December 5th, 2024 | 07:40 CET

Portfolio Rockets for 2025! Nel ASA, F3 Uranium, Renk, Rheinmetall and Hensoldt in focus

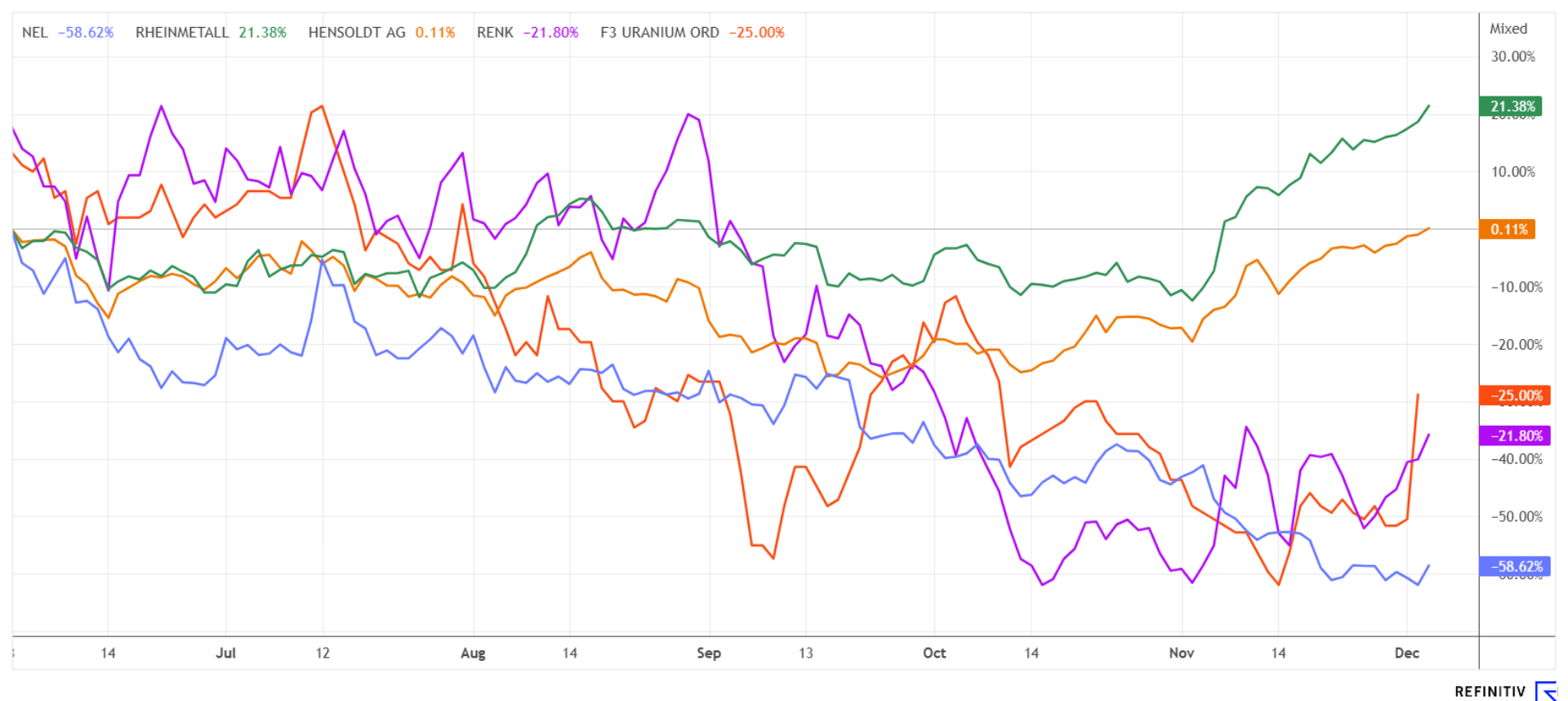

For many investors, this year's stock market felt like a warm rain. High-tech, AI, and defense stocks reached new all-time highs, thus gilding the returns of risk-conscious portfolios. However, even with the DAX 40 index constantly setting new all-time highs, there were only 34% winning stocks in Germany compared to 66% losing stocks. The market's rally has been highly selective, driven by just a few names. This makes it all the more important to identify dormant portfolio risks, regroup, and build a lineup poised to deliver strong returns in 2025. Here are some suggestions to consider.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

NEL ASA NK-_20 | NO0010081235 , F3 URANIUM CORP | CA30336Y1079 , RENK AG O.N. | DE000RENK730 , RHEINMETALL AG | DE0007030009 , HENSOLDT AG INH O.N. | DE000HAG0005

Table of contents:

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

F3 Uranium – JR Zone Results

The worldwide shortage of uranium is scientifically demonstrated for the years from 2027. This is because not enough uranium projects can currently be launched to meet the growing demand for over 100 new reactors in the next five years. Then there are the political risks involved in dealing with Russia, Kazakhstan, and China, which will certainly not be made easier under the new leadership of Donald Trump. The spot price of around USD 77.50 does not yet reflect this scarcity, as it had already exceeded USD 100 by mid-year.

