February 20th, 2024 | 07:30 CET

Takeover fever in the biotech sector! Will MorphoSys now be followed by Defence Therapeutics, Evotec and Bayer?

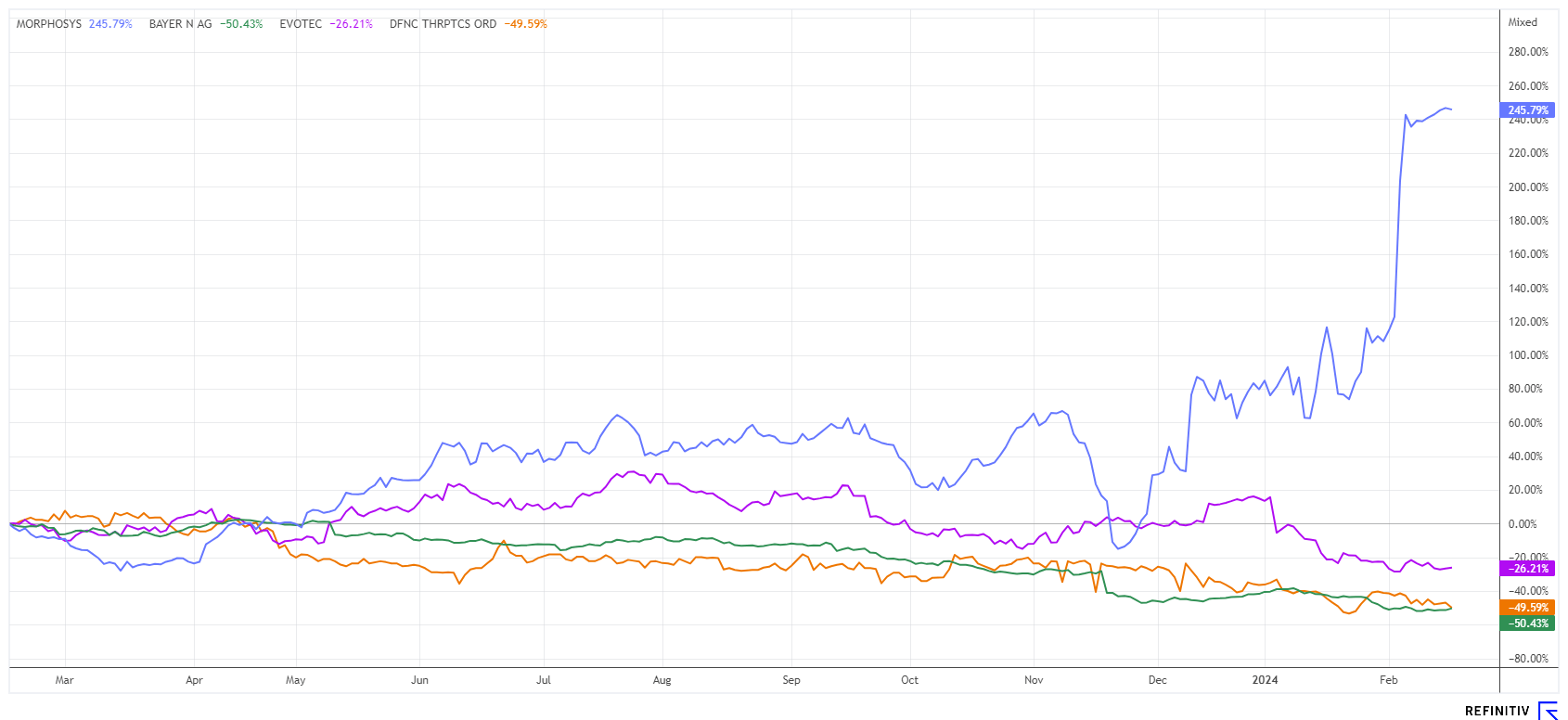

It has happened: Novartis is bidding for MorphoSys. Once again, a long-lasting and persistent rumour mill eventually confirms itself. Those who remained loyal to MorphoSys despite heavy selling last fall have now made a profit of over 300%. If we turn the analytical magnifying glass on the sector, we can see that the speculative biotech stock market segment has started to move again since the challenging year 2023. Hopes of falling interest rates in the near future, along with several other M&A hopes, have led to steady inflows into listed bio-ETFs, resulting in fund managers having recently adjusted their weightings upwards. We analyze which stocks are currently making the loudest noise.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

MORPHOSYS AG O.N. | DE0006632003 , DEFENCE THERAPEUTICS INC | CA24463V1013 , EVOTEC SE INH O.N. | DE0005664809 , BAYER AG NA O.N. | DE000BAY0017

Table of contents:

"[...] Defence will continue to develop its Antibody Drug Conjugates "ADC" and its radiopharmaceuticals programs, which are currently two of the hottest products in demand in the pharma industries where significant consolidations and take-overs occurred. [...]" Sébastien Plouffe, CEO, Founder and Director, Defence Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

MorphoSys - Is EUR 68 enough for the scolded shareholders?

