January 22nd, 2026 | 07:10 CET

NATO under pressure – Is silver the new gold? Dream returns with Silver North, fresh momentum for Rheinmetall and TKMS

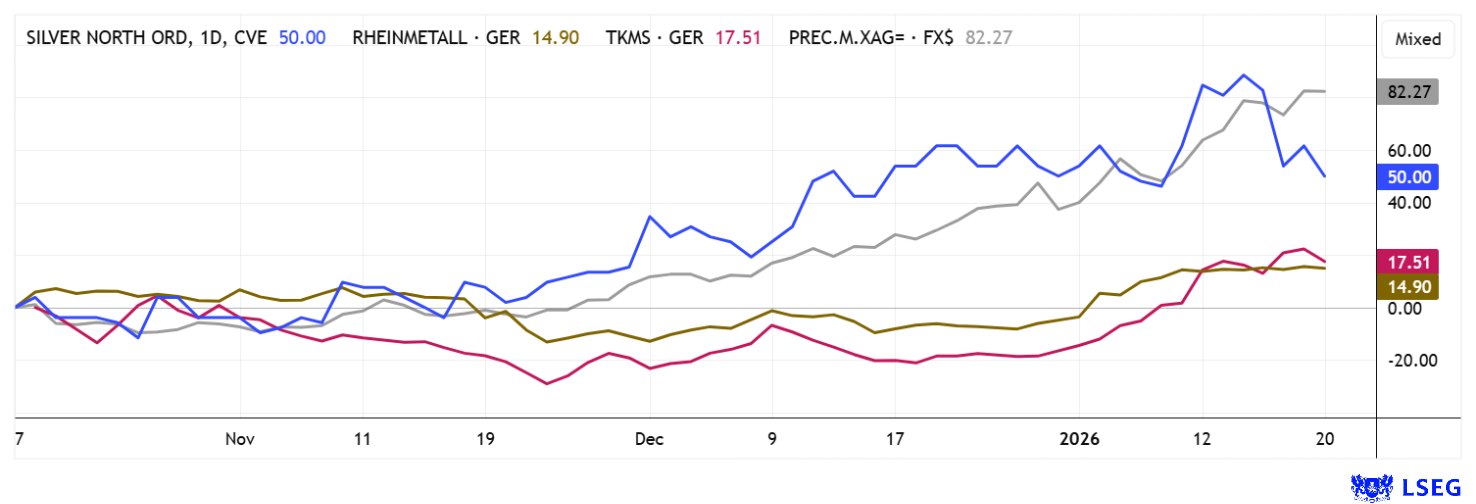

Geopolitical upheavals are exposing deep rifts of trust between the superpowers. The US approach toward Greenland is reminiscent of long-outdated colonial practices and has alienated the political actors involved. As a result of this blunt conduct on the international stage, trust in political institutions is eroding, and long-standing alliance structures are beginning to fall apart. The wobbling of the transatlantic alliance, NATO, marks a new level of tension and escalation. What this means for the capital markets in the short term remains unclear. However, what is already evident is the almost daily appreciation of gold and silver, along with another surge in valuations of defense stocks. A scenario of rising interest rates is also looming on the horizon. None of this is good news, and investors would be well advised to examine their portfolio structures for weaknesses. Here are a few ideas.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

SILVER NORTH RESOURCES LTD | CA8280611010 , RHEINMETALL AG | DE0007030009 , TKMS AG & CO KGAA | DE000TKMS001

Table of contents:

"[...] Internally we expect the resource to significantly grow the deeper we mine. [...]" Dennis Karp, Executive Chairman, Manuka Resources

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Silver North – Strong financing creates operational clout for the coming years

At the beginning of 2026, the silver market is in an extraordinary period of stress, as the price has risen in a short period of time to levels that were considered unrealistic a year ago. The main driver is a structural supply deficit, which is further exacerbated by geopolitical tensions, high government debt, and growing industrial demand. This is compounded by speculative interests from derivatives investors. The physical availability of silver is declining noticeably, which is reflected not only in falling inventories but also in increasing delivery bottlenecks for forward contracts. Despite everything, the fact remains that silver is increasingly evolving from a classic precious metal to a strategic industrial metal, especially for electromobility, digitalization, and photovoltaics. This combination of macroeconomic pressure and technological demand creates an environment in which exploration companies with real deposits can benefit disproportionately.

