January 29th, 2024 | 07:00 CET

Demo against the right, overtake the left with these stocks! PayPal, Saturn Oil + Gas, Evotec and Bayer

Millions of people are on the streets, demonstrating for democracy. However, democracy also means pluralism, tolerance and fair discourse. It remains to be seen whether the politicians currently in power will eventually embrace these principles. The stock market is also a mass phenomenon, with many things developing in the same direction without much reflection. The herd instinct has both good and bad sides; on the capital markets, it often leads to irrational hype movements, as seen recently in the artificial intelligence sector. This technology is not an economic panacea either, as the elimination of jobs through the use of learning machines leads to less growth at the end of the day. As in all things, we need to use our heads, especially when it comes to the white knights of our future. Where are the opportunities for investors?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

PAYPAL HDGS INC.DL-_0001 | US70450Y1038 , Saturn Oil + Gas Inc. | CA80412L8832 , EVOTEC SE INH O.N. | DE0005664809 , BAYER AG NA O.N. | DE000BAY0017

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

PayPal - Many promises, little innovation

The American online payment service PayPal suffered a major setback in 2023, with its growth story stuttering in several places and investors ultimately abandoning the stock. Now, the management is going public and announcing promising news. However, with a renewed share price slump of 6% last week, the New Year offensive seems to have backfired.

The much-anticipated Innovation Day failed to deliver new milestones, as some investors commented in forums. With a 33% online share of the US consumer landscape, the masses expected more than just a "cashback feature". Percentage rebates for reaching certain shopping thresholds are no longer a novelty, as retailers' bonus systems offer discounts in their online shops, providing consumers with many attractive coupons before their next purchase. Of course, one possible starting point is the use of AI to advance the world of personalized advertising.

"We will set a new trend and now focus on the AI personalization of commerce," said CEO Alex Chriss in an interview. With more followers than trendsetters and clearly too little for the eager audience, the share was sold off further. A look at the Refinitiv Eikon rating platform shows 22 "Buy" recommendations out of a total of 46 ratings. The average price target is only a low USD 72.70, just 17% above the current price. Keep the stock on the watchlist until the price generates buy signals above the USD 70 mark. Before that, it lacks any attractiveness.

Saturn Oil & Gas - Step by step into a new league

The Canadian oil and gas specialist Saturn Oil & Gas continues to achieve great success with its new drilling techniques. The initial production results in the Cardium and Bakken light oil targets in southeastern Saskatchewan are impressive. With a 30-day average production (IP30) of approximately 233 barrels per day of light oil, the technical team is ahead of the Company's expected type curves for OHML Bakken wells in this area.

"The strong initial production and low decline rates of the Viewfield 01-07 well are excellent indicators of the improved economics achieved through this new drilling innovation in the Canadian oil and gas sector. OHML wells require less surface space and less water compared to typical drilling and completion techniques used in the development of Bakken formations. The superior economics of OHML drilling provide access to light oil resources previously considered uneconomical and open up a broad new field for Saturn's future development," said Justin Kaufmann, Chief Development Officer.

Saturn renegotiated its exploration credit facility in December. The amendment provided the Company with more financial flexibility to finalize its robust development plans for the fourth quarter of 2023. This allowed an additional OHML well to be drilled at the end of the year. With the new drilling locations, the output volume will increase; it stood at 26,265 barrels per day at the end of the third quarter and could develop above the 27,000 barrel mark in the first quarter. If the WTI price remains close to the USD 80 mark, an adjusted operating profit (Adj EBITDA) of around CAD 375 million is expected for 2023. Cash flow per share is estimated at CAD 2.25 per share, which is only slightly below the current market price of CAD 2.36. Saturn's low valuation continues to go unnoticed. Annual figures for 2023 will likely be published at the end of March, by which time the share price could already be above CAD 3.00. Collect up to CAD 2.50!

Bayer and Evotec - Trading the technical rebound

Bayer and Evoec shares are still struggling. The Leverkusen-based company has been under pressure for several years, with repeated operational setbacks and headwinds from the US lawsuits related to Monsanto's glyphosate. The takeover of the US CropScience giant caused the Bayer Group to lose a further USD 80 billion approximately in addition to the takeover price of USD 63 billion in 2016. Even worse than the billion-dollar hole of the Chrysler takeover by Daimler, this acquisition will go down in the record books of German M&A transactions with a value destruction of USD 140 billion. However, after a 5-year downward trend, Bayer may have reached an interesting level. The market capitalization is now only EUR 32 billion, with a consensus P/E ratio of 5.8 for 2024. In addition, there is a dividend of 6.4%. Risk-conscious investors are boldly moving in the EUR 31 to 33 range.

