March 26th, 2025 | 11:05 CET

Steyr, Hensoldt, Mutares, and thyssenkrupp sell, First Phosphate remains a gamechanger

The special fund of up to EUR 1 trillion has been approved. What seemed impossible before the election is now law. Federal President Steinmeier signed the amendment to the constitution at the weekend, thereby sealing the largest economic stimulus package in German economic history. Instead of celebrating, the DAX only rose briefly to 23,136 points, then the sell-off occurred according to the motto "Buy the Rumor, Sell the Fact". The hyped defense stocks could now suffer the same fate. A lot of imagination has been priced in here, but capacity expansion is proceeding slowly. Therefore, not all expectations will immediately translate into positive cash flows. A thorough analysis is needed!

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

STEYR MOTORS AG | AT0000A3FW25 , HENSOLDT AG INH O.N. | DE000HAG0005 , MUTARES KGAA NA O.N. | DE000A2NB650 , THYSSENKRUPP AG O.N. | DE0007500001 , FIRST PHOSPHATE CORP | CA33611D1033

Table of contents:

"[...] Boron is one of the most versatile elements in the whole world! Everyone reading this text regularly uses hundreds of products that depend on boron. [...]" Tim Daniels, CEO, Erin Ventures

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Steyr and Mutares – Falling into the trap

One really has to give the management of Mutares top marks here. The Munich-based investment company brought Steyr Motors AG back again at precisely the right time, namely on October 30, 2024. In the run-up to the listing, 1.11 million new and existing shares were placed with institutional investors in a private placement at a price of EUR 14 per share. At the time of the listing, the share price was around EUR 16, and the parent company held a majority stake of 70.9% in Steyr Motors AG. Mutares itself was listed at around EUR 24 at the time. In March, rumors emerged that Steyr is excellently positioned in the defense sector. The share price exploded in just 5 trading days from around EUR 40 to a high of EUR 384 on Xetra, and Mutares also saw a 100% jump to EUR 47.

Due to very strong investor demand, Mutares is now planning to reduce its stake in order to increase the free float. This is expected to ease the lock-up conditions. This could be a reason for other market participants to cash in on Steyr. As a result, the share price plunged from its dream levels to EUR 55 yesterday. It is still a quadrupling for first-time buyers, but for Mutares, it is a billion-dollar deal. Last-minute buyers are now down by up to 85%, so good advice is hard to come by! It is safe to assume that in addition to the main shareholder's sales, there were also some short sellers in Steyr. The price should stabilize in the short term. However, this offers little consolation, as the all-time high of over EUR 380 and a company valuation of nearly EUR 2 billion is unlikely to be reached again in the next 10 years.

