August 9th, 2023 | 08:55 CEST

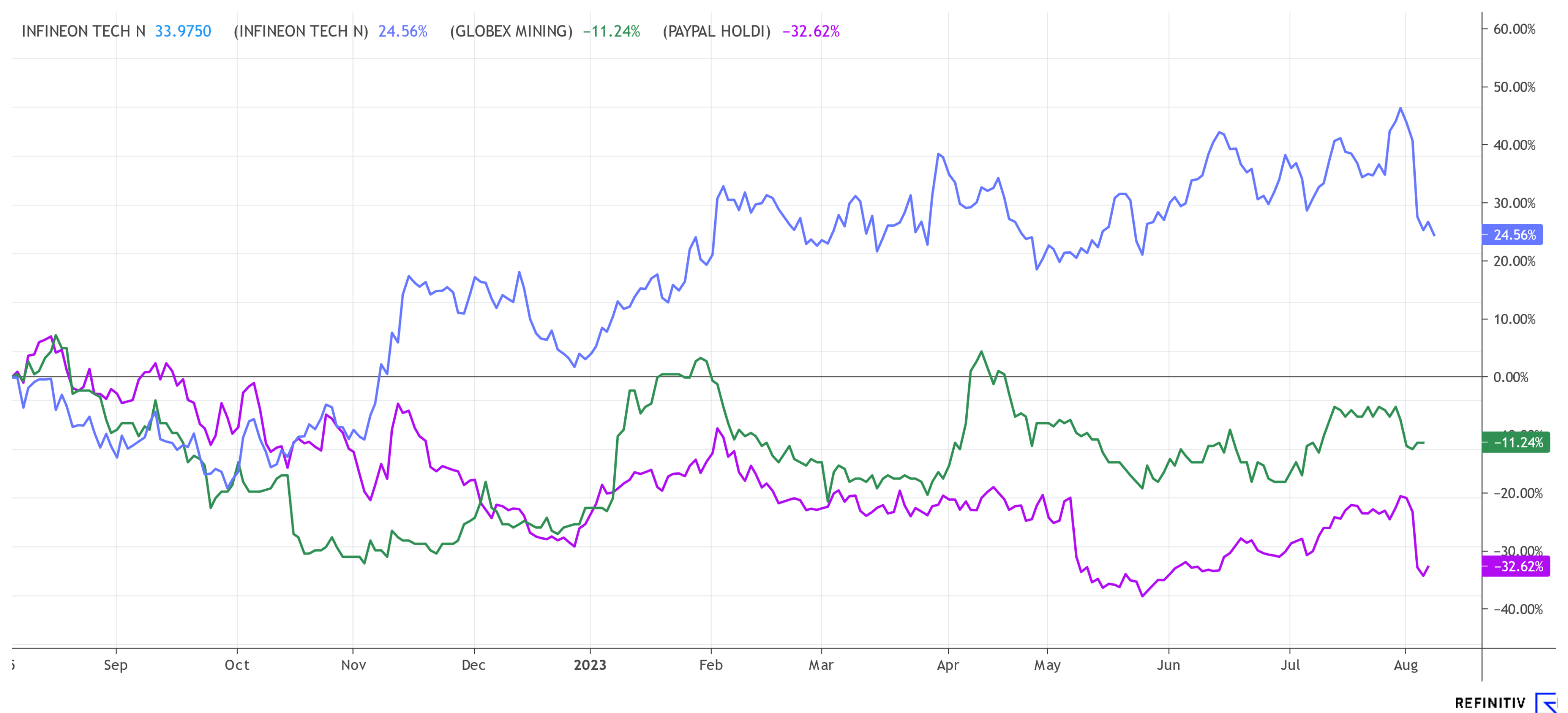

Infineon, Globex Mining, PayPal - Where is it worth getting in after the setback?

The world of finance is characterized by constant fluctuations and changes. This dynamic, which is a source of uncertainty for some investors, can also provide opportunities to profit for well-informed shareholders. One such approach to profiting from the ups and downs of the financial markets is the art of "Buy the Dip" - taking advantage of setbacks or downturns in stock prices to invest cheaply in promising companies. This approach requires a solid understanding of market behavior and the ability to distinguish between temporary price corrections and long-term value potential. We have selected three candidates where an entry could be worthwhile.

time to read: 4 minutes

|

Author:

Armin Schulz

ISIN:

INFINEON TECH.AG NA O.N. | DE0006231004 , GLOBEX MINING ENTPRS INC. | CA3799005093 , PAYPAL HDGS INC.DL-_0001 | US70450Y1038

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

Armin Schulz

Born in Mönchengladbach, he studied business administration in the Netherlands. In the course of his studies he came into contact with the stock exchange for the first time. He has more than 25 years of experience in stock market business.

