June 11th, 2025 | 07:00 CEST

Revolution in a billion-dollar market! Argo Living Soils shares surge! Soon to be a takeover target?

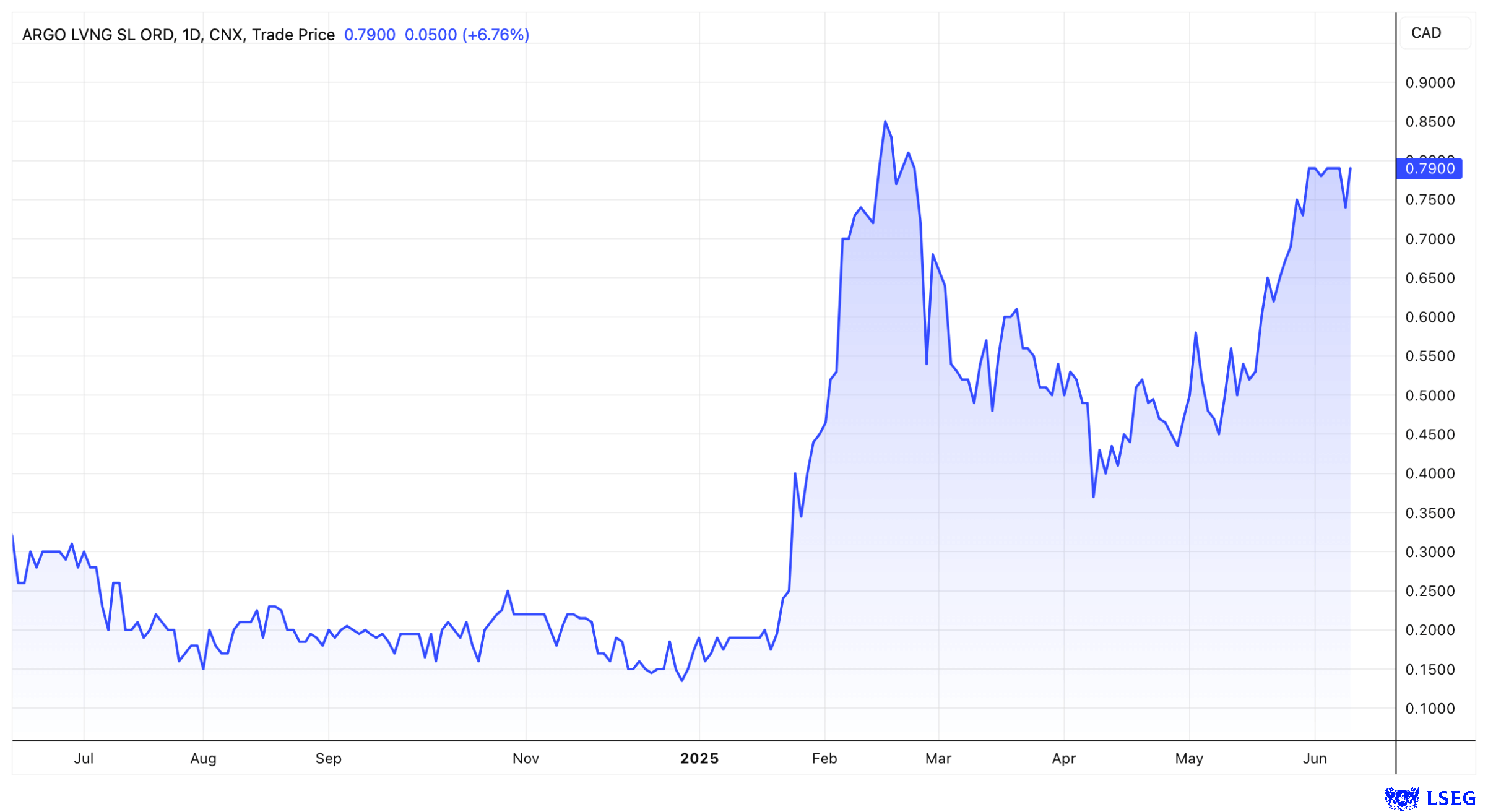

Argo Living Soils is focusing on its business model this year and has a clear goal: to revolutionize the construction industry. Nanotechnology is set to make concrete and asphalt more durable and environmentally friendly. Buildings and bridges, for example, will be better protected against earthquakes thanks to this "miracle material." At the same time, emissions will be reduced, as the cement industry is one of the world's biggest polluters. The potential is in the billions. Argo Living is still valued at less than CAD 10 million. If progress is made on the road to market launch, a takeover attempt is likely. CAD 100 million should not be a problem for interested parties. There are several reasons to add this stock to your portfolio.

time to read: 4 minutes

|

Author:

Fabian Lorenz

ISIN:

Table of contents:

Author

Fabian Lorenz

For more than twenty years, the Cologne native has been intensively involved with the stock market, both professionally and privately. He is particularly passionate about national and international small and micro caps.

