March 9th, 2023 | 10:56 CET

Running out of fuel? BYD, Porsche, VW, Globex Mining - Metals in demand!

In benchmarking, anyone who sees electromobility at the forefront cannot ignore a powerful battery. In the last 3 years, there have been no real leaps forward in development, but at least power compression in lithium-ion technology achieved a doubling of the range and, in parallel, also lowered the previously long charging times. This made an electric vehicle suitable for long-distance travel for the first time, even though faster discharge must be expected in winter due to non-engine services such as heating. But technological development continues, and BYD, as one of the world market leaders, sets technological standards. Which stocks are the favourites in the sector?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

BYD CO. LTD H YC 1 | CNE100000296 , PORSCHE AUTOM.HLDG VZO | DE000PAH0038 , VOLKSWAGEN AG ST O.N. | DE0007664005 , GLOBEX MINING ENTPRS INC. | CA3799005093

Table of contents:

"[...] We quickly learned that the tailings are high-grade, often as high as 20 grams of gold per tonne; because they are produced by artisanal miners, local miners who use outdated technology for gold production. [...]" Ryan Jackson, CEO, Newlox Gold Ventures Corp.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Porsche SE or Dr. Ing. Porsche AG - Where is the greater opportunity in the VW empire?

Since the placement of the new Porsche Ing. AG in the fall of 2022, there have been many opportunities to invest in the shares of the VW-Porsche empire. Some investors wonder about the different performances of the individual protagonists. The issue of new preferred shares to the operating unit of Dr. Ing. Porsche AG visibly brightened the values below the VW umbrella brand. Although the parent company is valued at only EUR 81 billion, its high stake in the Porsche subsidiary means that there is a huge hidden valuation item on the balance sheet, namely a 75% stake in the Porsche share, which is valued at over EUR 50 billion. Alongside Toyota, VW is one of the world's largest car manufacturers, and the listed group is home to more than 10 established car and motorcycle brands. In addition to bright growth prospects, there is a low P/E ratio of 10 for 2023 and a dividend of over EUR 8 or 5.8% based on today's share price.

