August 23rd, 2022 | 10:12 CEST

Records push for action - Desert Gold Ventures, ThyssenKrupp, BioNTech

The statement comes as little surprise to many. The German Federal Bank said that annual inflation in the eurozone would likely reach a new record high in the last quarter of 2022 due to rising commodity costs and supply shortages. In addition, German Bundesbank head Nagel believes the German economy may slip into recession in the winter. It is therefore likely that the monetary watchdogs have lost the race for inflation, especially in the eurozone. Further rate hikes are only expected to stall the economy's growth engine further. It is time to look at long-term positions in the precious metals sector.

time to read: 4 minutes

|

Author:

Stefan Feulner

ISIN:

DESERT GOLD VENTURES | CA25039N4084 , THYSSENKRUPP AG O.N. | DE0007500001 , BIONTECH SE SPON. ADRS 1 | US09075V1026

Table of contents:

"[...] Our district-scale 104,000-hectare land package already hosts the Barsele deposit (2.4Moz Au) and multiple new gold anomalies identified through modern exploration techniques. [...]" Taj Singh, CEO & Director, First Nordic Metals Corp.

Author

Stefan Feulner

The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

He is passionate about analyzing a wide variety of business models and investigating new trends.

Tag cloud

Shares cloud

Desert Gold Ventures - With leverage on the gold price

Even if we repeat ourselves and express our point of view prayerfully, in the long term, we continue to expect a strong increase in the price of gold with significantly new highs - the conflicts and crises in Taiwan, Ukraine and other parts of the world, plus rampant inflation on the one hand and the threat of recession on the other. The time for interest rate hikes is probably already over; in any case, the first step was delayed too long, the keyword being "temporary inflation". A further increase is likely to cause serious problems for other highly indebted countries in the eurozone alone, in addition to the permanent patients, Italy and Greece.

Thus, the recent setback and fall below the support zone of USD 1,750 per ounce provides another opportunity to take an anti-cyclical position in gold mining stocks to offset skyrocketing inflation. As Jared Scharf, CEO of Desert Gold Ventures, noted in an interview, "in general, gold stocks like Desert Gold are a reflection of the gold price and respond exponentially to the price, both up and down." So, too, the Canadian company's stock has lost about 80% since the August 2020 high of the gold price, to CAD 0.09. The stock market value of the promising exploration company, which is also traded in Frankfurt, currently stands at CAD 14.65 million.