Tag cloud

Shares cloud

Argo Living Soils aims to revolutionize the construction industry with nanotechnology

We often see news reports of buildings sustaining irreparable damage or even collapsing in even minor earthquakes. This should soon be a thing of the past. The Canadians aim to develop the next generation of concrete and asphalt. The opportunities are so tremendous that they have been focusing entirely on this since the beginning of this year. And in May of this year, they announced a partnership with Graphene Leaders Canada. The partners want to mix graphene nanoplatelets (GNP) into concrete and asphalt, resulting not only in stronger materials but also more environmentally friendly ones.

Revolutionary advantages: Strong and environmentally friendly

The incorporation of graphene into concrete is expected to offer revolutionary advantages. This applies, for example, to concrete's compressive and tensile strength, which is expected to increase by up to 30%. This will enable more stable buildings to be constructed using less material. The same applies to asphalt, meaning roads would not need to be repaired every few years. The best part is that using less cement could reduce CO2 emissions by up to 20%. This would have a massive impact on the carbon footprint of the concrete industry, which is one of the biggest polluters of our time, with cement being largely responsible for this. Its production releases large amounts of carbon dioxide, partly through the heating of the rotary kiln and the chemical process of deacidification of limestone. The cement industry is responsible for around 8% of global CO2 emissions, almost three times as much as international air traffic.

Incidentally, Argo Living's technology could reduce the amount of water needed to produce concrete and asphalt. This issue is likely to become increasingly important, not only in Africa but also in other arid regions. Graphene could also help replace sand as an aggregate in cement, which is becoming scarce in some areas.

Graphene: The "miracle material" made of carbon

But what exactly is graphene? It is a nanomaterial. Like the more familiar graphite, it is made from carbon. Due to its lightness and near-transparency, it is often referred to as a "miracle material." Although only one atom thick, it is over 100 times stronger than steel and electrically conductive. These unique properties make graphene a promising material for applications in electronics, energy storage, sensor technology, biomedicine, and, of course, the construction industry.

Graphene could give concrete new, "smart" properties. Graphene concrete could become electrically conductive, enabling applications such as inductive charging of electric vehicles on roads, heated road surfaces (to keep ice off), or detecting cracks in concrete structures using electrical circuits.

Billion-dollar markets in sight

Graphene in concrete and asphalt could revolutionize the construction industry in terms of sustainability and stability and enable entirely new applications. Argo Living Soils is thus addressing a huge market. The North American market for ready-mixed concrete alone was estimated to be worth around USD 250 billion in 2024 – and the trend is rising. Driven by infrastructure modernization and growing demand for sustainable building materials, the market volume is expected to grow by an average of 4.5% annually through 2030.

The global asphalt market is also huge. It is mainly driven by road construction and infrastructure maintenance. New construction is underway in emerging markets, and as we know from Germany, there is a great need for repair and renewal in developed countries. According to various market studies, the global market volume was around USD 82 billion in 2023. Average growth of between 4% and 5% is forecast for the coming years. New materials – such as graphene – could further drive market growth.

Making the most of opportunities with a new CEO

To make the most of these opportunities, Argo Living appointed a new CEO yesterday. The previous director, Scott Smale, was appointed the new President and CEO. Robert Intile has stepped down from his position as President and CEO and will continue to serve as a Director for Argo. Scott Smale has over 35 years of experience in design, construction, and project management for large commercial construction projects. During his career, he has held various positions, from craftsman to construction manager for high-rise buildings.

Scott Smale commented: "I am honored to accept this appointment and look forward to bringing my extensive experience in the construction industry to Argo as we continue to develop graphene solutions for the construction sector. I look forward to continuing to work with Robert Intile, who has provided valuable insight and guidance to the Company."

Conclusion: Huge potential, low-priced stock with takeover speculation

The potential of Argo Living Soils is enormous. After focusing on this area, investors can expect more news in the coming months. If the technology can be scaled up and proven in practice, takeover speculation will likely follow. For one of the major cement companies, a price of CAD 100 million should not be an obstacle. The stock is still valued at less than CAD 10 million and remains a real insider tip. However, the price increases of recent weeks show that attention is growing. There are good reasons to add an initial position to your portfolio. In addition to Canada, the stock is traded on the Frankfurt Stock Exchange, although not for long yet, so orders should be placed with a limit.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.