December 13th, 2022 | 10:43 CET

Rheinmetall, Aspermont, BioNTech - Strong momentum

With its many drastic events, the turbulent stock market year 2022 is drawing to a close. With the Ukraine war, the change in monetary policy by central banks and rampant inflation, the year was characterized by strong uncertainty and high volatility, and it is almost certain to continue in the coming year. Nevertheless, the favourites are emerging more and more clearly from various sectors that should outperform the broad market in the months ahead.

time to read: 4 minutes

|

Author:

Stefan Feulner

ISIN:

RHEINMETALL AG | DE0007030009 , ASPERMONT LTD | AU000000ASP3 , BIONTECH SE SPON. ADRS 1 | US09075V1026

Table of contents:

"[...] In Canada, there is $1.75 of debt for every dollar of disposable income - and that was true even before the pandemic. [...]" Karim Nanji, CEO, Marble Financial

Author

Stefan Feulner

The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

He is passionate about analyzing a wide variety of business models and investigating new trends.

Tag cloud

Shares cloud

Aspermont - The scaling begins

Not many companies with organic revenue growth of 20% and margins of over 50% have a price-to-sales ratio as low as 3. One of the companies joining this rank is mediatech company Aspermont. The leading provider of business-to-business (B2B) digital media in the mining, energy, and agriculture sectors has delivered 25 quarters of uninterrupted revenue growth and has a tool to scale its business both horizontally and vertically with its platform technology and database of 8 million contacts from board members and executives in key industries.

After a successful FY2022, with revenues growing 17% to AUD 18.7 million and a gross margin of 64%, Aspermont plans to grow from free cash flow and its cash resources of AUD 6.6 million, both organically and inorganically. In addition to adding staff, the Company plans to launch its first generation Skywave, Esperanto and Archive platforms. Geographically, Aspermont wants to develop new markets in North America in particular. The listing on the US technology exchange Nasdaq is only logical.

The market capitalization of the Australians, who have branches in Great Britain, Australia, Brazil, the US, Canada, the Philippines and Singapore, is AUD 48.58 million. According to its forecasts, the Company is debt-free and plans to continue double-digit growth in all areas in 2023. In a recent report, the analysts at GBC AG confirmed their "Buy" rating with a price target of AUD 0.11, which equates to a potential of around 450% in relation to the current price. However, this does not yet include the Company's plans regarding new projects and possible economies of scale through the expansion of the existing XaaS platform. You can read a detailed update on the annual figures at https://researchanalyst.com/en/updates/stock-news-aspermont-growth-at-all-levels.

Rheinmetall - New ammunition for upward movement

The Ukraine conflict has lasted longer than expected, and the rearmament of NATO countries and their allies have filled the Düsseldorf-based defence company's order books to bursting. The supplier to the German armed forces has been awarded a framework contract for the supply of over 600,000 rounds of medium-calibre ammunition for the Puma infantry fighting vehicle. In total, ammunition is to be procured for around EUR 576 million. On November 30, 2022, the Budget Committee of the German Bundestag approved the bill for this extensive procurement.

In addition to the defense sector, the MDAX member is also regarded as a renowned development partner and direct supplier to the global automotive industry. The latest coup in this sector, which is being handled by the Group subsidiary Pierburg, is an order for exhaust gas recirculation modules worth around EUR 300 million from a well-known automaker. Production will start in August 2026. Some actuators will be manufactured at the Abadiano site in Spain, while the Berlin branch will supply the electric bypass actuators.