Silver North Resources is positioning itself precisely in this area of tension as a growth-oriented explorer in Canada's Yukon, one of North America's most renowned silver jurisdictions. The 100% owned Haldane Project is located immediately adjacent to a producing mine and has long been considered underexplored, but now shows clear indications of a high-grade system. The latest drill results confirm continuous mineralization along a significant structure that can be traced over several hundred meters. Particularly noteworthy are thick sections with very high silver grades, complemented by relevant gold, lead, and zinc content, which significantly improves the economic quality of the system. The increasing gold content in deeper zones further enhances the attractiveness of the project and indicates robust vertical continuity. In addition to Haldane, the second core project, Tim, located in the vicinity of an established mine, also offers optional upside through a partnership with a larger producer. In addition, the early exploration potential of the GDR project underscores its regional comparability with known high-grade districts.

On the financial side, Silver North recently signaled strong investor interest by successfully placing significantly increased financing of CAD 10.58 million. This means that the Company is fully equipped for several years of exploration work and can efficiently expand its planned programs. The Silver North share (ticker: SNAG) has consolidated somewhat in recent days and offers excellent entry points in the range of CAD 0.40 to 0.45!

Rheinmetall – And again just shy of the EUR 2,000 mark

The German defense contractor Rheinmetall is one company with a particularly high demand for critical metals. The precious metal silver has also long been a central component of the group's technological development, especially in areas such as electronic control, target acquisition, and defense systems. Its excellent conductivity, resistance to corrosion, and ability to dissipate heat make it virtually irreplaceable for high-performance components in modern tank technology, drone controls, and air defense systems. Although internal data on the exact amount consumed is not available for competitive reasons, market observers speak of considerable use, in some cases in the double-digit kilogram range per missile module. With the growing demand for digital, networked weapon systems, the need for raw materials is also increasing, and with it, the vulnerability to supply bottlenecks in the metal markets.

After temporary price declines due to geopolitical détente, the signs are pointing to stormy weather again in the artificially created "Greenland conflict." Since the beginning of the year, the stock has gained around 20%, demonstrating how strongly investors are betting on the continued expansion of the defense industry. Analysts expect the order pool to reach record levels soon, while research firms such as Deutsche Bank Research and mwb research continue to forecast rising target prices between EUR 2,100 and EUR 2,200. But caution is advised: as in fall 2025, the Düsseldorf-based company is once again trading at valuation multiples that reflect continued high optimism for the future. The parameters for 2026 are thus set at a P/E ratio of 45 and a sales multiplier of 5.5. On the LSEG platform, the consensus target has recently risen to EUR 2,186, Rothschild foresees EUR 2,400, and in some cases, EUR 2,500 is cited as a target. The stock is clearly benefiting from the behavior of international fund managers, who, after decades of ESG compliance and avoidance of defense investments, now have to invest in the war machine to reflect the changing times for their investors.

TKMS – Flood of orders leads to unexpected rally

The example of TKMS shows how pressure from institutional investors can quickly push even newcomers into new valuation spheres. The former subsidiary of the thyssenkrupp Group was floated on the stock exchange in 2025 and reported a 66% increase after just 24 hours of trading. Subsequently, it fell back to the issue price of EUR 60. In the weeks and months that followed, the share price fluctuated very volatilely in a range between around EUR 60 and EUR 80. A revaluation now seems necessary for 2026, as the move to independence opens up completely new opportunities for the agile naval subsidiary.

TKMS was able to land a billion-dollar submarine order from Canada and is coupling this with a comprehensive industrial package that includes investments in rare earths, mining, AI, and battery production. CEO Oliver Burkhard emphasized that this is not just about the up to twelve Class 212CD boats, but also about long-term offset commitments over 30 years, which will be implemented with German and Norwegian partners such as Isar Aerospace. As one of two finalists against Hanwha Ocean from South Korea, TKMS sees its order backlog of over EUR 18 billion and its recent entry into the MDAX as confirmation of its expansion strategy. Negotiations are currently underway for an Indian submarine order worth a further EUR 6.8 billion, and analysts continue to rejoice. The latest recommendations easily reach the EUR 100 mark. The crux of the matter is that the TKMS share price has risen by a full 50% in just two weeks and is now trading at the EUR 97 mark. The only thing that helps now is to look at the figures: in 2024, TKMS achieved revenue of EUR 1.98 billion, and rumors suggest that this figure will double by 2028. This would mean that there is still some room for the share price to rise. The LSEG expert consensus has not yet been able to process the latest developments accordingly. Anyone getting in now needs nerves of steel and the conviction that armaments will remain the credo of the 2020s.

USD 95 and climbing higher every day! This week, silver reached levels where a jump to USD 100 seems within reach for the first time. As a reminder, gold's little brother was still trading at an unspectacular USD 30 at the beginning of 2025. Now, however, powerful interests are at work, with the international security situation also driving those seeking protection and speculators into the metal. With a current market capitalization of CAD 35 million, the explorer Silver North still offers plenty of potential for risk-conscious investors.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.