buch, CEO of Vonovia.

Vonovia invested a total of EUR 1.60 billion (2023: EUR 1.53 billion) in modernization, maintenance, and new construction in 2024, with a focus on CO₂ reduction and barrier-free apartments. Thanks to the serial prefabrication of facade elements and the increased use of photovoltaics and heat pumps, the carbon intensity of the German building stock has fallen by 1.6% to 31.2 kg CO₂e/m². In addition, Vonovia has responded to the needs of an aging society by partially modernizing around 11,100 of its apartments to make them barrier-free.

Based on this development and the existing dividend policy, the Management Board and the Supervisory Board plan to propose a dividend of EUR 1.22 per share at the Annual General Meeting. This is around 36% higher than the previous year (2023: EUR 0.90) and reflects the Company's successful performance. The dividend yield amounts to 4.2%.

Tariffs could increase construction costs due to more expensive imports, even though Vonovia relies on existing rents. "New construction is not our focus," says Buch. For investors, this presents a dilemma: Stability is possible, but not guaranteed. Those who enter at the current EUR 24.66 are betting on a turnaround. The coming days will be crucial.

Power Metallic Mines has a promising future despite the new US tariffs. The NISK project, with high-grade battery metals like gold, nickel, and copper, will continuously benefit from the global energy transition. The combination of markets unsettled by US tariffs and the Company's strong fundamentals makes the stock particularly attractive for investors with a long-term horizon. Steyr Motors is showing stability and growth potential, supported by a EUR 200 million order backlog in the defense sector and plans for acquisitions. However, the alarming share price drop from EUR 400 to EUR 62 is causing uncertainty. For growth-oriented investors, the stock could be a stable value once the price confusion is cleared up. Vonovia presents itself as a stable anchor with a dividend yield of 4.2%, strengthened by investments in the modernization of existing buildings and a stable rental business. It offers an option for stability-oriented investors, but the coming days will show whether the price holds or falls.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.