December 28th, 2022 | 08:05 CET

Outperformer stocks in 2023? BioNTech, Steinhoff, Saturn Oil + Gas, K+S

Will energy stocks continue to be outperformers in 2023? In any case, in 2022, MSCI World Energy clearly outperformed MSCI World. In the case of individual stocks, Shell, for example, has gained over 45% in the current year. Jefferies recommends the stock as a buy with a target price of GPX 3100 (pence). Warren Buffett has also invested billions in the oil sector in 2022. Chevron and Occidental Petroleum are among Berkshire Hathaway's seven largest holdings. Energy, after all, is likely to be in demand in 2023. Those looking to bet on a laggard should look at Saturn Oil & Gas. The Canadian oil producer faces a milestone in 2023, and analysts see over 200% upside potential. BioNTech enters the new year with solid newsflow. And what is Steinhoff doing after the horror news?

time to read: 4 minutes

|

Author:

Fabian Lorenz

ISIN:

BIONTECH SE SPON. ADRS 1 | US09075V1026 , STEINHOFF INT.HLDG.EO-_50 | NL0011375019 , Saturn Oil + Gas Inc. | CA80412L8832 , K+S AG NA O.N. | DE000KSAG888

Table of contents:

"[...] The Oxbow Asset now delivers a substantial free cash flow stream to internally fund our impactful drilling and workover programs. [...]" John Jeffrey, CEO, Saturn Oil + Gas Inc.

Author

Fabian Lorenz

For more than twenty years, the Cologne native has been intensively involved with the stock market, both professionally and privately. He is particularly passionate about national and international small and micro caps.

Tag cloud

Shares cloud

Saturn Oil & Gas: Buy the share now?

