June 10th, 2024 | 06:45 CEST

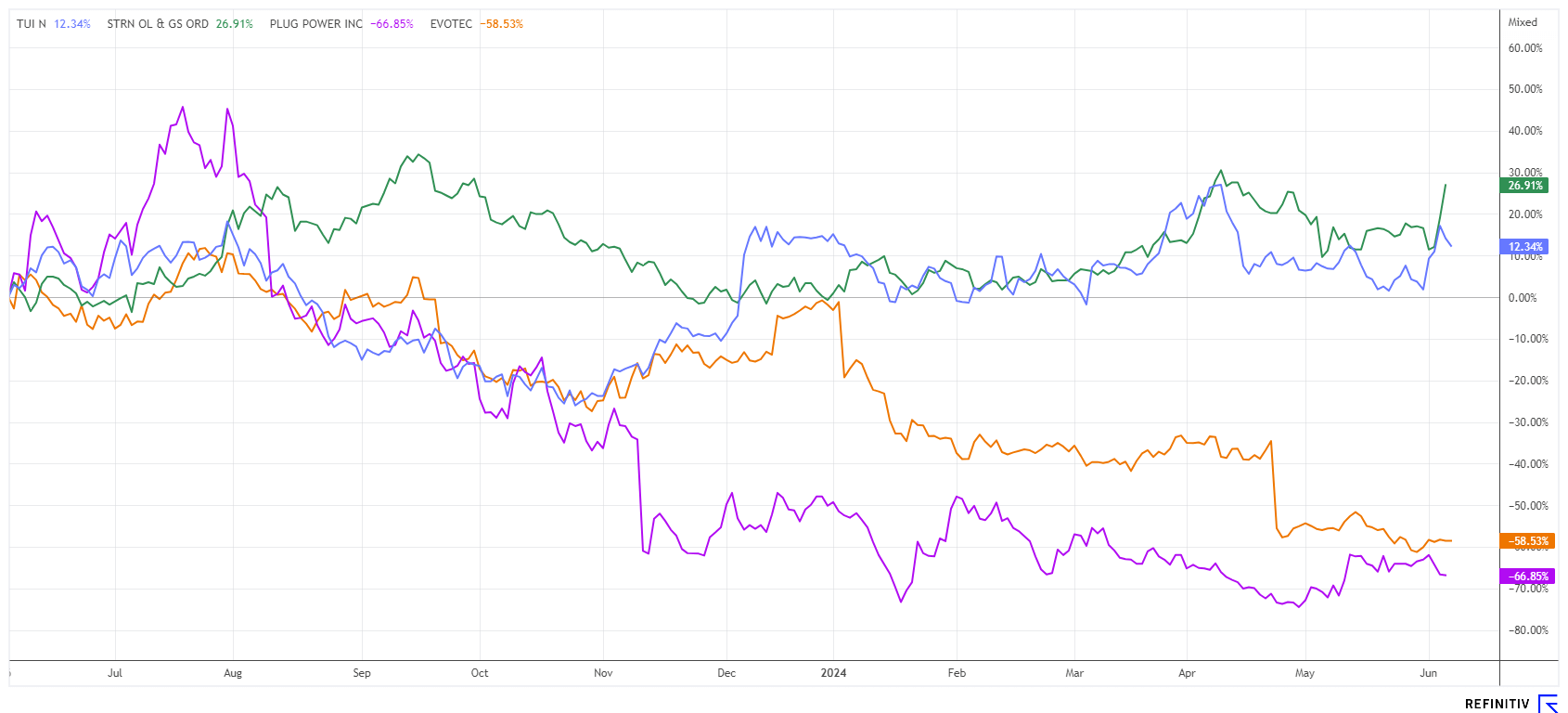

Nasdaq short bets remain dangerous! TUI, Saturn Oil + Gas, Plug Power, and Evotec in the crosshairs

Last week, Nvidia shares gave the bears a scare. Despite massive price gains in recent months, the shares of the specialist for high-performance chips gained another 20%, adding USD 600 billion to its valuation. Now, behind Microsoft, Nvidia is the second most valuable company in the world, surpassing even Apple. Of course, this did not happen without reason because, as of today, the share is trading at 1:10, which means a tenfold increase in the number of shares in the portfolio for shareholders. This does not change the market value per se, as the share price is also reduced by 90% at the opening. The aim is to make the share more accessible and allow retail investors to get involved. Stock splits of this kind are common on the NASDAQ and have often brought investors additional price gains in the following months. Where are the opportunities for investors?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

TUI AG NA O.N. | DE000TUAG505 , Saturn Oil + Gas Inc. | CA80412L8832 , PLUG POWER INC. DL-_01 | US72919P2020 , EVOTEC SE INH O.N. | DE0005664809

