June 6th, 2024 | 07:00 CEST

Rally start for biotech! Evotec, Bayer, Defence Therapeutics, CureVac and BioNTech in pole position

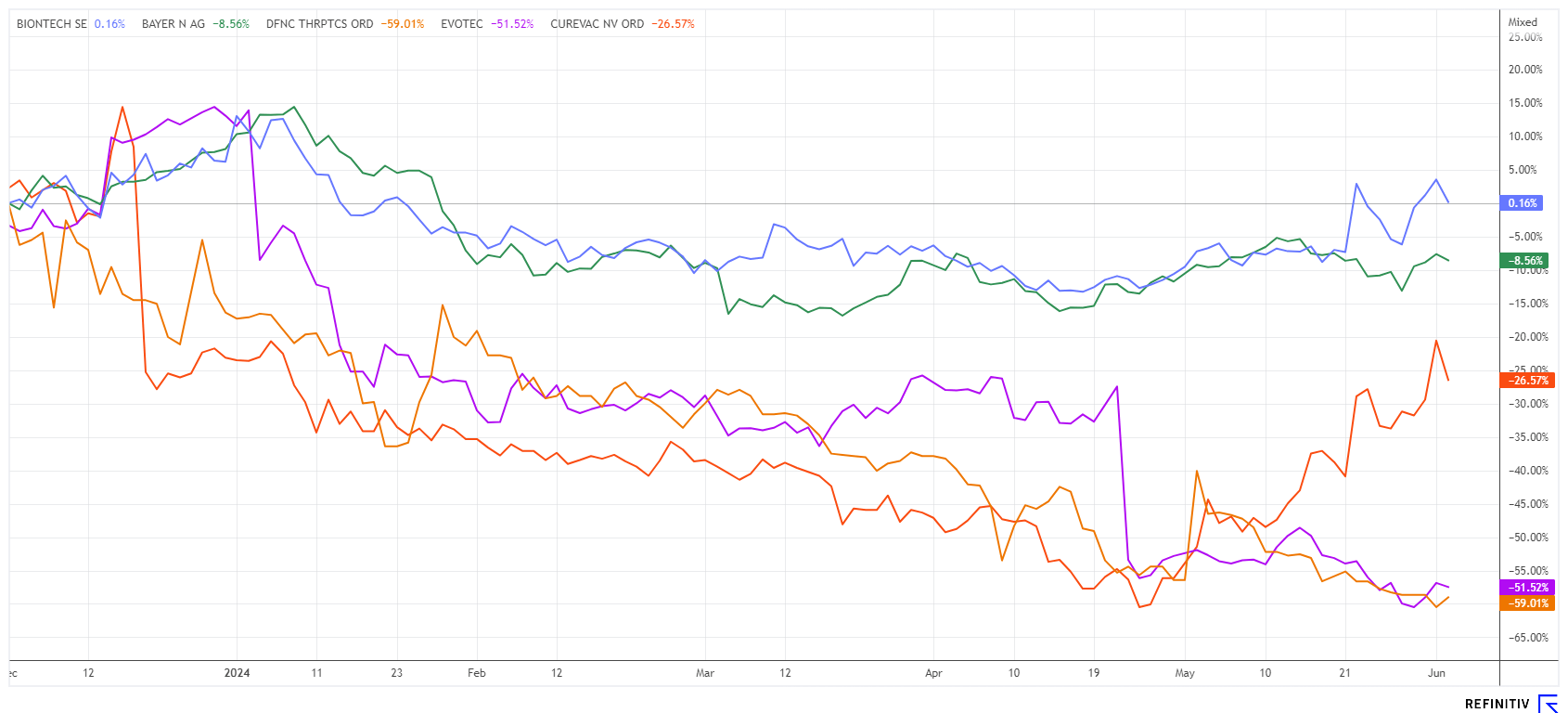

Sell in May and go Away! Far from it, as the stock markets continue to rise steadily in June. After a disappointing start to the year, the biotech sector is now also showing signs of recovery. Bayer and Evotec seem to have found their footing with improved outlooks. BioNTech, CureVac and Defence Therapeutics are providing promising data on various cancer vaccines. Whoever opens the door here can save millions of lives. And investors stand to make a fortune if one of the vaccines hits the mark. We analyze the opportunities and risks.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

EVOTEC SE INH O.N. | DE0005664809 , BAYER AG NA O.N. | DE000BAY0017 , DEFENCE THERAPEUTICS INC | CA24463V1013 , CUREVAC N.V. O.N. | NL0015436031 , BIONTECH SE SPON. ADRS 1 | US09075V1026

Table of contents:

"[...] Defence will continue to develop its Antibody Drug Conjugates "ADC" and its radiopharmaceuticals programs, which are currently two of the hottest products in demand in the pharma industries where significant consolidations and take-overs occurred. [...]" Sébastien Plouffe, CEO, Founder and Director, Defence Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Evotec and Bayer - Keeping a daily watch will not hurt

On June 10, the new Evotec management will have to take a stand on all outstanding issues at the Annual General Meeting. There was the devastating cyber attack in 2023, the inglorious departure of former CEO Dr. Lanthaler, and the hopeful outlook for 2024. At the beginning of June, Evotec's share price fell again to around EUR 8.35, forming a double bottom from a technical perspective. After all, the share price came from around EUR 24 and has now lost two-thirds of its peak value. The reported collaboration with Qiagen is a positive sign, but the coming weeks will be crucial. On July 1, the new CEO, Christian Wojczewski, will take office and a few weeks later, on August 6, there will be an update on the medium-term outlook as part of the half-year report. Stay tuned.