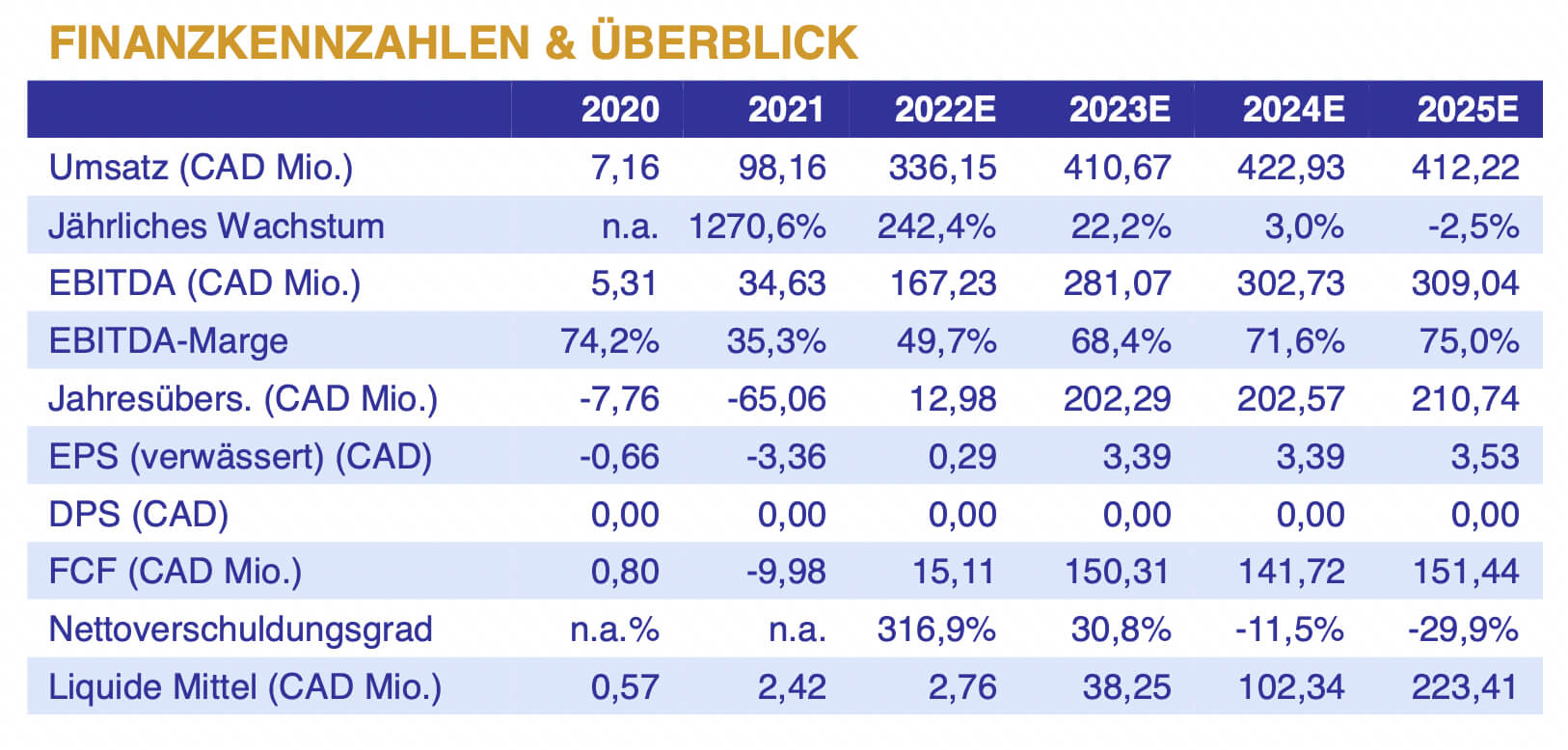

The MSCI World Energy Index has gained a good 50% in 2022. And you do not have to be an expert to expect persistently high energy prices in 2023 based on geopolitical developments. Goldman Sachs, for example, sees an oil price of USD 100 per barrel. Therefore, energy stocks belong in a diversified portfolio in 2023. And that includes the Saturn Oil & Gas share. The share of the Canadian oil producer may be one of the disappointments of 2022, but operationally things went more than smoothly: through acquisitions, the daily production volume was increased more than fifty-fold to 12,000 barrels of oil equivalent (BOE/d) within 1.5 years. Nevertheless, the stock market failed to revalue the Company, and the share lost around 25%. Trading is also liquid in Germany, with the share trading at EUR 1.83. An important reason for the underperformance is likely the somewhat complex acquisition financing through warrants. These will be repaid in 2023, and the share should take off then, at the latest. Analysts at least see considerable upside potential.

First Berlin sees the Saturn Oil & Gas share fairly valued at EUR 7. Accordingly, the analysts recommend the stock as a buy. The analysts say that the two oil fields, Oxbow and Viking, are among the most profitable oil and gas properties in all of North America. Both projects are highly profitable, even at a WTI oil price of USD 75. As a result, the analysts expect that the debt of CAD 220 million - which should already be less on the balance sheet as of December 31 - could be fully reduced from cash flow in 2023 alone. By the end of 2024, they even expect a net cash position of CAD 55 million. In order to put this in perspective, the Company is currently valued at only CAD 160 million. That would give Saturn Oil & Gas more than enough liquidity for further smaller acquisitions, dividend payments and share buybacks. (Read here for the First Berlin study http://www.more-ir.de/d/25821.pdf)

Therefore, it is not surprising that the analysts of Beacon Securities are even more optimistic and have announced a price target of CAD 9. Saturn combines value-enhancing acquisitions with impressive drilling results. In the current year, a free cash flow of CAD 39.2 million is to be generated - and the trend is continuing to rise.

BioNTech: With momentum into the new year

Investors can also look forward to a strong - and hopefully positive - newsflow at BioNTech in 2023. There was a taste of this in the past days and weeks. Most recently, the Mainz-based biotech company announced that German nationals living in China can finally get vaccinated with BioNTech's COVID-19 compound. It said some 11,500 doses arrived in mainland China on December 21, 2022. "We thank the Chinese and German governments for their continued support and joint efforts in providing Germans living in China with our monovalent and Omicron BA.4/BA.5 adapted bivalent mRNA COVID-19 vaccines," said Sean Marett, chief business and commercial officer at BioNTech. Based on the massive number of infections per day, BioNTech shareholders are also alive with hope that the Company's mRNA vaccine will be approved and made available to the general public in China after all. While the probability is not high, it would be a real boost for the share.

But even without COVID-19 vaccine demand from China, BioNTech is entering the new year with a tailwind. The Company is working with Pfizer on a combination vaccine (influenza/COVID-19), and its research and production sites have been expanded through acquisitions and collaborations. Then, just before Christmas, it was reported that the Phase I clinical trial for the potential malaria vaccine had begun. "The start of this trial is an important milestone in our journey to contribute to the fight against diseases with high unmet medical needs. We aim to develop a vaccine to help prevent malaria and reduce mortality. In the coming months, we will study different antigens with great scientific precision to identify the optimal candidate," said BioNTech CMO Prof. Dr Özlem Türeci. "In parallel, we are working on establishing production sites on the African continent and in other regions worldwide."

In addition, the Phase 1 clinical trial for a potential vaccine against herpes has also started. Prof. Dr Özlem Türeci said, "This program is part of our strategy to contribute to the fight against diseases with high unmet medical needs and great relevance to global health. We combine our novel technologies, such as mRNA, with our expertise as immune engineers."

Steinhoff: Fingers off

After the recent horror news, Steinhoff is unlikely to be one of the outperformers of 2023. The stock was already only something for gamblers in recent years, but after the latest news, existing shareholders will probably be left empty-handed after the restructuring. Since the accounting scandal in 2017, a huge mountain of debt weighs on the South African-Dutch holding Steinhoff. The loans, with interest rates of around 10%, are now to be extended until 2026. However, this is no reason for shareholders to celebrate. They are giving up 80% of their equity in favour of the creditors and losing all voting rights. Accordingly, the share is now only quoted at EUR 0.029. At the beginning of 2022, it was temporarily above EUR 0.30.

Oil as a fossil fuel will continue to be in demand. Star investor, Warren Buffett, is not the only one to have recognized this. If debt reduction in the current year happens as planned, the Saturn Oil & Gas share should be one of the outperformers in 2023 after a disappointing year in 2022. The signs are also good for a rising share price at BioNTech. Of course, as with all research-based pharmaceutical companies, the study data must be correct. Steinhoff is still only something for gamblers.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.