August 18th, 2022 | 11:28 CEST

New opportunities with BYD, MAS Gold and BASF

If you do not have the shares when they fall, you will not have them when they rise! As stock market legend André Kostolany noted, it is extremely difficult to hit the exact low point to enter. By waiting, however, most investors miss the subsequent price increases. The current price weakness could represent the final wave down for the precious metals of gold and silver. Subsequently, quite a few chartists expect a long-lasting upward movement. From this point of view, putting the first foot in the door on selected gold mining stocks is probably not the worst decision.

time to read: 5 minutes

|

Author:

Stefan Feulner

ISIN:

BYD CO. LTD H YC 1 | CNE100000296 , MAS Gold Corp. | CA57457A1057 , BASF SE NA O.N. | DE000BASF111

Table of contents:

"[...] We can make a big increase in value with little capital. [...]" David Mason, Managing Director, CEO, NewPeak Metals Ltd.

Author

Stefan Feulner

The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

He is passionate about analyzing a wide variety of business models and investigating new trends.

Tag cloud

Shares cloud

BASF - Not yet clean

The chemical company from Ludwigshafen has had to contend with all kinds of nasty blows in recent months. Exploding energy prices, low water levels and the threat of gas shortages are just a few of the obstacles BASF has had to overcome. The DAX-listed Company also suffered a defeat in a dispute with Bayer related to the sale of its seed business. Bayer had sold parts of its seed and weedkiller division to BASF for EUR 7.4 billion in 2017 and 2018 to address competition regulators' concerns about dominant market power from its more than USD 60 billion acquisition of US seed giant Monsanto.

In doing so, BASF filed an arbitration claim in 2019, seeking damages from Bayer for allegedly failing to adequately disclose certain cost items, in particular personnel costs, and failing to allocate them appropriately to some of the divested businesses. Bayer had disputed this. According to information, the claim involved EUR 1.7 billion plus interest. However, the arbitration court dismissed the claim, meaning that Bayer does not have to pay any compensation to its German competitor.

By contrast, the agricultural business in the US is performing positively. The analysts at Bernstein Research see this potential and reiterated their "outperform" investment rating with a price target of EUR 72. In contrast, the Swiss bank UBS sees a sell candidate with a price target of EUR 37.

The UBS target is significantly lower and, therefore, also in line with the technical chart of the chemical giant. The current share price is quoted at EUR 43.22, not far from the low for the year at EUR 39.35, which also represents the Corona low of March 2020. A sustained undershooting would break the double bottom formation, and a sell-off in the direction of EUR 36 would be likely. On the upside, there would be an all-clear if the share broke above the downward trend formed in January 2018 at EUR 62.68.

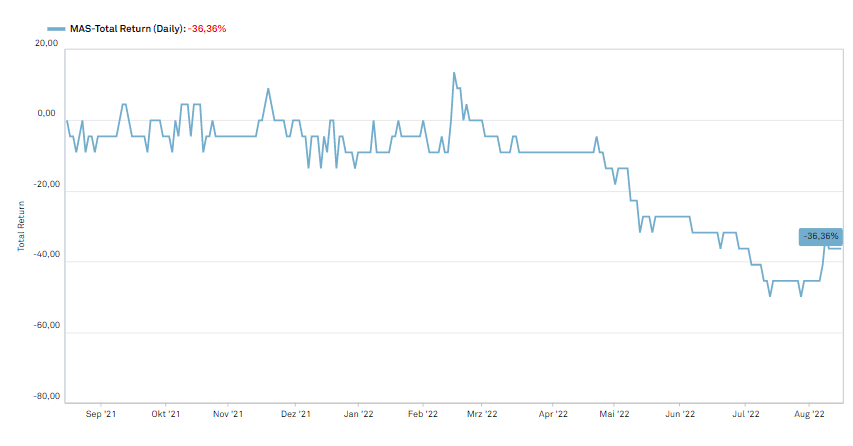

MAS Gold - Caution, opportunity!