The departure of the long-standing CEO, Dr. Werner Lanthaler, hit Evotec like a bomb. In addition to all the gloom, there are insider trading transactions dating back to 2021. These transactions were not properly reported via AdHoc and could now call BaFin, the German financial regulatory authority, into action. Hedge funds continue to impact the share price, while analysts see a buying opportunity in this non-operational issue. The Canadian bank RBC issues an "Outperform" rating with a price target of EUR 18.60, and Jefferies votes "Buy" with a 12-month price target of EUR 28. This represents an outright doubling from the current price level of EUR 14.25. Speculative investors are offering the shorties initial resistance here.

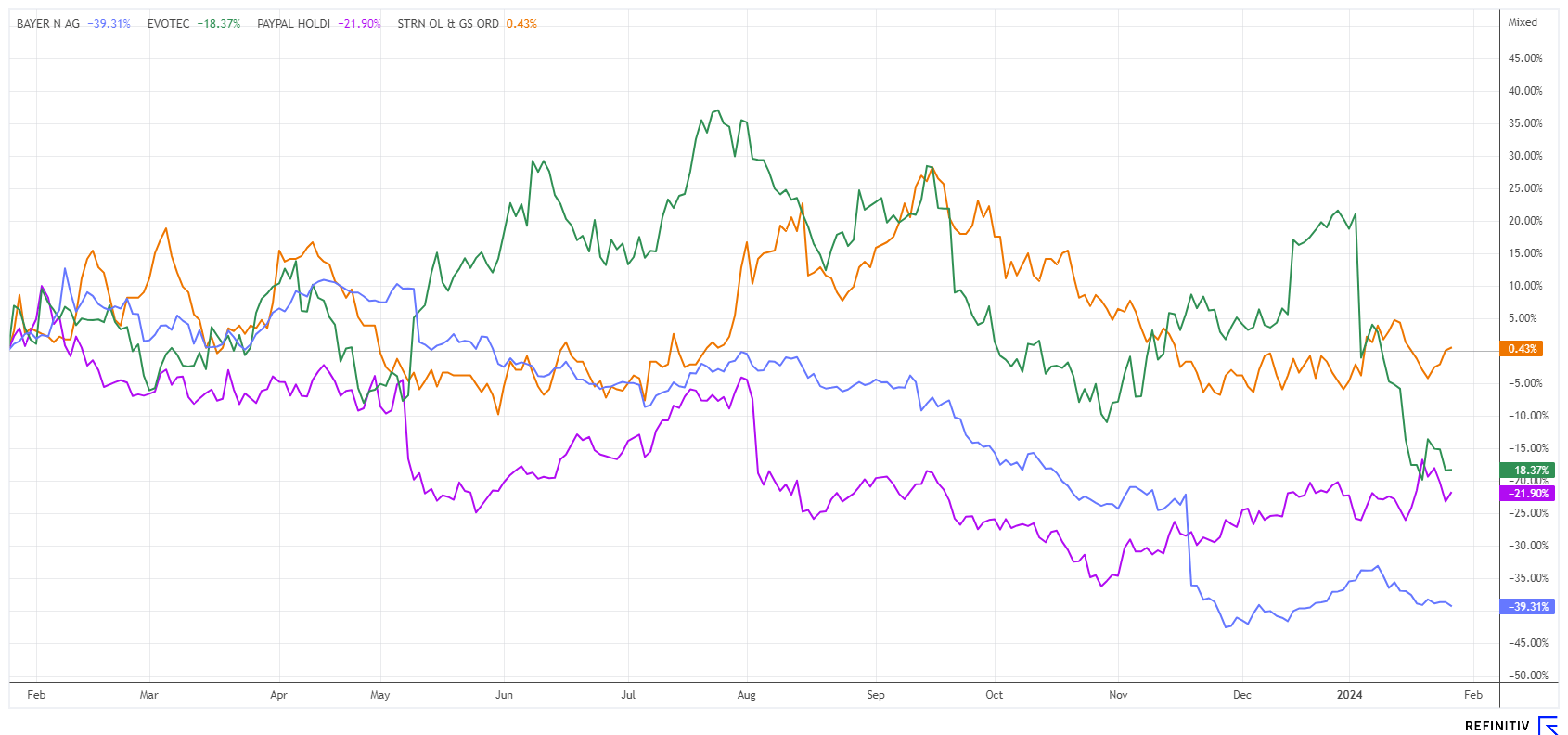

The two indices, DAX 40 and NASDAQ100, are again up strongly in 2024. The IT and Artificial Intelligence sectors are setting the standard for excellent performance. PayPal, Bayer and Evotec are grappling with their specific challenges, while Saturn Oil & Gas consistently delivers better operational figures from one report to the next. With fundamental strength, a long-term breakout in the share price could be on the horizon.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.