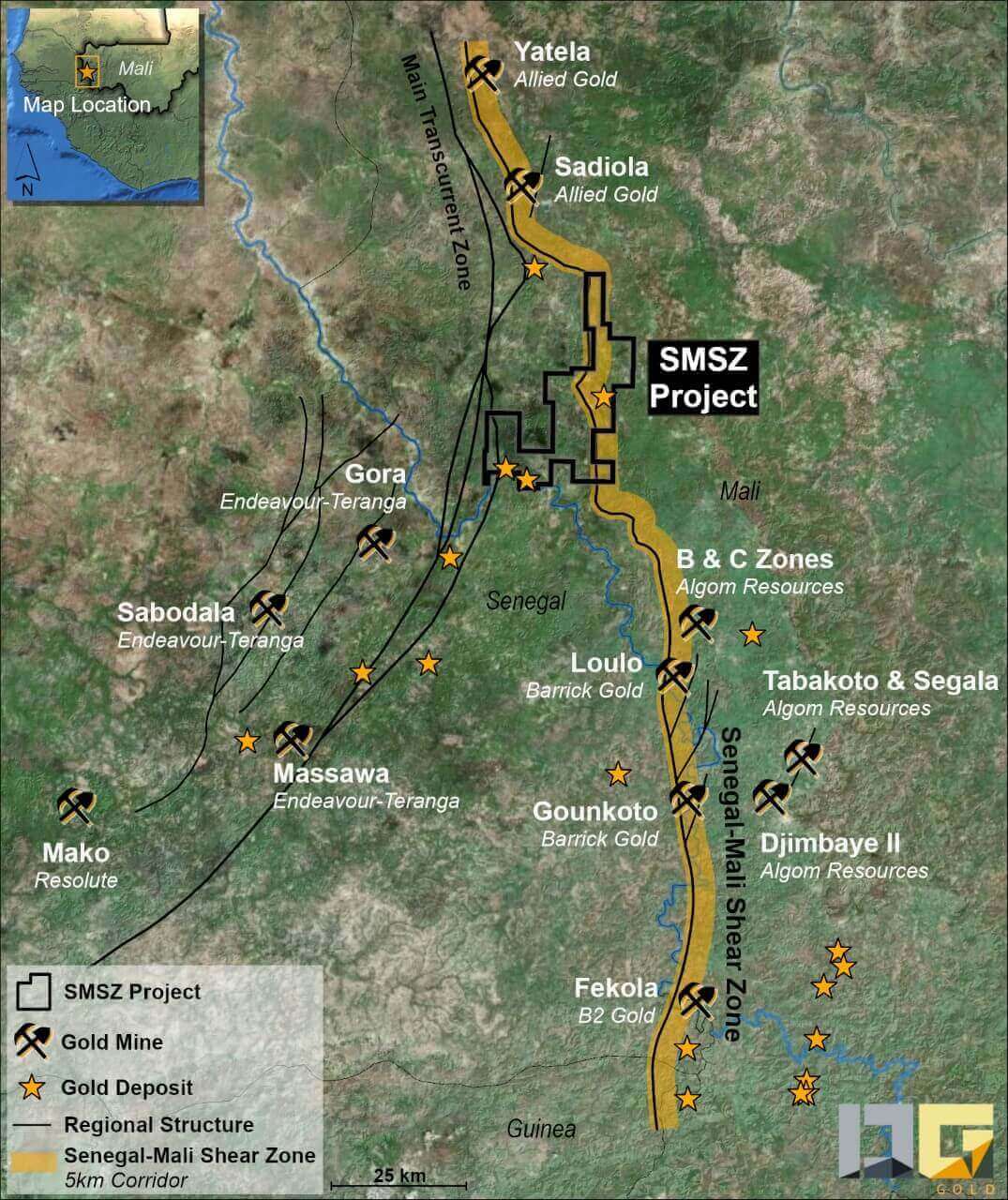

In contrast to the falling quotations, Desert Gold Ventures delivered strongly positive results in the past months. With the SMSZ project in Mali, the Canadians own one of the largest non-producing land areas in West Africa, with 440 sq km. In close geographic proximity are several producing Tier 1 gold mines, including those of Barrick Gold, Allied Gold, Endeavour Mining, and B2Gold. The SMSZ property hosts Measured and Indicated Mineral Resources of 8.47Mt grading 1.14 g/t gold totaling 310,300 ounces and Inferred Mineral Resources of 20.7Mt grading 1.16 g/t gold totaling 769,200 ounces.

A total of more than 23 gold zones have been discovered in the area to date, which will be progressively developed and analyzed for economic grades. In the recently released results, above-average grades were obtained. In the Linnguekoto West zone, Desert Gold's first drill hole detected 1.83 g/t gold over a 27m interval. Another drill hole in the Barani East zone beat the estimates by far. Over a length of 45m, 12.41 g/t gold was detected. In a bull market phase, such results would translate into a jump in the share price. According to CEO Jared Scharf, Desert Gold has by far one of the lowest, if not the lowest, discovery costs per ounce of gold. Thus, assuming you believe in a sustained rise in the gold price, the stock is a candidate for outperformance.

BioNTech - Refresher creates imagination

Everyone has probably heard the flat joke and the similarities between a vaccine manufacturer and a surfer. That is right; they are both waiting for the next wave. As expected, Health Minister Karl Lauterbach warns of another Corona wave in the fall. "A very difficult time lies ahead of us," he said recently after a conference of health ministers in Magdeburg.

If it is up to the Chairman of the World Medical Association, Frank Ulrich Montgomery, the Standing Commission on Vaccination (Stiko) should make a more comprehensive recommendation for the second booster vaccination against the coronavirus. The fact that the Standing Committee on Vaccination (Stiko) now recommends the second booster for all people over 60 years of age is good, Montgomery told the Redaktionsnetzwerk Deutschland (RND). However, Stiko should recommend that people under 60 whose "last vaccination or infection was at least six months ago can receive a second booster vaccination if they wish," Montgomery demanded. "Significantly younger people should also have access to the second booster vaccination, for example, if they come into contact with many people at work and therefore have a higher risk of infection."

For the vaccine producer from Mainz, this demand is, of course, grist to the mill. From a chart perspective, the BioNTech share is in dire need of such news. After breaking out at the beginning of August to an interim high of USD 185.09, the stock fell back into the sideways channel to USD 147.77. A fall below the support area at USD 138 would generate a sell signal, resulting in a target range of USD 120.

ThyssenKrupp - Significantly higher targets

In contrast to the BioNTech share, the paper of Germany's biggest steel producer has been going downhill for months. Since the end of the last stock market year alone, the stock has lost over 50% to currently EUR 5.41. The cyclical steel sector is suffering more than any other from the weak economy. Due to the less than sparkling outlook and the likelihood of the sector entering a recession, there is currently more or less a buyers' strike in this type of stock.

The analyst community is divided over further price targets for the ThyssenKrupp share. While the British investment bank Barclays had left its rating for ThyssenKrupp at "underweight" with a price target of EUR 5.40, Jefferies has now come out of the woodwork and reiterated its buy recommendation with a price target of EUR 13.80.

Even though gold has broken through its support area at USD 1,750 per ounce, there is much to be said for the precious metal in the long term. As a portfolio addition, Desert Gold Ventures, which recently delivered strong drill results, comes into question. BioNTech is at a crossroads despite positive news. At steel producer ThyssenKrupp, the consequences of a recession could lead to further share price losses.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.