The Canadian company F3 Uranium holds several properties in the uranium-rich Athabasca Basin. Formed as a spin-off from Strathmore Uranium, the Company was part of the well-known Fission Uranium for many years. Recent updates from the JR Zone have been received, including assay results for the highly anticipated drill hole PLN24-176 from the ongoing 2024 drilling program on the PLN property. The mineralization assayed 30.9% U3O8 over a length of 7.5 m, including an ultra-high grade core of 4.5 m with 50.1% U3O8. The Company considers uranium mineralization assaying higher than 1.0 wt% U3O8 as high-grade, and assays higher than 20.0 wt% U3O8 as ultra-high-grade. Geologists are naturally excited by these findings and are hopeful for further extensions.

Sam Hartmann, Vice-President of Exploration, commented: "PLN24-176 is the best hole drilled in the JR Zone to date in terms of thickness of the intercept, including a 50.1% U3O8-bearing interval that is 4.5 m true thickness starting at a shallow vertical depth of only 190 m below surface. These results from PLN24-176 underscore the need for closely spaced drilling in these high-grade, basement-hosted, structurally controlled uranium deposits, which can often lead to the development of additional targets for high-grade mineralization, in this case towards the top."

The PLN project includes the PLN, Minto and Broach properties. The results suggest that this is one of the next major development areas for new uranium operations in Northern Saskatchewan. Investors celebrated the good news, with the FUU share price jumping 26% from CAD 0.23 to CAD 0.29. The medium-term price targets of the research firms Red Cloud and SCP are CAD 0.60 and CAD 0.75, respectively. The turbocharger has clearly been ignited.

Rheinmetall, Hensoldt and Renk Group – Is a major reshuffle looming?

What many investors may not know is that the defense industry also has a high residual demand for uranium. Depleted uranium is a by-product of uranium enrichment that consists mainly of Uranium-238. Due to its high density of about 1.7 times that of lead, it is used for armor-piercing ammunition because it is highly destructive upon impact due to its kinetic energy. It is also used in armor that is particularly resistant to penetration. It is also used as radiation shielding in armaments facilities to protect sensitive electronics or personnel from radiation. In submarines and aircraft carriers, Uranium-235 is used as fuel in nuclear reactors that allow for an almost unlimited range.

Within the defense sector, investors have been able to really take off with Rheinmetall shares since 2022. Starting from a listing of EUR 95 in Q1-2022, the value rose to a new all-time high of EUR 652 yesterday. The market capitalization reached EUR 27.3 billion. Looking at the valuation, a P/E ratio of 24 is applied based on a 2025 estimate, with 3.5 times sales now reflected in the market value. Management speaks of a revenue doubling by 2027. From an analytical standpoint, the stock can indeed grow into its current valuation, but the risk of a 25% consolidation is always present. With the share price halving, Renk Group AG is enticing investors to buy in at around EUR 20.80. In April, after the IPO, the value had already climbed to the EUR 39.70 mark. The poor Q3 figures and the surprising departure of CEO Susanne Wiegand have recently caused uncertainty. Finally, Hensoldt: Here, the valuation is neutral. For 2025, the value reaches a P/E ratio of 20, and the P/S ratio is in the green at 2. All three values are no longer a bargain, but where can they be found today?

Nel ASA – A major order from Korea

The stock market reaction to the next "order lifeline" from Korea for Nel ASA shows how bombed out hydrogen stocks have become. The Norwegian hydrogen company, through its subsidiary Nel Hydrogen Electrolyser AS, has signed a contract with Samsung C&T to supply 10 MW of alkaline electrolyser technology. The demonstration plant in Korea will be used to test a model for so-called "pink hydrogen" projects, in which surplus energy from nuclear power is used to produce hydrogen. It is a good idea that could gain traction. The contract value is a low EUR 5 million, but it is certainly relevant with annual revenue of around EUR 25 million. Nel ASA recently hit a five-year low of NOK 2.75 and was able to gain 10% at its peak yesterday. That's something! Is this the turnaround? In our opinion, not yet, as technically, the zone of NOK 3.15 to 3.30 has to be overcome. However, several orders of this kind could quickly boost the price next year. Keep an eye on the value!

**Which stocks do you want to start the new year 2025 with? The high-tech winners of the year are already highly valued, but they continue to be supported by globally investing ETFs. Defense stocks could remain interesting, as geopolitical hotspots continue to exist. A uranium admixture like F3 Uranium should be considered, as over 100 new reactors are expected to come online globally by 2030.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.