Quite a number of times over the past year, we wrote that we expect high and long-lasting inflation, thereby contradicting the monetary guardians of the FED and the ECB, who saw inflation as only temporary. Now we are going out on a limb again and assuming that the interest rate steps that have been taken and those that may still be taken will not be able to contain inflation. Above all, this is almost impossible without turning off the tap to the global economy and sending it into a brutal recession. In addition, there is the debt problem, which means that further interest rate hikes will be equivalent to the financial ruin of many countries. As a result, in our opinion, the first reductions in interest rates are likely to be made in the fourth quarter at the latest, in order to open the money floodgates again.

The gold price could not defend the USD 1,800 mark and is currently declining. Around USD 1,750, this downward spiral could come to a halt. Initial positions in promising exploration companies such as MAS Gold would therefore be appropriate. After all, we expect a sudden reversal in the gold price in the near future. Historically, such a change in direction can happen overnight.

MAS Gold is drilling in the historic La Ronge Gold Belt mining district in the province of Saskatchewan. Jim Engdahl, a mining industry veteran, is at the helm of the Canadian Company that has set a goal of getting at least 1 million ounces of gold out of the ground at a total of 5 deposits. As early as the middle of the last century, numerous gold deposits and showings were outlined in the La Ronge greenstone belt. MAS Gold's current projects include the North Lake, Greywacke North, Contact Lake and Point gold deposits and the historically defined Elizabeth Lake volcanic massive sulphide copper-gold deposit on four properties totaling 34,703.4 hectares. The 843-hectare Preview SW property, adjacent to Preview North and acquired at the turn of the year, complements the current portfolio of the hub and spoke properties. Here the concept is that mineralized material from various satellite deposits will be consolidated into a centrally located processing facility at Preview North.

Running fresh off the ticker were the final winter drill results from the 30 remaining diamond drill holes. These results include 22 drill holes from the North Lake deposit, 4 drill holes from the Point deposit and 4 drill holes from the Preview SW property. Results from the remaining 22 diamond drill holes at the North Lake deposit are highlighted by high-grade mineralization in the southernmost hole at 8.79 grams per tonne (g/t) gold over three metres (m) in diamond drill hole (DDH) NL22-101. In addition, the North Lake extension has been confirmed.

At Point, a deposit extension of approximately 295m to the south and a down-dip extension were also identified, while Preview SW revealed multiple sub-parallel high-grade lenses hosted within a dioritic intrusion.

Jim Engdahl, CEO of MAS Gold, expressed his excitement and commented: "The winter drill results, along with the acquisitions of the Preview SW deposit and the Contact Lake mine, will allow MAS Gold to resume the PEA (Prefeasibility Economic Study) in 2023. Our North Lake deposit continues to demonstrate the feasibility of being the hub in MAS Gold's Hub-and-Spoke model, with the Preview SW deposit and Contact Lake mine being the primary spokes. Management is extremely pleased with this latest round of 30 diamond drill results."

Despite fundamental successes, the Company's stock, which has a market value of CAD 12.23 million, has corrected about 70% since its peak. With its experienced management and Hub-and-Spoke model strategy, MAS Gold is expected to outperform as the gold price rises.

.

BYD - Euphoria faded

Fundamentally, things are undoubtedly still going in the right direction for the Chinese market leader BYD. In addition to excellent sales figures, the Company is investing heavily in its strategy for the future. As explained in a detailed report, the expansion of the Company's own battery production is being pushed in addition to the electromobility business. According to experts, the blade batteries are considered the safest in the industry.

In the future, the Company will not only equip its own vehicles with its self-developed batteries but will also supply them to other manufacturers. The Company plans to invest USD 4.1 billion in a battery factory and mining project in Yichun in the Chinese province of Jiangxi. The battery factory is expected to be responsible for an annual capacity of 30 GWh. The mining project would enable BYD to produce 100,000 tons of lithium annually.

From a chart perspective, BYD shares have lost some of the strong momentum seen in recent months. In addition, the RSI and the trend-following indicator MACD turned and marked a sell signal on a weekly basis. The next correction target is currently based on the 200-day moving average at USD 33.64.

For BASF, it is a case of wait and see; a fall back to the area around EUR 36 would be a good basis for a long-term investment. BYD is currently in correction mode. MAS Gold would be a good place to start.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.