April 16th, 2025 | 07:45 CEST

Tariff madness drives gold! Caution advised with Barrick, Globex Mining, Mutares, and Steyr

Every day brings a new spectacle from the White House. What resembles a farce is, unfortunately, a harsh reality. The new president, Donald Trump, leaves no doubt about who dictates the conditions in global trade. But even Mr. Universe has to row back now and then because experts have a clever piece of advice or two on how to avoid completely running the US into the ground. After all, the proclaimed tariffs threaten a severe cooling of the global economy and a surge in inflation - a perfect opportunity for precious metal investments. Due to the general uncertainty, defense stocks also remain in focus. We do the math.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

GLOBEX MINING ENTPRS INC. | CA3799005093 , MUTARES KGAA NA O.N. | DE000A2NB650 , STEYR MOTORS AG | AT0000A3FW25 , BARRICK GOLD CORP. | CA0679011084

Table of contents:

"[...] Our SMSZ project is the largest contiguous land package of any exploration company in the region at 400km2 and overlays a 38km portion of the prolific Senegal Mali Shear Zone. [...]" Jared Scharf, CEO, Desert Gold Ventures Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Barrick Gold – A medium-term buying opportunity

In times of economic uncertainty and rising inflation, investors repeatedly turn to gold. It has the reputation of being one of the oldest stores of value in human history, as it is considered a safe haven and a stable protection against currency devaluation. But what makes gold so valuable? The yellow metal cannot be artificially produced or multiplied indefinitely like paper money. Global gold production is growing slowly, and existing mines are constantly looking for new properties to extend their lifetimes. Precious metals such as gold, silver, platinum, and palladium have been considered safe havens for centuries and retain their value even in times of crisis. Things do not always go according to plan in gold mining, as Barrick Gold is experiencing in Mali, West Africa. The gold major temporarily suspended operations at its largest mine, Loulo-Gounkoto, at the beginning of 2025. This news in mid-January is the negative culmination of the dispute between the world's second-largest gold producer and the state of Mali, which has been simmering for months. Since a military junta took power there, it has been seeking higher revenues.

