January 12th, 2023 | 14:33 CET

Powerful movements in the biotech sector - CureVac, Cardiol Therapeutics, Ambrx Biopharma

That the biotech sector stands for high volatility is nothing new. Price jumps of more than 50% in one day after study results are no exception. Last year, the capital-intensive sector of the future suffered from the change in strategy by the central banks with several interest rate hikes. The Nasdaq Biotech Index alone lost around 50% of its value in some cases. In addition, smaller stocks that do not yet have a commercial product on the market experienced massive upheavals. The speed with which a rebound can set in was demonstrated not only by vaccine producer CureVac.

time to read: 4 minutes

|

Author:

Stefan Feulner

ISIN:

CUREVAC N.V. O.N. | NL0015436031 , CARDIOL THERAPEUTICS | CA14161Y2006 , Ambrx Biopharma Incorporation | US02290A1025

Table of contents:

"[...] As a company dedicated to developing treatments for rare heart diseases, we see this as an opportune moment to contribute to the fight against heart disease and make meaningful strides in improving heart health worldwide. [...]" David Elsley, CEO, Cardiol Therapeutics Inc.

Author

Stefan Feulner

The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

He is passionate about analyzing a wide variety of business models and investigating new trends.

Tag cloud

Shares cloud

Ambrx Biopharma - 1000% in one day

For the shareholders of Ambrx Biopharma, Christmas came early on December 9, placing great gifts under the tree. Because within one day, the share price shot up by a whopping 1,000% from USD 0.41 to USD 4.54. The Company's vision from La Jolla in California is to discover and develop a pipeline of engineered precision biologics for the treatment of various cancer indications with high medical needs.

Driving the share price jump was the release of preliminary safety and efficacy data from the Phase II ACE-Breast-03 trial during a spotlight poster presentation at the San Antonio Breast Cancer Symposium 2022. Data presented by the investigating physician showed an overall response rate of 51.7% by RECIST v1.1 and a 100% disease control rate after treatment with ARX788 in HER2-positive mBC patients resistant or refractory to T-DM1. ACE-Breast-03 is a multicenter Phase II study of ARX788, an anti-HER2 ADC, being evaluated for patients whose metastatic disease is resistant or refractory to T-DXd, T-DM1 or tucatinib-containing therapies. The study was conducted in the United States, Korea, and Australia.

At the data cutoff date, seven patients enrolled in the study were previously treated with T-DM1 and received a median of five lines of prior anticancer therapy. Four of seven patients were previously treated with HER2 tyrosine kinase inhibitors. Patients had a median duration of therapy of 7.2 months, and treatment is ongoing. None of the patients experienced drug-related serious adverse events.

After the price explosion to USD 4.54, the stock corrected back to the resistance area at USD 1.51 but was able to defend it. Currently, the stock is trading at USD 2.39. The market capitalization of Ambrx Biopharma is USD 96.16 million.