Bayer also consolidated again at the beginning of June to around EUR 26.90. However, the shares regained an important breakout line at EUR 28.70 yesterday. The positive sentiment is likely due to the reduced fine for the latest glyphosate decision from Philadelphia. Originally, the plaintiff had demanded the utopian sum of USD 2.25 billion. Damages of this magnitude are only possible in the US. Bayer brought the problems surrounding the glyphosate-based weed killer Roundup into the Company in 2018 with the USD 60 billion takeover of US company Monsanto. A first judgment against the new pharmaceutical giant followed in the same year. Bayer has lost a horrendous EUR 100 billion in market value since the Monsanto takeover. Nobody knows today when the political situation on this issue will really ease. Watch!

Defence Therapeutics - The timing could not be better

The Canadian biotech specialist Defence Therapeutics develops immuno-oncology vaccines and drug delivery technologies. The main target is cancer. To this end, the Company developed its proprietary Accum™ platform, which enables the precise delivery of vaccine antigens or ADCs in their intact form to the target cells. The recent approval of AccuTOX® as one of the company's first first-in-class therapies was a huge step forward for Defence in the field of immuno-oncology.

It is now reported that several new patents have been granted, and applications have been accepted for various patent families across Defence's diverse portfolio. Defence'sDefence's vaccine enhancement platform technology, based on the simple combination of Accum™ and variants of this platform with specific antigens, is further strengthened by the recent approval of US Patent Application No. 18/169,440 by the US Patent and Trademark Office (USPTO). Importantly, this patent family is the first to comprehensively cover the ARM anti-cancer vaccine platform. Recent preclinical studies with the ARM-002 vaccine suggest an effective antitumor response in in vivo melanoma, lymphoma and pancreatic cancer models when combined with the anti-PD-1 immune checkpoint inhibitor. The patents sought include claims covering a method of improving the immunogenicity of the polypeptide antigen, wherein a covalent conjugation of any antigen is performed in conjunction with Accum™ or a variant thereof. This also applies to potential vaccine compositions.

"We are very pleased to announce the issuance of these patents and the allowance of the patent applications covering our ADC and vaccine platforms. This underscores our continued pursuit of innovation and our relentless commitment to improving human health," said CEO Mr Plouffe.

An expedited review of the remaining applications in the vaccine platform patent families is currently underway through the Patent Prosecution Highway (PPH) program in connection with these claims. Therefore, new patents in these families are expected to be granted soon. This paves the way for the upcoming Phase I clinical trials. The Defence share is currently stabilizing noticeably in the CAD 1.00 to 1.50 range. The share is also being traded actively again in Germany. No wonder, as the Phase I studies mark the beginning of the clinical phase. Major pharmaceutical companies are likely already positioning themselves.

BioNTech versus CureVac - That sounds promising

BioNTech and CureVac are also well-known in the field of vaccinations. BioNTech and its partner Genmab recently presented data on their promising antibody at the ASCO 2024 conference in Chicago. The drug acasunlimab showed significant success in the treatment of metastatic non-small cell lung cancer. Judith Klimovsky of Genmab announced plans for a Phase 3 pivotal study to further develop acasunlimab, which is expected to start before the end of 2024. BioNTech's share price has already reacted significantly to this news, rising from EUR 86 to EUR 91. One should still only observe for now, as the technical breakout will only occur once the EUR 105 mark has been overcome.

CureVac is also worth a look at the moment. Since the end of April, the share has seen a 100% rally from EUR 2.07 to EUR 4.18 yesterday. The Tübingen-based biotech company has vaccinated the first test subject in a Phase 2 study with a multivalent vaccine candidate against seasonal influenza. The new mRNA-based vaccine is designed to cover all three influenza strains recommended by the World Health Organization (WHO). CureVac is collaborating with GSK to develop the vaccine. For CureVac, this represents a truly new opportunity after the embarrassing COVID-19 failure and a 98% crash since 2021. Let's see what else GSK has in store for CureVac.

High-tech and defense are driving the major indices. However, biotech stocks are also slowly making their way back up. Players continue to speculate on possible interest rate cuts by central banks. After a two-year break, some prominent biotech stocks have already reached attractive levels. When the sector rotation sets in, things could go up very quickly here.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.