December 19th, 2022 | 13:54 CET

Power Nickel, Rock Tech Lithium, BYD - Race to secure critical raw materials

Since the major car manufacturers decided to equip their cars with electric drives, the demand for certain raw materials has skyrocketed. The result has been a sharp rise in prices. Some of the most important raw materials needed for the production of electric cars include lithium, cobalt and nickel. At the G20 summit in Bali, Indonesia, the world's largest nickel producer proposed to the Canadians that they set up an organization similar to OPEC for nickel. Such moves are a sign that the battle for key EV commodities is growing. So today, we look at one nickel and one lithium company and see how the battery and electric car maker BYD is positioning itself.

time to read: 5 minutes

|

Author:

Armin Schulz

ISIN:

Power Nickel Inc. | CA7393011092 , ROCK TECH LITHIUM | CA77273P2017 , BYD CO. LTD H YC 1 | CNE100000296

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

Armin Schulz

Born in Mönchengladbach, he studied business administration in the Netherlands. In the course of his studies he came into contact with the stock exchange for the first time. He has more than 25 years of experience in stock market business.

Tag cloud

Shares cloud

Power Nickel - Drill results pending

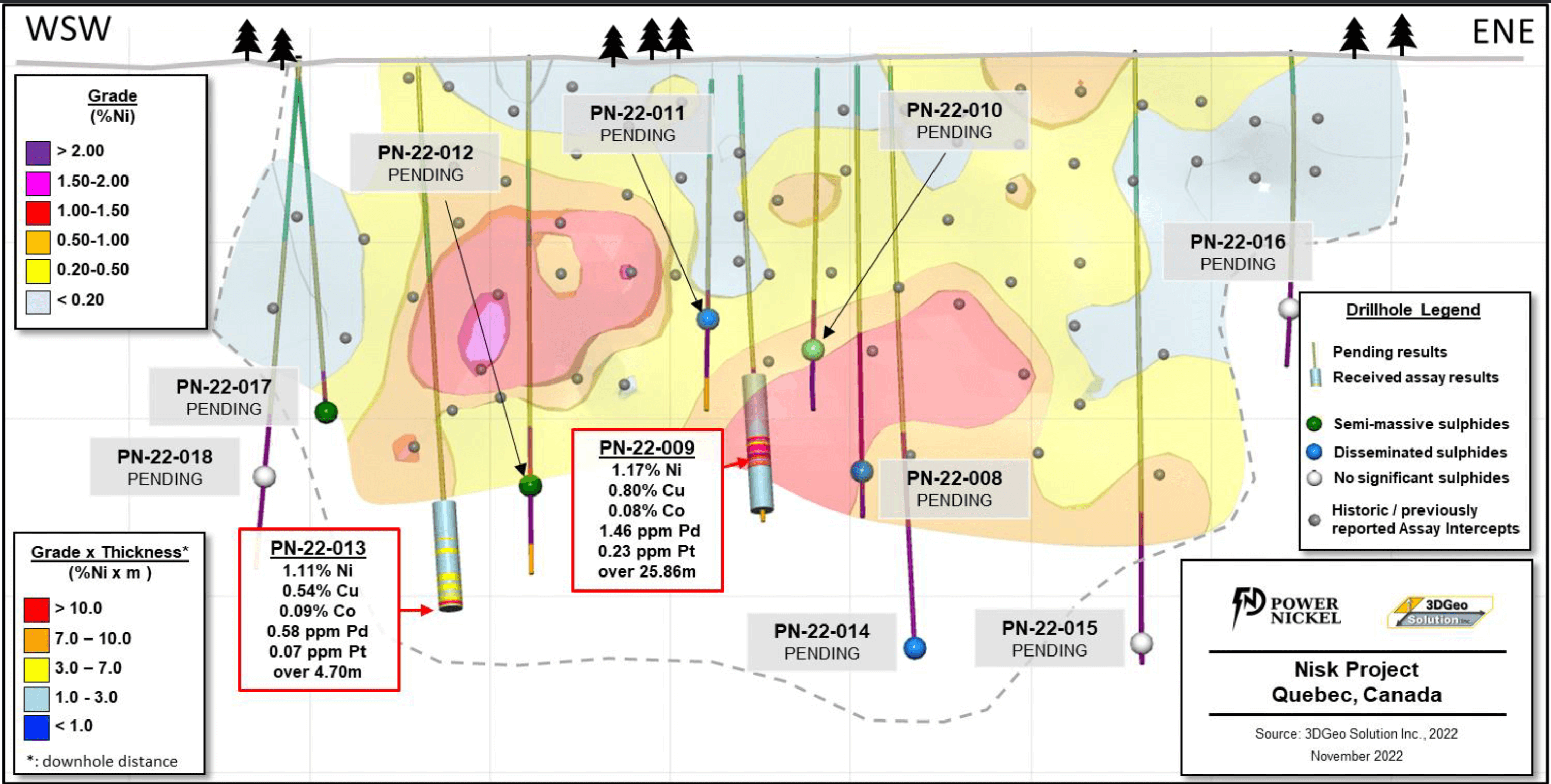

Power Nickel is a Canadian mining company focused on its NISK project near James Bay in Quebec. The property hosts mainly nickel but also other battery metals such as copper, cobalt, palladium or platinum and has a strike length of 20km. The infrastructure in the area is good. For example, low-cost and low-emission hydroelectric power can be accessed. The Company aims to develop the NISK project into a TIER1 mine. An official NI 43-101 mineral resource estimate has been in place since August 30, with estimated indicated resources of 2.6 million tonnes grading 1.20% nickel equivalent (NiEq), based on cut-off grades of 0.33% NiEq for open pit resources and 0.91% NiEq for underground resources. Inferred resources total 1.4 million tonnes at a grade of 1.29% NiEq.

