August 17th, 2022 | 10:41 CEST

Positive signs - Infineon, Defence Therapeutics, MorphoSys

A well-known rule says that stock markets trade the future. At the moment, politicians and monetary watchdogs are fighting to contain rampant inflation on the one hand and to prevent a global recession from occurring on the other. Added to this are geopolitical tensions in Ukraine and Taiwan. But the capital market has been robust for weeks, with the DAX alone gaining around 1,500 points since the beginning of July in this year's summer slump. But things are not turning out as predicted by the crash prophets, who are again in the spotlight. There are increasing signs that the stock market has already seen its lows.

time to read: 4 minutes

|

Author:

Stefan Feulner

ISIN:

INFINEON TECH.AG NA O.N. | DE0006231004 , DEFENCE THERAPEUTICS INC | CA24463V1013 , MORPHOSYS AG O.N. | DE0006632003

Table of contents:

"[...] Defence will continue to develop its Antibody Drug Conjugates "ADC" and its radiopharmaceuticals programs, which are currently two of the hottest products in demand in the pharma industries where significant consolidations and take-overs occurred. [...]" Sébastien Plouffe, CEO, Founder and Director, Defence Therapeutics Inc.

Author

Stefan Feulner

The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

He is passionate about analyzing a wide variety of business models and investigating new trends.

Tag cloud

Shares cloud

Infineon - Acquisitions and pessimistic voices

The shortage of semiconductors and the lack of important components continues not only in the automotive industry. Chips continue to be in short supply, thus disrupting the global economy. Experts do not predict an end before 2023. The new CEO of Infineon, the semiconductor manufacturer based in Neubiberg near Munich, is taking the same line. He, too, does not yet see any light in the tunnel but rather a further shortage in certain areas: "We will continue to see bottlenecks in semiconductors that we purchase from contract manufacturers, for example, in the area of microcontrollers and connectivity, until next year," Hanebeck told the Süddeutsche Zeitung on Tuesday.

The Company leader sees another risk factor in the escalating Taiwan conflict: "In recent years, during the semiconductor crisis, we have seen what it means when manufacturers in Taiwan cannot supply enough chips. But if no more chips came from Taiwan at all, it would have a profound impact on all sectors of the economy, worldwide." Europe is even more dependent on semiconductors from Taiwan than on energy from Russia, he said.

In addition, Infineon, one of the largest semiconductor manufacturers in Europe, is expected to grow through small- and medium-sized acquisitions, "which could then well be in the billions." The goal is to expand wafer production at the three existing sites in Dresden, Villach in Austria and Kulim in Malaysia. The DAX-listed company has already been able to announce one acquisition with the complete takeover of the Berlin-based startup Industrial Analytics. This will strengthen Infineon's software and service business in the application of artificial intelligence for the predictive analysis of machines and industrial plants.

The chipmaker's stock has recovered significantly since the July lows at EUR 22.20 and is currently trading at EUR 27.36. The analysts of the major Swiss bank UBS recently reiterated their "buy" rating with a price target of EUR 40 following the published quarterly figures.

.

Defence Therapeutics - Important milestone

The potential of Defence Therapeutics' proprietary platform for developing next-generation vaccines and ADC products is huge. At the core of this is Accum™ technology, which enables precise delivery of vaccine antigens or ADCs in their intact form to target cells and achieves greater efficacy against diverse diseases. Based on Accum™, the Canadians have built a pipeline of therapeutic candidates that include cancer, HPV and COVID-19 vaccines, antibody-drug conjugates (ADCs) and novel small molecules. Management expects to initiate three Phase 1 trials by early 2023.

The global antibody-drug conjugates market is expected to reach more than USD 22.87 billion by 2030, growing at a CAGR of 16.4% during the forecast period, according to a recent 2022 report by Grand View Research Inc. The presence of strong pipeline products and strategic initiatives by key players is expected to drive market growth during the forecast period. The innovative biotechnology company is focusing on precisely this and recently celebrated a significant success by obtaining the US patent for its ADC platform technology.

This new patent covers conjugated compounds that enable the delivery of antibodies into the cell nucleus through Accum™. For CEO Sébastian Plouffe, the protection of the commercial potential of Accum™ directly related to the ADC program represents a milestone.

Defence Therapeutics currently has a market capitalization of CAD 75.96 million and is playing on multiple highs due to its highly scalable Accum™ technology, which can be applied to diverse disease conditions. The Company still falls into the "highly speculative" category due to its development stage, but the potential is enormous.

.

