May 2nd, 2024 | 06:45 CEST

Is it time already? Get out of AI, and buy biotech: Nvidia, Evotec, Defence Therapeutics and Bayer in focus

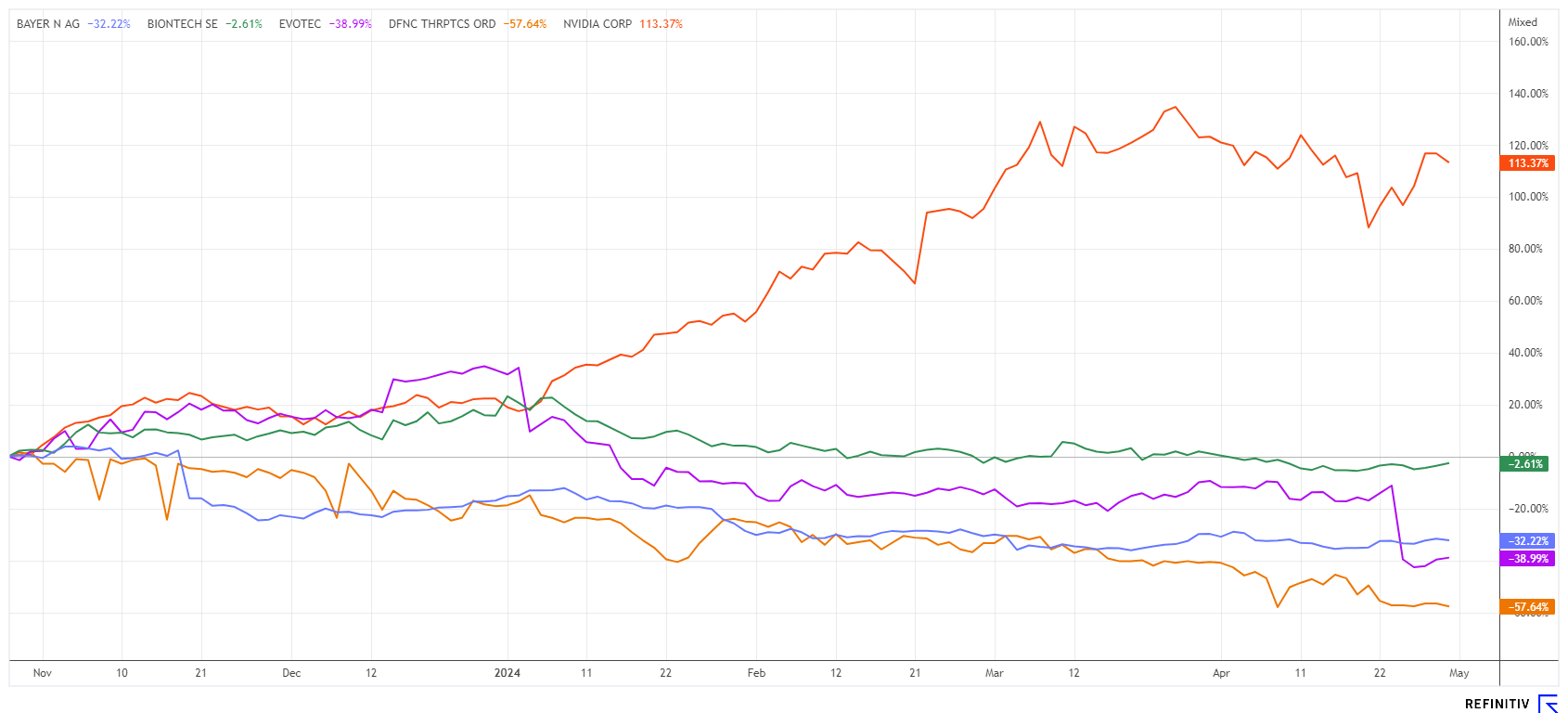

Another blow to the bottom line! At the end of April, the Nasdaq technology exchange plummeted for the third time, again showing significant weakness at 17,333 points. After a long upward trend of the NDX to just under 18,500 points, an upper limit seems to have been found. Even high-tech favorites such as Nvidia, Super Micro, Meta, and Apple show dangerous reversal points on the chart. At the same time, some stocks in the biotech sector are forming good bottom formations. Is now the time to switch?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

NVIDIA CORP. DL-_001 | US67066G1040 , EVOTEC SE INH O.N. | DE0005664809 , DEFENCE THERAPEUTICS INC | CA24463V1013 , BAYER AG NA O.N. | DE000BAY0017

Table of contents:

"[...] Defence will continue to develop its Antibody Drug Conjugates "ADC" and its radiopharmaceuticals programs, which are currently two of the hottest products in demand in the pharma industries where significant consolidations and take-overs occurred. [...]" Sébastien Plouffe, CEO, Founder and Director, Defence Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Sector rotation ahead - BioNTech, Bayer and Evotec

If the central banks adjust interest rates downwards for the first time in early summer, biotechs will be back on the buy list as they benefit from a more favorable refinancing environment. Stocks such as Evotec, BioNTech and Bayer should already be on the shortlist due to the advanced corrections. The fundamental developments promise an imminent improvement, and the chart technology is already sending signals. The beginning of May will be exciting for the elite of the German biotech sector, as the Q1 reports are due.

