August 19th, 2024 | 07:15 CEST

New Nasdaq bull market: Highs ahead for Rheinmetall, Almonty Industries, Super Micro Computer, and Infineon

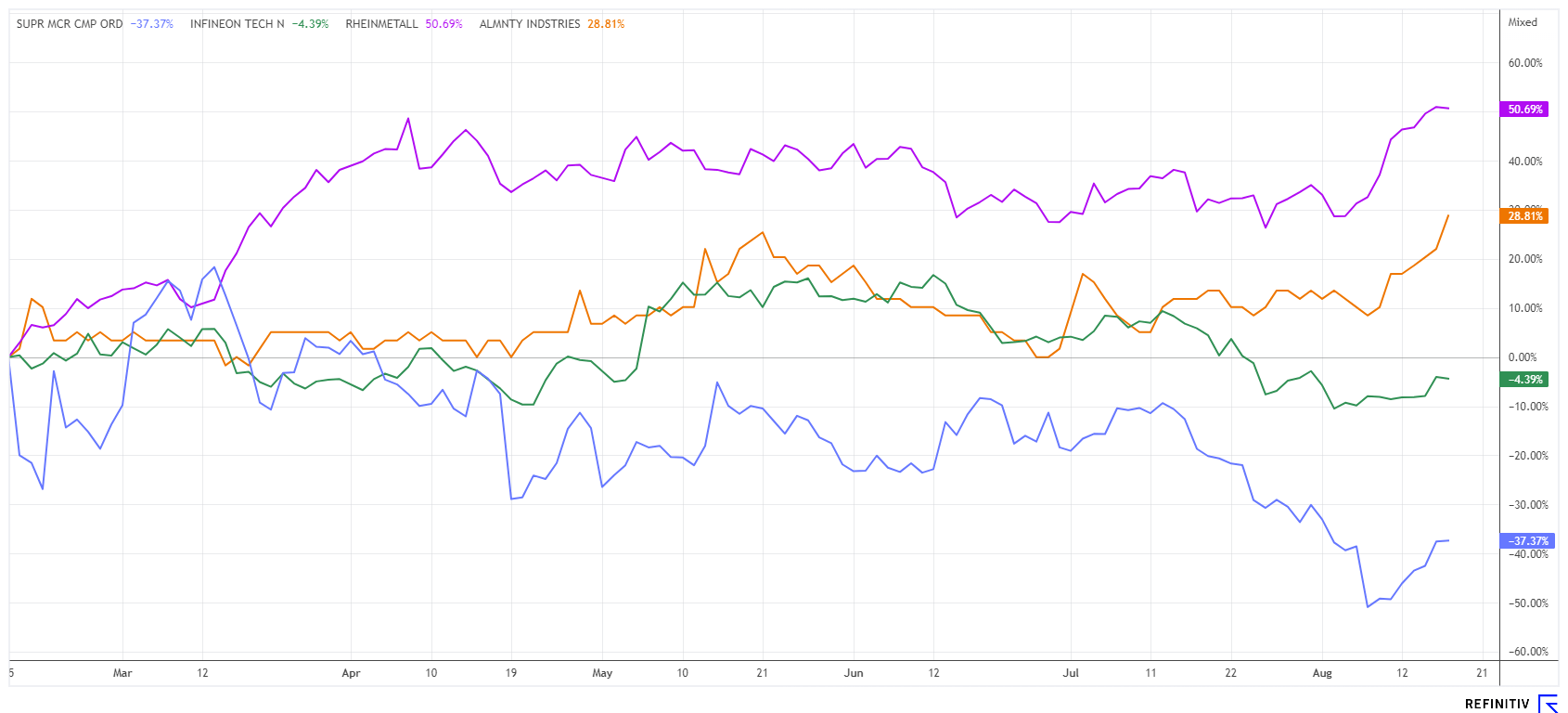

The correction was over quickly! The Nasdaq 100 index has lost 3,000 points since the beginning of July. This meant a third of the annual performance was wiped out in the short term. However, the fantasy of imminent interest rate cuts by the Fed quickly put an end to the correction. The highly regarded technology index recovered more than half of its losses in just one week. Nvidia led the way, rebounding from USD 92 to USD 125. The half-year figures for Rheinmetall and Almonty will be available at the end of August. We take a closer look.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

RHEINMETALL AG | DE0007030009 , ALMONTY INDUSTRIES INC. | CA0203981034 , SUPER MICRO COMPUT.DL-_01 | US86800U1043 , INFINEON TECH.AG NA O.N. | DE0006231004

Table of contents:

"[...] While tungsten has always played an important role in the chip industry, it is now being added to batteries for e-cars. [...]" Lewis Black, CEO, Almonty Industries

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Rheinmetall - Unstoppable after the half-year figures

Prices below EUR 470 quickly became history again. Rheinmetall was boosted last week by the dazzling operational figures for the second quarter. As a result of the war in Ukraine, the armaments group's order books are fuller than ever at EUR 48.6 billion. Surprisingly, the main drivers are not tanks but 155 mm artillery ammunition, which is in demand worldwide. Revenue increased by a third to around EUR 3.8 billion in the first half of the year, while the operating result almost doubled to EUR 404 million. Last week, a groundbreaking acquisition was made in the US.