Table of contents:

"[...] The Oxbow Asset now delivers a substantial free cash flow stream to internally fund our impactful drilling and workover programs. [...]" John Jeffrey, CEO, Saturn Oil + Gas Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

TUI - The bankruptcy of FTI Travel gives wings

The European tourism market leader TUI is currently benefiting from its inclusion in the MDAX and Stoxx 600, as fund managers have to increase their weightings accordingly. The industry situation remains favorable, especially after the FTI bankruptcy, as the upcoming summer booking season should now result in higher sales volumes for the industry leader. However, the FTI bankruptcy also shows the industry's vulnerability: excessively high prices charged by hotel operators and the continuing rise in flight prices are weighing on the margins of travel providers. The industry now anticipates a market reorganization following the exit of Europe's third-largest travel operator, FTI. This will be accompanied by a further price increase for those wishing to travel, as the number of competing tour operators will fall.

A look at the rating platform Refinitiv Eikon shows 8 "Buy" recommendations out of a total of 12 ratings for the TUI share. The average price target is EUR 9.88, around 40% above the current price of EUR 6.99. The share is not expensive, with a P/E ratio of just 6.5 for the current year 2024. According to consensus estimates, sales are set to rise by a good 8% to EUR 22.7 billion. The chart will become interesting when the EUR 7.80 mark is exceeded.

Saturn Oil & Gas - This is sustainable financing

At the beginning of May, the Canadian oil and gas specialist Saturn Oil & Gas announced that it had concluded a further purchase agreement for the strategic acquisition of major shale properties in southern Saskatchewan. This time, the deal size was CAD 525 million, increasing the daily production capacity by a good 10,000 barrels per day (BOE/d) to a new level of 38,000 to 40,000 BOE/d. The highlight is that the latest drilling fields are directly adjacent to the Company's existing plant base, which enables significant operational savings and increases synergies in the logistics area.

With this acquisition, Saturn is taking the next development step towards becoming a "midsize producer" and catapulting itself into a CAD 1.5 billion oil and gas company. The refinancing is now also in the bag. In addition to raising CAD 100 million in equity, Saturn is also issuing senior bonds with a volume of USD 650 million. The new loan will replace old debt, and the average interest rate will fall from 15% to just 9.625%. The new near-market interest rate will give Saturn enormous relief for the next 5 years. The closing of the debt restructuring will take place on June 14, 2024. If the WTI price remains close to the USD 80 mark, an adjusted operating profit (Adj. EBITDA) of around CAD 586 million can be expected for 2024.

Hedging must be set at 75% of production output until June 2025 in order to secure interest payments. Only then will the volume of oil sold forward decrease. The total debt of CAD 856 million is approximately 1.45 times the expected operating income, which is easily manageable for the now larger company. In its June study, the research house Eight Capital raised the price target per share significantly from CAD 4.45 to CAD 7.35. Last week, the share reacted and moved from CAD 2.50 to 2.85. This is likely just the beginning of the upcoming revaluation.

Evotec and Plug Power - Sailing off the cliff

The beaten-up biotech company Evotec is holding its Annual General Meeting today. Following the departure of long-time CEO Dr. Werner Lahnthaler, interim CEO Dr. Mario Polywka now has to comment on the outstanding issues. Not exactly pleasant because the year 2023 was anything but glorious. In addition to operational difficulties, a devastating cyber attack resulted in high losses. After the insider dealings of the former CEO, which are certainly still being investigated by the SEC, the new team now has to look positively to the future. The shareholders are not yet so convinced. At EUR 8.83 on Friday, the share price was only 6% above its low at the end of May. Wait and see!

Trouble is looming again for Plug Power. In May, the US Department of Energy (DOE) announced a conditional loan guarantee of USD 1.66 billion. However, certain technical, legal, environmental and financial conditions still need to be met before the backup line can actually be provided. In addition, Senator John Barrasso, a member of the Committee on Energy and Natural Resources, would like to initiate a special audit of the award, as he suspects possible conflicts of interest on the part of Jigar Shah, the Director of the Office of Loan Programs. This is because there were probably business relationships between Jigar Shah and Plug Power in the past. At the time, Shah was president of Generate Capital, a financing firm focused on clean energy. The senator is also concerned about the red figures, which, according to CEO Andy Marsh, will still be in the red until 2026/2027. All in all, Plug Power is turning into a casino stock! While the indices continue to explode, the hydrogen top dog has lost 38% since January**.

Selection is becoming increasingly difficult. With new highs almost daily, high-tech and defense stocks are favored by investors. While individual stocks such as Evotec and Plug Power have a rocky road ahead, the outlook has significantly improved for TUI and Saturn Oil & Gas recently.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.