Tag cloud

Shares cloud

Infineon - Full order books

At the end of March, Infineon raised its forecast for the current year. As recently as mid-July, there was positive analyst commentary from Jeffries for the European chip industry. But with the figures on August 3 for the last quarter came the cold shower for investors. Although revenues of EUR 4.1 billion, gross margin of 46.6% and earnings of around EUR 1.2 billion were up year-on-year and within analysts' expectations, the share price plummeted. The reason for this is the weaker performance compared to the previous quarter.

In addition, the semiconductor market shows a mixed picture, according to CEO Jochen Hanebeck. While demand in the areas of electromobility and renewable energies is high, there is little demand in the area of consumer electronics. In order to meet the increased demand from the booming markets, the Company invested EUR 768 million in the last quarter, among other things, in the expansion of corresponding production capacities. The order backlog is around EUR 32 billion, roughly two times the Group sales this year. The outlook, therefore, remains favorable.

Given the full order books, the sell-off appears to be excessive. Compared with its competitors, the Company is favorably valued. This is also the view of many analysts, who issued 7 buy recommendations after the figures, with price targets between EUR 38.50 and EUR 54.00 being issued. Only 2 analysts recommended holding. From a chart perspective, however, the share is battered. The upward trend has been broken. In order to assume a false breakout, the share, which currently stands at EUR 34.17, must rise above the EUR 34.62 mark again as quickly as possible and should not fall below it. Then a head and shoulder formation would be formed.

Globex Mining - Share buyback program

Globex Mining (GMX) is a Canadian company focused on the acquisition, exploration and development of mineral properties. With now 232 projects in various metal categories, including precious metals, base metals and specialty metals, Globex offers a diverse portfolio. The business model involves selling or licensing projects to other companies in exchange for cash, shares, royalties, or work and investment commitments. In this way, Globex mitigates exploration risks and costs while maximizing profit potential. In doing so, the Company is debt free, has over CAD 25 million in the bank and holds shares in many different companies.

A diversified portfolio means there is constant news. On August 3, Cartier Resources reported new drill results on a GMX property of 3.2 g/t gold over 15 meters. GMX will receive a 3% gross metal license when gold production starts. In late July, Burin Gold received approval from TSX Ventures to acquire 100% of the nickel, copper and cobalt project called Dalhousie from GMX. Burin will pay CAD 1.5 million cash, 4 million treasury shares and must invest CAD 5 million in the property within 4 years. More positive news came from Cerrado Gold, which announced the acceptance of an Expression of Interest (EOI) from the UK Export Credit Agency to provide up to USD 420 million in support for the Mont Sorcier Iron Vanadium project. GMX holds a 1% gross metal license for all iron production from the property.

In addition, the Company owns a significant interest in Electric Royalties, which in turn holds a 1% gross metal license for all vanadium production. By looking at these 3 examples, one can see the diversity of the different projects. Several explorers have more market capitalization with one project than GMX has with its entire portfolio. The management wants to counter this undervaluation with a share buyback program of up to 1 million shares, representing about 1.8% of the total shares. At a current share price of CAD 0.75, the Company has a market capitalization of only CAD 41.5 million.

PayPal - Entry into digital currency

The last few months have been challenging for PayPal investors. At the peak, the losses were around 80%. With the announcement of the figures for the 2nd quarter, the share again went on a dive. PayPal's revenue grew 7% year-on-year to USD 7.3 billion, and profits climbed to USD 1.29 billion**. However, gross margins fell due to the product mix of branded and unbranded transactions. The Company receives less commission on the latter. Operating margins, however, improved thanks to cost reductions. Management expects better gross margins in the coming quarters.

It also expects the e-commerce market to brighten as inflation declines. PayPal's Q3 and fiscal 2023 forecasts point to modest revenue growth but improved margins. In addition, the search for a successor CEO is in its final stages. Currently, the Company is investing in artificial intelligence, platform infrastructure, and product quality. With better product quality, the Company hopes to retain its customer base. Most recently, the number of active accounts has been declining.

On August 7, the group announced they are partnering with Paxos Trust Company to launch a new stablecoin called PayPal USD backed by USD deposits, short-term US Treasury notes, and similar cash equivalents. This is a step towards a digital currency that can also be used to exchange cryptocurrencies. This news could stop the fall of the stock. Currently, one pays USD 63.94 for a share certificate. Management's focus on increasing earnings per share and expanding operating margins, and share buybacks could now ensure a turnaround.

All three companies featured here are buy candidates. At Infineon, the order books for the next 2 years are already filled. The annual forecast has been confirmed. Globex Mining is well-diversified, debt-free and has initiated a share buyback program. The value of its 232 projects significantly exceeds the current market capitalization. PayPal has lost over 80% from its high. The numbers were decent, and the launch of its own coin has created a new business segment.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.