January 30th, 2023 | 09:13 CET

Mega biotech rally 2023! Defence Therapeutics, Bayer, BioNTech, Morphosys - Where to put the money?

Who would have thought it? Since the beginning of the year, the stock markets have been jubilant despite difficult predictions about the economic trend in 2023. High inflation and rising interest rates are not a good breeding ground for the popular biotech stocks because they have to constantly refinance their research expenses. As the risk fee is readjusted as costs rise, investors demand higher premiums for providing money. However, some biotech stocks have taken off since the beginning of the year despite adverse conditions. What is their secret?

time to read: 6 minutes

|

Author:

André Will-Laudien

ISIN:

DEFENCE THERAPEUTICS INC | CA24463V1013 , BAYER AG NA O.N. | DE000BAY0017 , BIONTECH SE SPON. ADRS 1 | US09075V1026 , MORPHOSYS AG O.N. | DE0006632003

Table of contents:

"[...] As a company dedicated to developing treatments for rare heart diseases, we see this as an opportune moment to contribute to the fight against heart disease and make meaningful strides in improving heart health worldwide. [...]" David Elsley, CEO, Cardiol Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Morphosys - Despite prophecies of doom, the share is unstoppable

Stealthily and despite all the scolding in the final quarter of 2022, the Morphosys share took off. The reason for the sell-off was a disappointment in Alzheimer's research in November. The active ingredient Gantenerumab®, which was developed together with Roche, did not achieve a slowdown in the clinical course of the disease. Brokerage houses hailed downgrades until the consensus price target plummeted to EUR 12.64. The share price followed the poor sentiment in giant steps and reached an all-time low of EUR 11.82 at the end of December.

Then buybacks started, and the management around CEO Dr Jean-Paul Kress were able to raise hope again after the JP Morgan Health Conference in San Francisco. The study results for pelabresib should be available as early as the beginning of 2024. Morphosys hopes for approval in 2025, which would be the former contract manufacturer's second drug. Morphosys has been in the red for years because of its costly research and is, therefore, under tremendous pressure to succeed. With increasing competition, the sales driver Monjuvi is also showing that the trees are not growing into the sky. After provisionally reported US sales of USD 89.4 million, the figure for the current year is expected to be between USD 80 and USD 95 million - which is not a noticeable increase!

As if the market had already known this rather bad news, there was only one direction for the share in January: Up! Morphosys is now a whole 48% in the green. And this does not have to be the end of the line because, in addition to better news, there is also an extensive short quota of about 3% of the capital. Chart-wise, the share recently managed to overcome the 50-day line, and the 200-day line at EUR 18.40 is also not far away from the current price of EUR 18.15. MACD and relative strength are also sending strong buy signals. Currently, the stock is trading 40% below the September 30, 2022 cash level, and the 2022 annual results are expected on March 15, 2023. It should be highly exciting!

For an in-depth study on Morphosys, visit www.researchanalyst.com.

Defence Therapeutics - US patent gives the share wings

The Canadian biotech company Defence Therapeutics (DTC) is currently going from strength to strength. Most recently, the Company announced the issuance of a US patent on the use of Accum™ as a so-called drop-in enhancer to increase the immunogenicity and performance of nearly all cell-based or protein vaccines. The challenge now is to provide statistical evidence. Together with a European partner, Defence wants to combine proprietary mRNA vaccines against cancer with its Accum™ technology and put them against the vaccine without Accum™ in a trial. As a result, the Accum™ technology is expected to improve the efficacy of vaccines and other substances significantly. In parallel, Phase 1 studies are planned in several solid tumour types. Currently, a Phase 1 study is pending around the high-dose AccuTOX™ to be used as a chemotherapeutic agent in lung cancer.

A few days ago, the innovative Canadian company reported that a 60% cure rate was achieved in the validation of its ARM vaccine candidate. Defence used a variant of Accum™ (A1) to reprogram mesenchymal stromal cells ("MSCs") to behave like antigen-presenting cells. Vaccinated animals survived and the vast majority of these animals rejected the tumour and remained tumour-free for more than three months. Based on these compelling results and the apparent therapeutic validation they provide, Defence continues to pursue activities with this vaccine aggressively. The current program was prepared according to the same protocol as for a potential Phase I cancer clinical trial, using melanoma cell lysate to boost the ARM vaccine prior to vaccination.

