October 7th, 2022 | 10:15 CEST

Strong rebound in gold: Varta, TUI, Desert Gold - Is it already buying time for these shares?

Despite all the gloom, the capital market offers plenty of opportunities every day. The Varta shares experienced a crash of over 80% in only 12 months but could also swing up by 15% within 1 week. Such movements are part of a revaluation that many stocks are now undergoing. The experienced investor is not bothered by this because, fortunately, there are upward exaggerations as well as downward ones, and both provide buying opportunities. The only question that remains is whether the level reached could already be down. Fundamental analysis helps here, but chart technology also provides valuable clues for timing. We take a closer look at the following stocks.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

VARTA AG O.N. | DE000A0TGJ55 , TUI AG NA O.N. | DE000TUAG000 , DESERT GOLD VENTURES | CA25039N4084

Table of contents:

"[...] Internally we expect the resource to significantly grow the deeper we mine. [...]" Dennis Karp, Executive Chairman, Manuka Resources

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Varta - Has the share been sold off too much?

The technology company from Ellwangen had to row back three times in 2022 and most recently completely discarded its forecasts. Many investors are asking themselves what has become of the many positive trends at Varta. To put it in a nutshell: Varta is suffering from high purchase prices for raw materials and preliminary products. In addition, the confirmations of two major customers for key purchase batches in the area of micro batteries are stalling. In addition, there is a lengthy test phase for the V4Drive cells for e-mobility, which are in great demand. None of this is particularly good news.

The enormous rise in energy prices is putting an additional strain on the profit statement. The bottom line is that the Ellwanger's profits could even slump by more than 50% in the current year. The high costs can, at best, be passed on to customers in the medium term, but not immediately. As a result, Varta is already losing a lot of margin on current shipments. Next year, the pricing scenario will likely improve, but there is no forecast. The lynchpin is the input costs, which are dependent on raw materials, and the possibilities of passing them on to the consumer market. Understandably, Varta has suspended guidance.

Analysts reacted after the last profit warning and corrected the sales expectation by more than 12%. The consensus earnings per share were calculated at EUR 1.30 but are expected to increase by 50% by 2024. Even at a strongly reduced price level, the Varta share is trading at a 2022 P/E ratio of 24.5; the price/sales ratio has been reduced to 1.5. Starting from EUR 30.50, analysts surveyed estimate an average price target of EUR 46.40 on a 12-month horizon. All this, of course, is in anticipation of a fundamental improvement.

Desert Gold Ventures - Now comes the buying season for gold

Since the rumors that storm clouds are gathering again in the European banking system, gold and silver have shown a remarkable recovery movement. Within just 72 hours, gold rose USD 100 to USD 1,725; silver even managed a jump of 15% to currently USD 20.60. Of course, the precious metal prices also depend on the news from the war front. Here, too, the nuclear threat gestures from Moscow underpin further security investments on the part of unsettled investors. In addition, the last quarter of 2022 has now arrived, a buying time especially for Asian investors because here, gold is regularly given away to relatives and friends at the turn of the year.

Canadian explorer Desert Gold Ventures (DAU) has enjoyed excellent exploration success at its SMSZ gold project in Mali, most recently reporting a gold recovery rate of 88%. The most recently released resource estimate is 1.1 million ounces of gold. As metallurgical sampling at the Mogoyafara South Zone has returned promising results, the announced 35,000-meter drill program will be rigorously pursued. Overall, Desert Gold intends to follow up and expand the known and largest gold zones discovered to date on the SMSZ property. In the immediate vicinity are mine operators such as Allied Gold, Barrick and Endeavour, which together can already show more than 5 million ounces of production from Mali.

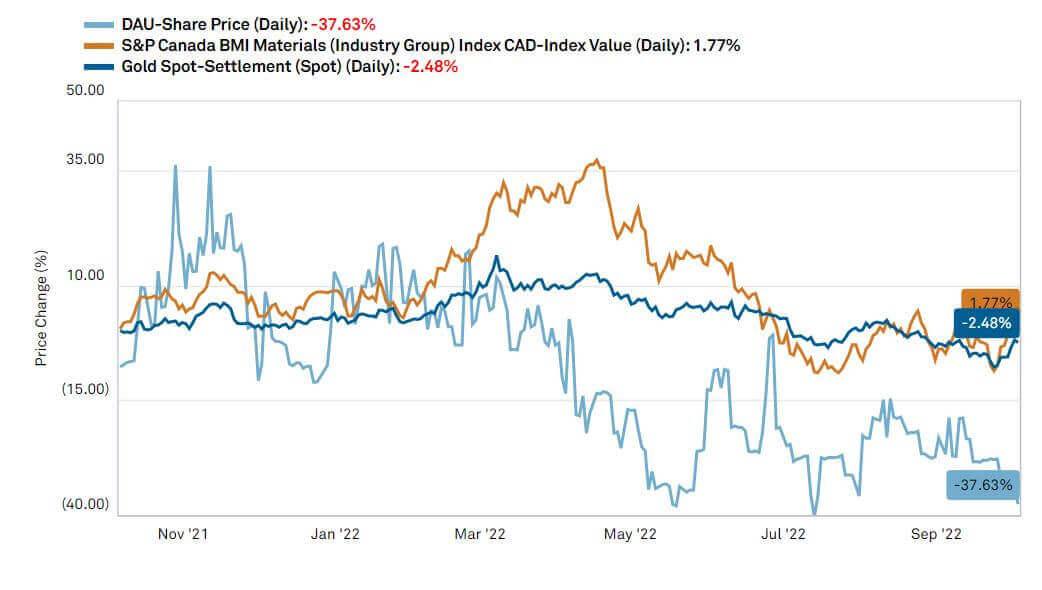

CEO Jared Scharf is convinced that he will be able to prove in the coming months that a mining operation on the 440 sq km SMSZ project promises high economic success. Like all juniors in Canada, Desert Gold shares took a good beating as spot gold corrected from 2050 to USD 1,625. However, the following chart now shows considerable catch-up potential.

.

TUI - A hot speculation on the travel year 2023

Due to ongoing disputes in the group management and unresolved ownership, investors had to cope with multiple sell-offs in the TUI share. The last capital increase was carried out at over EUR 2, and now the highly indebted European travel group is just above its all-time low at EUR 1.28.

Even if the latest YouGov survey regarding winter business gives some hope, Germans' desire to travel could still suffer massively from the surge in inflation. Although around 75% of the more than 2,000 respondents want to travel during the cold months, the smoldering Corona pandemic could prevent this, especially as the willingness to be vaccinated in Germany has plummeted to very low levels. After all, there are no insights yet into whether a vacation flight is tied to a renewed vaccination. That could then become a showstopper of the first order.

Investors fear a slump in travel demand given extreme inflation and the onset of recession and recently sold their TUI shares. At EUR 2.35 billion, market capitalization is now well below debt, and further capital increases are difficult in this environment. Fundamentally, there are virtually no reasons for a commitment, technically, the first buy signals are lurking above EUR 1.80, and unfortunately, no line can be identified on the downside. Highly speculative!

The last quarter of the botched investment year 2022 has begun. Historically, September and October are generally poor stock market months, after which a recovery often sets in. This year, investors have to take into account the threat of a recession, and commodity prices will probably be linked to the further course of the war. It is not a good scenario for stocks from the industrial and travel sectors, but it is certainly an environment for rising precious metal prices.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.