January 7th, 2025 | 07:30 CET

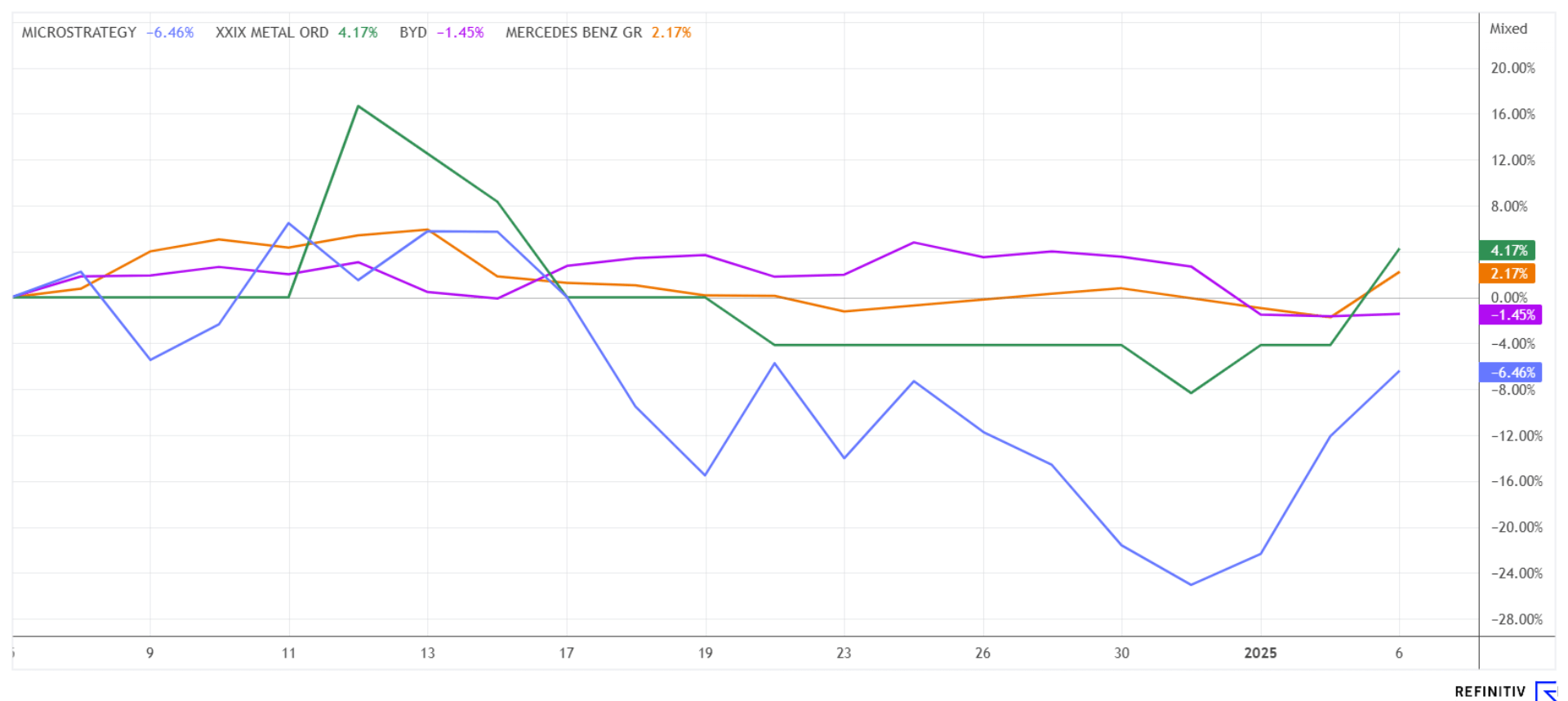

Super Rally 2025: Artificial intelligence, crypto and the hunger for energy! TOP performance with MicroStrategy, XXIX Metal, BYD and Mercedes

The sudden cancellation of the government environmental bonus for e-vehicles at the end of 2023 has led to a significant drop in the number of electric vehicles being registered. However, interest in electric vehicles remains, albeit constrained, partly due to the high prices of many electric models. New government measures are expected to boost electric mobility again starting in 2025, with potential incentives of up to EUR 3,600 – though the implementation will likely only happen after the elections. What is being treated as an election promise for Germany has become the norm for the rest of the world. The increasing demand for energy driven by the electrification of various sectors, from high-tech and artificial intelligence to the crypto arena, which is even now being considered as a "reserve currency," highlights how quickly the world is changing in this disruptive environment. However, what all economic and political trends have in common is the need for access to strategic metals, especially copper! Where are the opportunities for investors?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

MICROSTRATEG.A NEW DL-001 | US5949724083 , XXIX Metal Corp. | CA9013201012 , BYD CO. LTD H YC 1 | CNE100000296 , MERCEDES-BENZ GROUP AG | DE0007100000

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

XXIX Metal – New drilling results from the Saddle Zone are impressive

Copper is part of the list of critical metals that are closely monitored by Western industrial nations. Without these metals, the "Net-Zero" targets of further electrification within the energy transition are not feasible. Trends in the high-tech industry are further exacerbating the scarcity situation. This is because a single megawatt of data centre capacity already requires 20 to 40 tons of copper. In addition, further progress is being made in the field of e-mobility and the expansion of alternative energies. Conclusively, research institutes expect a general supply deficit of 4 to 5 million tons by 2030, which is likely to further exacerbate the price and availability situation.