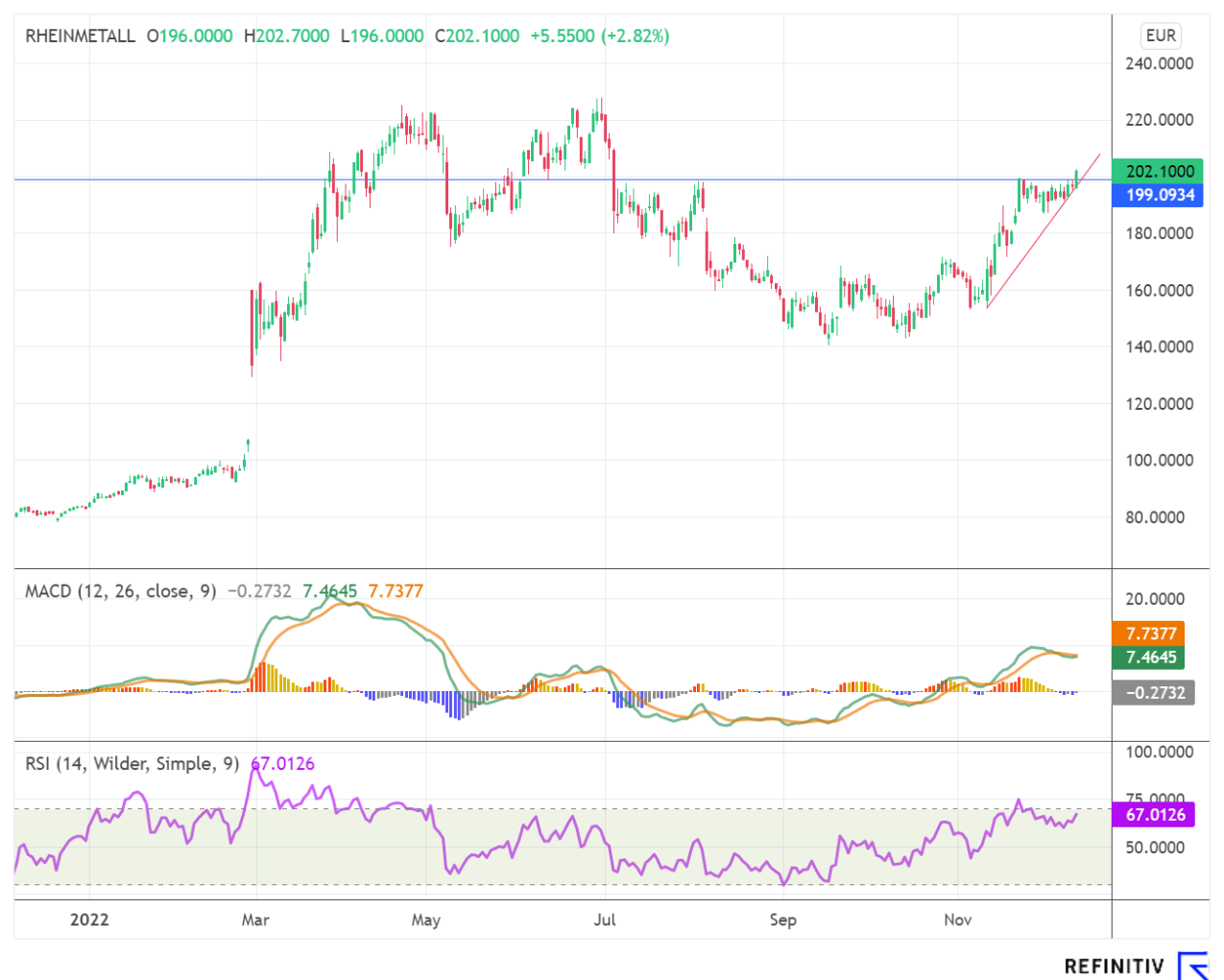

Rheinmetall AG shares managed to jump above the EUR 200 mark, generating a fresh buy signal. The share price is receiving a tailwind from the indicators, which are also on the verge of new buy signals.

BioNTech - The combination makes the difference

"Nimm2- so that the vitamins are right!" The 1960 slogan for the lozenge of the same name takes on a new meaning for the vaccine manufacturer BioNTech and its US partner Pfizer. That is because a combination vaccine developed by BioNTech and Pfizer, which could be used in the future to vaccinate against COVID-19 and influenza at the same time, has been accepted by the US Food and Drug Administration (FDA) for an accelerated approval process.

The vaccine aims to address two respiratory diseases with a single injection. The fast-track process is designed to facilitate the development of new drugs and vaccines to treat or prevent serious diseases, address high unmet medical needs, and expedite the review of these products. Pfizer and BioNTech previously announced the initiation of a Phase 1 study evaluating the safety, tolerability and immunogenicity of their combined influenza COVID-19 vaccine candidate in healthy adults.

The vaccine candidate is based on BioNTech's proprietary mRNA technology platform and includes mRNA encoding the spike protein of SARS-CoV-2 wild-type and the spike protein of Omicron sublines BA.4/BA.5, as well as mRNA encoding the hemagglutinin of four different influenza variants recommended by the World Health Organization (WHO) for the Northern Hemisphere for 2022/23.

BioNTech's stock also successfully moved past the critical support area at around USD 131. With a breakout above resistance at USD 185.09, the signs point to a buy with a short-term potential to close the mid-January 2022 price gap at USD 194.61.

The last weeks of a volatile stock market year are drawing to a close. The high volatility is likely to continue into the new year. With its platform technology, Aspermont offers enormous economies of scale, and the order books at Rheinmetall's should continue to fill. BioNTech is on the verge of a technical buy signal.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.