October 1st, 2024 | 07:15 CEST

New DAX highs – are 100% gains still possible for Airbus, Rheinmetall, Almonty, or Hensoldt after the correction?

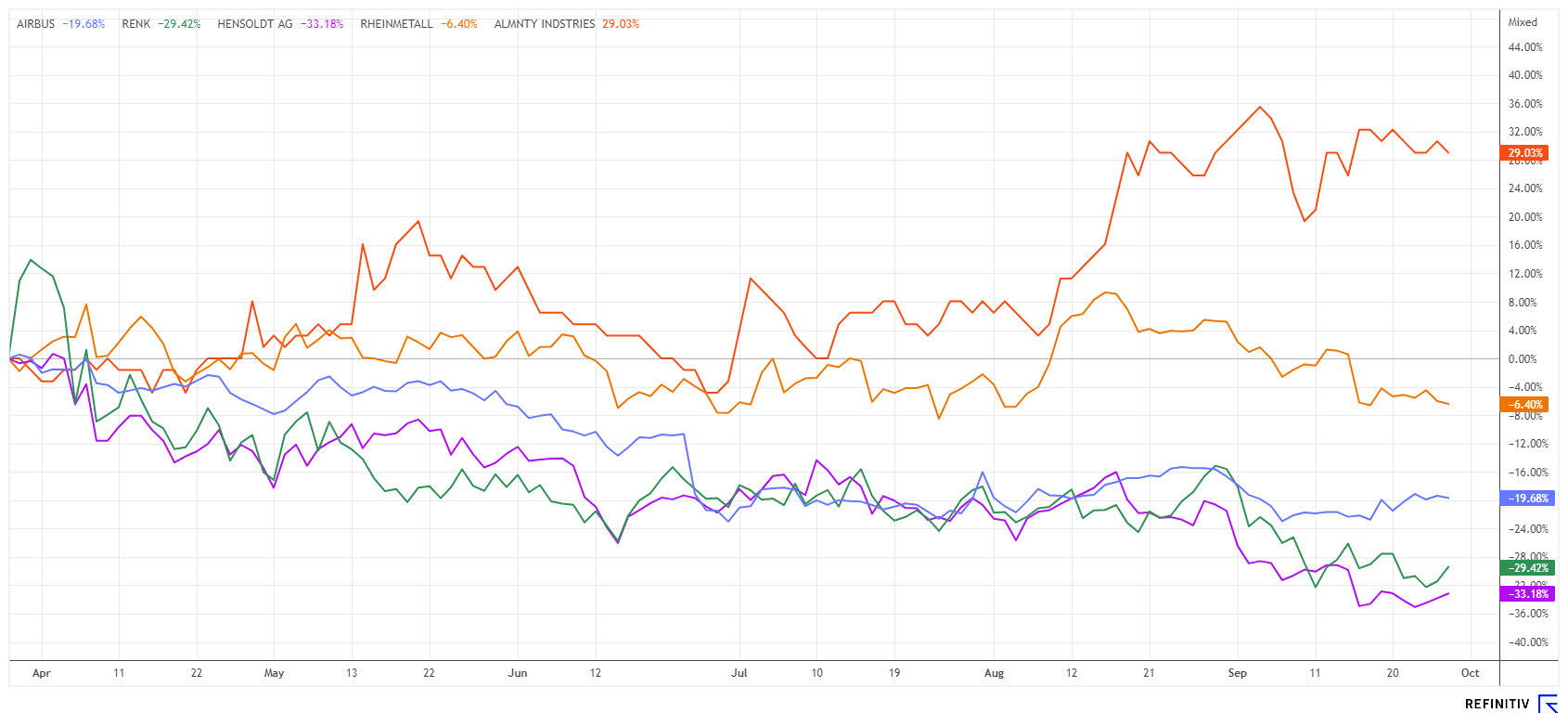

With a new all-time high of over 19,400 points, the DAX has now run very far. The drivers are the recent interest rate cuts by the central banks and hopes of an early change of government in Berlin. Despite the widespread euphoria, some top stocks have already corrected significantly. Possible peace negotiations in Ukraine initially pushed down the well-performing armaments stocks. However, with the renewed escalation of Russian attacks, these hopes have once again faded into the distance. As a result, defense stocks and tungsten supplier Almonty Industries are back in the spotlight. Strategic metals also remain on the shopping lists of Western nations, and the focus is now on securing the supply chains as best as possible. Where are the opportunities for investors?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

AIRBUS | NL0000235190 , RHEINMETALL AG | DE0007030009 , ALMONTY INDUSTRIES INC. | CA0203981034 , HENSOLDT AG INH O.N. | DE000HAG0005 , RENK AG O.N. | DE000RENK730

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Airbus SE – Failure to meet annual targets expected

In March of this year, the Airbus share price reached its all-time high of EUR 172.80, when the market capitalization was around EUR 137 billion. With the first profit warning, the price fell to as low as EUR 127, and now analysts are wondering whether the European aviation group can meet its 2024 estimates. Last week, doubts were again raised by experts, with aircraft deliveries in September falling behind the previous year's pace. This raises doubts about the ability to achieve the annual target, which has already been revised twice. In July, Airbus revised its delivery target for the year down from 800 to 770 aircraft, citing an acute shortage of engines and other supply chain issues. The Company also pushed back its medium-term production target by one year to 2027.