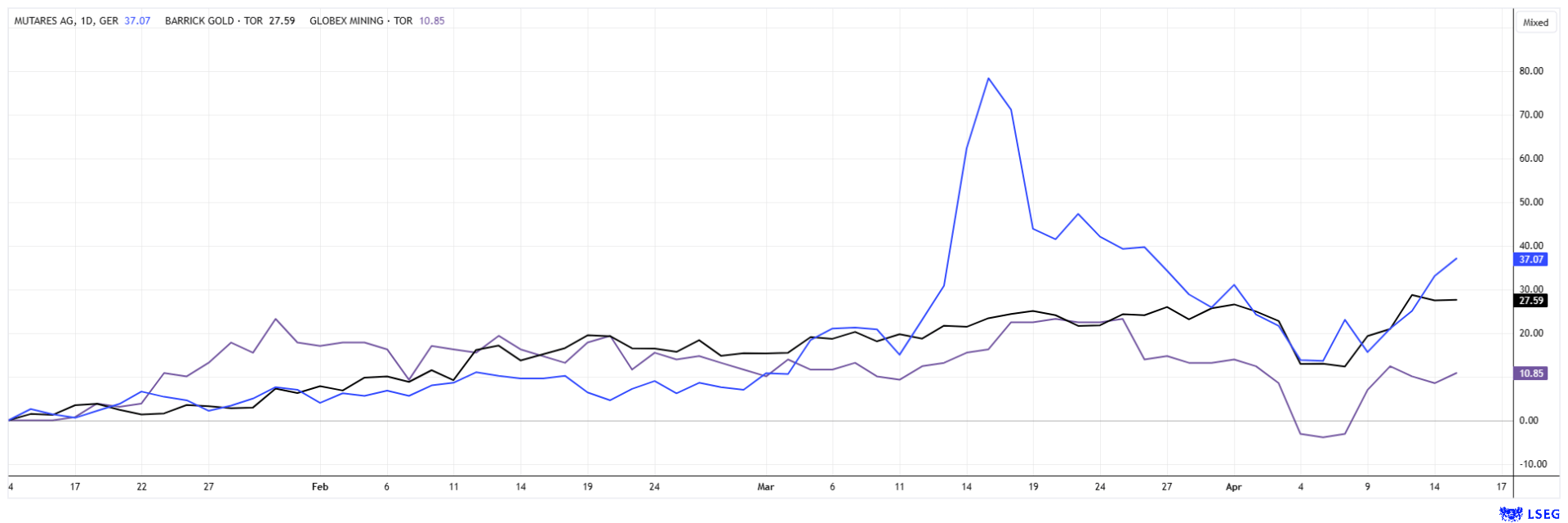

The closure is painful for Barrick Gold, as the Company produces over 500,000 ounces per year there. However, it is also a problem for Mali, as Loulo-Gounkoto contributes about 9% to the GDP of the West African country. In 2024, Barrick produced 3.9 million ounces of gold and almost 200,000 tons of copper worldwide. Production costs in Q4-2024 were USD 1,451 per ounce and, on a yearly average, at a high of USD 1,484. However, net income rose sharply by 69 % to USD 2.14 billion, and free cash flow reached over USD 500 million in the fourth quarter and amounted to USD 1.3 billion for the full year. Not bad figures, but Mali continues to weigh on performance. At plus 11%, the gold giant's 12-month performance can be described as rather weak. If the Africa issue is resolved, things could move quickly because the current 2025 P/E ratio is just 12. And the estimates do not yet include the recent explosion in the price of gold. Collect it!

Globex Mining – Gold prospectors now receive over USD 3,200 per ounce

With over USD 3,200 for an ounce of gold, the mining sector is looking better than it has in years. Especially for properties that still hold their resources in the ground, the valuations on the stock market would have to be raised dramatically because producers are confronted with significantly higher transaction sums when taking over a junior company. This is a stroke of luck for Globex Mining, as the Company holds over 250 mineral concessions in Canada, primarily focused on gold and metal projects in Quebec. The deposits are at various stages of development and some are tied into partnerships through option and royalty agreements. This leads to a constant deal flow within the portfolio and ensures constant cash inflows.

There is currently an update on the drill results reported by Manganese X Energy Corp. at the 1% gross manganese license property Battery Hill in New Brunswick. Manganese X reported 12 new drill holes totaling 1,393 meters in the Moody Hill and Sharpe Farm sectors of the property, in addition to the 93 previous drill holes. Intercepts of up to 72.6 meters were reported. Drilling focused on in-fill and extension drilling to upgrade inferred resources to measured and indicated categories. They form the basis for an upcoming NI 43-101 pre-feasibility study currently being conducted by Mercator Geosciences. In addition, Globex is a major shareholder of Electric Royalties, which also holds a 2% gross metal royalty on the Battery Hill property.

Globex has a large number of projects that are now coming into the spotlight as investors look for investment opportunities in the gold sector. GMX shares are currently trading at around CAD 1.45, which, with 56,294 million shares, results in a market capitalization of CAD 81.6 million. Around 25% of this valuation is backed by cash. That is a good reason to continue accumulating!

Mutares and Steyr – In the right place at the right time

Sometimes, owning the right portfolio company at the right time pays off. Mutares acquired Steyr Motors Betriebs GmbH and Steyr Motors Immo GmbH from Thales Austria GmbH in November 2022. Since the acquisition, Steyr Motors has performed particularly well. In 2023, the Company generated revenues of over EUR 40 million and revenues of EUR 41 to 45 million are expected for 2024. The figures will be announced on May 7. In October 2024, the parent company Mutares successfully floated Steyr Motors AG on the stock exchange, selling 21% of the shares but remaining the majority shareholder with 70.9%. In recent days, Mutares has reduced its stake to 40% with the placement assistance of Hauck Aufhäuser. The total proceeds of the sales amount to around EUR 74 million, which can now be used for new investments. Steyr shares took a wild rollercoaster ride due to the narrow market, with prices of up to EUR 385, which pushed the market capitalization up to over EUR 2 billion. Mutares has been attracting a lot of attention again recently and broke through the EUR 34 mark yesterday. The journey could go a little further here, but in our opinion Steyr Motors is fundamentally overvalued even at EUR 48.50.

It is hard to believe what is currently happening on the stock market. 4,000 DAX points in just 5 trading days is quite something. High volatility and uncertainty are driving up precious metal prices in particular. It is uncertain whether the NASDAQ can reach new highs again, as the days of exuberant growth appear to be over for now. Experts are warning of an impending recession starting in the US. With its portfolio, Globex Mining provides a smart, precious metals hedge for turbulent times.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.