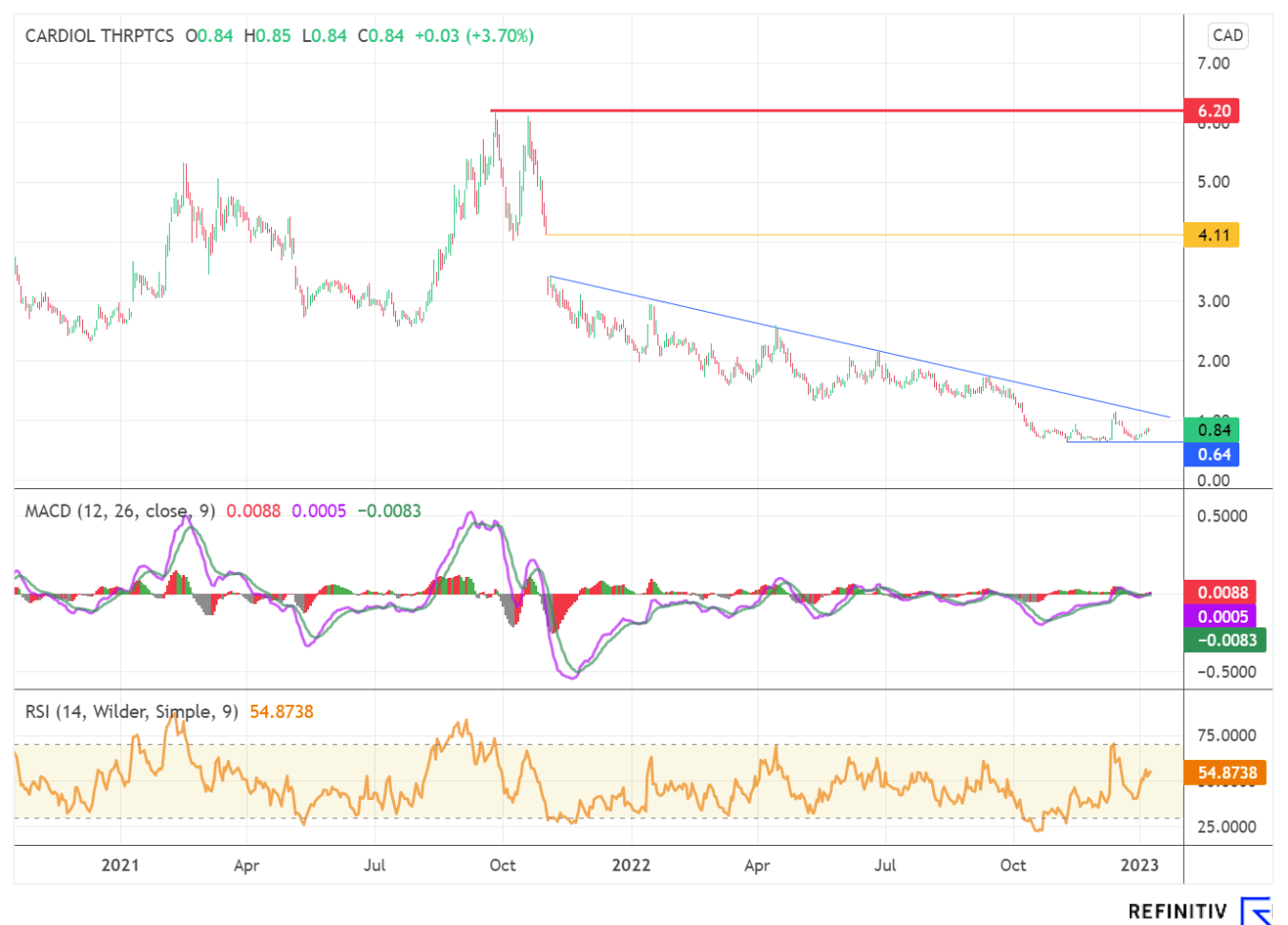

Cardiol Therapeutics - The 500% chance

The share of Cardiol Therapeutics also experienced a short squeeze at the end of the past stock market year. Without news, but with comparatively high turnover, it went up by around 70% within three days to an interim high of CAD 1.16. Since then, the chart has been consolidating in the area of CAD 0.80. As seen in the chart, what is important now would be a sustainable crossing of the downward trend formed since November 2021 at CAD 1.12 to complete the bottom formation.

Various analyst houses agree that the price should be significantly higher with regard to products and development. Thus, the analyst house Cantor Fitzgerald assigned the judgement "buy" in a recent study with a price target of CAD 5.00. Compared with the current share price, this means an upward potential of nearly 500%. Similarly, analysts at Leede Jones Gable Inc. renewed their "buy" recommendation for the shares of Cardiol Therapeutics. The Canadian biotech company has started the Phase II pilot study after strong preclinical data for its lead product CardiolRx. Analysts expect new data during the coming year. Thus, Cardiol Therapeutics is on track, the experts say. Accordingly, their price target is CAD 4.50.

Cardiol Therapeutics specializes in cardiovascular diseases. The main product CardiolRx is supposed to be effective against pericarditis. Preclinical data already showed a convincing anti-inflammatory effect. The Phase II study with 25 patients is being conducted at two renowned cardiology centers in the US. "The initiation of this significant study at the Cleveland Clinic and the Mayo Clinic is an important milestone in our efforts to improve treatment options for patients with recurrent pericarditis," said Cardiol CEO David Elsley. Cardiol Therapeutics' market capitalization is CAD 53.93 million. That puts the stock at its current cash position of more than CAD 50 million.

CureVac - The second wave starts with doubling

While the Tuebingen-based company failed in developing a first-generation COVID vaccine and was punished by the market, the happy ending could come after all following the Corona pandemic. That is because the vaccine producer financed by SAP co-founder Dietmar Hopp has now published successes with mRNA vaccines against influenza and coronaviruses. Promising modified mRNA vaccine candidates for COVID-19 and influenza have been identified based on positive preliminary data from the ongoing phase I trials. The vaccine candidates tested were developed in collaboration with GSK.

Preliminary results from this broad technology approach showed that vaccine candidates using a modified second-generation mRNA backbone demonstrated promising immunogenicity and reactogenicity profiles in both indications. Based on these preliminary data, the development of modified mRNA COVID-19 and influenza vaccine candidates will move into the next phases of clinical testing in 2023.

"The data from CureVac's mRNA technology platform and the second-generation mRNA scaffold implemented in current clinical agents demonstrate the potential of our portfolio not only in COVID-19 and influenza but for the entire spectrum of RNA therapies," said Igor Splawski, Chief Scientific Officer of CureVac. "This includes the field of oncology, where CureVac's second-generation mRNA scaffold is also applied."

After doubling in price to EUR 12.05, stubborn resistance awaits, so a correction back to the EUR 8-9 range would be likely. In the long term, investors should monitor the development.

After the weak stock market year 2022 with sharp corrections, many biotech companies are currently forming their bottom. Volatility is likely to remain high in the current year. The shares of CureVac and Ambrx Biopharma show how quickly price multiples are possible in this segment due to positive studies. News is also expected soon from Cardiol Therapeutics. Analysts give the value a price potential of 500%.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.