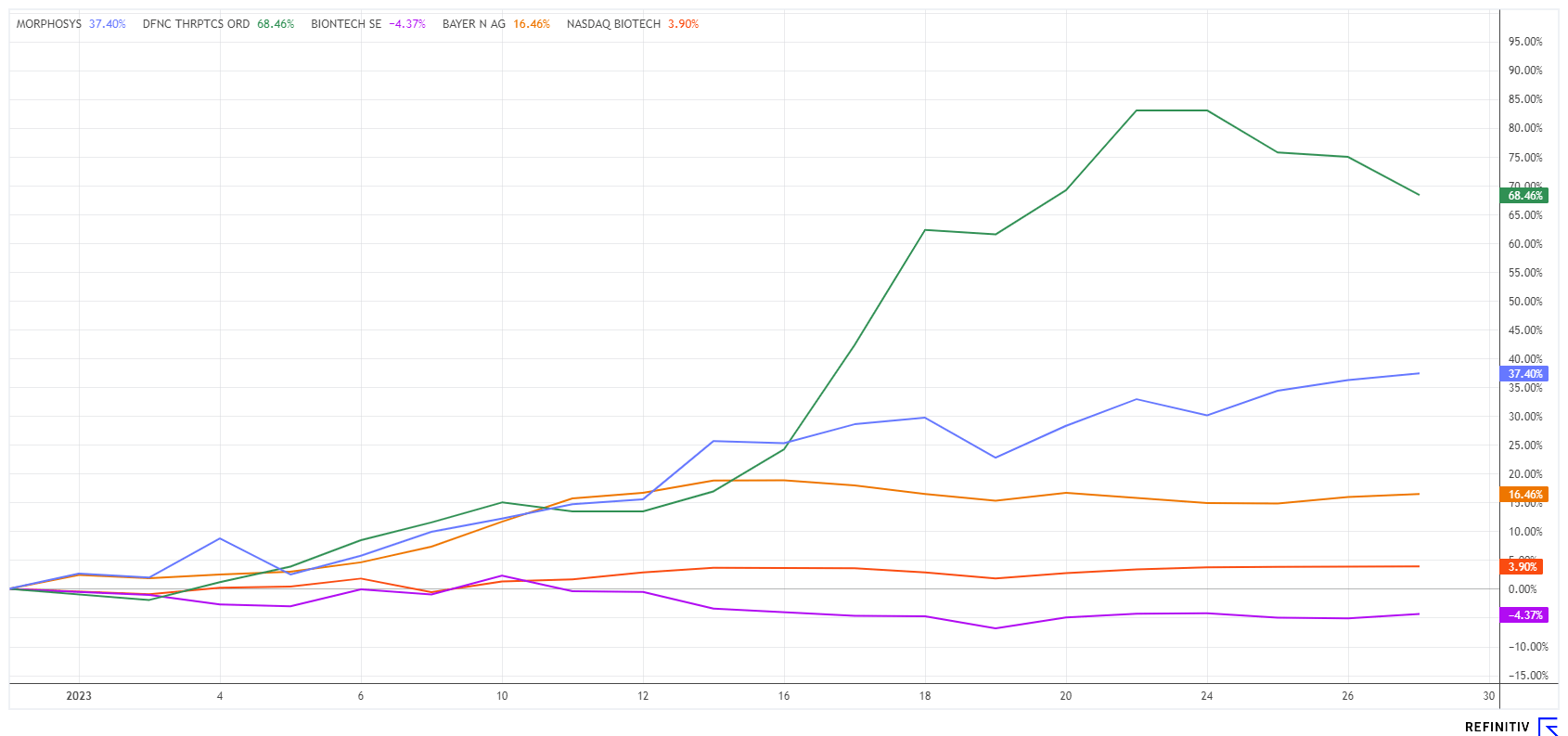

"This experiment represents an important step in our progress plan as it demonstrates that Defence's ARM vaccine can be used against any cancer type," said Mr Plouffe, CEO of Defence Therapeutics. In addition to targeting the start of production of an ARM vaccine in the first quarter of 2023, a Phase I cancer clinical trial for the treatment of patients with solid tumours is also scheduled to begin in the fall. DTC's share price has recently struggled to keep up with all the good news, jumping up by double digits at times. Investors likely suspect a breakthrough in cancer vaccination in the near future. This would mean an immediate jump to the billion mark for the EUR 125 million company. The chart comparison to Morphosys, BioNTech and Bayer shows the considerable outperformance of Defence Therapeutics.

You can also read today's update on www.researchanalyst.com.

Bayer and BioNTech - Where is the attraction?

Bayer's stock is getting a lot of attention at the moment, as the sustained success of Bayer's healthcare sector is fueling the fantasy that the group will now complete its often-suspected split in 2023. Investors hope that the valuation discount with which the Company is traded could be reduced by a demerger. There are already indications of activity by major institutional addresses. The hedge funds Inclusive Capital Partners and Bluebell Capital Partners most recently announced their investment in the pharmaceutical and agricultural giant. Currently, the Company is still indebted to the tune of around USD 43 billion due to the expensive Monsanto takeover. Calculated with a sharp pencil, the individual divisions of Bayer would generate at least 50% value growth in the event of a separation. This perspective also explains the recently sharply increased price targets of the well-known research houses. Bernstein Research, UBS and Barclays see more than 50% potential with positive ratings and price targets between EUR 80 and EUR 99. The stock is also fundamentally worth a look, as the 2023 P/E ratio is a low 7.4, and there is a dividend of around 4% - the split speculation is a cherry on top.

No good press for BioNTech and Moderna. In the midst of the Corona pandemic, the biotech giants are said to have cashed in big. EUR 13.1 billion has been spent by the federal government on vaccine orders since the outbreak of the disease. This was announced by the Ministry of Health in response to a press inquiry. Not every vaccine dose had the same price, as documents show. At the pandemic's peak, the prices increased by almost 50%, despite the costs remaining the same. A downright rip-off of the taxpayer in times of need if the allegations are true. BioNTech and Moderna would do well to provide clarification as quickly as possible. After peaking at around USD 460 in 2022, BioNTech shares have started 2023 quietly and are currently 5% behind at around EUR 132. A scandal would certainly not help the share price, but a positive resolution of the circumstances certainly would. Keep watch!

The year 2022 has cost biotech investors the last nerve. However, those who have been doing trend-following research since the beginning of the year are very well off with the speculative stocks Morphosys and Defence Therapeutics. Bayer and BioNTech are blue chips with a full cash box and pipeline. As always, what matters is: Diversification reduces risk!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.