July 15th, 2025 | 07:20 CEST

Infrastructure hype in 2025: Sustainable construction is in demand! Keep an eye on Siemens, Heidelberg Materials, Argo Graphene, and Porr

A lot is falling apart around the world right now, not just in material terms, but also structurally. Wars, geopolitical tensions, and economic upheavals are putting entire regions under pressure. Although Germany is not directly affected militarily, the consequences of the wear and tear are clearly noticeable here as well: our infrastructure, which has been criminally neglected for decades, is increasingly showing cracks, both literally and figuratively. Dilapidated bridges, overloaded rail networks, outdated power lines, and sluggish fibre optic expansion are now even hampering competitiveness. Europe has recognized these weaknesses and is responding with ambitious investment programs. The Green Deal, the EU Recovery Fund, and national economic stimulus packages are set to pour billions into sustainable mobility, energy supply, digitalization, and resilience. Where are the winners for your portfolio?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

SIEMENS AG NA O.N. | DE0007236101 , HEIDELBERGCEMENT AG O.N. | DE0006047004 , ARGO GRAPHENE SOLUTIONS CORP | CA04021P1018 , PORR AG | AT0000609607

Table of contents:

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Heidelberg Materials and Siemens – "Engineered by Germany" remains in high demand internationally

From an international perspective, the two DAX companies Siemens and Heidelberg Materials are involved in many infrastructure projects. Siemens is driving forward numerous key projects. In the UK, Siemens Mobility has been awarded infrastructure and service contracts worth around £560 million for the HS2 high-speed rail line, including digital signal management and high-voltage power supply systems, a milestone for British mobility. At almost the same time, Siemens Mobility is also modernizing the German rail network under a framework agreement with Deutsche Bahn worth around EUR 2.8 billion, which will enable the nationwide use of digital control systems (e.g. ETCS, digital signal boxes). In Italy, Siemens eMobility is completing the nationwide rollout of a fast-charging infrastructure for buses and logistics vehicles.