In the last week of April, Evotec had to absorb another 40% discount to EUR 8.63 with its 2023 figures and gloomy expectations. With consolidated sales of EUR 781.4 million, revenue was up 6% on the previous year, but the Company had to record extraordinary costs of EUR 15.9 million due to a serious cyber attack. At EUR 66.4 million, adjusted EBITDA was well below the previous year's figure of EUR 101.7 million.

As the new CEO and successor to Dr. Werner Lanthaler, Dr. Christian Wojczewski will take the helm on July 1. According to research by Manager Magazin, his predecessor had sold shares worth EUR 6 million via the stock exchange and not reported them. Evotec now wants to initiate a restructuring in 2024 and achieve double-digit growth again. Investors will receive the first indications on May 22, when the Q1 figures are published. Before that, BioNTech will report on May 6 and Bayer on May 14. So a hot spring is just around the corner!

Defence Therapeutics - Vaccine shows strong antigen presentation

The Canadian biotech specialist Defence Therapeutics is developing vaccines against cancer. The core of the Company's platform is the Accum™ technology, which enables the precise delivery of vaccine antigens or ADCs in their intact form to the target cells. In research, the Company works successfully with the City of Hope University Hospital near Los Angeles, which submits around 50 FDA applications a year and has so far been an excellent partner in this collaboration. A partnership that can be rewarding for investors and, above all, for patients in need. The recent approval of AccuTOX® as one of the Company's first-in-class therapies is a huge step forward for Defence in the field of immuno-oncology.

The second-generation ARM cancer vaccine using AccuTOX®, called ARM-002, in combination with the anti-PD-1 immune checkpoint inhibitor, is now reported to be therapeutically effective against established melanoma. The application of reprogrammed mesenchymal stromal cells (MSCs) represents a leading vaccine platform due to the ease of production and therapeutic efficacy of this standard allogeneic vaccine. The use of AccuTOX® to reprogram these MSCs is mainly based on the induction of protein aggregation. This process is known to activate the "Unfolded Protein Response", a cellular defense mechanism that typically destroys all captured protein aggregates due to their toxicity and disruption of cell integrity.

"AccuTOX® from Defence was originally known for its ability to kill cancer cells. In addition, our team found that at certain doses, AccuTOX® forms protein aggregates when mixed with tumor lysate. This process induces MSCs to degrade these intracellular complexes, resulting in strong antigen presentation," says Sebastien Plouffe, CEO of Defence Therapeutics.

Following initial success in mice, Defence is now testing the ARM-002 vaccine in difficult-to-treat cancers such as pancreatic, colorectal and ovarian cancer. These results will define the target indication for the Phase I trials and also show how versatile and adaptable the cancer vaccine really is. Defence shares are attracting a lot of attention at the moment; with a share price of CAD 1.20, investors can get on board with a valuation of just EUR 37 million. After all, the Company will soon be entering the clinical phase.

Nvidia - Slowly running out of steam

Another blow to the Nvidia share price. In the month-end sell-off on the Nasdaq, the share price of the stock market favorite fell by more than USD 50. In yesterday's US trading session, the share price could only recover slightly, gaining USD 10. This is not a very good sign because after repeatedly testing the USD 900 mark, this barrier seems to be holding for the time being.

Good advice is now required. The analysts on the Refinitiv Eikon platform have barely changed their fundamental opinion recently, with 53 out of 57 experts recommending the share as a "Buy" with an average 12-month price expectation of USD 1,004. Based on today's USD 850, the potential is thus around 18%. Technically, Nvidia is currently trading right in the middle of the Bollinger Bands. Although momentum still points upward, the RSI has weakened to below 60%. In the meantime, four diagonal and downward sloping intermediate tops can be identified since the high in March. While the 200-day line at USD 540 is still miles away, the 50-day sell trigger at around USD 785 has already crept up quite far.

Conclusion: For those looking to invest in the megatrend of artificial intelligence and Big Data over the long term, Nvidia is certainly a solid choice. However, one must accept a valuation based on the figures for 2028. Because with a market value of USD 2.1 trillion, Nvidia is currently trading at a price/sales ratio of 20, which is expected to decrease to around 10 by 2028. If the earnings estimates for the current year of USD 57 billion actually materialize, the P/E ratio would also be "only" 37. The currently noticeable need for correction may lead to further price losses. For buyers with strong nerves and a long-term horizon, however, this may be a good time to buy.

Valuations in the high-tech segment are very advanced on the stock markets. Players are waiting for the hoped-for interest rate cuts by the central banks. This could lead to some corrective movements in early summer. Prominent biotech stocks, on the other hand, have already reached attractive levels .

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.