Rheinmetall is taking over the American vehicle specialist Loc Performance with an enterprise value of USD 950 million. The armaments group hopes that the acquisition will give it an advantage regarding orders from the US military. Loc Performance and its approximately 1,000 employees can be used to expand both the product range for military vehicles and the local production capacities required by the US government. In addition to the military, the Company's customers include the construction and agricultural industries. Analysts at Hauck Aufhäuser and DZ Bank have a "Buy" rating and price targets of EUR 680 and EUR 645, respectively. We also remain invested and have raised our stop-loss from EUR 515 to EUR 527.

Almonty Industries - Things are going smoothly

Access to critical metals is crucial for all high-tech and defense manufacturers. Due to extensive geopolitical upheavals, total dependence on China has long since ceased to be opportune. Western industrialized countries are, therefore, seeking stable jurisdictions to ensure their security of supply. Tungsten is a rare metal relatively scarce in the Earth's crust. China currently accounts for 70% of global production of this heat-resistant hardening metal. Tungsten is used in the production of superalloys, filaments, and electronic components, particularly in sensitive technology sectors.

The Canadian Company Almonty Industries owns four properties of the rare metal and is focusing on a rapid increase in global production. Western countries are betting on this scenario, and the Company's shares are currently in demand accordingly. Many investors are speculating on a multiplication of the share price, as there are already inquiries from major technology manufacturers in addition to KfW and the Austrian Plansee Group. The revitalization of the Sangdong mine in South Korea, the metal's largest property outside of China, should be quite promising. Mine construction is already well advanced, and production of tungsten oxide could start in 2025 as planned, possibly even molybdenum in the following years.

The latest half-year figures are encouraging. The Panasqueira mine in Portugal has already achieved an operating EBITDA of CAD 2.4 million at grades of 0.14%. Sangdong has an ore grade of 0.46%, which should significantly boost operating results in 2025. Almonty shares recently rose by around 20% to CAD 0.76. This brings the 258.607 million shares to a total market value of CAD 196 million. In our opinion, the appreciation will continue.

Super Micro Computer and Infineon - In demand again after the correction

Super Micro Computer (SMCI) shares gained 28% last week. From a low of EUR 440, the share price rose again to over EUR 570. The extremely high short-selling ratio, which ultimately forced the short sellers to cover their positions after the upward turnaround, is likely to have been the driving force behind the share price performance. According to the research firm Hazeltree, SMCI is now the most shorted US large-cap stock, surpassing Tesla. In the ranking by California-based analysts, Super Micro Computer achieved a score of 99 points, up from 82 points in June. The score is based on a combination of short selling ratio and trading activity.

Infineon came up with a blockbuster announcement. The Munich-based manufacturer of specialty chips inaugurated the first phase of a 200-millimeter silicon carbide (SiC) power semiconductor factory in Malaysia. An investment volume of EUR 2 billion is planned for the first expansion phase, which will develop upwards to EUR 5 billion. Initially, 900 new jobs will be created in Kulim, and the complete facility, the largest of its kind, will eventually generate a total of 4,000 jobs. Six major OEMs from the automotive sector, as well as customers from the renewable energy and industrial sectors, are accompanying the project as potential customers. The Kulim 3 site will be connected to the Infineon site in Villach, Austria, Infineon's global competence center for power semiconductors. Infineon currently employs more than 16,000 people in Malaysia.

On the Refinitiv Eikon platform, 9 out of 18 analysts would invest in SMCI shares with a 12-month price target of USD 765, representing a premium of around 20%. For Infineon, 22 out of 26 experts are positive and expect prices of EUR 42.20, around 34% above the currently traded EUR 31.60. Both stocks fit well into a forward-looking, risk-conscious portfolio.

Tech is back! Whenever share prices tumble on the Nasdaq, new speculators get into position to initiate a new upswing. This was the case again in July. Over a 15% correction was addressed, and now the rally is starting up again. Pay attention to Rheinmetall and Almonty Industries. In addition to good fundamentals, there are also important unique selling points here that can drive prices significantly higher.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.