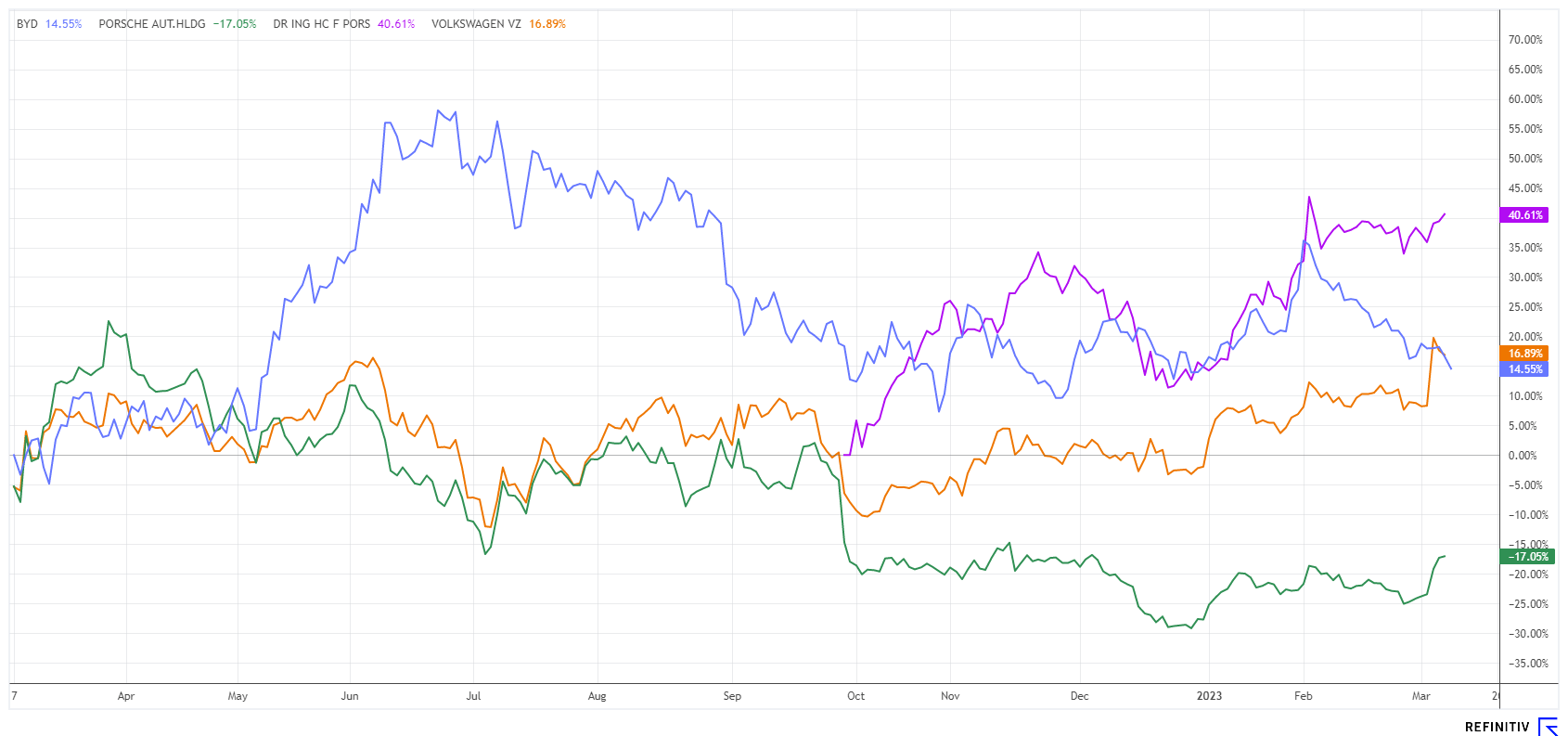

If we compare the sister company Porsche Automobil Holding SE and Dr. Ing. Porsche AG, it is noticeable that here, too, a huge discount is applied to the investment company. Since the initial listing, Dr. Ing. Porsche AG has gained more than 40%, while the former parent company Porsche SE is lagging with 14% even on a 12-month view. The 25% share from VW to Porsche SE through the placement on the stock exchange is now worth over EUR 12 billion. However, Porsche SE is listed on the stock exchange with a capitalization of only EUR 18 billion. According to Refinitiv Eikon, the holding company is expected to generate a profit of EUR 3.66 in 2023, of which around 75% will be distributed. So if you want to position yourself in the VW Group in a way that is easy on the nerves and profit-oriented, you buy VW preferred shares or the old Porsche SE. On the other hand, Porsche's newcomer on the stock market is somewhat overvalued; analysts have also recently been rather skeptical about the share and expect 12-month target prices of EUR 111.57 on average - still 6% below the current quotation.

Globex Mining - A metal supplier from Canada

Not only the automotive industry depends on a supply of metals. Rare raw materials like copper, nickel and lithium are part of the desired climate change, but they must be mined first. One of the potential suppliers is the well-diversified Canadian commodity explorer Globex Mining. The Company is considered a potential supplier of valuable metals in the energy renewal process and also owns many gold and silver properties. The current portfolio includes around 220 projects and holdings, many of which are optioned as exploration properties or deliver permanent royalties after production has begun, i.e. payments for outputs of raw materials extracted from the ground.

Currently, there is good news on the two gold properties, Kewagama and New Alger, both owned by Radisson Mining Resources Inc. Globex holds a 2% net smelter royalty on the Kewagama mine and likewise receives 1% on successes at the New Alger gold mine. Radisson has now released an update reporting significant potential to expand gold resources at Kewagama as drilling has identified additional high-grade trends. Radisson's press release announced a substantial increase in Indicated and Inferred resources and identified Inferred resources totalling 293,000 tonnes grading 7.59 g/t Au for just over 72,000 ounces at the New Alger property. With the envisaged start of production in the next few years, there is thus considerable revenue potential for Globex.

Globex shares have suffered a 12-month discount of around 42% due to the ongoing weakness in gold and silver prices. However, the current market capitalization of EUR 28.4 million overlooks the medium-term potential and the good financing position of almost CAD 20 million cash in the Company. Speculative investors can pick up cheap pieces here.

BYD - New battery plant starts production

The Chinese technology group BYD is one of the world's largest battery manufacturers. However, the innovative company is also very successful with its e-cars, already outstripping US carmaker Tesla in China. Last fall, BYD launched its battery-powered Atto 3, Tang and Han models. Germany's largest car rental company, Sixt, ordered 100,000 to make them available to its European clientele for test drives - a great win-win situation for both companies.

With a new battery plant in Wenzhou, China, BYD is setting the next milestone to maintain its global leadership in battery production. All major automakers are currently planning gigafactories around the globe, and the market is growing at double-digit rates. Volkswagen will produce car batteries in the Spanish city of Valencia starting in 2025. The new BYD battery factory is one of 29 major projects by the Chinese, with a total investment volume of around USD 11 billion. Ground has now been broken, and the new battery plant, with a planned annual production capacity of 20 GWh, is expected to start producing blade batteries for electric cars as early as 2024, creating more than 6,000 jobs.

Meanwhile, BYD stock is still in a major consolidation. After Warren Buffett's share sales following the high of just under EUR 42 in July 2022, the price had first halved to EUR 21. So far, the value has only recovered slightly to EUR 26.40. The valuation has now cooled somewhat, with a 2023 P/E ratio of 22. A total of 30 analysts are commenting on Refinitiv Eikon and see an average target price of EUR 49.37 in the next 12 months. Tough expectations!

The energy turnaround is a key driver of the high global demand for raw materials, especially nickel, copper and lithium. The copper price has already gained over 15% in 2023 and is currently consolidating. In the rally to the top, auto stocks are still in demand, and Globex shares should also be able to pick up the momentum well.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.