Located near Vale and Glencore's operating mines, the 'Opemiska' copper mining complex is a former high-grade copper producer in Quebec with a property size of over 13,000 hectares. The most recent resource estimate showed a substantial 2.1 billion pounds of copper equivalent in measured and indicated resources. The property is owned by XXIX Metal Corp (XXIX). Encouraging results have now been obtained from the Saddle Zone, where 5.3% Cu and 1.20 g/t Au were identified over 11 metres, over a length of 81 metres (drill hole OPM-24-281). The Saddle Zone lies between the past producing Springer and Perry mines within the current open pit concept outlined in the January 2024 Mineral Resource Estimate. This section is relatively underexplored and serves as a transition zone between Springer and Perry. XXIX has been working to determine the orientation of the veins in this area and has recently developed a new geological thesis that underlies the 3-hole scout drilling program completed in November. The drill program results support this thesis and indicate the potential for further exploration, and the work will continue consistently. Further results should follow in the next few months. The successful discovery and delineation of new mineralization in this area could significantly impact Opemiska's future technical and economic studies.

XXIX Metal Corp currently has 174.37 million shares issued, bringing the market value to around CAD 20 million. The stock is actively traded in Frankfurt at between EUR 0.08 and 0.09. Significantly higher valuations are expected with rising copper prices. (Note: the symbol XXIX represents the Roman number 29, which is the atomic number of copper in the periodic table.)

MicroStrategy – The icon of the crypto world

Copper demand will increase significantly by 2030 due to the boom in Web 3.0, crypto mining, and energy-intensive artificial intelligence (AI) applications. According to forecasts, the AI industry alone could add up to 1 million tons to annual demand. This increase results from the massive use of copper in high-performance data centres, which are crucial for the functionality of AI applications and crypto mining.

With Bitcoin trading above USD 102,000, MicroStrategy's stock is again rising sharply in the new year after a correction of around 45% in the last 6 weeks. Yesterday, prices of USD 360 were reached again, with the high for 2024 at USD 542. The Company recently made another major investment in Bitcoin, spending USD 101 million. This decision is part of an ongoing strategy that has been in place for several weeks. According to a document filed with the US Securities and Exchange Commission, the latest purchase includes 1,070 Bitcoin tokens at an average price of about USD 94,000 per token.

Michael Saylor, the visionary CEO of MicroStrategy, still plans to raise a total of USD 42 billion by 2027 in order to implement his proclaimed Bitcoin strategy. This capital raising is to be done by selling shares and convertible notes. A key part of this strategy is the issuance of preferred shares that rank senior to Class A common shares. In the first quarter, up to USD 2 billion will be raised. As things currently stand, this should not be a problem; the bubble may only be at the beginning. In any case, 9 out of 9 analysts on the Refinitiv platform give it the thumbs up. Meanwhile, Bitcoin targets of up to USD 1 million are circulating among traders – well then!

Mercedes-Benz and BYD – Is the new environmental bonus coming?

Car manufacturers are operating on a much smaller scale. They are operating beyond the hype in a challenging market. The global inflation trend is making large-scale investments increasingly expensive, and purchasing a new vehicle, in particular, has become a matter of conscience for European citizens due to the high level of uncertainty. While only 0.8% of vehicles worldwide are electric, the figure in Europe is already significantly higher. In 2023, electric vehicles accounted for 14.4% of new registrations. In 2024, this figure fell to 12.5%, influenced by the sluggish development in Germany.

The Chinese supplier BYD has greatly expanded its presence in Europe in recent years. In 2023, BYD sold 15,644 electric vehicles in Europe, corresponding to a market share of about 1.1% in the European EV market; according to forecasts, this share could rise to 5% in 2025. In 2026, BYD's plant in Hungary will start production, and then the Company will also save the EU import duties of currently 17.4%. The Mercedes-Benz Group had to accept sharp declines in vehicle sales and margins in 2024. The share price also lagged well behind the DAX performance of plus 19%, with a minus of around 15%.

The funding of e-mobility could receive a boost after the federal election in February. According to press rumours, CSU plans to revive the purchase bonus for electric vehicles following a Union victory. The funding is to amount to up to EUR 3,600 per vehicle, and leasing costs are to be reduced by EUR 100 per month. CSU parliamentary group leader Alexander Dobrindt is already talking about the dual benefits of the measure: it would strengthen employment in Germany and promote climate protection. The need for a new subsidy is obvious: demand fell significantly after the state e-vehicle purchase incentive expired at the end of 2023. Even the current chancellor, Olaf Scholz, recently suggested a Europe-wide reorganization of the subsidies. For BYD and Mercedes-Benz, this could provide a new entry argument. Mercedes-Benz is currently "offside" with 12 out of 27 "Buy" recommendations. With a price of EUR 54, we see perhaps a good entry point for long-term investors. After all, the 2025 P/E ratio of just 5 is only one-third of BYD's.

The world is on the verge of a new surge in energy consumption. A large number of industrialized countries have recognized the demands of the times and are investing heavily in new power plants and electrical infrastructure, as well as storage systems. Germany has also missed this train and has to import expensive energy from its EU nuclear partners. XXIX Metal Corp. is consistently pursuing a path of exploration and could be producing essential copper for the world markets in a few years. XXIX Metals – New drilling results from the Saddle Zone are impressive.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.