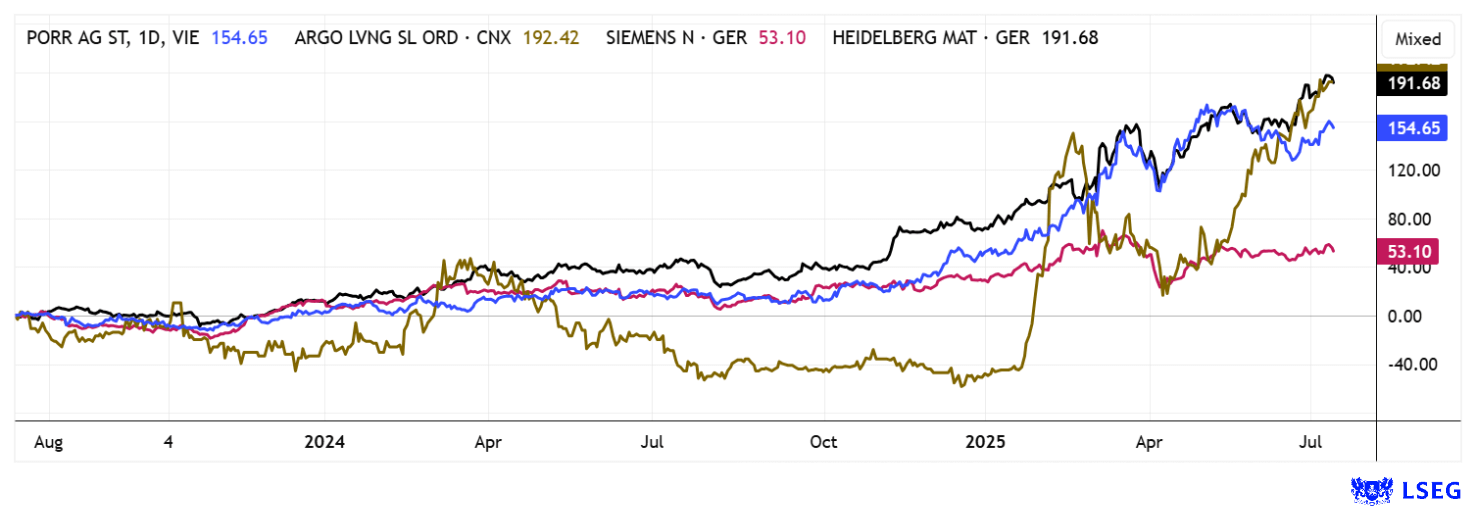

Heidelberg Materials is also involved in groundbreaking projects in European infrastructure construction. The first industrial CO₂ capture plant in the cement sector (CCS) is currently being built in Padeswood, Wales. It aims to capture around 800,000 tons of CO₂ annually, sending a strong signal for technology-driven decarbonization. In addition, Heidelberg is pushing ahead with a CCS project in Brevik, Norway, thereby strengthening its role as a pioneer in low-emission cement production. Both companies are thus making a decisive contribution to the modernization and decarbonization of European infrastructure. While Siemens has made progress in recent months with a 22% increase, Heidelberg Materials has seen a strong move since March, bringing it to plus 99%. Both standard stocks remain promising.

Argo Graphene Solutions – Innovation under a new name

Argo Living Soils becomes Argo Graphene Solutions. With this rebranding, the Canadian company underscores its strategic shift toward high-performance materials, focusing on sustainable solutions for the construction and agricultural sectors. Using modern technologies, Argo will deliver green products for the infrastructure of the future. Argo has set itself the goal of reducing global carbon emissions through sustainable agricultural and industrial innovations and creating a renowned brand for environmentally friendly products. Argo Living is thus addressing key trends in the sustainable circular economy and is becoming a focal point for ESG-oriented partnerships and investors.

Argo Graphene Solutions is opening a new distribution and mixing center in the fast-growing southern US state of Louisiana, near the major port of New Orleans. The strategic location offers ideal conditions for scaling up Argo's innovative graphene-enriched building materials. Through the partnership with Landry Construction, Argo will mix and customize concrete and cement formulations on site, tailored to the requirements of customer projects in the US and Mexico. Thanks to excellent transport links (inland waterways, rail lines, Interstate 10 highway), Argo can optimize its supply chains while significantly expanding the reach of its environmentally friendly infrastructure technologies. The multifunctional facility will serve as both a logistics hub and a technology development center, underscoring Argo's goal of providing sustainable materials where they are needed.

"This agreement with Landry Construction and their facility in Kenner provides us with the ideal location for market launch, scaling, and fulfillment," said Scott Smale, President and CEO of Argo. Smale added: "The proximity to one of the country's most dynamic ports and regional connectivity will enable us to efficiently supply the southern United States and Mexico with sustainable building materials."

ARGO shares have already quadrupled since January, and the small dip from March to May has been replaced by scarcity-driven pricing above CAD 0.95. Since investors have factored Argo's strategic turnaround into their future expectations, the stock appears to know no bounds. With 18.3 million shares issued, the Company is currently valued at CAD 17.7 million. The journey north is likely to continue apace.

PORR – Aggressive growth in Eastern Europe

When it comes to infrastructure, Austrian construction company PORR has a lot to say. PORR already demonstrated impressive momentum in Eastern Europe in Q1 2025 and further expanded its strong position in the region. Revenue in the International Infrastructure segment rose by almost 25% in Poland and the Czech Republic in particular, driven by growing demand for modern transport and healthcare buildings. Order intake in the CEE countries rose by a remarkable 46.7%, with the order backlog growing by 18.8% in parallel. Major projects such as the expansion of the Nezamyslice–Kojetín rail link and several new hospital buildings in Warsaw demonstrate how closely growth and social benefits are interlinked at PORR.

At the same time, the Company is focusing specifically on sustainable construction: new data centers with the highest energy efficiency standards in Poland and Germany are just as much a part of the portfolio as the first wind turbines in the infrastructure network. PORR is thus increasingly establishing itself as an innovation leader for climate-friendly, digital construction concepts. Supported by EU infrastructure programs in Eastern Europe, the Company is currently ideally positioned to benefit from long-term investment trends. The share price responded to the announced EU investment programs with a rise of over 60% since the beginning of the year. According to consensus estimates, net profit is expected to increase by 20% in 2025 and really take off from 2026 onwards, reaching over EUR 120 million. According to analysts on the LSEG platform, the party could continue unabated until around EUR 34.

**The selection on the stock markets is becoming increasingly difficult after a DAX rise of a good 20% since January. But not even the uncertainty caused by Trump's announcement of new trade tariffs was able to slow down the upturn in blue chips. A risk-controlled portfolio contains first-class blue chips such as Heidelberg Materials, Siemens, and PORR. As a small-cap addition, Argo Graphene Solutions is currently delivering very high returns.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.