The drilling program has been ongoing since September 22, with 5,000m planned. The first two results from the drilling have been available since November 28 and show high-grade nickel (Ni), copper (Cu) and cobalt (Co) sulphides, as well as platinum and palladium mineralization. The largest discovery has 1.17% Ni, 0.80% Cu, 0.08% Co and 0.23 ppm platinum and 1.46 ppm palladium over 25.86m. At peak, the nickel content was 1.97%. Drilling, with results pending from 9 holes, has extended the mineralization by an additional 150m at depth and to the east in the Nisk Main Zone. Due to the good results, further financing has been implemented, allowing an additional 10,000m to be drilled in Q1 2023.

Compared to its competitors, the Company is currently significantly undervalued. But there is an extra for shareholders. Before changing its name to Power Nickel, the Company was called Chilean Metals. It holds an 80% stake in Consolidation Gold & Copper, which in turn holds a 100% stake in the Golden Ivan project in British Columbia's Golden Triangle and three projects in Chile's Atacama region. A spin-off could be carried out here in the future as soon as the gold and copper market picks up again. The market currently values this asset at 0. In addition, the Company will receive 3% of the gross profit of the Copaquire mine when Teck Resources brings the mine into operation. Currently, the stock is priced at CAD 0.195, giving it a market cap of CAD 23.4 million.

Rock Tech Lithium - Next target funding

Rock Tech Lithium plans to build a lithium converter in Guben, Brandenburg, in 2025. This would be the first lithium converter in Europe and would secure supply chains for the automotive industry. It is not the mining of lithium that is the bottleneck, but the refining. According to various studies, there will be a bottleneck in the coming years. The lithium refinery in Guben is to be the first of five in Europe. Since the planning and construction of such a plant is very complex, there are few suppliers. On November 16, the Company was able to submit the last partial application of the approval process. The first lithium hydroxide is expected to come out of the plant in Q2 2025.

In addition to the converter, Rock Tech Lithium is advancing its lithium mining project called Georgia Lake, located in Ontario and covering 1,042 hectares. On November 15, the Company announced the results of the pre-feasibility study. The mine life is 9 years, and it can be open pit mined for the first 4 years. The estimated net present value is USD 223 million at an interest rate of 8%. A total of 100,000t of spodumene concentrate is expected to be produced annually. The investment will pay for itself in 2.9 years. Together with the converter, the Company will then cover the entire value chain.

Despite the binding 5-year offtake agreement with Mercedes, published on October 20, the share is still in its downward trend. Due to inflation and the resulting price increase, both the mine and the converter will cost more than originally planned. The market fears that financing could become problematic. Everything should be in the bag by the end of March. It will be a mix of subsidies, debt and equity. One possible route is to sell part of the converter. Once the first converter is in place, the next four converters will be much easier to finance. The share is currently quoted at CAD 2.57.

BYD - Battery factory in the US?

BYD, the Chinese electric vehicle manufacturer, is committed to electric mobility and has a deep understanding of the sector thanks to its extensive experience as a battery manufacturer. With its proven strategy of covering a large part of the value chain, BYD has achieved sustained growth in electric vehicle production and recently overtook Tesla in this market. On December 2, BYD released its November sales figures, which showed an impressive growth of 152.61% YOY and 5.8% month-on-month, with 230,427 NEVs sold.

The group is considering building a battery factory in the US to be allowed to sell electric cars there in the future. Only if an electric car's battery comes from the US, an electric vehicle may be sold in the United States. BYD has also recently invested in companies, again and again, to secure raw materials for its rapid growth. Starting in 2023, it plans to establish a premium brand to provide even greater competition to Tesla.

Meanwhile, Warren Buffet continues to sell shares in the Company. Most recently, Berkshire Hathaway sold another 1.3 million shares and has now reduced its stake to below 15%. Even though the share price has recovered slightly, the sales are still affecting the market. Last Friday, the share went out of trading at EUR 24.94. If Buffet continues to sell via the stock exchange, the share will remain under pressure.

Conclusion

The turn towards electric mobility has led to a surge in demand for certain raw materials. Demand will remain high in the coming years. Good for Power Nickel, which has several battery metals on its property at once. Here, one should keep an eye on the upcoming drill results. Rock Tech Lithium, on the other hand, is fully focused on lithium. Operationally, things are progressing. When the financing is in place, the stock should pick up again. BYD is growing rapidly and is trying to secure supplies for production. Only the Buffet sales are a headache.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.