The presentation of the Phase III trial data on pelabresib at the ASH annual meeting in December initially caused uncertainty but then lured investors out from hiding. After a quick sell-off low of EUR 14.50, the share price rose in stages to EUR 30, then EUR 44 and finally EUR 50. Several technical resistance levels were broken in succession. Initially, various hedge funds were blamed for the rapid rise, but in the background, it was the takeover speculators who picked up large quantities on the market. Although the takeover price of EUR 68 offered by the Swiss pharmaceutical group represents a premium of more than 100% on the weighted share price of the last three months, some industry experts have nevertheless spoken out, suggesting that the equity value is now somewhat higher than the EUR 2.7 billion offered. With the help of the Swiss marketing channels, the drug pelabresib could quickly become a blockbuster after the hoped-for approval by the FDA and EMA.

UBS and JP Morgan consider the takeover bid reasonable and, like the Management Board and Supervisory Board, are unanimously recommending acceptance of the offer. Those who want to attach a little more hope to the whole situation can buy the shares at EUR 64.70 and simply wait to see if another offer is made or if a higher squeeze-out price has to be paid. Despite all the euphoria, the MorphoSys share is far from its high of over EUR 135 in 2020. Most investors are, therefore, still likely to be sitting on significant losses.

Defence Therapeutics - Good technology, shares severely undervalued

Canadian biotech specialist Defence Therapeutics (DTC) has advanced to the hot phase of the FDA "Study May Proceed" review with its drug ACCUM-002TM Dimer CDCA-SV40, commonly known as "AccuTOX®". The approval of AccuTOX® as one of the Company's first-in-class therapies is a huge step forward for Defence in the field of immuno-oncology. It is now only a few steps away from the Phase I trial, which aims to demonstrate the results obtained to date with mice in humans. Very exciting!

For Defence, the FDA vote is a critical milestone in getting off to a good start in 2024, as it was announced in early January that AccuTOX® had also been successfully tested against tumors in the lungs. The active ingredient stimulates the immune system and inhibits tumor cell growth. This makes it clear that cancer vaccine therapies with AccuTOX® could quickly become an attractive flagship in the field of oncology for the Canadians. If Novartis is putting EUR 2.7 billion on the table for MorphoSys, why should an innovative company like Defence Therapeutics settle for a valuation of EUR 57 million? The announced refinancing of over CAD 2 million is intended to raise additional operating working capital. At the beginning of February, the Company closed the first tranche of CAD 850,500. The conditions of CAD 1.50 per share and a warrant at CAD 2.00 are extremely attractive. The offer phase should, therefore, end very soon.

On February 21 at 14:00 CET, Dr. Moutih Rafei, Vice President R&D, will present live at the 10th International Investment Forum and report on the latest company developments. Click here to register.

Evotec and Bayer - Takeover or break-up?

Anyone looking at the share prices of Evotec and Bayer is likely to be teary-eyed at the moment. The two stocks have lost more than 70% in the last three years. Evotec shares have been on the decline since summer 2021. From today's perspective, it seems strange that the former CEO, Dr. Lanthaler, still has to "subsequently report" share transactions from these years. BaFin should conduct extensive investigations in this case, as shareholders have to absorb cumulative market value losses of more than EUR 5 billion. The fact that takeover hopes are also being sparked here after the good news about the cooperation with Advanced BioScience Laboratories is due to the wave of speculation within the sector. Nevertheless, new investors should carefully consider their investment in Evotec, as the SEC will also look closely at the Lanthaler case.

Bayer shares have been battling a wave of lawsuits from the US since the takeover of Monsanto and have also had to cope with setbacks in the pharmaceuticals division. Bayer is a life science company with a history of over 150 years and core competencies in the fields of healthcare and agriculture. Now, voices are being raised calling for a strict split-up of the ailing company. Shareholder representatives are calling for the Crop Science division, including the debt from the Monsanto takeover, to be spun off and stand on its own two feet so that the cross-subsidization from the pharma division can be ended as quickly as possible. Despite all plausibility, we do not believe in such a scenario, nor is a takeover by a third party likely to be on the agenda due to smouldering lawsuits in the billions. At least Bayer is trading at a 2024 P/E ratio of 4.7 and additionally offers a dividend yield of over 7%. However, new entrants should be prepared and have long-term staying power.

Takeover fever has reignited. The biotech sector is currently still focused on developments at MorphoSys. However, this demonstrates that patience with innovative companies is rewarded eventually. While Bayer and Evotec continue to struggle with problems, the takeover fantasy, due to promising advancements, should be noticeable for the very attractively priced Defence Therapeutics.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.