September 22nd, 2025 | 07:20 CEST

SMR nuclear power on the rise! 100% with Oklo, First Hydrogen, E.ON, and Plug Power

Since Fukushima, nuclear power seemed to be on the decline, but with the energy transition, it is now experiencing a spectacular comeback, with small modular reactors (SMRs) taking center stage. Although this topic is only sporadically addressed in Europe, the US, under Donald Trump, recently approved a program to quadruple domestic nuclear power by 2050. While Brussels is still hesitating, the technology is advancing in Poland, France, Finland, and Czechia. These innovative countries are planning concrete SMR projects, while France even classifies the reactors as a pillar of future energy supply. Of course, large amounts of electricity are also supplied to Germany at high prices. Canada has already started approval processes for its first plants, and British energy giant Rolls-Royce is working on the series production of its own SMR technology. Even the International Atomic Energy Agency (IAEA) is now talking about a turning point. Which companies are currently at the forefront of this nuclear revolution?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

OKLO INC | US02156V1098 , First Hydrogen Corp. | CA32057N1042 , E.ON SE NA O.N. | DE000ENAG999 , PLUG POWER INC. DL-_01 | US72919P2020

Table of contents:

"[...] We are committed to stay as the number one Canadian and global leader in the Hydrogen-On-Demand diesel technology [...]" Jim Payne, CEO, dynaCERT Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Oklo – Positioned for rapid growth

One thing is clear: SMRs are considered more flexible, safer, and more cost-efficient than traditional large reactors. In recent months, the US company Oklo has made a name for itself as one of the most exciting players in the market for small modular reactors. The young company recently successfully completed the first round of testing by the US Nuclear Regulatory Commission and presented new projects at the same time. Particularly noteworthy is the planned construction of a fuel recycling plant in Tennessee. Investments of up to USD 1.7 billion are to be made there, creating over 800 jobs. The focus is on recovering usable materials from spent fuel rods to supply modern reactors. According to CEO Jacob DeWitte, this will generate electricity from waste and, at the same time, increase the national security of supply. Tennessee is considered a model state for nuclear innovation and aims to use the new momentum to expand the regional energy infrastructure. Together with the Tennessee Valley Authority, options are currently being explored for utilizing its existing fuel stocks. If successful, this would be the first time a US utility has generated electricity from recycled fuel.