According to Cirium Ascend data, the European aircraft manufacturer has delivered 30 aircraft so far in September, bringing the total for the current year to around 477. This is below the 488 deliveries at the same point last year. An Airbus spokesperson recently reaffirmed the Company's latest forecast without providing any further details. Although Airbus has often been able to increase deliveries in the fourth quarter in the past, there are currently significant delays in the delivery of LEAP engines, which are produced by partner CFM. The supply of engines currently remains a critical problem that affects some aircraft deliveries and jeopardizes the annual planning. Of course, the group is fully booked for years to come, with 8,585 orders still outstanding at the mid-year point. However, the problems could currently prove to be a showstopper for analysts' expectations. Nevertheless, the mood on the Refinitiv Eikon platform is positive. 16 of 20 analysts rate the stock a "Buy" and calculate an average 12-month price target of EUR 164 - at least a potential of around 23% for the European aircraft manufacturer.

Almonty Industries – It is all about the supply chains

When considering high-tech, aircraft construction, or the defense industry, one cannot ignore the secure supply of critical metals. The conflicts in Ukraine and the Middle East, as well as the rapprochement between Russia and China, demonstrate the international complexity. Western industrialized nations are, therefore, looking for stable jurisdictions to ensure their supply. Tungsten is a rare metal that occurs comparatively rarely in the earth's crust. So far, China accounts for over 70% of global production of this heat-resistant hardening metal. It is used in the manufacture of superalloys, filaments, and electronic parts, especially in sensitive technology areas. South Korea is now building the largest mine outside of China, with the first oxides scheduled to be produced in 2025.

The Canadian company Almonty Industries already operates tungsten deposits in Europe and is now focusing on the development and revitalization of the South Korean Sangdong mine. Important partners have already been brought on board with Deutsche Rohstoff AG, the KfW Group, and Plansee from Austria. Now, the final phase of the development of flotation processing technology starts before the installation of the entire complex. To this end, Almonty has developed a special flotation process together with the Korea Institute of Geoscience and Mineral Resources (KIGAM) that is tailored to the unique properties of the Sangdong tungsten ore. Trial production was carried out in South Korea and at the operating mine in Portugal to verify the stability of the flotation technology. During the trials, the Company successfully produced tungsten concentrate (WO3) with a grade of over 60%, and with optimized reagent settings, a yield of 86.3% was achieved. The tests and construction work are continuing.

CEO Lewis Black commented: "With the successful completion of the pilot plant phase, all the preparations related to process technology development and plant performance validation have been completed. With minor adjustments to the equipment and reagents in the processing plant currently under construction, we expect to see stable tungsten concentrate production from our Sangdong mine in 2025." AII's share price is currently around CAD 0.81, bringing the 258.6 million shares to a total market value of CAD 209.5 million. We expect a valuation jump once production begins.

Rheinmetall, Renk or Hensoldt – Which defense stock will turn things around?

When it comes to defense stocks such as Rheinmetall, Renk or Hensoldt, timing is key. Investors follow current developments in the conflict zones very closely, and price movements reflect these. Rumors of an imminent ceasefire in Ukraine cost Rheinmetall as much as 11% in September, taking the stock down to its current level of EUR 480. Even a denial was unable to push the value up again, apparently the market is satisfied with the current valuation. Looking far ahead, Rheinmetall can comfortably grow into its current market capitalization of EUR 21 billion. This is because sales are set to rise steadily from EUR 7.17 billion to an estimated EUR 9.97 billion in 2024 and EUR 16.3 billion in 2027. That is a good 20% increase in sales per annum, while EBIT is expected to rise to almost EUR 3 billion by 2027. As a result, a current P/E ratio of 23 in 2024 no longer seems too high; in the next few years, the valuation will even be overtaken by the good fundamentals. We hear that CEO Papperger still does not know how he will be able to deliver the artillery ammunition ordered from NATO countries on time. The total order book was around EUR 38.3 billion in 2023 and is expected to swell to between EUR 60 billion and EUR 70 billion by the end of the year, analysts estimate. The outlook is just as good for Renk and Hensoldt, with 2024 P/E ratios of 33 and 19, respectively, although growth is lower than for the Düsseldorf-based companies. On the Refinitiv Eikon platform, 16 out of 20 analysts are enthusiastic about Rheinmetall, while for Renk and Hensoldt, the figures are only 7 and 4 out of 10, respectively. The 12-month price targets are, on average, EUR 611 for Rheinmetall, EUR 31.4 for Renk, and EUR 38.1 for Hensoldt. This indicates a potential of 30 to 40% in the three well-known defense stocks. A balanced mix fits into any future-oriented portfolio, with Rheinmetall offering the most potential.

Despite new highs, investors have sold off arms or defense stocks for the time being, which is not surprising, as these stocks have been among the blockbusters of the last 24 months. However, after the recent correction, some stocks look interesting again, particularly Airbus and Rheinmetall. In the strategic metals space, Almonty Industries looks poised to be a clear outperformer over the next 12 to 24 months.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.