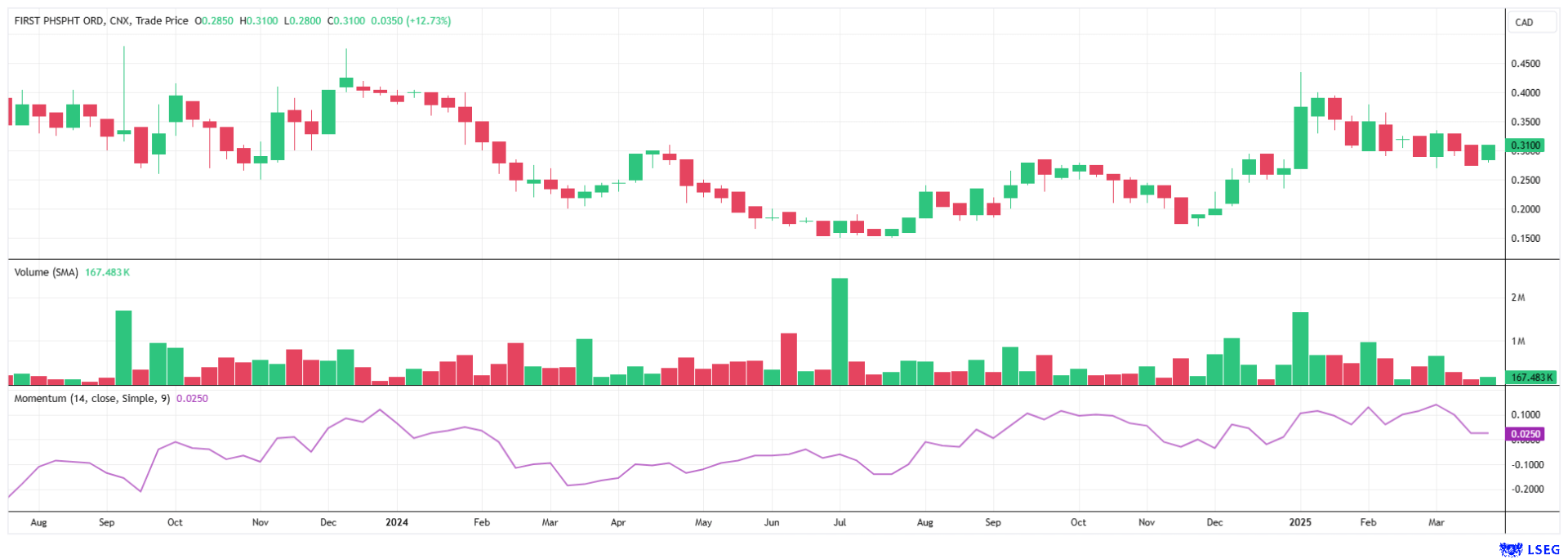

First Phosphate – The energy transition on the agenda

Storage technology remains one of the key issues in the energy transition. If we want to master it, we need innovations in the field of batteries. Whether for e-mobility or the urgently needed energy storage, performance and endurance are required. Germany already gets more than 50% of its energy mix from renewable sources. One problem, however, is the ability to store energy at night and when there is no wind, known as “dark doldrums”. The newly elected government in Berlin is promoting “openness to technology”, which means that all available methods are being examined for their suitability in achieving the goals, without ideological barriers.

The Canadian company First Phosphate (PHOS) is focusing on the resolutions from various climate conferences and is betting on phosphate. The market for this raw material is well known worldwide from the fertilizer industry, but in the light of the energy transition, highly pure phosphate is primarily used to produce active cathode material for the lithium iron phosphate (LFP) battery industry. In the future, the rare, high-purity phosphate is to come from the company's own mines, which will deliver directly to Western industries. This will make First Phosphate an important part of the energy storage supply chain in the future. A resource estimate in the indicated and inferred categories of around 15.5 million tons of phosphate (P2O5) has already been made for the company's own Begin-Lamarche project. A current PEA provides a net present value (NPV) of almost CAD 1.6 billion. Exploration will continue in the current year and may further increase the resource.

High-purity phosphate is most important for high-tech industries such as fast data centers for artificial intelligence, robotics, defense technology and the trend towards rapid mobility in large cities. Highly efficient storage solutions are needed everywhere, and they require the coveted and rare phosphate that First Phosphate can supply in the future. The commencement of the company's planned industrial activities, including the Begin-Lamarche phosphate mine, the phosphoric acid plant and the First Saguenay iron phosphate plant, is subject to a number of conditions, including approvals and financing. Armand MacKenzie has been appointed President of the company and David Dufour Senior Vice President. First Phosphate is currently valued at a low CAD 28 million with almost 90 million shares. This still offers plenty of room for initial revaluations in the critical metals and strategic resources environment. The PHOS story is just beginning and can accelerate rapidly.

Hensoldt and thyssenkrupp – A bit over the top in the short term

The price dynamics at Hensoldt and thyssenkrupp have developed somewhat more moderately than at Steyr. In both cases, defense-related investors were able to reap price gains of around 100% by mid-March. At Hensoldt, the fantasies are driven by a solid order situation and further orders from the NATO sector. CEO Oliver Dörr recently explained in an interview what his industry has learned from the Ukraine war and why the industry has to reposition itself today. Those who want to benefit from the special fund of EUR 100 to 300 billion must be able to deliver operationally to share in the pie. Orders are currently going through the roof, but capacity adjustments take longer. This "boost" in the books provides companies with planning security for years to come. Hensoldt has already made some investments to increase capacity. The paradigm shift in politics is intended to quickly enhance military strength, requiring systems for air defense, space, and reconnaissance. Oliver Dörr knows that some of the necessary investments will be reflected in Hensoldt's books, but at this point in time, concrete profit expectations are completely premature.

At thyssenkrupp, the story is somewhat different. After a turnaround speculation in the range of EUR 2.80 to 3.50, rumors arose that the marine sector (TKMS) could be outsourced in the current environment. The catch: TKMS is currently attracting a lot of attention because substantial investments are also needed in the maritime sector. So when, if not now, should one consider a spin-off? thyssenkrupp's management and division head, Oliver Burkhard, expect massive market growth. For the German defense technology industry, rising budgets mean not only more orders but also an accelerated implementation of projects. TKMS has already expanded its production capacities and taken over a shipyard in Wismar. In the future, warships for Germany and international customers will be built there. Collaboration with partners is also being intensified. A joint venture with India's Mazagon Dock Shipbuilders involves the construction of six submarines for the Indian Navy. Optimistically, the IPO for TKMS is expected by the end of 2025. The thyssenkrupp stock is anticipating this event with a threefold increase in price in just 6 months.

The most commonly used energy storage systems currently are based on LFP technology. An important component is the relatively rare phosphate. The planned investments in defense will require a vast amount of these important metals. Some stocks, such as selected defense titles, have already priced in these scenarios well. First Phosphate is still at the beginning of its appreciation and is highly exciting because of its valuable assets.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.