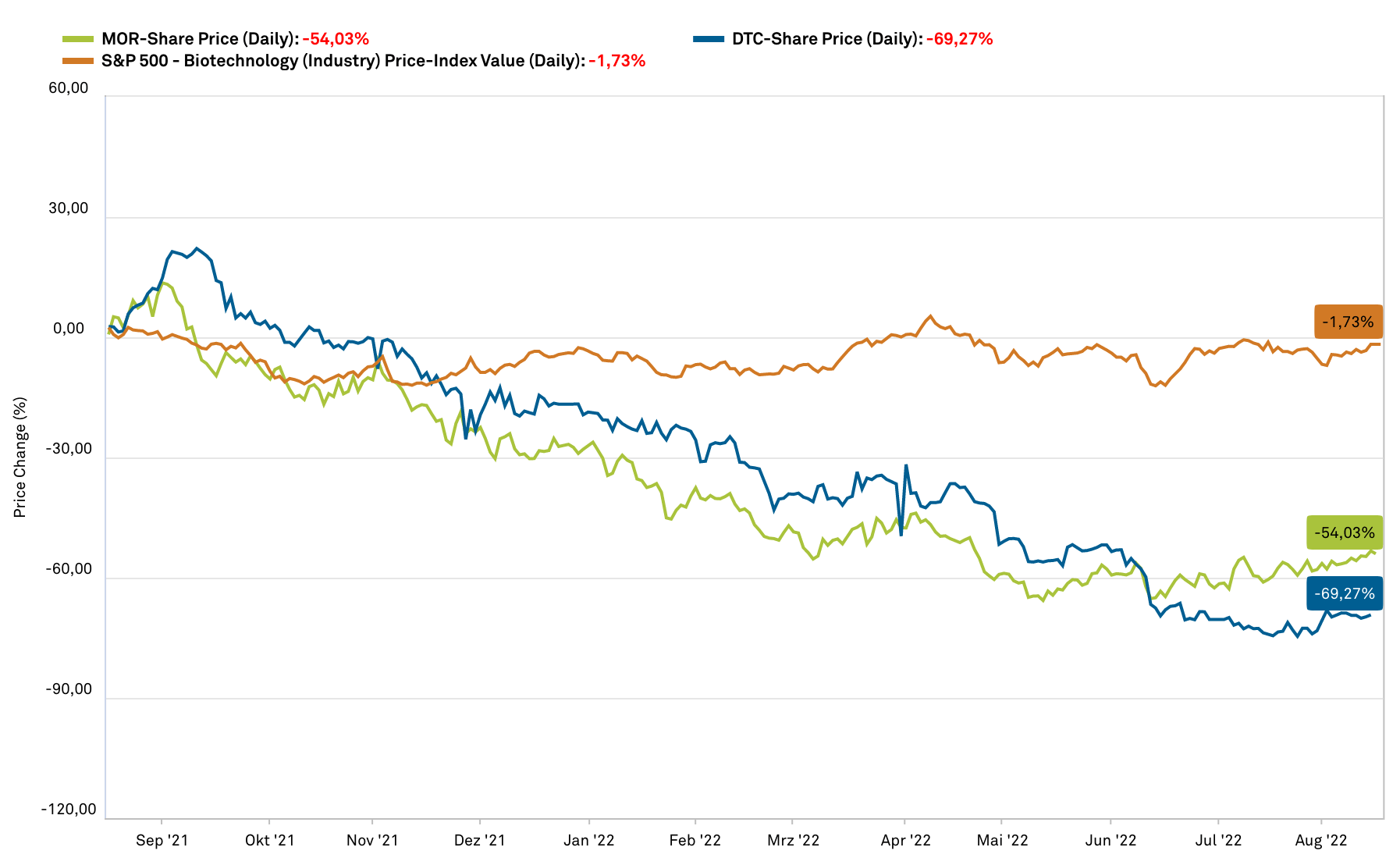

MorphoSys - Bottom found?

Since January 2020, the MorphoSys AG share has only known one direction: steeply downwards. The loss amounted to a total of 89% until the low in mid-May of the current stock market year. Since then, the chart of the Planegg-based company has been working on bottoming out. The share is currently quoted at EUR 23.98, not far from the 200-day line at EUR 25.82. Should this be broken, a short-term run-up towards the EUR 33.97 mark would be possible.

From a fundamental perspective, the recently published results gave hope for improvement. According to Dr Jean-Paul Kress, Chief Executive Officer of MorphoSys, important progress was made in patient recruitment for the Phase 3 registration studies and the marketing of Monjuvi. In addition, sales of Monjuvi picked up in the second quarter compared to the first three months of the year. "Despite the downward revision to our financial guidance, we expect Monjuvi's growth to continue in the second half of the year and beyond. We remain well capitalized to achieve key clinical milestones, potentially making new effective blood cancer drugs available to patients and generating significant value for our shareholders," the Company CEO said in a press release.

In the wake of the published quarterly figures, the Hamburg-based private bank Berenberg reiterated its investment "buy" rating with a price target of EUR 65, which implies a share price potential of more than 150%.

Despite the continued difficult chip market, analysts are optimistic for Infineon. For the biotechnology company MorphoSys, Berenberg sees a price target of EUR 65. The platform technology of Defence Therapeutics is scalable and therefore has considerable potential.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.