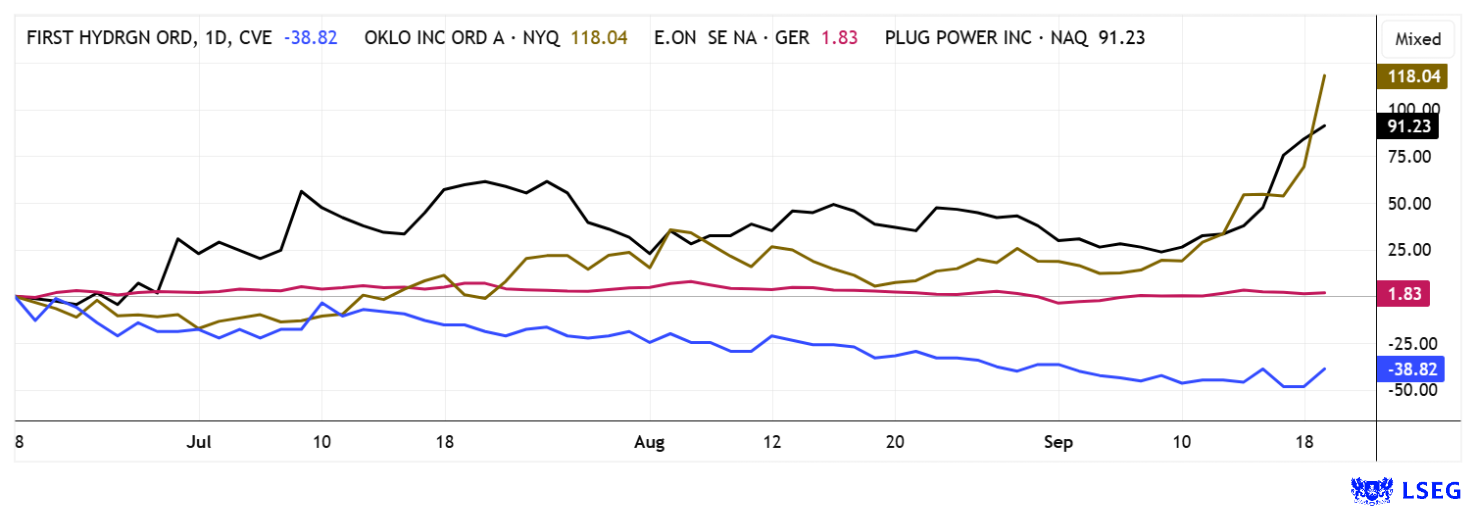

At the same time, Oklo is undergoing the NRC approval process, with initial preliminary discussions on commercial plants underway. The Company expects to start producing its own fuel for the Aurora reactor model in the early 2030s. The Company is also receiving a boost from new agreements between the US and the UK that provide for closer scientific cooperation, including in the field of nuclear energy. This is increasing political pressure to regain the West's pioneering role in nuclear energy. For Oklo, this opens up a window of opportunity to help shape the coming decade. Investors have already sensed the potential of a golden nuclear age and have pushed the stock up 1,950% in the last 12 months—a windfall for Nvidia shareholders. As is often the case, revenues and profits will not materialize until 2030. Investors are focusing heavily on future potential, while the long realization timelines are often overlooked. Significant temporary setbacks would come as no surprise!

First Hydrogen – Right in the thick of it

Canadian company First Hydrogen (FHYD), with its subsidiary First Nuclear Corp., plans to use small modular reactors (SMRs) to establish decentralized hydrogen production. The focus is on remote regions and industrial sites that require a reliable energy supply. The Canadian government's decision to accelerate the Darlington SMR project in Ontario is particularly important in this regard. It is considered a key national project and is intended to make Canada the first G7 country with an operational SMR. For First Hydrogen, this represents a decisive tailwind, as the Ontario government is elevating reactor technology to a strategic level - a move that will accelerate investment, adoption and acceptance.

The Company sees Darlington as a signal that SMRs will become a central component of Canada's energy infrastructure in the future. At the same time, it is working with the University of Alberta to further develop the design and fuel materials to make SMRs more efficient and scalable. This is particularly relevant in view of the rapidly increasing energy demand of AI data centers, which is forecast to more than double by 2030. This makes the Darlington SMR project not only a pioneer for Canada's energy transition but also a model from which First Hydrogen can directly benefit. The FHYD share has technically stabilized in the range of CAD 0.50 to CAD 0.60. Investors can position themselves for another buying spree towards CAD 1.30 if trading volumes are high. Oklo shows how a share price can rise 100% in just four weeks.

E.ON – What approaches are being pursued in Germany?

E.ON is not currently pursuing any active projects in Germany for the construction or use of small modular reactors (SMRs). The energy company has spoken out against the recommissioning of old nuclear power plants and sees no future for nuclear energy in Germany for economic reasons. Other major operators such as RWE, PreussenElektra, and Siemens Energy also rule out a return to nuclear power, particularly due to high costs, lengthy approval procedures, and a lack of qualified personnel. While there is discussion at the political level about the possible reactivation of some decommissioned nuclear power plants, the energy companies are not prepared to support this. Current energy policy in Germany focuses more on expanding renewable energy and strengthening the hydrogen economy. E.ON shares are now considered a dividend stock, with the group concentrating primarily on the operation and expansion of energy networks and energy-related services in order to drive forward the energy transition. With 18% growth in 12 months and a 2025 P/E ratio of 6.5, the stock is a solid anchor in any portfolio with a virtually guaranteed dividend of just under 5%.

Plug Power – The technical turnaround is 99% complete

One more technical note on Plug Power. In our last reports, we clearly highlighted the support zone of USD 1.20 to USD 1.50. Over the last three days, the share price has risen to over USD 2.20 with high trading volumes. With the completion of the well-known saucer formation, the technical turnaround is essentially complete. A short-term pullback to the "handle" line of USD 1.50 cannot be ruled out, but currently looks unlikely. Fundamentally, analysts on the LSEG platform expect an average 12-month price target of USD 2.40. That is not much, but further upgrades are likely in the coming weeks. Fundamental analysis tends to be sluggish and often lags behind the charts!

Energy stocks are back in the investor spotlight as the power supply becomes more strategically important than ever in view of the increasing use of AI. First Hydrogen is pushing ahead with its own SMR projects and positioning itself as an innovator at the interface between clean hydrogen and nuclear power. Oklo is considered a pioneer in SMRs in the US, but companies such as E.ON and Plug Power are also strengthening the tailwind for the segment with infrastructure and technology. Investors should diversify accordingly to reflect a strategically sensible positioning in their portfolios.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.